The forex market is a place to buy and sell currency pairs. It is a vast market where the main participants are banks and institutional traders. Therefore, retail traders often find trading as tricky as they have to compete with giant investors.

Many people became millionaires just by trading FX, where many people are still struggling to sustain their accounts. Therefore, it raises a question regarding how much a forex trader earns from trading.

Let’s see details about the earning opportunity in trading, including some valuable methods.

Is forex trading really profitable?

FX trading is profitable, and it is better than any other traditional business. However, trading is not suitable for everyone. It is worthwhile, but it doesn’t mean this place is for you and you will make money here. Most of the retail traders in the forex market are losers. So if you are looking to consider forex trading as a place to earn a guaranteed profit, you are wrong.

Let’s see the hidden truth of forex trading!

A global forex market is a place where institutions buy and sell currencies through the over-the-counter market. It is the wholesale market where institutions and banks operate the buying and selling. On the other hand, retail traders have a small impact on the market where their activity means nothing to institutional traders.

In that case, success in trading depends on utilizing smart traders’ activity in the market. If you can catch their movement, you can easily make money but follow their direction. Otherwise, there is a higher possibility of losing all of your investment and ending up trading with nothing.

How much do forex traders make?

The profitability depends on the investment, risk tolerance level, and money management system. We cannot say that a $10,000 investment can make you a millionaire over a year. Instead, we should measure the performance based on the percentage of gain.

For example, if you invest $10,000 and start to achieve 5% per month, you will end a year with more than 40% profit from your investment, which is very impressive. Many traders achieve 10% to 40% per month, depending on their strategy and risk tolerance level. The higher risk you will take, the higher return you will get.

The main challenge in trading is to keep the deposit safe, rather than making a huge profit in one month and losing all the investment in the next month.

Do I need a lot of money to make an excellent profit?

You don’t need to invest thousands of dollars to make a considerable profit. However, the profit depends on how much risk you take and how much gain you achieve from a trade. For example, a monthly 50% gain from $1000 is $500. On the other hand, a 5% gain from a $10,000 investment is also $500. So, even if you made $500 in both cases, the gain in the percentage was not the same.

So, if you are a conservative trader and want to make a stable profit of 5 to 10 percent a month, you should invest a minimum of $10,000 approximately. On the other hand, if you are a scalper and confident about your strategy, you can get a 20% to 50% gain in a month from a small investment.

What forex strategy is the best to make a profit?

There are thousands of trading strategies in the world based on the time frame, elements, indicators, and fundamental releases. You can choose any strategy according to your need, but all strategies will not suit you. You have to follow a system that correctly explains the market condition, particularly what the smart money is doing.

Based on this concept, we can say trading strategy using supply and demand has a higher possibility of working out in both the short and long-term.

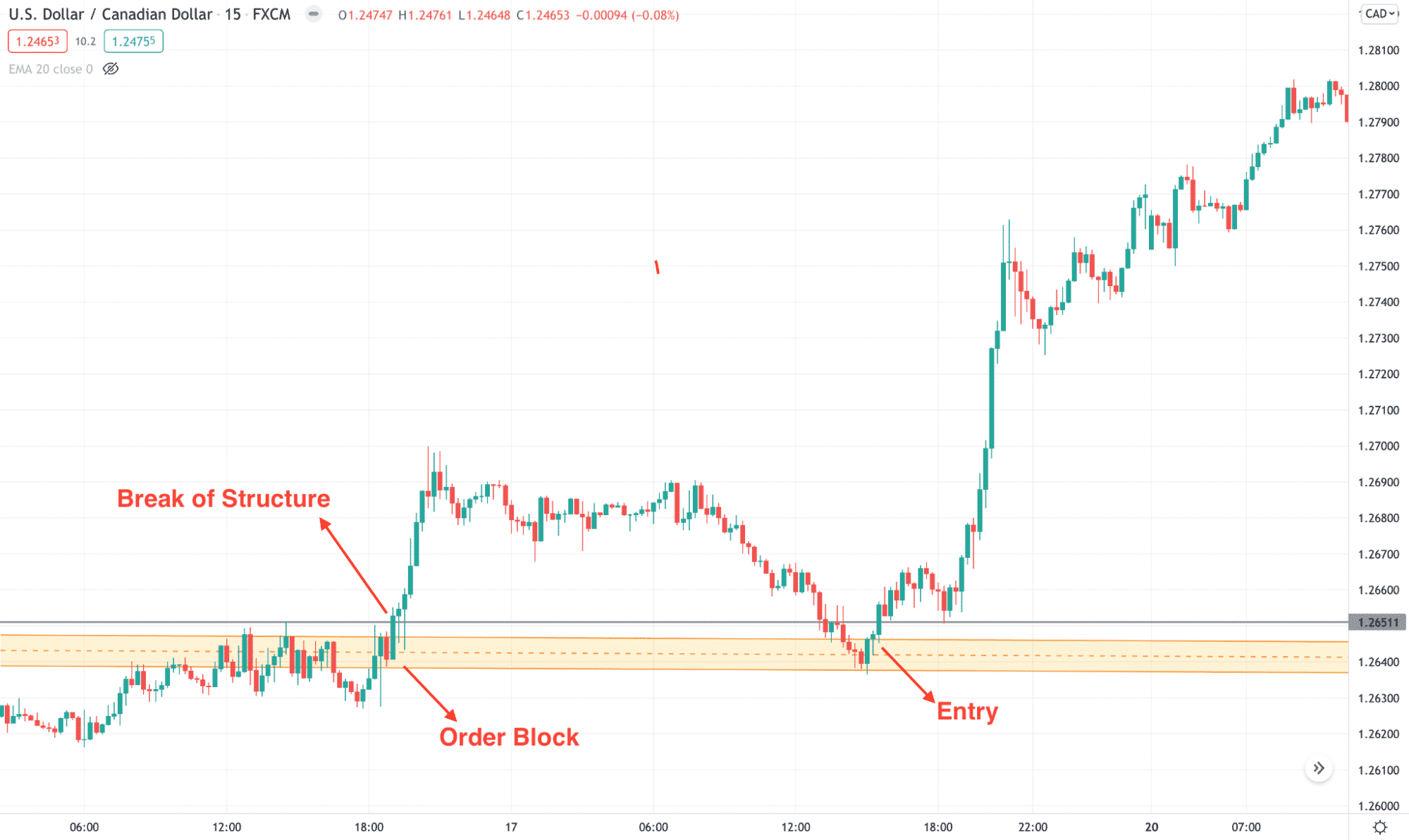

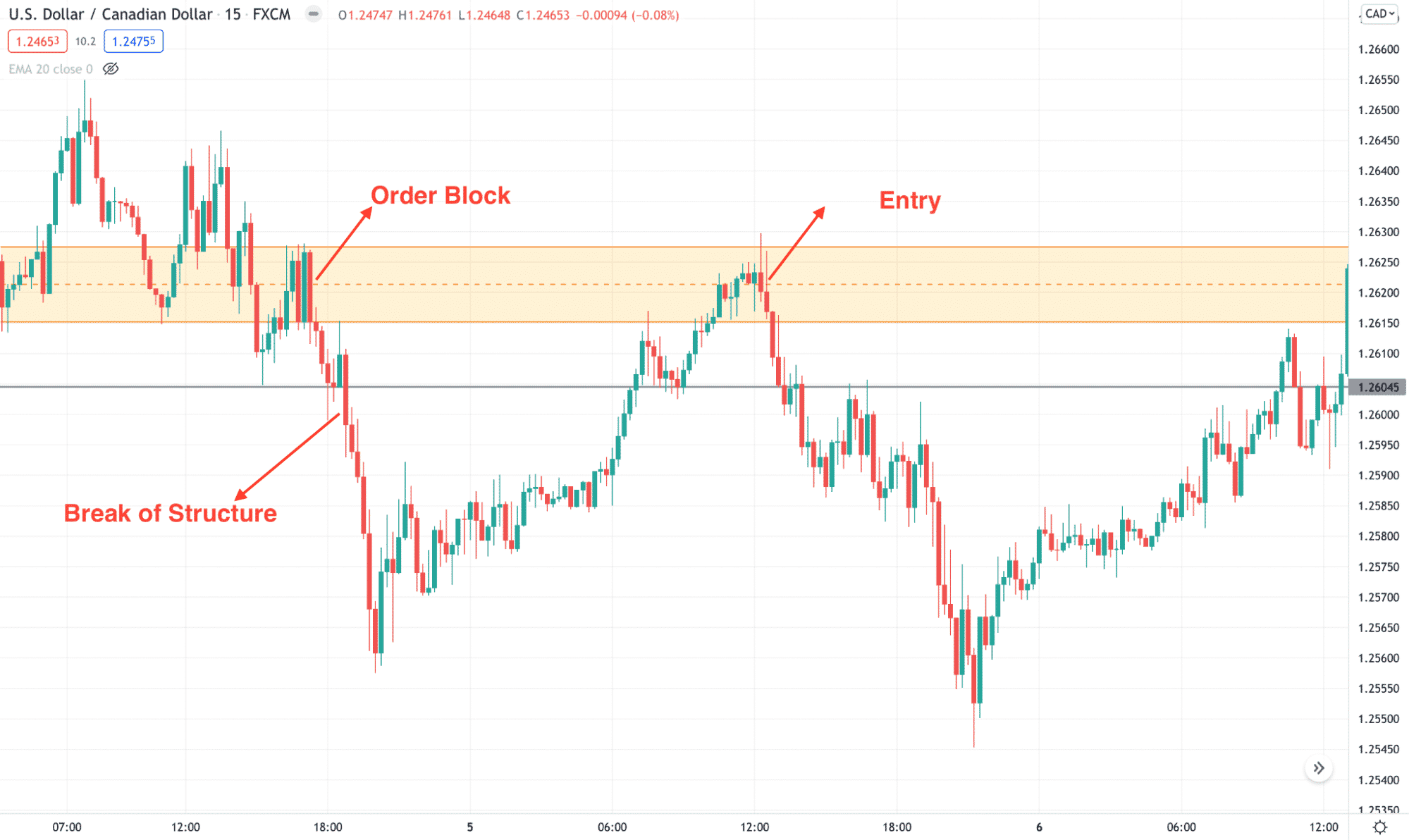

A short-term strategy

In this method, we are interested in order blocks from where an impulsive pressure started, and the price invalidates the near-term swing. After that, once the price comes back to the order block, we will open the trade.

Bullish trade setup

- The market trend is bullish.

- Price breaks any near-term high with solid pressure in the 15m time frame.

- Price came back to the order block from where the break of the structure was started.

- The price showed a bullish rejection with a candle close.

Bearish trade setup

- The market trend is bearish.

- Price breaks below near-term low with strong pressure in the 15m time frame.

- Price came back to the order block from where the break of the structure was started.

- The price showed a bearish rejection with a candle close.

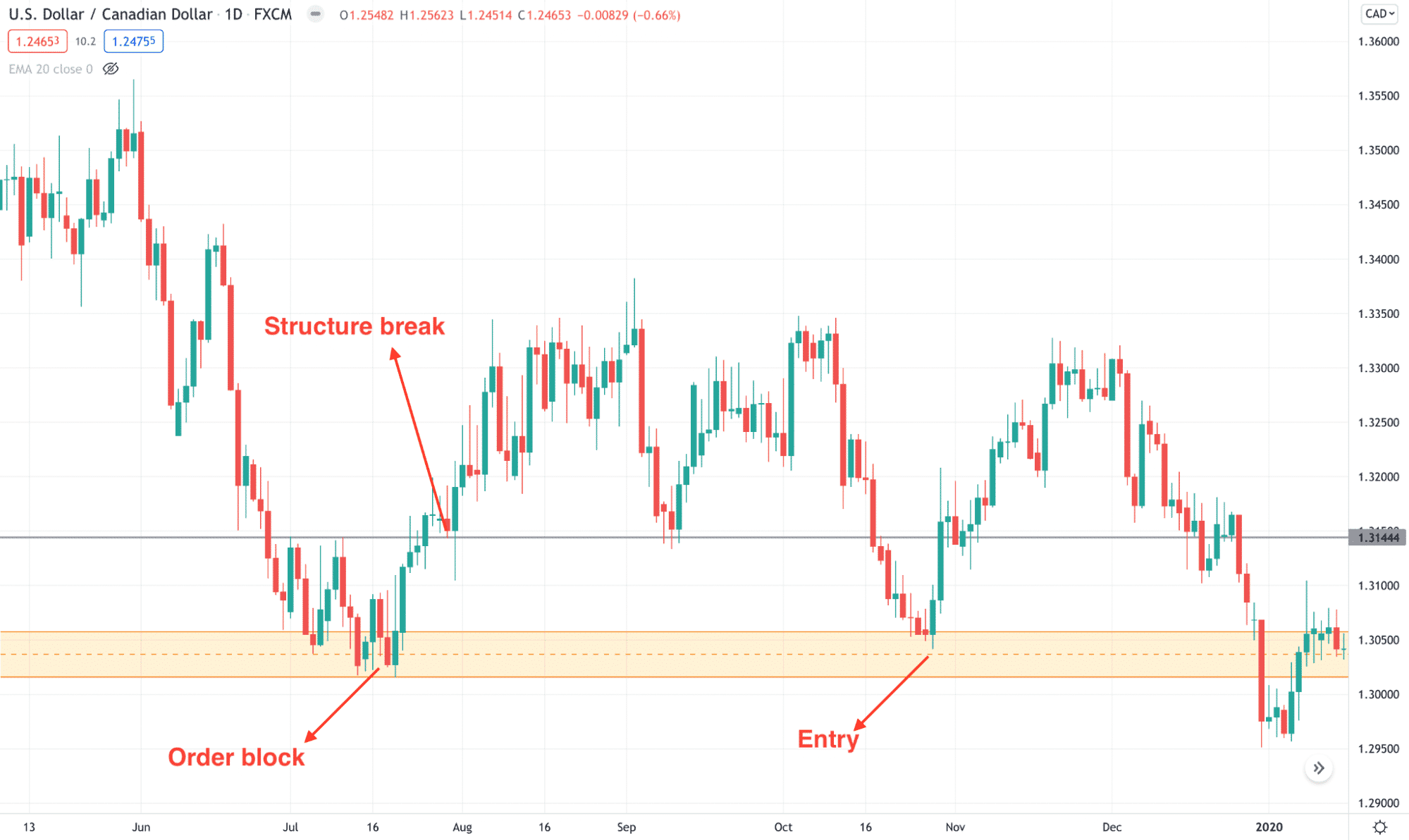

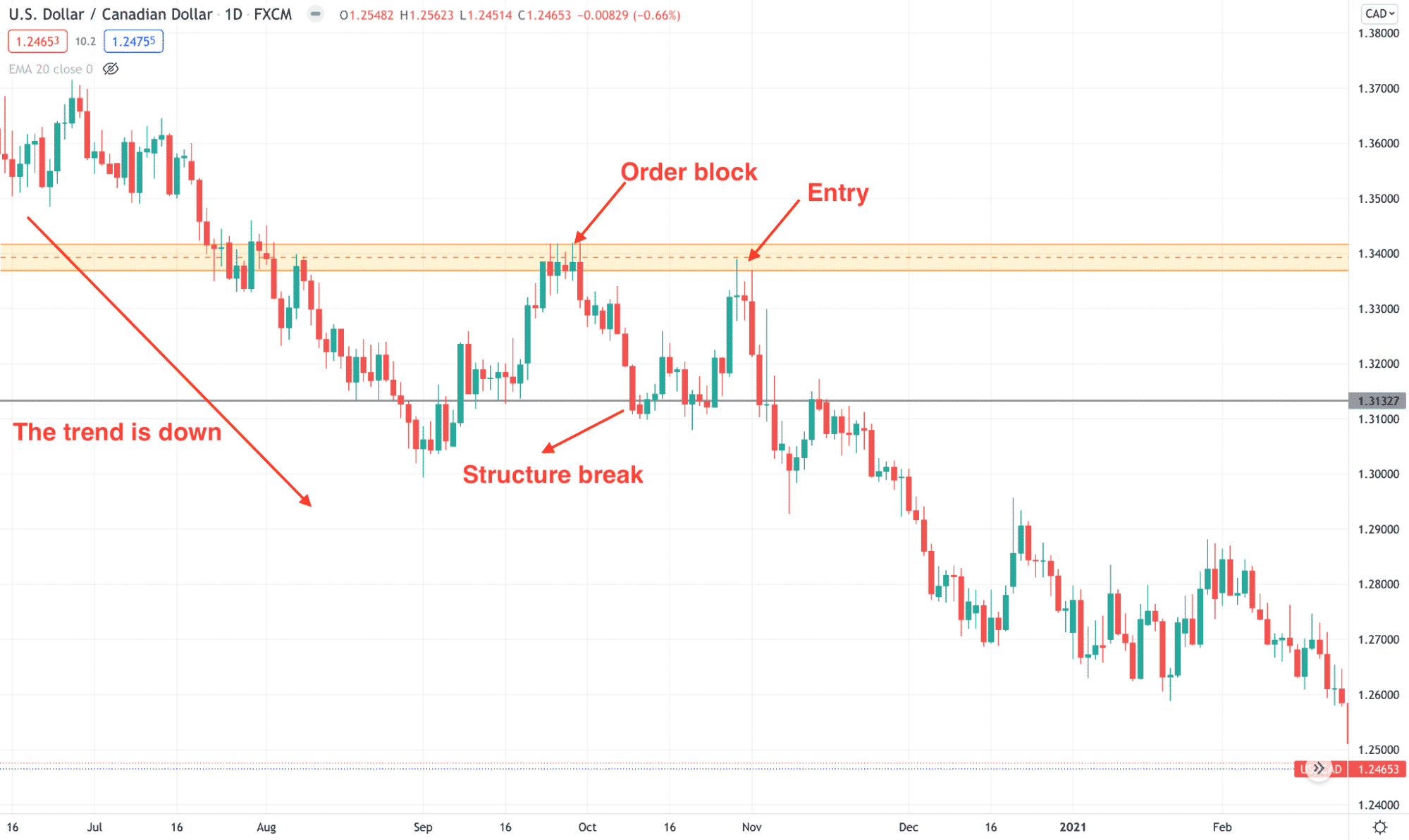

A long-term strategy

The same strategy applies to a higher time frame. In that case, you will have better accuracy in trading as there is no intraday volatility in the higher time frame.

Bullish trade setup

- The weekly trend is bullish.

- Price breaks any near-term high with strong pressure in the daily chart.

- Price came back to the order block from where the break of the structure was started.

- The price showed a bullish rejection with a candle close.

Bearish trade setup

- The weekly trend is bearish.

- Price breaks any near-term low with strong pressure in the daily chart.

- Price came back to the order block from where the break of the structure was started.

- The price showed a bearish rejection with a candle close.

Final thoughts

Supply and demand are core components in forex trading. When they exceed their momentum, it creates an imbalance. Therefore, the price shows an excellent movement from these areas, but it is often hard for new traders to identify the correct supply and demand level. Moreover, picking the right level at the right time is mandatory for this strategy. Proper practice and enough backtesting are required to master this technique.