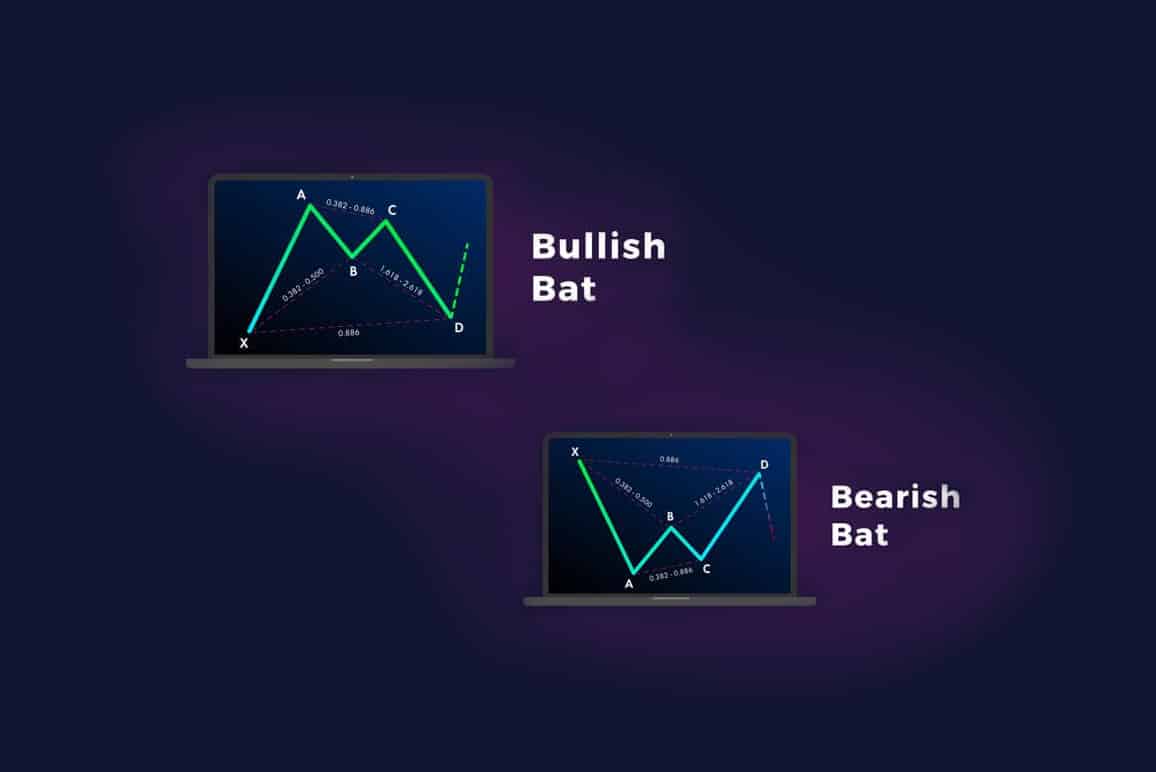

The Bat method strategy for MT4 is a productive trend following technique to decide the price momentum contingent upon the market trend and wait for indicators that will sign to open a trade.

As this trading technique depends on indicators, we will consistently search for the affirmation given by the tools. Moreover, we will use multiple trading indicators like Fibonacci and Bat ATR set up to increase the trading possibilities.

What is the Bat method strategy?

Team Aphid developed the Bat method strategy, utilizing an indicator based on the Average True Range (ATR) trailing stop. It is a straightforward trading method that has decent win and loss ratios. However, good money management and risk is an immensely significant factor in using this trading method.

Bat method components

In this trading strategy, we will utilize multiple indicators to identify the price direction with higher accuracy. However, the forex market is full of doubt; the only path to hold down is to construct a trading strategy with higher accuracy utilizing various indicators.

Let’s have a look at trading indicators for the Bat Method Strategy for MT4:

- Fibonacci Retracement Levels (custom setup)

- Bat ATR (Average True Range)

Fibonacci retracement levels

They are horizontal lines, which indicates the support and resistance levels are probably occurring. However, the levels are based on the Fibo numbers. Every Fibo level is combined with a percentage. This percentage shows how much the previous move has retraced. The Fibonacci’s default retracements are 23.6%, 38.2%, 61.8% and 78.6%. However, the Fibo level of 50% is also used unofficially.

In addition, the Fibonacci retracement levels are handy because they can be drawn within the two significant price levels, for instance, high and low. Afterward, the Fibo will illustrate the levels between those two levels.

Fibonacci retracement levels setup

We will be going to use a custom setup for this trading strategy. First, insert the Fibonacci retracement tool on the chart. Once the Fibo lines have appeared on the chart, right-click on the chart, go to the objects list, click on the Fibo tool, and edit.

Afterward, go to the Fibo level tab and enter or change the following:

- Level 0 description — swing

- Level 0.382 description — 38.2 — 2 lots

- Level 0.618 description — 61.8 — 1 lot

- Level 1 description — enter 1 lot

- Level 1.618 description — 161.8

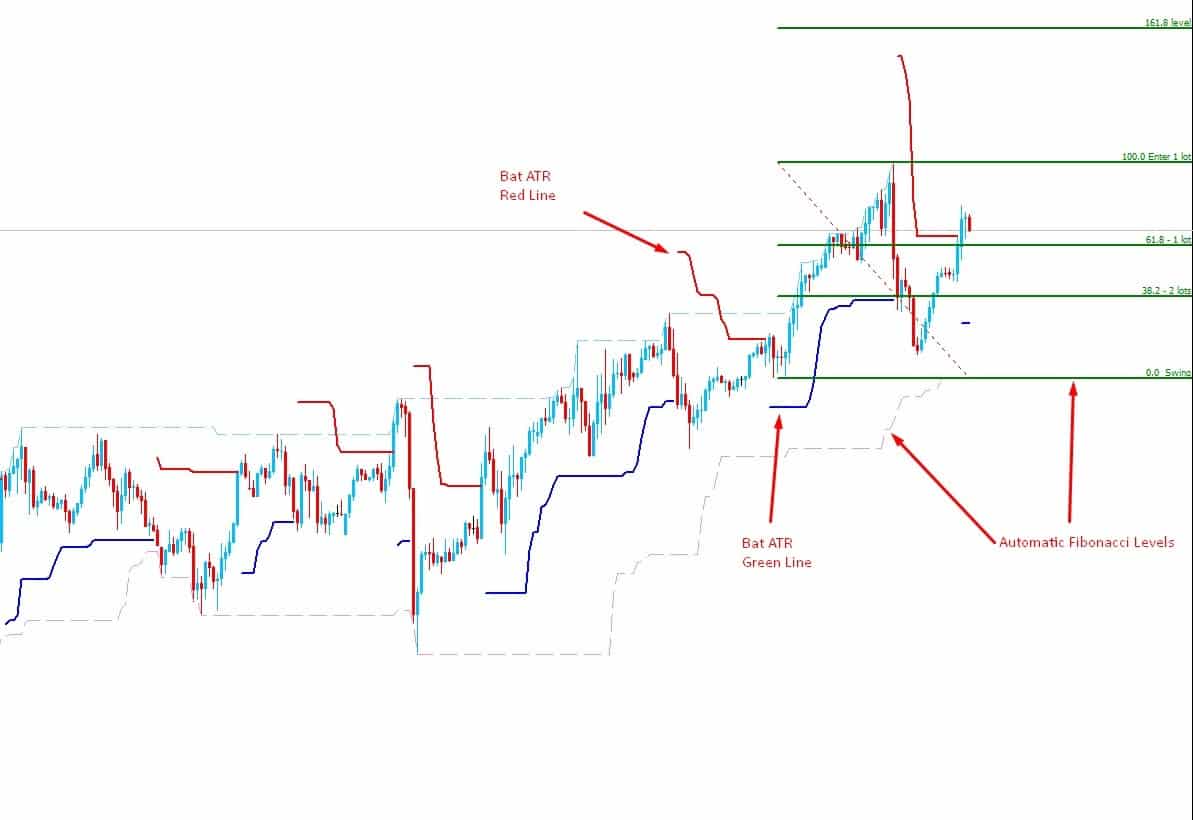

Bat ATR (Average True Range)

Bat ATR is a technical indicator that calculates the price movements and signals continuing the trend and reversal levels. If the price breaks above the red line, bulls are in charge of the market.

On the other hand, bears take over the market if the price breaks below the green line. It’s a straightforward method to identify the entry points by this Bat ATR indicator.

Let’s have a look at trading indicators for the Bat method strategy for MT4.

Bullish trading strategy

The Bat method strategy for MT4 is appropriate on all the time frames from five minutes to daily, where 1-hour and the 4-hour provide the ideal outcomes as it extracts the short-term dominance of the fundamental news.

However, you can choose any currency pairs, such as GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/ EUR/NZD, etc.

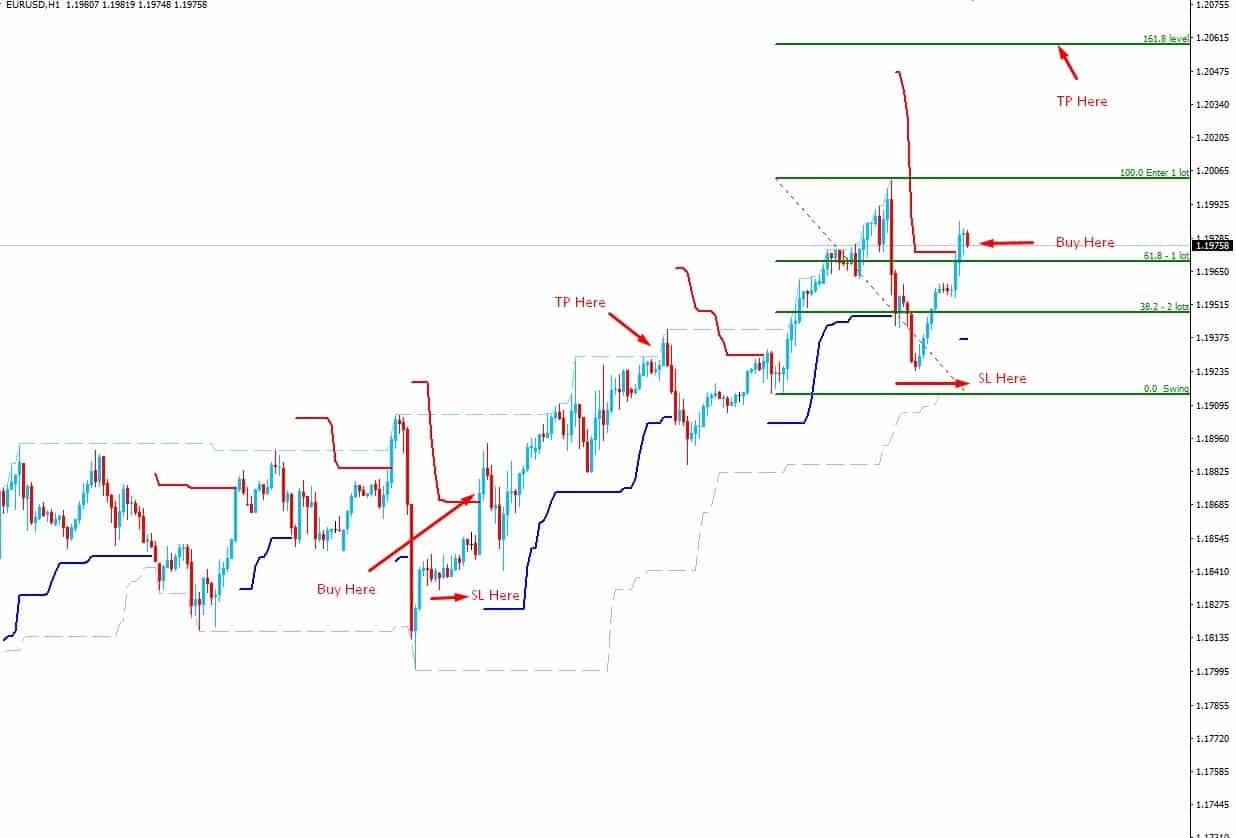

Bullish trading conditions

- The price is below the red line

- Buy on red line touch or break

Entry

After confirming all the trading conditions, you should wait for the candle to close and execute a buy trade as soon as the candles close. Otherwise, you can place a buy stop order near the red line.

Stop loss

As it is a trend riding strategy, the current trend is prospective to continue as long as the price trades over the most recent swing low. Therefore, put your stop loss below the recent swing low with a 10 to 15 pips buffer.

Take profit

The ideal take profit level is based on a 1:1.5 or 1:2 risk-reward ratio. Therefore, if your stop-loss is 10 beneficial pips, you should set the take profit at 20 pips. Alternatively, you can target the next potential resistance level.

Bearish trading strategy

The bearish trading strategy is also applicable to all time frames from five minutes to daily, where the 1-hour and the 4-hour chart will provide the best outcomes as it eliminates the short-term effect of the news.

However, you can choose any currency pairs, such as GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/ EUR/NZD, etc.

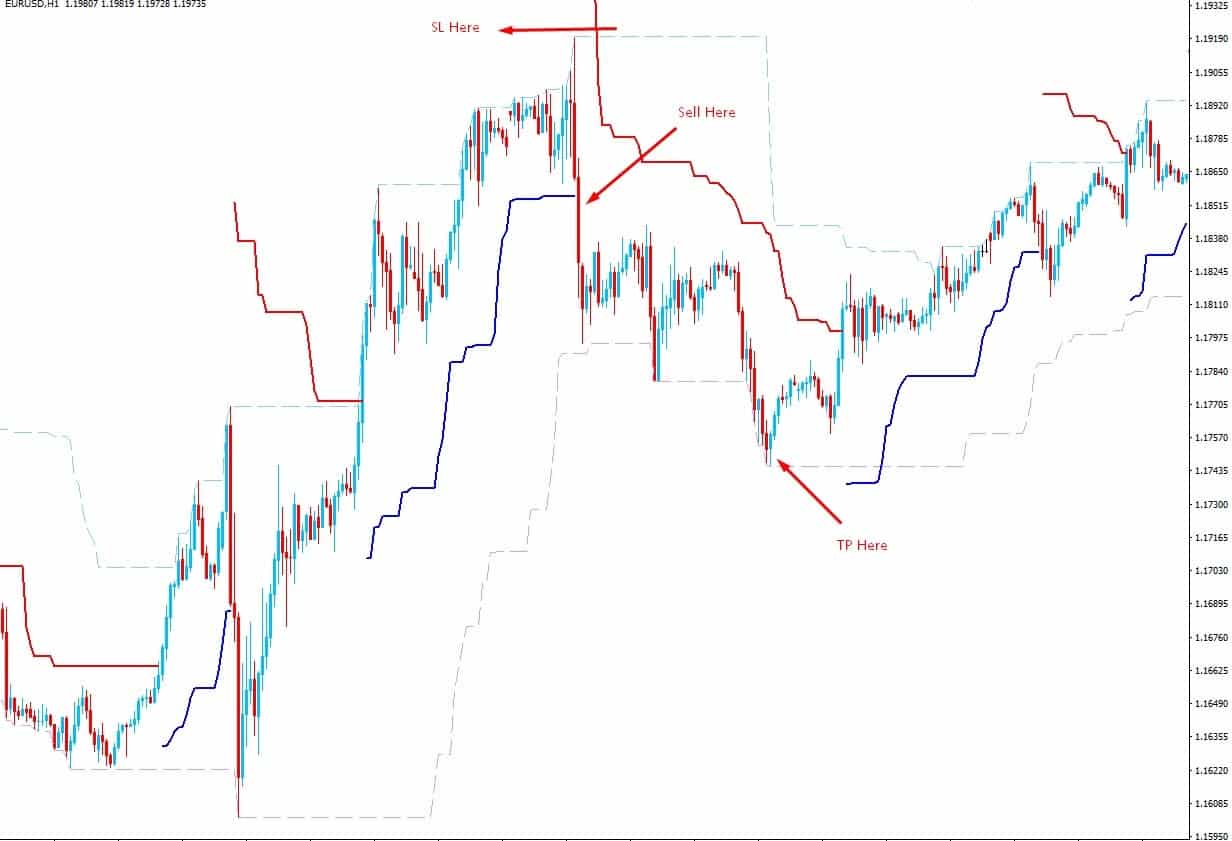

Bearish trading conditions

- The price is above the green line

- Sell on green line touch or break

Entry

After confirming all the trading conditions, you should wait for the candle to close and execute a sell trade as soon as the candles close. Otherwise, you can place a sell stop order near the green line.

Stop loss

As it is a trend riding strategy, the current trend is prospective to continue as long as the price is trading below the most recent swing high. Therefore, put your stop loss above the recent swing high with a 10 to 15 pips buffer.

Take profit

The ideal take profit level is based on a 1:1.5 or 1:2 risk-reward ratio. Therefore, if your stop-loss is 10 pips, you should set the take profit at 20 pips. Alternatively, you can target the next potential support level.

Final thoughts

The Bat method strategy for MT4 is the most profitable trading method because it depends on the high accuracy indicators. Therefore, you can gain decent trading results at the end of the month. However, in forex trading, there is no 100 percent guaranteed profit in each trade.

However, in every trading method, success depends on trade management. Therefore, you should utilize the proper money management system and better psychological states to get a better outcome from this trading strategy.