Armed with the rules of effective asset management and having a more or less thoughtful trading strategy in your hands, you are ready to start conquering the FX market.

But regardless of whether you are an adherent of systemic or discretionary trading, you need to understand the trading environment clearly before entering the market. If you imagine the foreign exchange market as a battlefield, you are a general, and your positions are your troops, and before sending them into battle, you need to be well-oriented on the terrain.

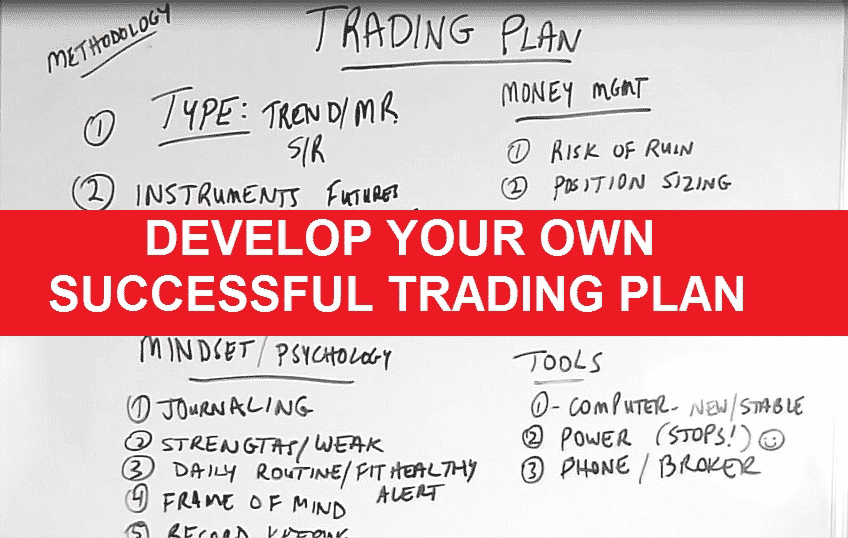

A trading plan is essential because it allows you to react quickly to rapid market changes and helps remove some of the decision variables from the equation by planning some steps ahead of time.

How to create a trading plan?

Being a prosperous FX trader necessitates having a trading strategy. After that, we’ll discuss a few essential assets that should be part of your trading plan.

Determine your risk tolerance

It would be best if you chose a risk level that you are convenient with when trading. Professional forex traders risk 1 to 5% of their capital. Thus, your trading technique and risk threshold should determine the amount you risk.

Set goals for yourself

Before you begin trading, you should set pragmatic profit targets and risk/reward ratios for yourself. Set weekly, monthly, and yearly profit targets for yourself as a trader, and review them regularly to determine if you’re on track.

Get ready to trade

You could go through a series of stages before placing your initial trade each trading day. Research the day’s big news announcements, put support and resistance zones on your charts, or even go over your trading strategy.

Make a list of everything

Keeping track of your overall trading performance will help you determine how effective your strategy is and where you went wrong if you have a run of losing deals.

Keep in mind while creating a trading plan

- The price of your entry/exit.

- Stop loss and take profit levels.

- The size of the position.

- Why did you enter the trade?

- How did you feel during the trade?

- How much money did you make, or how much money did you lose?

- A screenshot of the chart was taken at the entry and exit points.

Set exit rules

Even professional traders make the blunder of directing all of their energies on locating buy signals while ignoring exit from the trade. Most traders are prone to lose aversion bias and cannot sell when they lose money because they do not want to lose money. You’ll never make it as a trader unless you overcome your fears and learn to accept losses.

In the event your stop-loss is hit, it means you made a mistake. Nothing should be taken too seriously. Expert traders often lose more trades than they win, yet they profit by managing their money and limiting their losses.

Before you begin a deal, you should be aware of your exits. Every trade has at least two possible outcomes.

- Firstly, what is your stop loss if the deal does not work out as planned? It must be recorded. Cognitive stops are not taken into account.

- Second, for each trade, a profit target should be set.

Once there, sell a portion of your position and, if necessary, raise your stop loss to the breakeven point on the remainder of your investment.

Five tips for everyday

Before going on to something new, start with the fundamentals. Let’s take a look at some trading ideas that every trader should consider before trading currency pairs.

Tip 1. Recognize the markets

It is laborious to underestimate the importance of learning about the currency market. Before putting your own money at risk, understand currency pairs and how they are influenced; it’s a time investment that might save you much money.

Why does it happen?

Keep in mind that 60-70 percent of forex traders lose money. Education and experience can help you avoid typical mistakes and improve your chances of choosing a smart investment.

How to avoid the mistake?

Make a checklist of things you should be looking for ahead of placing any trade.

Such as:

- News events related to a particular forex or cryptocurrency pair can influence your trade.

- Double-check if all the technical indicators are aligned and suggest a buy or a sell trade.

- Following a proper risk management strategy.

Tip 2. Create and stick to a plan

Creating a trading strategy is an essential aspect of being a successful trader. Profit objectives, risk tolerance, technique, and evaluation criteria should all be provided.

Once you’ve developed a strategy, double-check that each transaction you’re considering fits inside the parameters of your approach. Remember that you are most rational before you make a transaction and most crazy afterward.

Why does it happen?

Most of the crypto and forex traders make the mistake of spending all of their time developing a strategy and then never putting it into action. As a trader, having a plan can help you stay disciplined. It should assist you in trading consistently, controlling your emotions, and even improving your trading strategy.

How to avoid the mistake?

Before you make any trades, make a list of what you should be looking for:

- Your motivation for trading.

- The time commitment you want to make.

- Your trading goals.

- Your attitude to risk.

- Your available capital for trading.

- Personal risk management rules.

- Your strategies.

Tip 3. Practice makes a man perfect

Use a risk-free practice account to put your trading plan to the test under real market circumstances. Put another way, you can practice forex trading while learning the basics and putting your trading strategy to the test for free.

Why does it happen?

Forex demo trading might be an excellent approach to get some practice without risking any real money. However, it is essential to practice on a real account. Trading a real account reveals your behavioral biases like risk-aversion, regret aversion, loss-aversion, and self-attribution.

How to avoid the mistake?

The following are the most common mistakes you should avoid while trading.

- Stop trading if you’re losing money.

- Investing without using a stop loss.

- Increasing the size of a losing day trade.

- Taking more risks than you can stomach.

- Putting everything on the line.

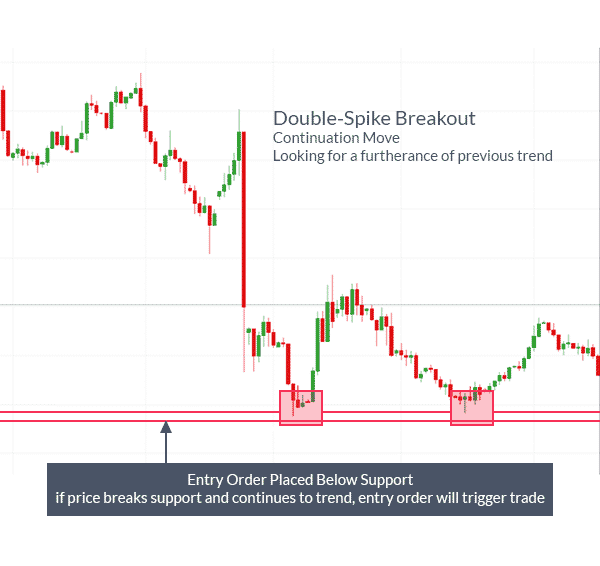

Tip 4. Determine the market’s conditions

Fundamental traders prefer to trade based on news and other financial and political data. In contrast, technical traders use technical analysis techniques like Fibonacci retracements and other indicators to forecast market moves.

The majority of traders do both. Regardless of your trading style, it would help if you used the tools available to identify prospective trading opportunities in shifting markets.

Why does it happen?

It’s crucial to keep an eye on the fundamental side of the market as economic events can drive massive volatility in the market. Making notes of important events like GDP, unemployment rate, monetary policies, and inflation figures can help you capture profitable trades.

How to avoid the mistake?

Preparing for economic events in advance can help you avoid missing important trades. Alongside scanning all the currency pairs and performing technical analysis to note down critical daily levels. Noting down the currency pairs on paper where a technical trade setup has formed can help you capture excellent trades.

Tip 5. Understand your limits

Know your limitations. It’s a basic concept, yet it’s crucial to your future success. Understanding how much you’re prepared to risk on each trade, adjusting your leverage ratio to meet your demands, and never attempting more than you can afford to lose are all examples of this.

Why does it happen?

Knowing your limitations is essential for survival in trading. So, determine your risk tolerance level and define your risk management strategy to avoid losing your deposit and profits.

How to avoid the mistake?

It would be best if you determined your RR (risk to reward ratio). Professional traders never risk more than 2% of the trading capital in a single trade. For example, if you have $5000 in your account, the maximum loss you can take should not exceed 2%. With these criteria, your maximum loss per trade would be $100.

Final thoughts

The implementation of a forex trading plan can help traders navigate the financial markets with more ease. However, changes can be made if necessary. Self-control is key to finding out what works best for you. Find out how to gain more confidence in your forex trading by studying several trader manuals. In the end, keep a trading notebook and regularly assess the current trading plan.