As an indicator for interpreting whether the market price is playing narrow or, Tushar Chande invented the Aroon indicator (AI) in 1995. The basic technical tool suggests the duration between highs and lows during a specific time frame. The tool also gives a measure of conviction of the price movement.

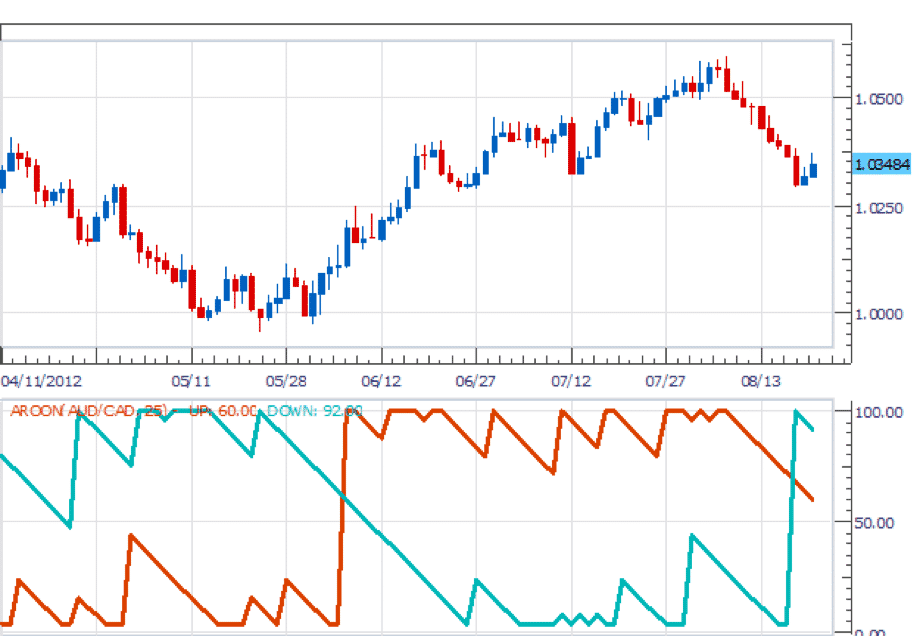

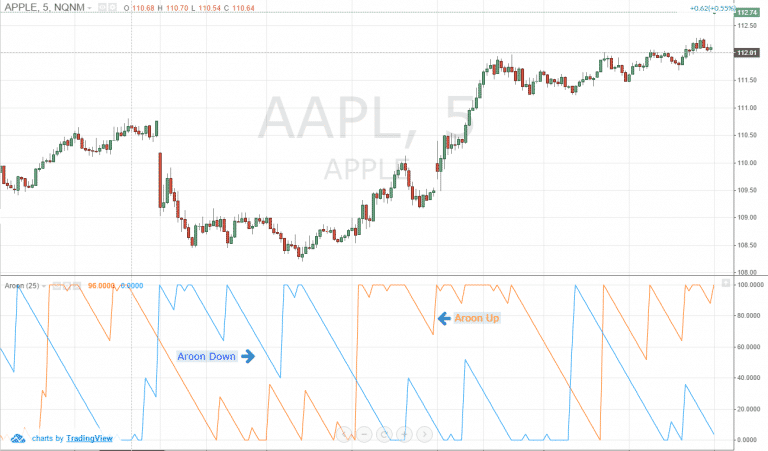

We regularly see new highs in a bullish movement, whereas strong downtrends regularly see new lows. It’s designed that way. This indicator comprises two lines, the ‘Aroon Up’ line, which symbolizes the periods in a high or intensity of bulls, and the ‘Aroon down,’ which indicates the severity of the bears and periods in low.

The intersection of lines shows trends in motion. For example, when AI up bisects AI down, a new up wave begins. Application of 25 day period applies to the AI. After certain bars, the indicator usually shows the previous high or low.

When the AI Up is above then AI down, it signifies bullish price, or when the AI down is above AI up, it shows the bearish price.

AI formulas:

AI up = 25 – period since 25 period high / 25 * 100

AI down = 25 – period since 25 low / 25 * 100

What is the indicator trading strategy?

The early light of dawn inspired Tushar Chande to name his indicator Aroon. He felt it’d be a good narration of his indicator as it shows the time in connection with prices, and it’s often used to signify the leading trend. It also tracks down correction times and recognizes when the market is affiliating.

Three levels are very effective in explaining the AI principle. These are the 0, 50, and 100 reading levels. The market shows a bullish signal when the AI up is higher than 50 and AI down is under 50. This setup signifies daily increases in price more than the daily lows in the market.

The crossover trading strategy

Crossover is the most helpful trading strategy where the trader goes longer and sees new uptrends whenever AI up transverses AI descending line. Similarly, traders go shorter when the AI down bisects the AI down the line. This strategy will remain forever; hence there are no exit signals for using this powerful strategy.

The AI trend strength strategy

With the indicator, you can see the depth and strength of the fundamental bias. Now that we’ve reached the 100 level, we’re getting a streak of little changes. If AI up reaches a plateau, it will simply hang for a while.

The AI up continues reading near the 100 level is a signal of very strong trends. However, at some point, probably in time one or two, the below trading synopsis can be expected, which is to predict a trend reversal and to expect a pullback.

The breakout of AI’s trading strategy

This is an effective strategy to regulate consolidations and breakouts. When AI down and AI up are adjacent, the price consolidates. Not any highs or lows are signified in the Levant period. Aroon simply explains that.

How to trade with the indicator?

Between zero and hundred, the AI index is scaled. Its up measurement more significant than 50 indicates that the price has sky-raised recently within 12.5 days. The down also obeys the same concept. When it surpasses 50, a low can be expected in the last 12.5 days. A lower reading close to a hundred means a low has been identified recently.

Crossover usually identifies the signals of passageway points. For example, AI up bisecting over down is a signal of purchasing. And down crossing below may be a signal of selling.

When both indicators are lower than 50, it can identify that the price is integrated. As a result, new highs or lows are not generated.

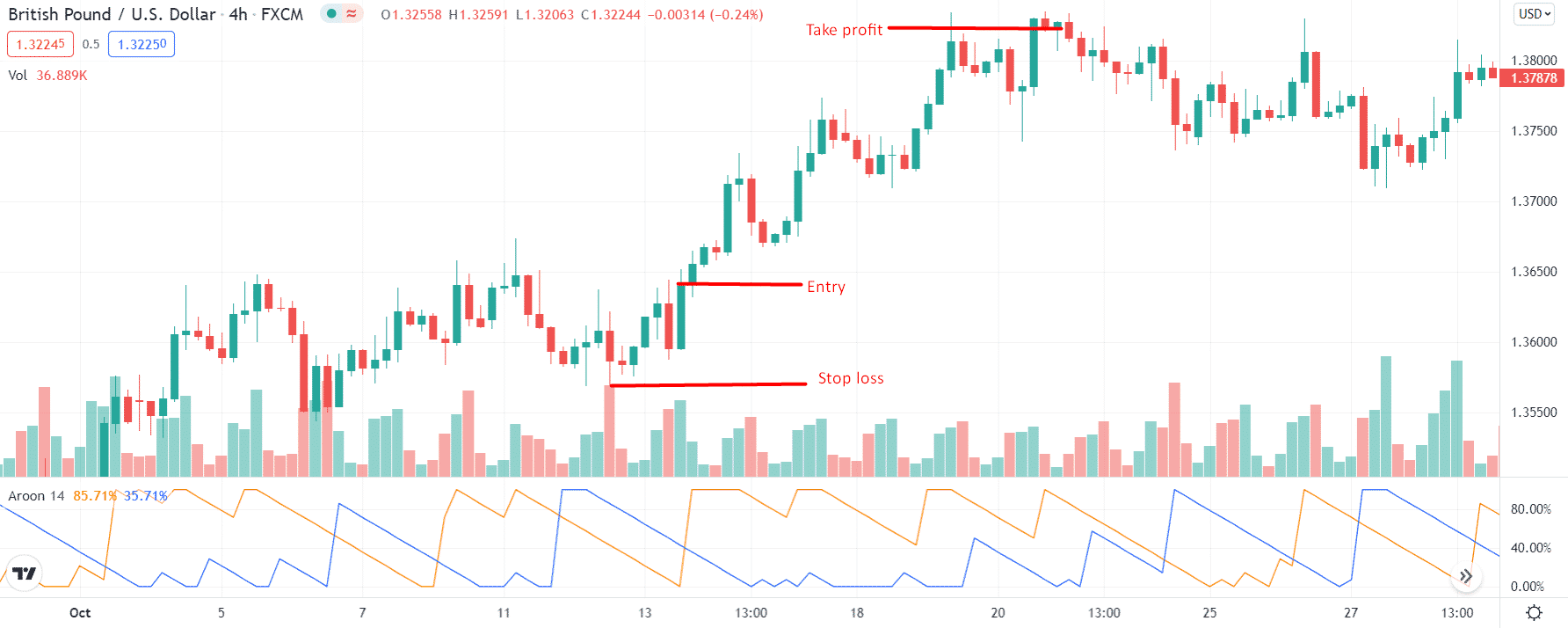

Bullish trading setup

Let’s explore the bearish trade setup using the tool above.

Entry

You can enter the long trade when the AI down crosses the AI up. You may instantly enter the position.

Stop loss

You may place an SL around or below the immediate swing lows.

Take profit

The TP level can be near the next resistance zone or when the up and down lines become flat.

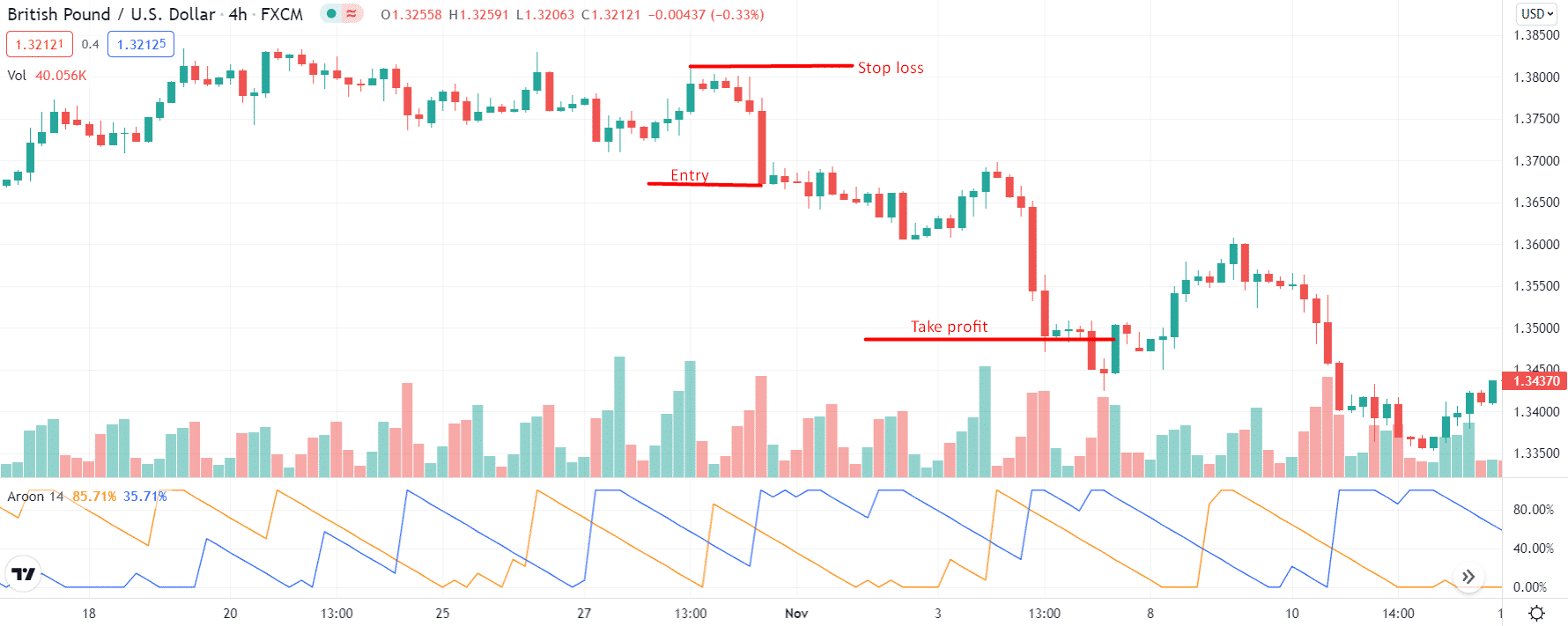

Bearish trading setup

Now the time begins to learn trading bullish setups. But, first, have a look at the given chart.

Entry

You can enter the trade when you see Aroon up moving below the Aroon down. Then, you can enter using the market order.

Stop loss

Place the stop loss order near the swing highs. You may also use the order blocks to protect your stop loss.

Take profit

You can place the take-profit order around the immediate support area. You can also exit when the indicator lines become flat.

How to manage risks in trading with the AI indicator?

The AI sometimes indicates a suitable passageway, but it will provide false signals for the following times. For example, buying and selling signals may arise too late after a notable price move has already happened. Or the signals could be lagging, and the poor signs usually appear in the sideways trade or range trading. So, traders should confirm the signals through other tools.

Final thoughts

One of the top high-tech tools for trading is the oscillator discussed above. This gauge can be used to detect changes in trend direction. Although the indicator couldn’t indicate sufficient signals alone, your trade should be verified from other indicators for quality trading.

The indicator, created by Indian trader, helps determine the market’s prevailing trend. It also gives its trading signals, which, for more excellent reliability, are best used in conjunction with classical methods of technical analysis, price figures, patterns. Before starting actual trading, you should practice using this indicator on a demo account.