Swing trading is becoming more popular as people explore methods to increase their income while working full-time. And now that fancy crypto apps have arrived, trading on the move has never been easier.

But how does swing trading works in the crypto market, and what are the pro tips you can use to decipher the market? In this guide, we’ll answer everything about swing trading and what are the top tips you can use.

What is the swing trading crypto strategy?

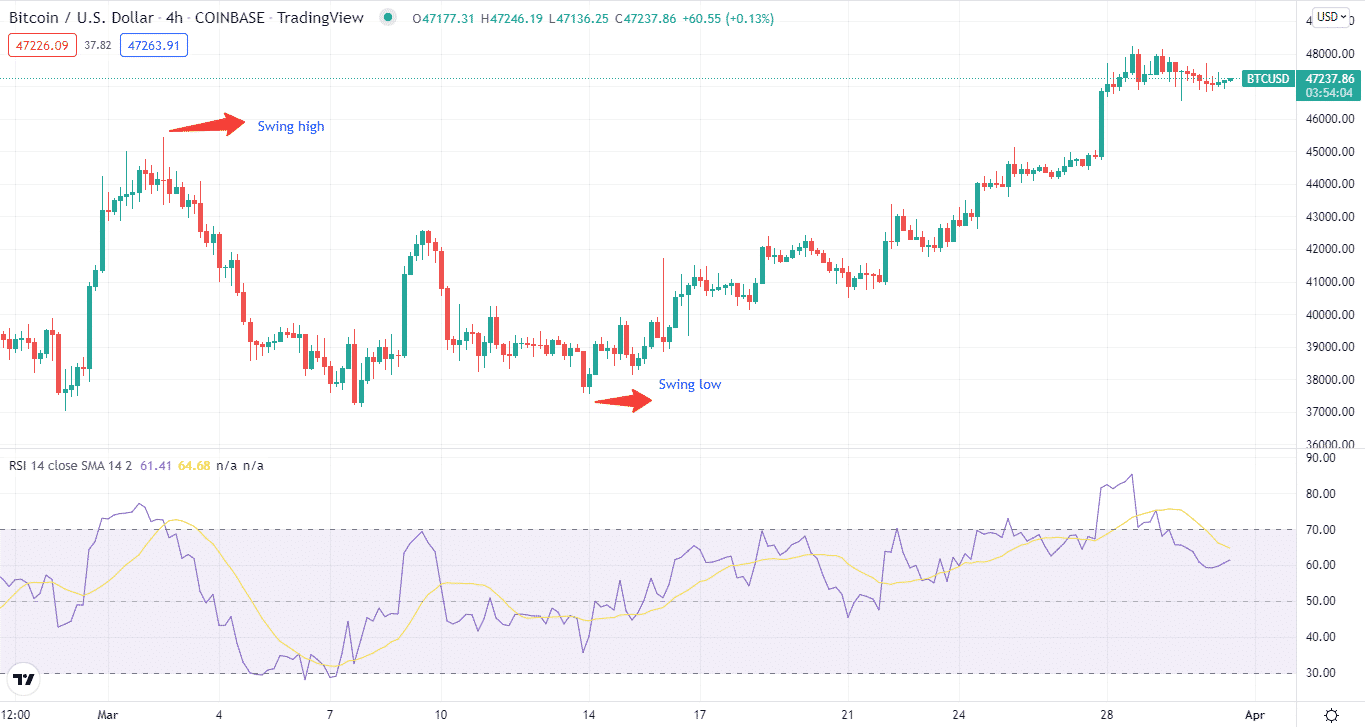

Such trading involves capturing price fluctuations from short to medium time frame. Here the market participant catches the market swings that last a few days to many weeks.

That differs from day trading, in which assets are kept for no more than a day, and position trading, in which assets are held for weeks, months, or years depending on market patterns.

Swing traders commonly use technical analysis to develop trade ideas, although not to the same extent as day traders. They may add fundamental analysis to their strategy since fundamental events might take weeks to pan out.

Swing traders make a deals from 4H charts to daily charts on the crypto market. They will frequently find market entrances, initiate long or short positions, and swing them based on this and the term of their chosen time frames.

It indicates that, while a trader is uninterested in the underlying asset’s short-term fluctuations, they are unconcerned about its long-term value. Instead, their main purpose is to profit from the ups and downs in the value of crypto.

Top five tips for swing trading with crypto strategy

Let’s move to the top five tips on how you can trade effectively.

Tip 1. Applying moving averages

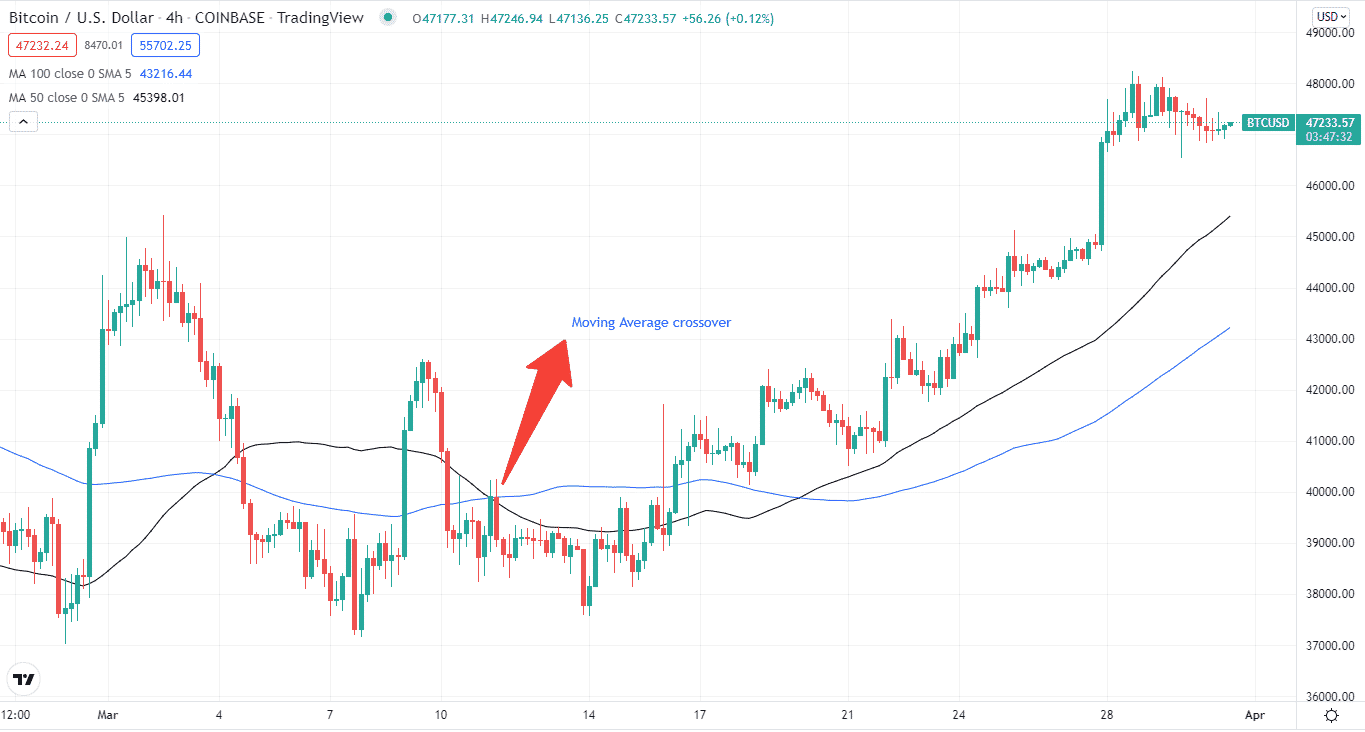

In the crypto trading world, moving averages are a popular technical indicator. MAs can tell us entries and exits depending on the choice selected, a single or many indicators.

Why does it happen?

A swing trader might employ MAs for trend analysis when several MAs are in play for a crossover technique.

On the other hand, swing traders frequently employ the 50 and 100-period MAs.

- The 50-period MA may be used to spot trends.

- The 100-period MA can be used to find support and resistance based on the trend.

How to avoid the mistake?

The 200-period MA is appropriate for more conservative swing traders since it captures price fluctuations over a year, 200 trading days. In addition, this MA works well on a daily chart.

Tip 2. Looking for pullbacks

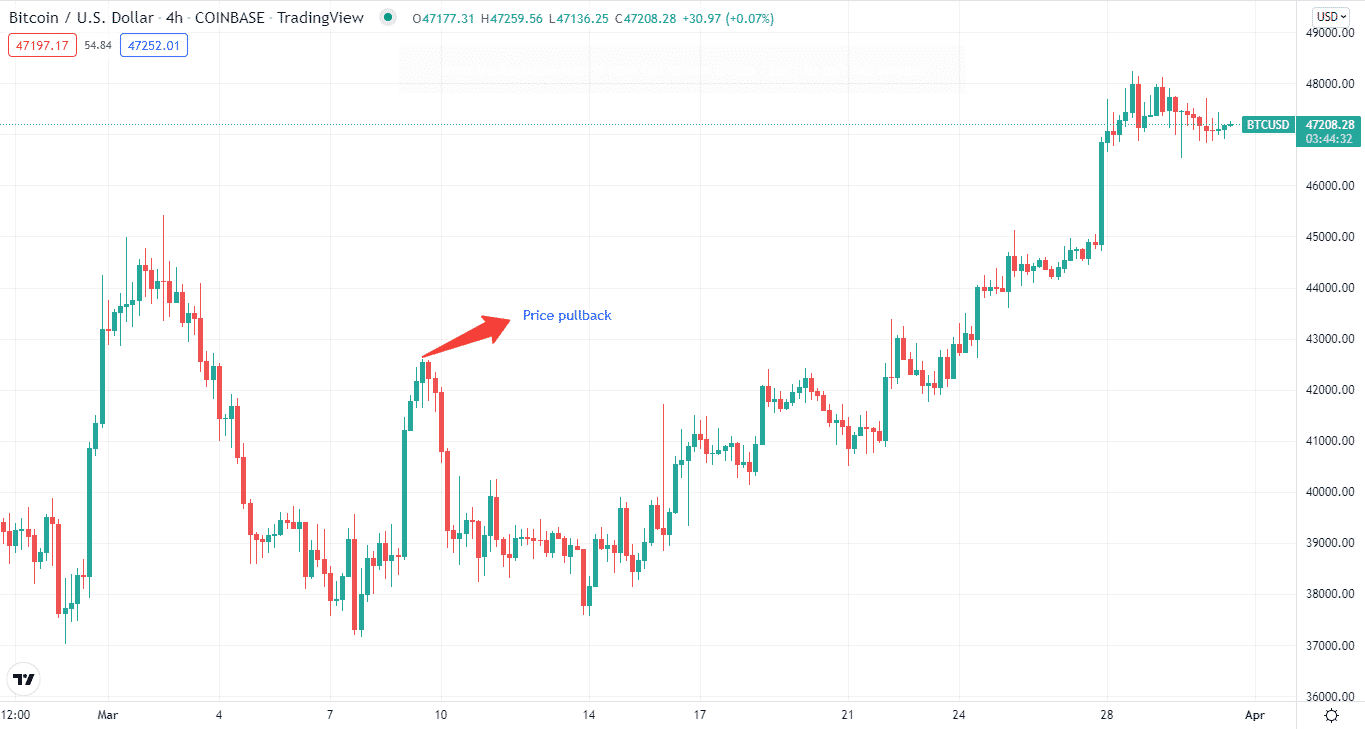

The pullback crypto swing trading is for those who missed the early breakthrough period. You aren’t entirely out of luck if you miss the breakout.

Why does it happen?

Many traders will do what is known as buying the pullback instead of buying during the run-up. Following a breakthrough, a coin’s price usually skyrockets.

Patient traders will not buy immediately before a severe pullback. Traders will, however, begin to take profits at some time. As a result, there is a major price drop. This substantial drop provides another buying chance for traders who missed the first breakthrough.

How to avoid the mistake?

Swing trading does not evaluate the potential long-term profits because the strategy’s main goal is to retain the asset for a few weeks and earn as much as possible.

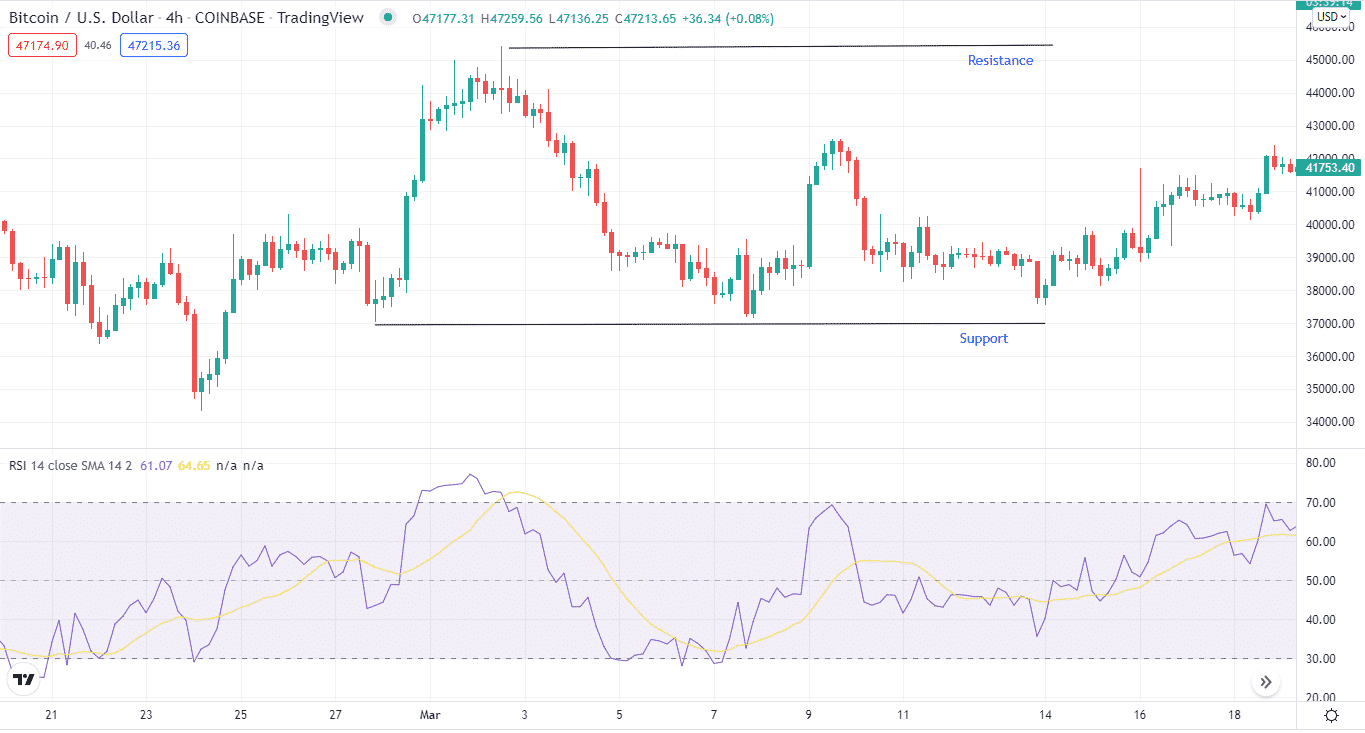

Tip 3. Trading in a range

Crypto markets are trending 30% of the time, moving in a definite uptrend or downtrend. For the most part, cryptocurrency prices are consolidating, or in a range state, 70% of the time.

Why does it happen?

Swing traders might profit from the market’s consolidating and volatile conditions. Using the 4HR or daily chart, a swing trader must indicate resistance and support zones using momentum trading indicators such as RSI or MACD.

How to avoid the mistake?

A break-over resistance or below support usually signals the end of the range market, allowing traders to select swinging positions using other methods.

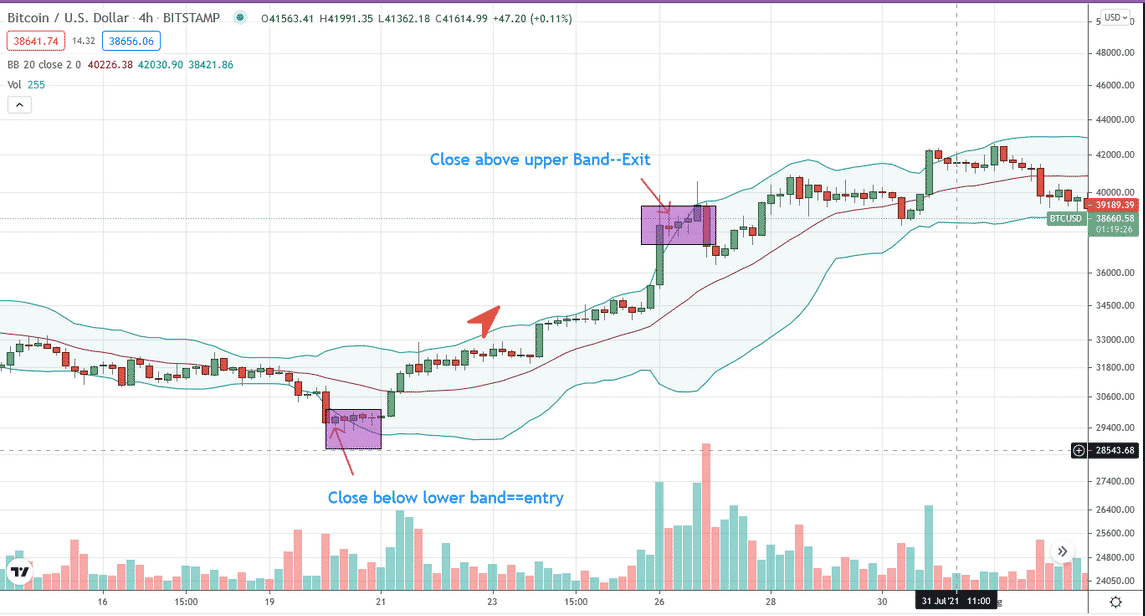

Tip 4. Applying the Bollinger Bands

The Bollinger Bands (BB) indicator is a popular tool for identifying trends in various time frames.

Why does it happen?

A swing trader may use the BB to determine entry and exit points. For example, a trader may start long when prices revisit the lower BB, a candlestick closes below the band, and then exit when prices retest the higher BB, or a candlestick closes above the band.

How to avoid the mistake?

BB is a lagging indicator that follows current market movements rather than predicting price trends. As a result, traders may not get signals until after the market movement.

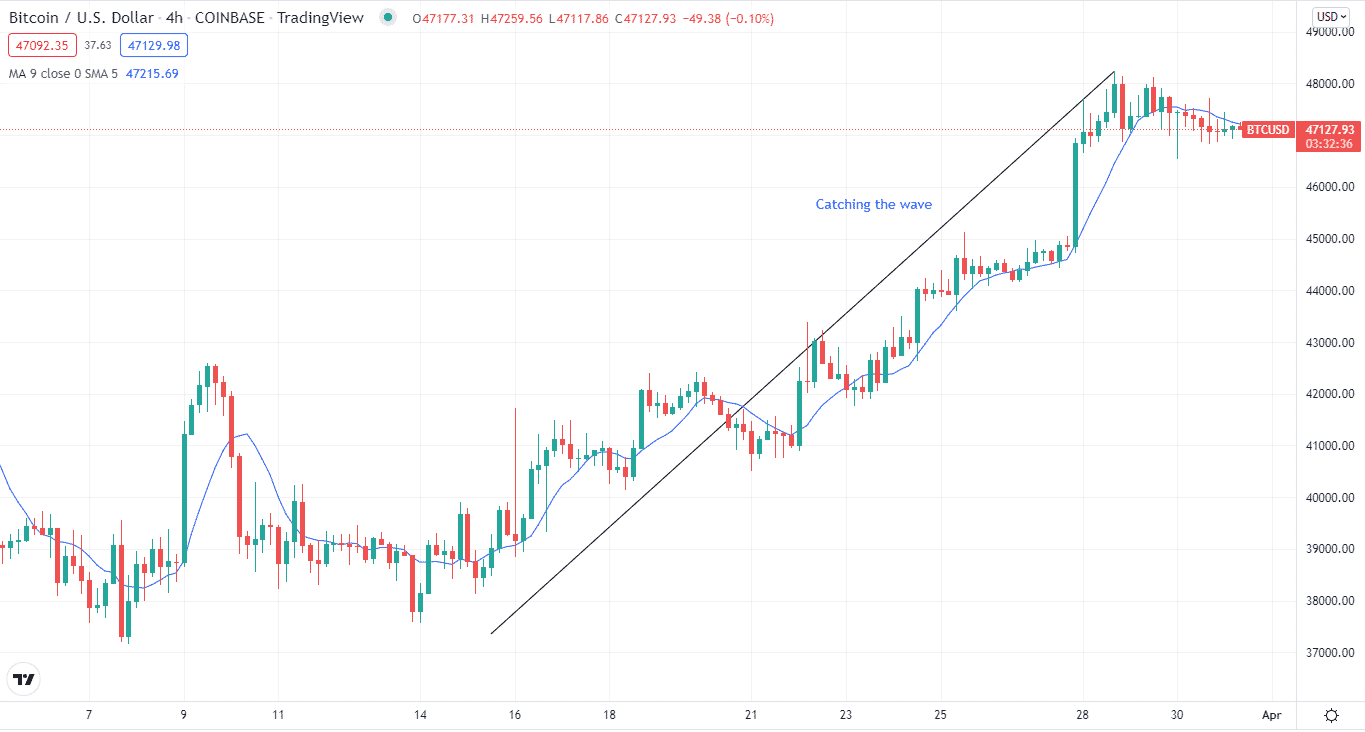

Tip 5. Catching the wave

It is a trading method in which the trader recognizes a trending market. Then, they try to ride a single huge move after identifying a pattern.

Why does it happen?

This method might be seen as a surfer spotting a wave and riding beside it. The surfer captures the wave and rides it for seconds before the wave smashes.

A trader may, for example, use a 50-day MA to spot a trending market. The trader goes long when the coin breaks through the MA. An increase in buying interest usually accompanies this breakout. A buying frenzy follows this breakthrough. The coin’s price rises as a result of this increase.

How to avoid the mistake?

Take note that you may use this method for a range of time frames. For example, a trader might try to ride the intraday price movement. They may, however, pan out and see the peak of a week-long trend.

Final thoughts

When it comes to trading strategies, there’s hardly a one-size-fits-all approach. Instead, fundamental and technical factors all play a part. On the other hand, swing trading can be worth looking into if you’re trying to get into trading swiftly.