In contrast with futures and stock markets, the foreign exchange allows you to trade even with a meager capital of $100. This is why many small traders around the world flock toward forex trading. This comes as a result of the availability of electronic trading and the proliferation of online brokers.

FX enables any trader to take significant positions with small collateral in his trading account as a leveraged market. You can allocate a small amount from your account as a deposit and then trade 20 times this amount or even more with margin trading. Depending on the broker, 500 times or 1,000 times leverage is even possible.

If you find forex trading interesting and have at least $100 of disposable capital, you can start trading after learning a simple strategy. When you succeed in growing a $100 account, nothing could stop you from trading a $10,000 budget or more.

To start your trading journey, read through this post, and find a simple strategy that you can apply right away. Now let us understand why you can trade with $100.

Can you trade forex with $100?

While many people assume that it takes a large amount of capital to get started in forex trading, that is not true, especially nowadays. You can open a $100 trading account or less. Some brokers even allow you to open an account with as small capital as $5. Trading in forex is everybody’s game today.

This phenomenon arises due to the availability of diverse trading accounts. Plus, traders can choose leverage at their disposal. Here are some of the standard trading accounts offered by many brokers.

| Account Type | Base Units | Pip Value |

| Standard | 100,000 | $10 |

| Mini | 10,000 | $1 |

| Micro | 1,000 | $0.10 |

| Nano | 100 | $0.01 |

| Cent | 10 | $0.001 |

How to trade forex with $100?

This section will not give you a step-by-step guide on how to trade with $100. Instead, it will provide beneficial insights that can kickstart your trading career.

Choose a correct leverage

This is one of the reasons why just about anyone can participate in forex trading. With a little capital, you can take large positions if you use a high-leverage account. Leverage is, however, a double-edged sword. It can magnify wins or losses.

Take note that leverage varies per broker. Some brokers are more conservative than others on this aspect. Such brokers may offer you a 50:1 or 100:1 leverage. On the other hand, other brokers will offer the highest leverage possible, including 500:1, 888:1, and 1,000:1.

As a new trader trading with a small account, it is best to use small leverage. In this case, the best leverage is 100:1.

Use the right approach

Many professional traders advise newcomers to think more about trading than making money. You have to learn how to trade first. It takes patience and time to learn this craft.

Making money or a living is everyone’s motivation in trading forex. However, when you focus on the reward part of trading, it can put you under stress, which will urge you to make bad decisions.

Traders embrace the concept that making money in currency trading is a product of learning how to trade. Assume the attitude of a trader and focus on the trading process. Money will start pouring in when you do.

Trade $100 like it is $10,000

Do not think of it as a small account even when you come to the forex market with just $100. Think of it as something big like it is $10,000 or more. You do not want to lose such a huge amount of money. Do the same with your $100. Do not allow a wrong trading decision to endanger your capital.

Do not be too emotional or impatient when trading. If you feel stressed because your account is growing slowly, it could lead you down a thorny road to overexposing and over-trading. Again, focus on becoming a good trader.

What is the best strategy for trading forex with $100?

There is no best strategy in trading with $100. You can use the same strategy you apply for a bigger account. Below are some best practices you can follow when trading with a small account:

- Risk only two percent of your account in each trade. Using a percentage risk instead of a dollar amount or a lot size allows you to scale in or scale out easily. If you are winning and your account is growing, you can scale in quickly. Meanwhile, when you are losing and your account is going down, you can lower your lot size equally fast.

- Always use a stop loss in all your trades. The stop loss will define the risk in each trade.

- Use a good reward-risk ratio in each trade. This will give you surviving chances until you become profitable.

The most straightforward trading strategy that any trader, regardless of experience, can attempt is the TLS strategy. TLS stands for trend-level signal. This strategy is a flavor of the pullback trading methodology and uses the concept of break and retest. Let us find bullish and bearish trade setups using this method.

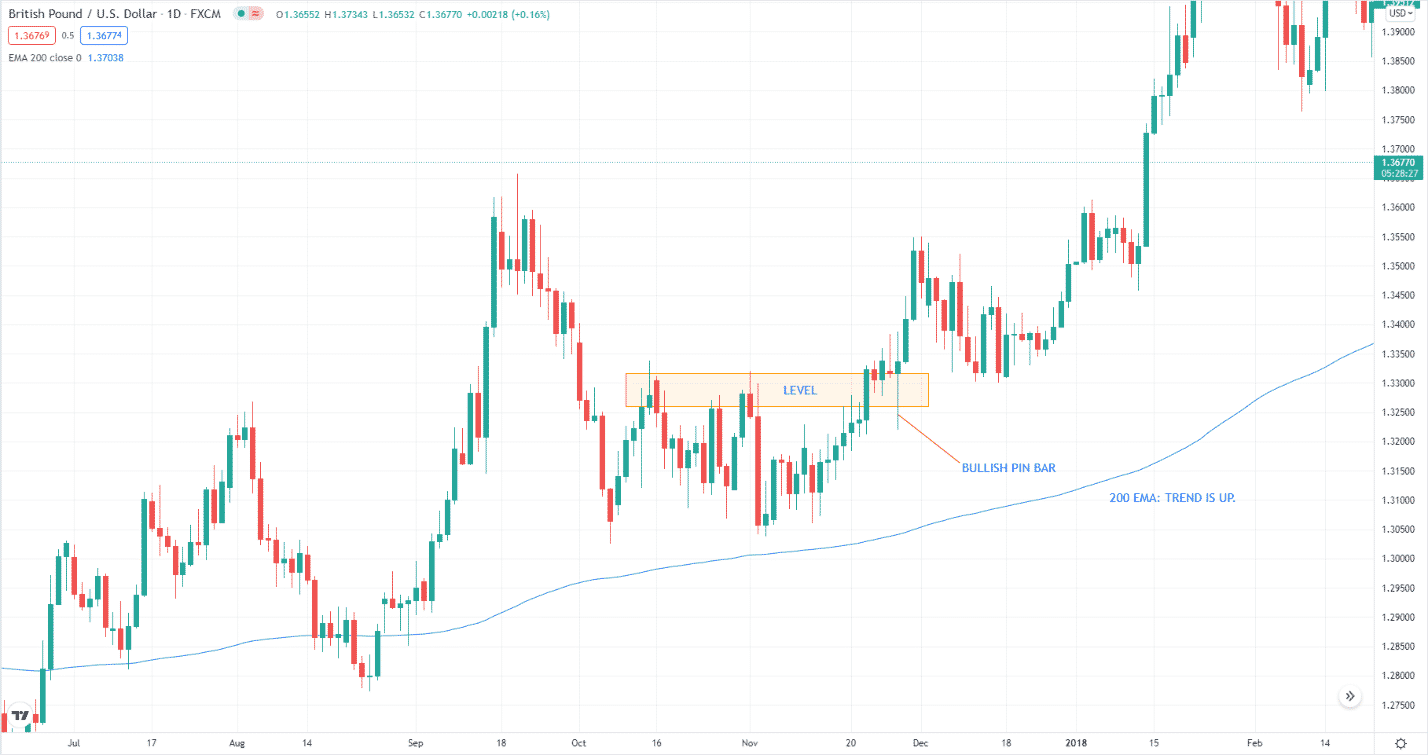

Bullish trade setup

See the bullish setup on the GBPUSD daily chart above. The trend is bullish since the price is above the 200 EMA. Then price formed a trading range that was broken to the upside. Shortly after, the price retested the breakout level or zone and rejected it with a big bullish pin bar. This signal is enough to open a buy trade.

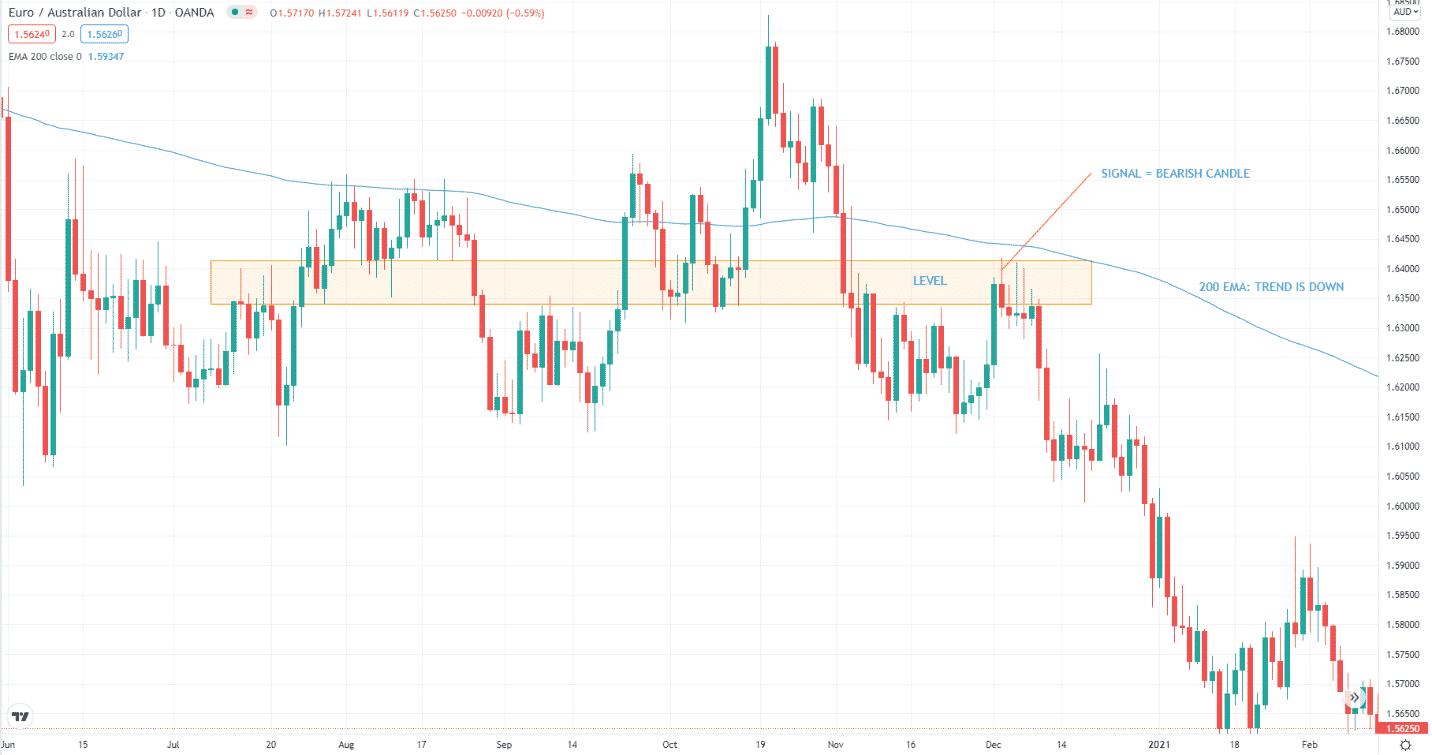

Bearish trade setup

Consider the above EUR/AUD daily chart. You can see that the trend is down because the price is below the 200 EMA. Meanwhile, the price retested the resistance level or zone from below. When you see the big bearish candle rejecting that level, you know that a sell-off could ensue. Price sold off vehemently afterward.

How to manage risks?

Risk management has been discussed at length in the previous sections. Let us summarize the key points here. To keep or even grow your $100 account, make sure to implement the following measures:

- Use suitable leverage, not too high and not too low.

- Risk only two percent in each trade.

- Put a stop loss in each trade.

- Have an excellent reward-risk ratio in each trade.

- Do not trade too many pairs at the same time.

- Trade less often.

Final thoughts

You can trade with $100. To do this, you must find a broker that offers a cent, nano, or micro account with high leverage. Then it would help if you traded according to your trade plan. You can use the simple TLS strategy presented in this article. Keep in mind the three pieces of advice given above. They will direct your path as you journey toward profitability.