What comes to your mind when you hear the words “supply” and “demand”? “Is this something to do with the economy”? Correct! However, in trading, it is more than that. It’s a whole new dimension and can open several profitable doors for you.

Let’s learn how you can use these concepts for position trading.

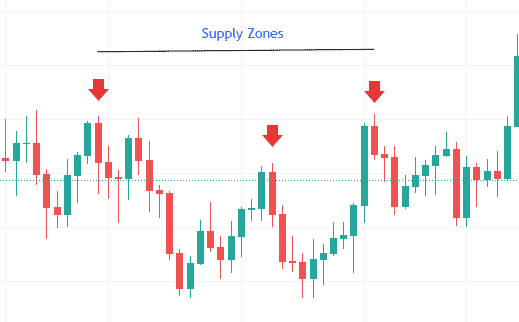

Supply zones

They refer to an area, which is above the current pricing level. This area surfaces on the chart when there is heavy selling.

- When the price touches the supply zones, it’s a signal that bears are taking over. When the price reaches a higher level, supply zone traders consider selling more because selling more at a higher price generates more profits.

- On the contrary, when the price is low, suppliers don’t take any position, as profitably is low.

Supply zones show the link between the volume and price from the seller’s standpoint. The more the price moves upwards, the more supply there is.

Let’s explain this on the chart.

The price drops between the first and the second arrow and then climbs again. After the second arrow, the price takes another dip and then rises till the third arrow. You may have noticed that the price moves in a certain range between these three arrows, thus creating a supply area.

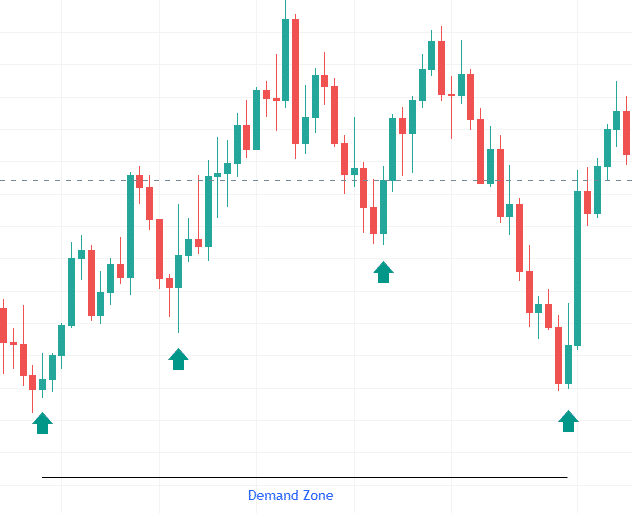

Demand zones

They mark an area below the current price level. The area forms when there is a lot of buying interest. The bulls are taking over, and you should go long.

So the price creates a certain range. The price does have a few hiccups, but it is traveling in the same range. So, whenever you identify demand zones, you take long positions.

Position trading

Many position traders look for strategies that can take all the hassle away. Why? Because they are in this for the long run.

Position trading is the most extended form when market participants hold positions for months or even years. They enter the trades and “forget” about it. The whole idea is to stay composed and wait for the more significant profits rather than scalping for a few pips.

How to use supply and demand for position trading?

The first thing you need to do is find market moves weekly or a monthly chart. These markets move to present us with supply and demand levels.

- Supply refers to bearish movements.

- Demand pinpoints a bullish fluctuation.

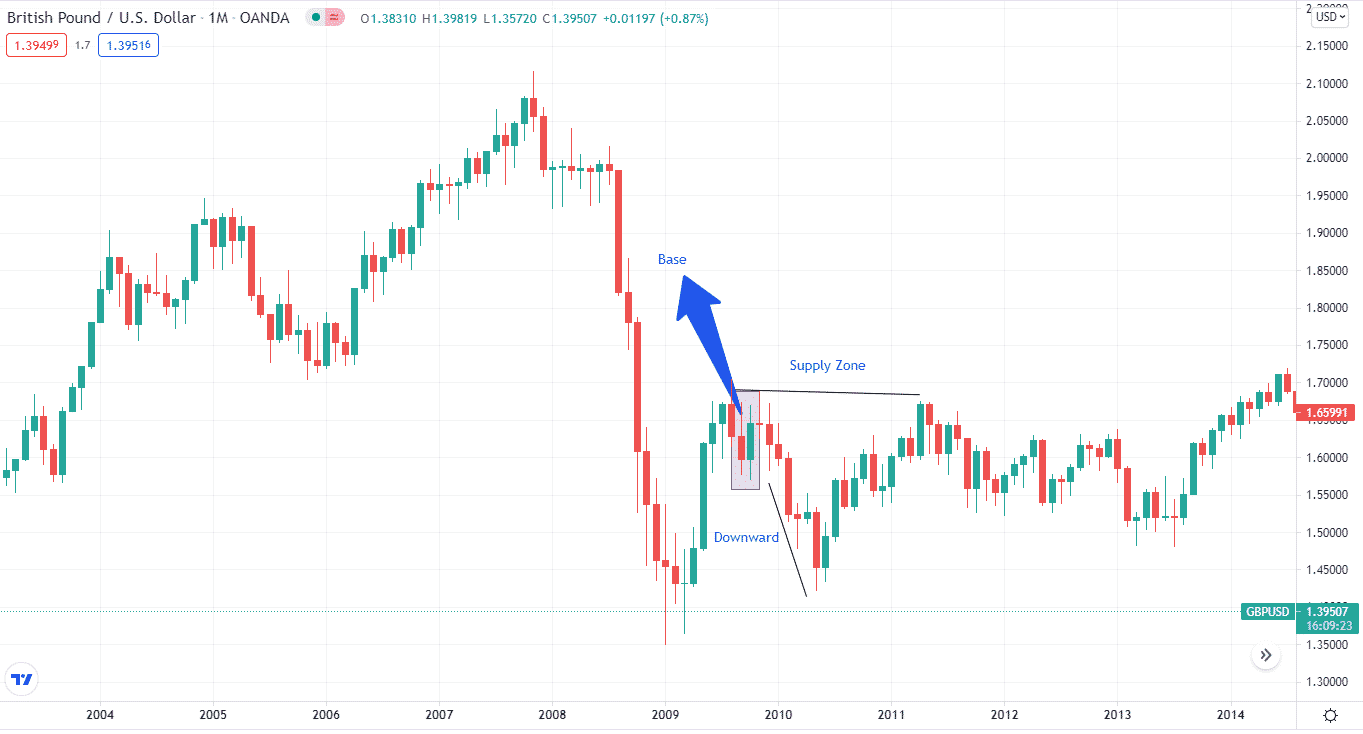

When we need to go short, we must first identify bearish candles in the supply zone.

On the chart below, you can see the price moving downwards inside the supply zone. The price climbs a little from the left side but then makes a three-candle structure, which is a base, and you can use less than six candles as the fundament. However, it is ideal to select a three-candle format.

These three candles determine whether you should go long or short when dealing with supply and demand zones. In this case, we are going short, so these three candles confirm the formation of the supply zone, and we can take a sell position.

You can take a position on the base, but it’s suitable to wait for confirmation. Then, right after the base, we can enter and leave the trade inside the supply area. You should also note how the price retraces up and drops as it reaches the supply zone.

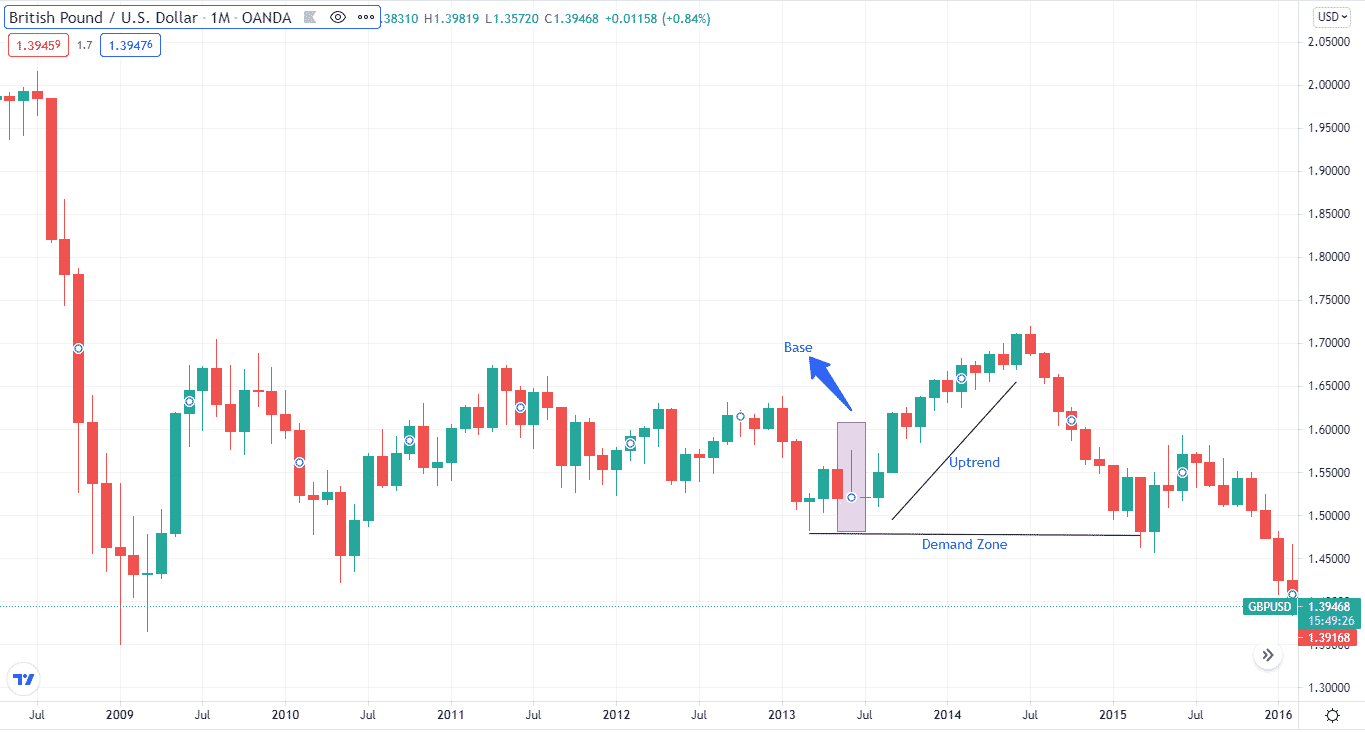

Let’s move to demand zones. It would help if you navigated bullish candles and a three-candle base structure for taking positions at the demand level.

Look at the example. Starting from the left, the price plummeted slightly, moved upwards, and then dropped again for a perfect buying point.

Notice that we could have taken the position earlier, but we waited for our three-candle base to confirm the demand zone. After that, we take our long position. By zooming out, you can look at areas where the price has earlier bounced off.

Do supply and demand zones work for position trading?

You probably are wondering:

- Are supply and demand profitable?

- Does supply and demand work for position trading?

- Are supply and demand trading a worthwhile strategy?”

The answer to all these questions is “Yes”. These zones are profitable for any style of trading. Be it position, breakout, or range trading.

But you should know that supply and demand are more of an idea than a strategy. This is because you can’t predict the future of these zones based on current supply and demand areas.

- Focus on identifying these zones

- Locate them on the chart

- Wait for the price action to go either bullish or bearish

- Take positions

Key takeaways for using supply and demand for position trading

- When the price goes up, you have a lot of buying pressure, thus creating a demand area.

- When the price goes down, there is heavy selling pressure, and we have a supply zone.

- Supply and demand zones in FX tell you about the possibility of a price reversal.

- You go long when the price moves upwards above the demand zone.

- You go short when the price dips below the supply area.

Final thoughts

Recognizing these zones is the most crucial step for position trading. You need to understand the overall structure of these areas and then take positions.