Among the many technical trend indicators used in the FX market, the moving average is widely used. Price movements are displayed through this indicator. As well as an integral part of Bollinger Bands and Envelopes, both popular indicators, the standard is a foundation for them.

MAs are available in various types, including simple, exponential, and weighted. Next, we will look at some strategies included in this article for trading the smoothed moving average (SMMA).

What is it about?

It is like a simple and exponential moving average. However, it has a more extended period. About half the EMA period: for example, a 20-period SMMA is about the same as a 40-period EMA.

Monitoring changes in cost is done with the help of this measurement. The moving average helps make long-term trends more apparent by smoothing out the price movement since they are less volatile.

It is a sign that investors are becoming bullish when the commodity price rises above the moving average. Lower prices indicate that the thing is bearish. Moreover, research suggests a downward shift in the market when the longer-term trend crosses the MA.

The market is likely to upswing whenever the short-term MA crosses the longer-term MA. A moving average with a more extended period smooth price movement. The longer moving averages indicate a trend with a longer horizon.

Top five tips for trading with SMMA indicator

SMMA is popular in trending markets because of its ability to remove short-term fluctuations and allow us to view price trends. However, as discussed above, it is impossible to delete the oldest price data when adding a new cost to the calculation.

As a result of the low assigned weight to the most senior data, the oldest share data always slightly impacts the analysis. Its superior filtering capability ensures that temporary fluctuations in price (also known as ‘noise’) do not last. Therefore, it succeeds in visualizing the prevailing trend better than the other MAs.

Tip 1. Trade the indicator with trend

Sometimes, the right indicator helps you find the trend reversal too early. SMMA is one of them.

How does it happen?

In trend following, one buys a financial asset whose value is increasing and sells one whose value is declining. It assists a trader in determining whether to hold on to a position or not.

For example, the indicator will remain below the price when the cost is upward. On the way to the end of the direction, the movement will begin to move towards the indicator.

How to avoid mistakes?

Identifying the suitable period to use with the arrow is essential to using the strategy effectively. Now the question is to find out the exact trend.

You can see the chart below to understand the concept. These shares seem to be in a bullish trend overall. Therefore, it is beneficial to bullish traders to hold the stock when its price is above the moving average. Conversely, sell signals are triggered when the shares cross the indicator.

A trading strategy that works across multiple asset classes is one of the most influential markets.

Tip 2. Try the SMMA indicator in reversal form

You might have used the SMMA indicator as discussed above. However, learn this unique way to adopt the indicator.

How does it happen?

SMMA is a tool to identify reversals. An asset that regressions refer to an investment that ends a trend and starts a new one. In a trend reversal, a bullish trend will reverse and become a bearish trend and vice versa. Again, using the SMA as part of a trading strategy is effective.

How to avoid mistakes?

It is possible to trade reversals using this trick in several ways. The most effective trading strategy uses two moving averages of different durations. You may see a turnaround when the shorter and relatively longer-term moving averages cross.

If they are making it after a substantial decline, it is an indication that a new bullish trend is about to begin. In contrast, it is a sign of recent bearish trends to come if they make it after a solid upward trend.

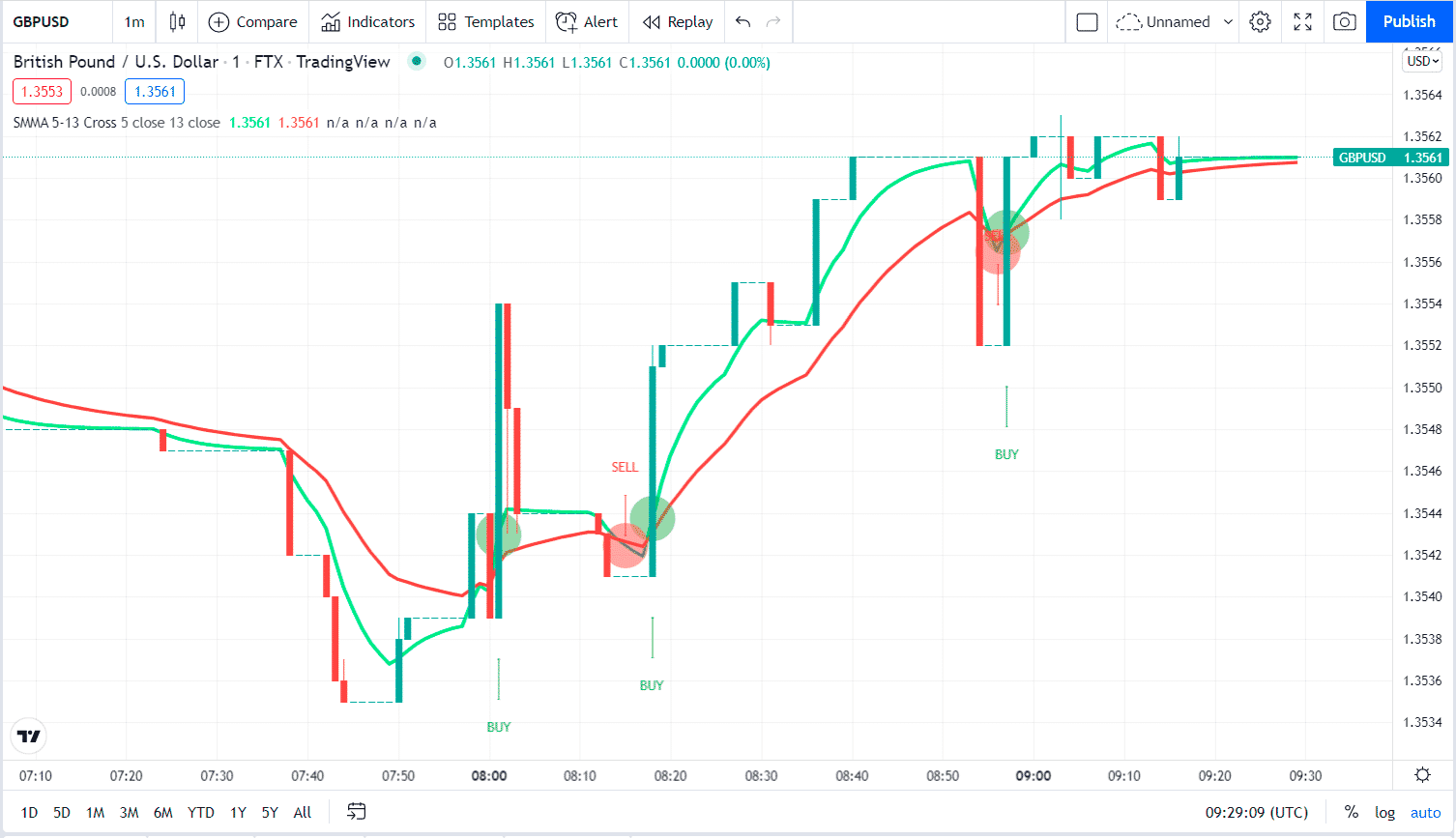

By looking at the graph below, we can see that the currency pair crossed over when the indicators turned bullish and bearish.

These crossovers are commonly referred to as golden crosses and death crosses by long-term traders. For example, if the 50-day and 200-day SMMA indicators cross in a bullish direction, they form a golden cross, whereas if they intersect in a bearish order, they form a death cross.

Tip 3. Try to use it in reliable and trending markets

It is always recommended to avoid the instruments that mostly remain choppy or lag trend.

Why does it happen?

In trending markets, trendlines are most effective. An indication to buy occurs when the short and intermediate-term moving averages cross from below to above the long-term moving average. On the other side, a sell signal happens when the intermediate and short-term averages cross above and below each other.

How to avoid mistakes?

Using only two SMAs, you can use the same signals in a crossover system. However, most market technicians recommend using longer-term averages.

Tip 4. Try the price concept while trading

While using the SMMA indicator, be sure to apply the basic price action concepts to filter the bad trades.

How does it happen?

The concept of current prices can also be a trading approach. For example, you buy when the stock’s current price is higher than the SMMA.

How to avoid mistakes?

You liquidate your position as the recent price drops below either MA. To take a short entry, the current price must be lower than the SMMA. Liquidate the situation when the current cost exceeds the SMA.

Tip 5. Trade when the indicator shows the delayed reaction

You may need to wait for confirmation before entering a trade. Impulsive entries may not be suitable in many circumstances.

How does it happen?

It may be a better choice for those more interested in the long term than the SMA and EMA as it has a much larger delayed reaction.

How to avoid mistakes?

This type of metric is helpful for position traders who base their investment decisions primarily on a company’s fundamentals, who can use it as a visual short-term price trend indicator. On a daily chart, 100 or 200 SMMA, for example, represent the long-term trend for an investment.

Final thoughts

An SMA combines a standard one and an exponential one. The recent prices have equal weight with the historical ones.

A trader can make informed decisions using the SMMA indicator that gives a clear market view. Therefore, it is highly recommended to use it as an indicator in conjunction with another type but a different period length.

However, like any other technical analysis indicator, it only works well when certain factors impact the market. It works best when there is a stable downward or upward trend. The hand has no meaning when the market price moves sideways. When a trader’s skills and experience permit, they may perform a specific trading technique, such as pip-hunting, or avoid trading activity altogether.