KDJ indicator is a highly captivating effort towards the technological world. The primary purpose behind developing this indicator is to make your trade more effective and profitable. It helps you to analyze trend direction and optimal entry points. Moreover, the KDJ indicator also predicts and suggests stock trends and price patterns in the trading forte.

The indicator somehow resembles the stochastic oscillator and Alligator indicator. However, the J line creates a significant difference between them. Therefore, the KDJ indicator comprises three K, D, and J (The K & D line is also found in the stochastic and Alligator oscillators).

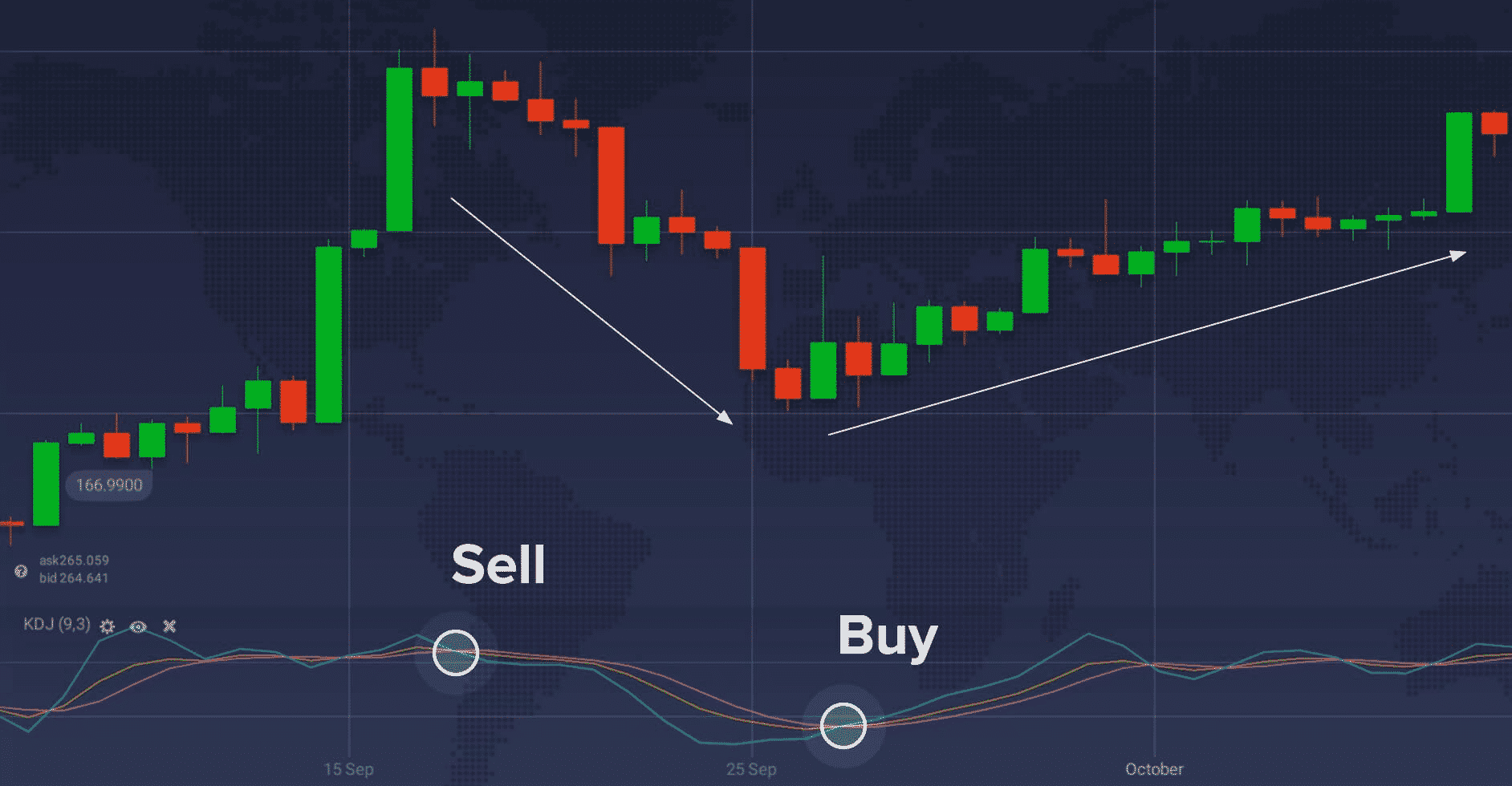

When the %D line crosses over %K, it will be the moment of purchasing or selling. Whereas the J line shows the divergence of the D line from K. The variation arises from exciting trading opportunities for investors.

How to find optimal entries with the KDJ indicator?

Before starting trading with the KDJ indicator, you will have to set it up accordingly. You can activate this indicator on your device by following these simple steps.

- Go to the Indicator button.

- Select the Trend tab. Afterward, click on KDJ in the given option.

- Tap on the Apply button without affecting the settings.

The indicator is usually used to signify optimal entry points and trends. Stochastic, Alligator, and KDJ indicators all have the same purpose. However, KDJ is based on a single plan called “The J line.”

By considering these below points, you may identify the optimal transactions.

The blue line above the yellow line, and the yellow line above the purple one, indicate an overbought condition. Therefore, selling the asset might make sense when the lines converge above the overbought level and vice versa.

However, it is best to consider buying a stock when the lines converge below the oversold level, with the blue bar above the yellow and the yellow line above the purple.

KDJ does not work during flat market periods, and it’d be better to get an accurate result if KDJ was combined with any other indicator. The average directional index (ADX) and the average real interval (ATR) are recommended to integrate.

ADX is situated before the curve and can suggest the subsequent inversion of the trends. Therefore, to know the fixed volatility of the market, ATR is highly-useful.

Whether the indicator, including ATR, ADX, KDJ, Alligator, or stochastic, keep in mind that one can provide 100% results. There are always some errors dancing in the loop.

Apart from depending on the indicator, make sure to follow all the basic principles of risk investment. That idea is capable of making your trade more cost-effective.

Top five tips to improve your trading skills

In many cases, traders put in the hours and believe that they will become more skilled if they analyze charts, read books, and study courses. Of course, investing some hours every day is essential, but “working smartly” should be your top priority.

The following are five basic ideas to help you improve your trading skills to make more profits with potential benefits.

Tip 1. Never go with other’s belief

Discussing your trading plan with your trade colleagues isn’t a concern. It also doesn’t matter if you rejoice in your performance with them. But always remember to trade your trading plane with the KDJ indicator. To trade specifically, you have to follow your strategies. Never try to go with your trading partner’s beliefs. If you follow their opinions, there must be a risk in your trading path for sure.

Why does it happen?

Constantly, poor performance or small profits could be the cause of it. However, there’s a 95% chance of missing out on your trading path or strategies. Media, press, magazines, websites, your trading referee are the reason behind your distraction.

How to avoid the mistake?

Try to keep your trading secrets to yourself. Too many discussions on the performance may make you lose. Websites, media, press, etc., are just stones. Remember, don’t let someone’s opinions destroy your trade profitability.

Tip 2. Keep on practicing with KDJ

Even if you’re a skilled person with years of experience in trading, you should practice keenly. Use a demo account with the KDJ indicator’s activation and implement new trading strategies without fear of losing. You wouldn’t generate extra profits or lose the previous amounts without keeping practice.

Why does it happen?

Most skillful traders stop practicing because they consider themselves experts in trading with the KDJ indicators. And if it’s a new trader who recently jumped into trading and surprisingly made some profits, did the same. Indeed, it’s not a good attitude.

How to avoid this mistake?

Nothing can stop you if you keep on practicing. Just use a trial account and start implementing all your intelligent tactics. In this way, you can eventually increase your profit. Don’t forget to check out the yellow, blue and purple lines, then make your next move accordingly.

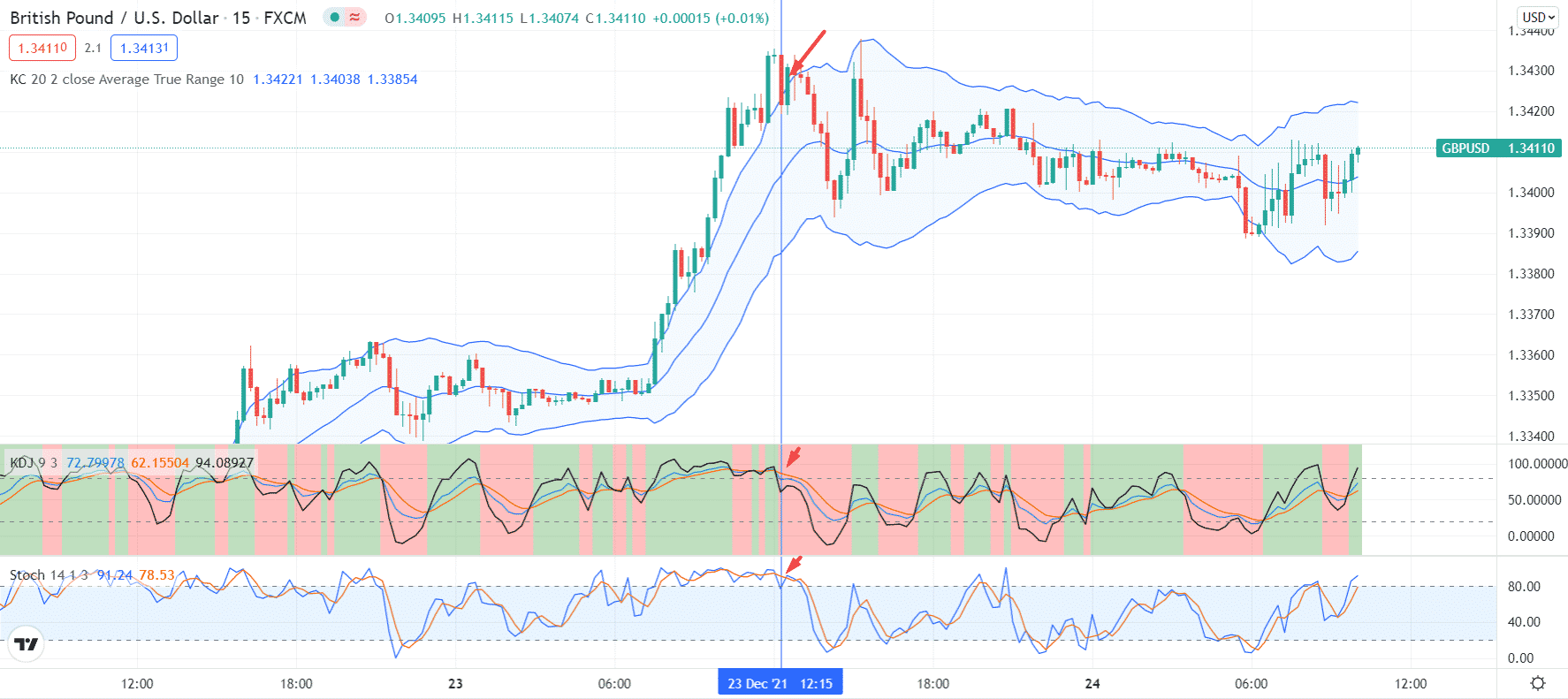

Tip 3. Intraday KDJ oscillator trading strategy

This trading strategy uses the following indicator to confirm the readings:

- Admiral Keltner (requires MetaTrader Supreme Edition – MTSE)

- Stochastic Oscillator (15,3,3)

- Admiral Pivot (D1) – recommended (also requires MTSE)

Using these indicators with KDJ, you can gradually improve your trading skills. This tip follows some famous rules known as short trades, long trades, stop loss, etc. To trade smartly, you need to obey these fundamentals.

KDJ is an excellent momentum oscillator. Keep in mind the basic principle of trading: when the price drops, we buy, and when the price rallies, we sell. Precisely this is what the KDJ identifies – when the price is ready to be sold or purchased.

Why does it happen?

Traders often forget to pinpoint the buy or sell signal. Due to a lack of focus on trading.

How to avoid this mistake?

Must focus on the basic rule, basic for example, long trades, short trades, etc. These are the essentials of the Intraday KDJ Oscillator Trading Strategy.

Tip 4. Record your trade with the KDJ indicator

Analyzing the chart and suddenly forgetting all the previous trades. Finding all the errors and highlighting them for the subsequent profits, you get blank when applying it practically. These are the reasons behind you not making progress.

Why does it happen?

When you’re in a hurry, you often make these mistakes. This can go crucial if you’re trading in your account. But this is only taken for granted when you are trading on a demo account.

How to avoid this mistake?

To trade effectively, every trade you make should be monitored and reviewed. Take screenshots of your trades, including the entry, stop loss levels, targets, and technical/fundamental annotations, so you can go back and evaluate them later.

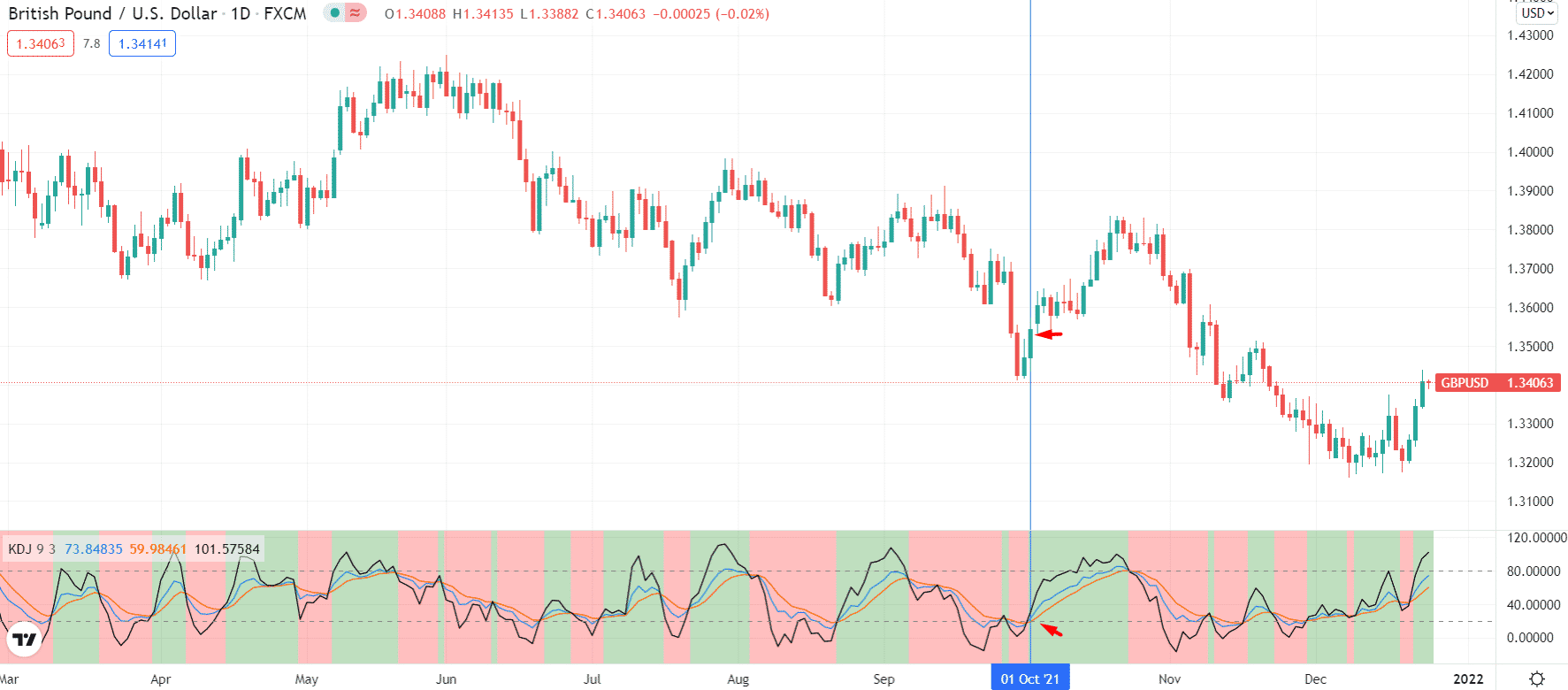

Tip 5. KDJ swing trading strategy

Frustratingly, this strategy has been developed to not sit in front of your computer and analyze the charts for the whole day. It will help you to trade effectively in a short time. Swing trading strategy is the most suitable way for part-time traders. However, there are many more aspects to consider, which we see later.

Why does it happen?

Traders get frustrated easily due to the up and down of profit readings. That’s why they don’t prefer sitting in front of devices to watch the trading with the KDJ indicator.

How to avoid this mistake?

Although it’s not a mistake, It’s a natural phenomenon with every next human. But for the sake of ease, this “KDJ swing trading strategy” seems to appear on the screen.

Final thoughts

Everything has been described in detail, from the explanation of the KDJ incisor to tips to improve trading skills. It’s your turn to implement these tactics and increase the profitability of your trading with the KDJ indicator.