The number of forex strategies is replete with variety. You can use them separately or combine them for new strategy creation. Many traders know the basics strategies but don’t know some of the hidden ones. One of them is FX straddle options.

If you ask your trader buddy what forex options straddle is, chances are he probably hasn’t heard of it. This is because it is not a common strategy. Only a handful of brokers offer forex options as spot trading.

However, other brokers are missing the big piece of the pie. In this guide, we will break down FX straddle options and show the benefits. But first, let’s check a few concepts.

Forex options explained

It is a contract that gives you the right to buy or sell a specific currency pair within the expiration date. You need to set up a price to buy or sell the contract, which is a strike price.

There are two options that you can use for either buying or selling — call and put options.

- A put gives you the right to sell a currency pair within its expiration date.

- A call gives you the freedom to buy a pair within a specific date.

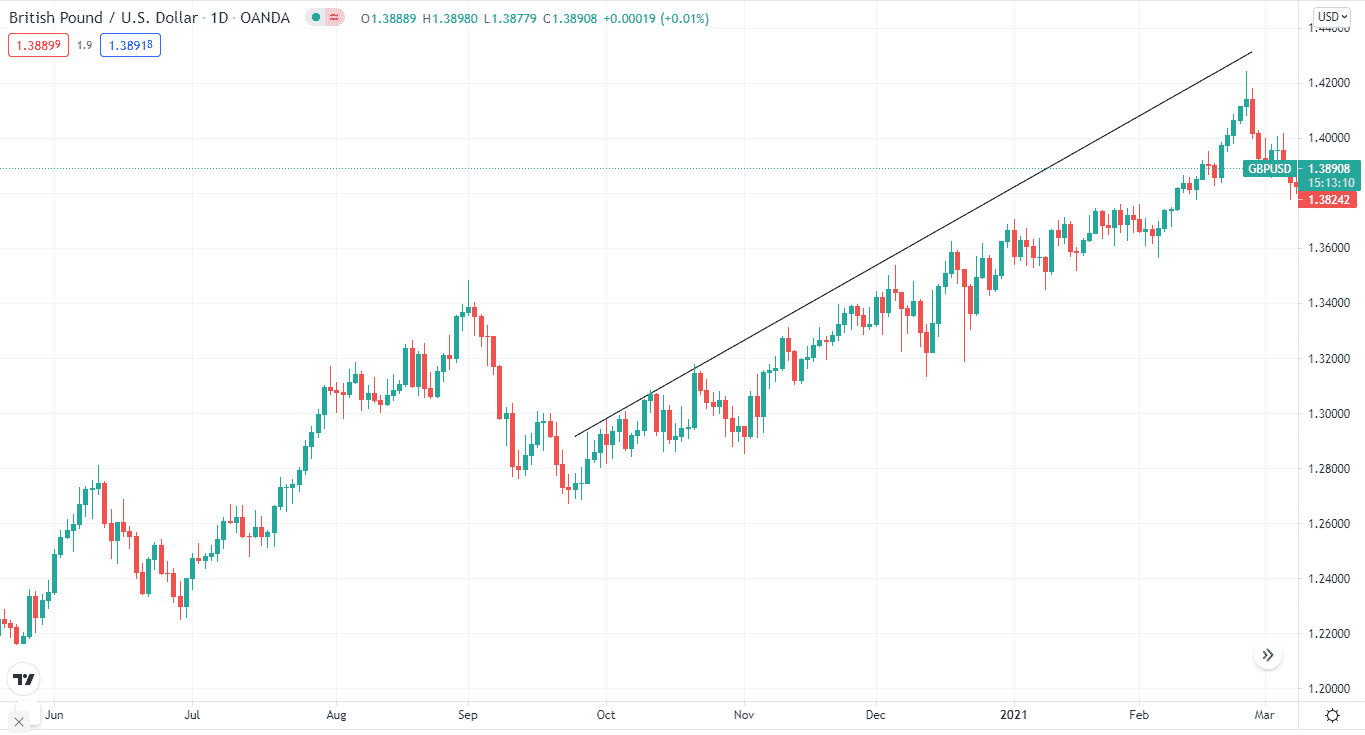

This is a simple approach to FX options, and it is plain vanilla options. You don’t have to be an Einstein to trade them, as you have to place a trade according to the direction of the prices. Let’s illustrate this on the chart.

As you can see, from October to the end of February, the price of GBP/USD was in an uptrend. So, you would have to place a trade using a call option within the contract expiration date.

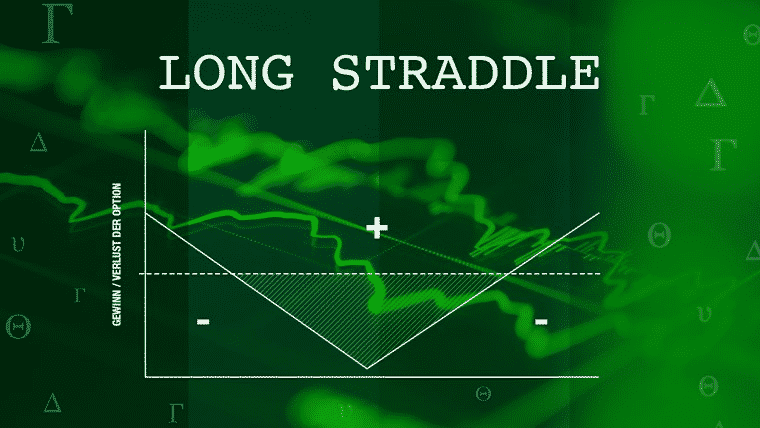

What’s a straddle?

It is a type of options strategy that is on the neutral side. This means you can both put and call options for a currency pair at a similar expiration date. Remember, while discussing FX options, we said you could buy a call or sell a put option. However, the straddle takes that out of the equation. This is why it’s a neutral strategy. You need to buy/sell a put and a call option within the same expiry.

Remember that you need to hold an equal number of put and call options. Disturb the balance, and you are no longer using a straddle strategy.

There are two types of straddle:

- Long

- Short

Long straddle

Think of a long straddle as your go-to source when there’s uncertainty in the markets. So the markets move in three directions:

- Up

- Down

- Sideways

When the market is up or down, there’s no need to break a sweat. Instead, you take positions on the course of price. But the real problem occurs when the market moves sideways. You can’t predict where the market will go next.

To solve this problem, you can use two approaches:

- Wait for the market to become stable.

- Hedge the market — take “buy” and “sell” positions at the same time. And that’s where the long straddle kicks in.

By using a long straddle, you buy a put and a call option. It doesn’t matter where the market will go next, as you are trading in both directions.

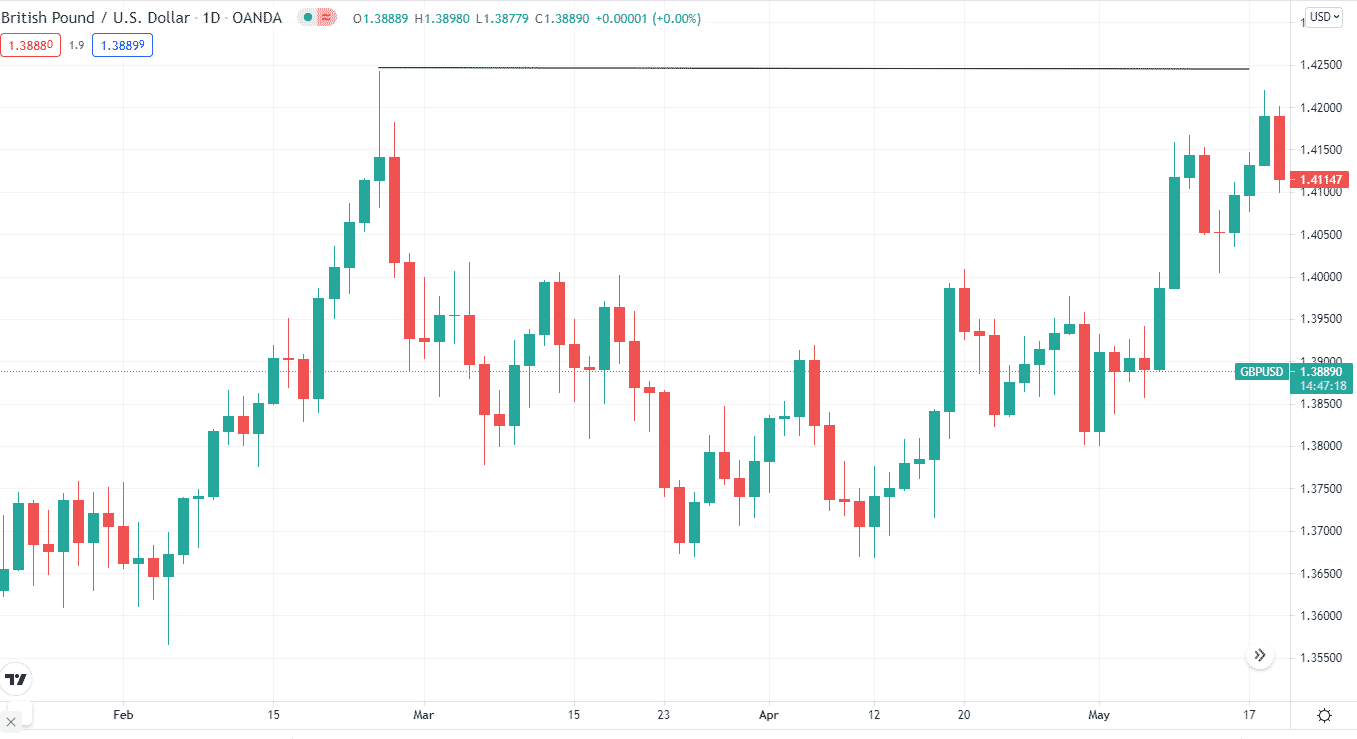

As you can see on the chart below, the price is moving in a certain range; you don’t know what will happen next. So, by using a long straddle, you can take the monkey off your back.

However, as no strategy is perfect, a long straddle has its flaws. First, you are holding both options at the same time. Second, the price will move in either one of your directions. But what if your losers become bigger than your winners?

This is where the long straddle lacks.

Short straddle

It allows you to sell put and call options. As long as the price is moving sideways, a short straddle is your friend.

If the price goes wild in either one of the directions, chances are your winners become less than losers. So, this is a major drawback of a short straddle.

Forex straddle options strategy

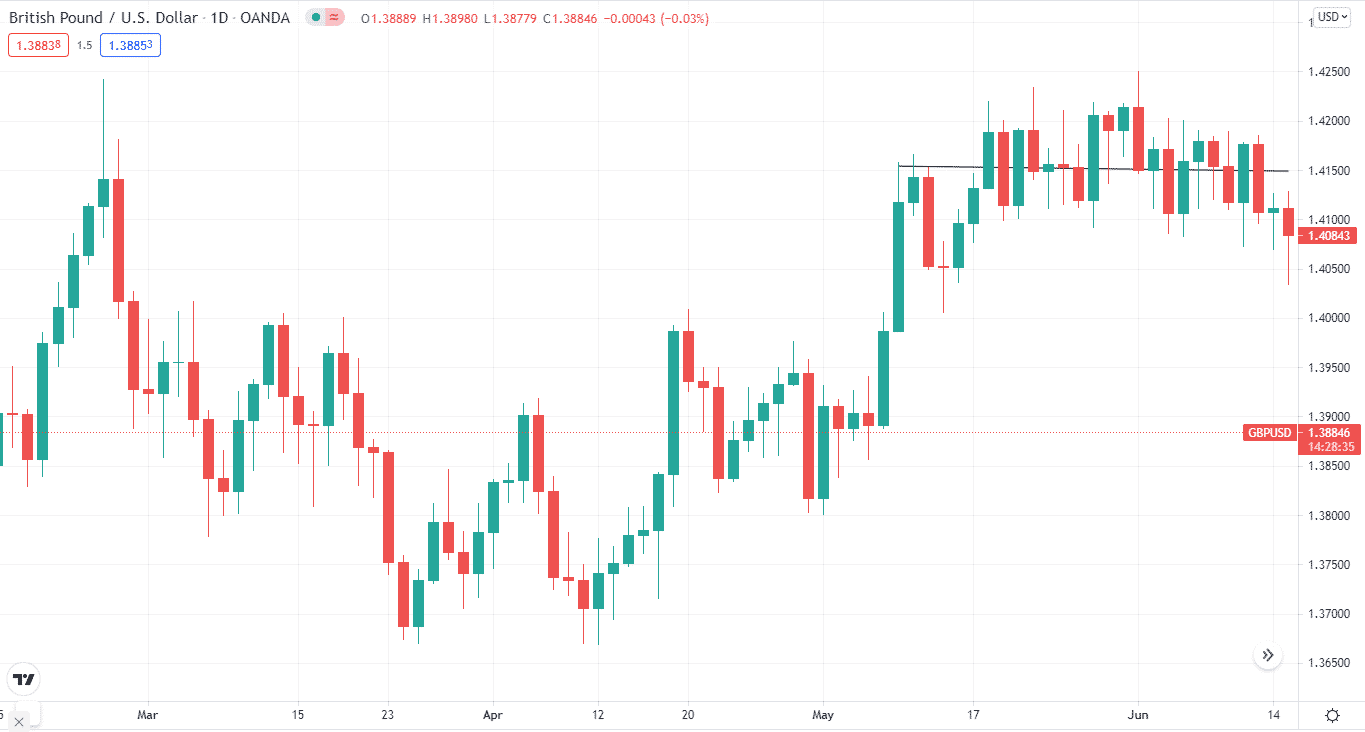

Below, you can see GBP/USD traveled in a specific pip range. From May 10 to June 15, it fluctuated between 1.4154 and 1.4143. After that, it rose to 1.4250. Then, however, there’s only an increase of 96 pips.

When these types of situations occur, you can apply a short or a long straddle. Keep in mind that the expiration date and the strike price have to be the same. Otherwise, it’ll ruin a perfect setup, and you can say “bye-bye” to your profits.

When do forex straddle options work best?

If you want to try your hands at FX straddle options, you need to remember a few points. First, this is when FX straddle options work best:

- If the market is moving sideways

- If there’s a major news event or announcement

- If market analysts are waiting for a certain announcement

It’s not rocket science that market analysts have a significant impact before a major news event.

As mentioned before, the market needs to move sideways for straddles to work. So there’s no point in using a straddle strategy if the market is going up or down.

The markets can be highly volatile if there’s a major news announcement. So, as a straddle trader, you must keep your economic calendar open before jumping in.

Before the announcements like NFP (non-farm payroll), or the Fed meeting, analysts try to predict the outcomes. Thus, they can forecast weeks before the events and take their positions accordingly.

How the markets react to their positions is uncertain, so you don’t know whether your straddle strategy will be effective. To solve this, you need to determine the market momentum. This way, you can know when to straddle long or short.

Final thoughts

Trading FX straddle options can be a bit of a hassle if you are a beginner. It can even be not very clear for pro traders.

But you don’t have to worry as we have covered it all for you. Go through the guide again if you don’t understand anything. You’ll find all your answers.