Trading the FX market is an exciting venture you can engage in. However, you cannot succeed in this business arena without sufficient knowledge and a solid trading plan. If you trade without a plan, you might find superficial success at first, but you will ultimately lose your account in due time. Currency trading is not suitable for those with lackluster dedication in learning the trading process.

This article will learn about the 5-13-62 trading system, which has gained a buzz in the past. It is a simple trading system that uses a battery of moving averages (MA) – the most straightforward indicator.

Shortly, you will learn about the system rules, including entry and exit. See if you can get something out of this primer to add to your existing trading repertoire or use the system in its entirety.

What is the 5-13-62 trading system?

Trader Rob Booker popularized this trading system when he released a free electronic book of this title. The idea behind the system is not at all new. Many traders are familiar with this trading strategy. It employs the MA of the exponential type to define buy and sell signals.

Although there are many other MA, Rob Booker used the exponential variant due to its importance in recent data. It reacts quicker to price movement than its predecessor – a simple moving average (SMA). To define a precise entry, the system employs three periods of exponential moving averages (EMA).

Basic trade setup

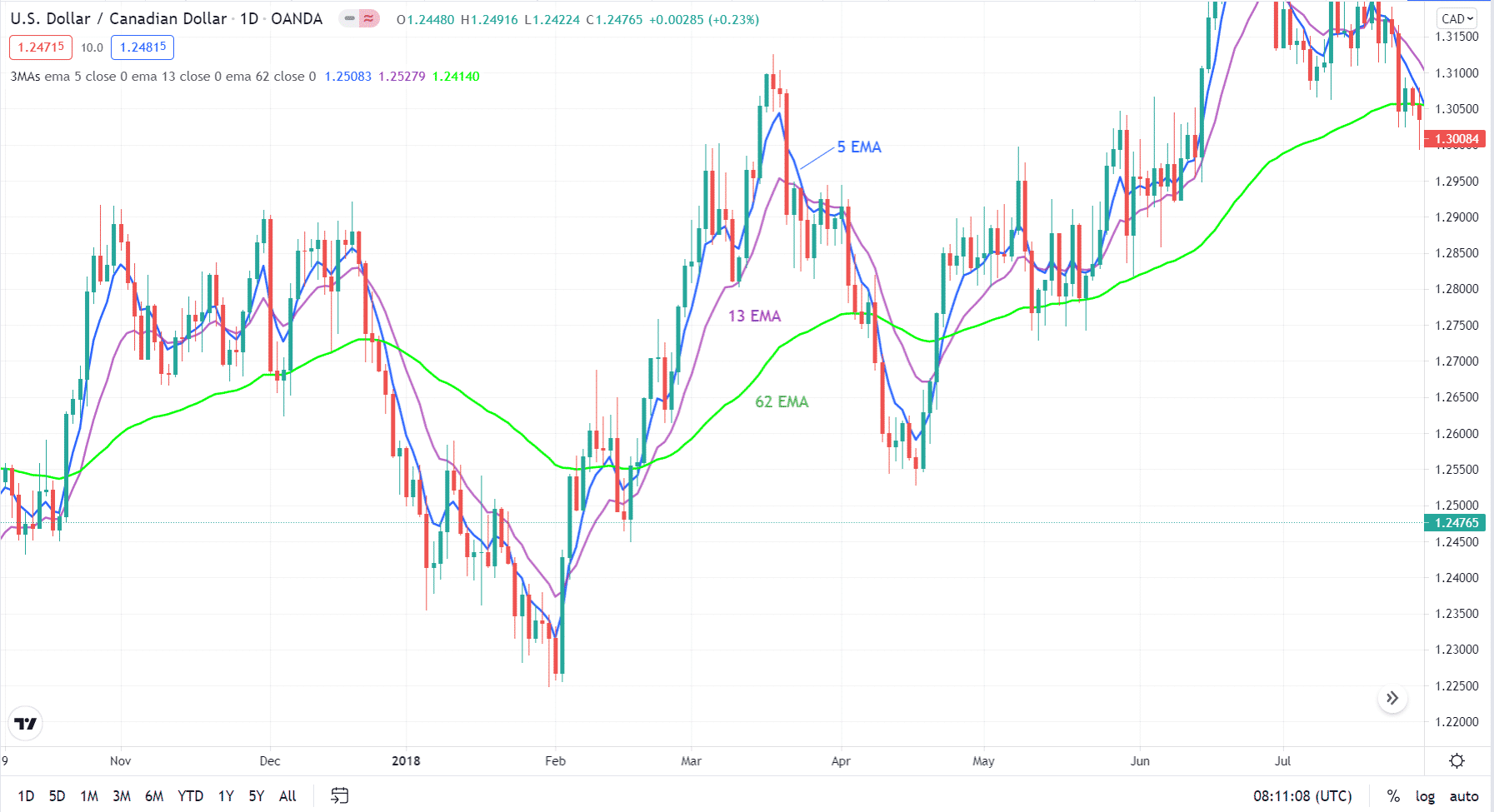

At the core of this methodology are EMAs. As you might have guessed, the periods of these MAs are 5, 13, and 62. The daily USD/CAD chart below shows the basic setup using the 5-13-62 system.

The system provides an entry signal every time the three MAs align in one direction.

- You will get a buy signal when the 5 EMA is above the 13 EMA, and the 13 EMA is above the 62 EMA.

- You will get a sell signal when the 5 EMA is below the 13 EMA, and the 13 EMA is below the 62 EMA.

This type of entry is all too common, though. Other systems have similar entry rules, and you can find too many trading opportunities with the basic setup. Many traders have developed the mindset that MA crossovers do not work, and for a good reason. Therefore, we need to qualify our trade signals using other ideas to take high probability trades.

Improved system rules

When trading with the 5-13-62 trading system, you need to consider other things, not just the basic setup. In this section, you will find guidelines on entering and exiting the trade.

Entering the trade

Here are the steps you take when looking for trade entries. Follow these steps and do not digress until you have updated your trading plan.

- If the 5 EMA has crossed over the 13 EMA, be ready for entry.

- If the 13 EMA has crossed over the 62 EMA, you can take the trade.

- Set your stop loss 20 pips above or below the 62 EMA.

- Trail your stop instead of setting a fixed take profit. Use a trailing stop of 20 pips.

To avoid trading false signals, you need to qualify your trades and select your trade candidates. Since we are dealing with MAs, they are most suitable in trending markets. Therefore, you must avoid ranging markets and trade trending markets with regular up and down oscillations.

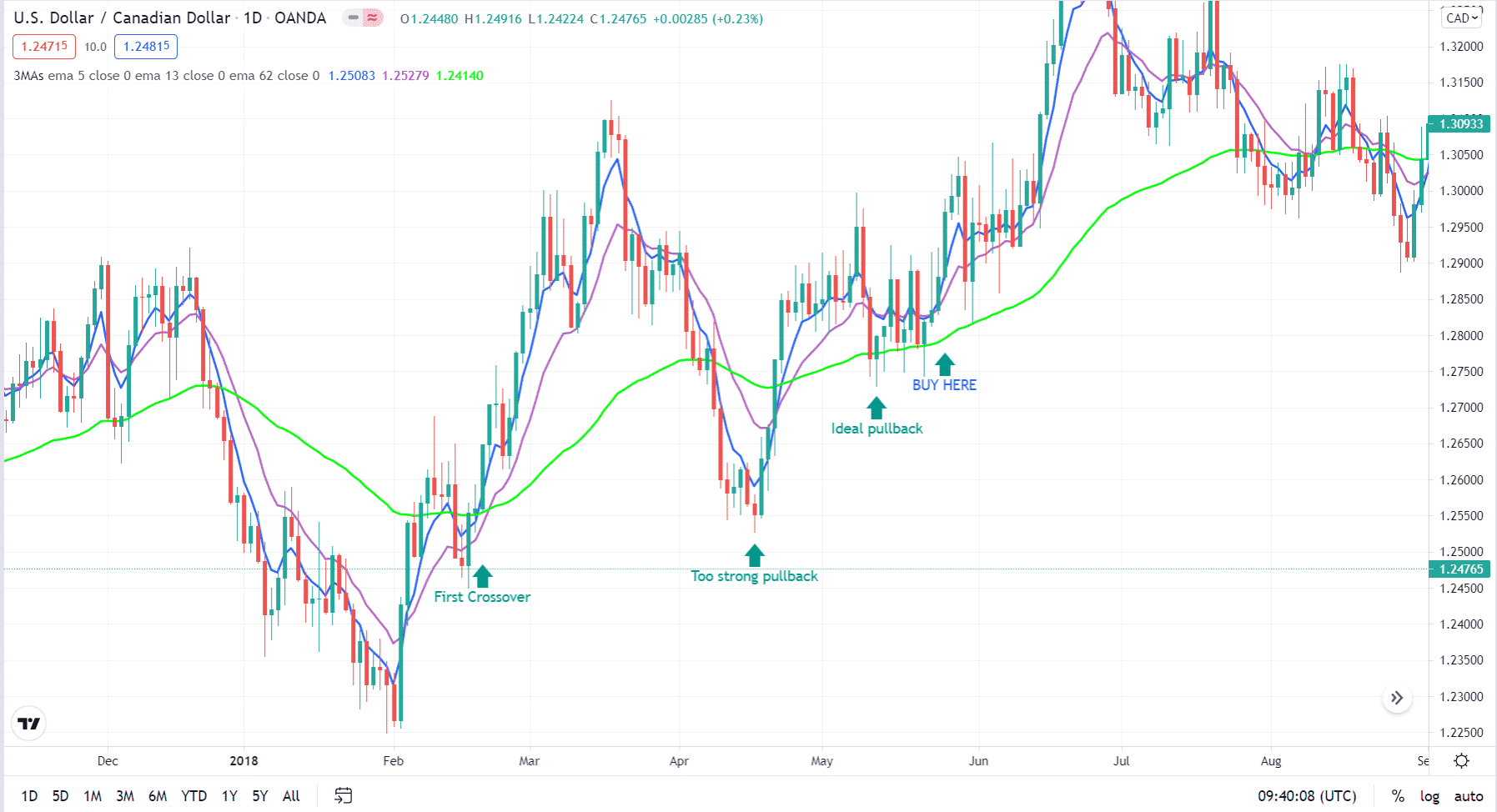

Another standard method is to avoid entering at the first crossover and waiting for a pullback. Let us consider the chart below. We will not buy on the first crossover and wait for a pullback. However, the first pullback was too strong as it broke down the 62 EMA. After a while, the price went up again and retraced toward the 62 EMA.

After this, the three MAs aligned, so you could open a long position when this happens.

Exiting the trade

There is not much you can do while trade is already live. Therefore, you should spend most of your time analyzing, planning, and qualifying trade candidates instead of taking trades. After the trade is open, one of two things can happen:

- Price hits your stop loss, and you are out of the trade.

- Price moves in your favor and gains 20 pips, prompting you to move the stop to breakeven. After this, if the market is kind enough to go further in your favor, you can keep adjusting the stop loss in the direction of the trade. This will continue until the price ultimately touches the latest stop loss.

The first situation is not favorable to you. You will lose money when it happens. The second situation is a winning scenario. In the second case, the trade result is either breakeven or profitable.

The attitude of winning traders

Generating profit in terms of pips is the goal of everyone taking part in currency trading. However, pips are fragile, and if you seek them out with great passion, you will realize that they tend to elude you. The more you pursue them, the more they keep their distance from you.

According to Rob Booker, 99 percent of trading is about attitude. You have to put your emotions at bay while trading. If not, you will not achieve consistency in executing your trade plan. What will happen is you trade outside of your trading plan and feel regret later.

The most crucial component of attitude is discipline, which is everything in trading. Discipline in this context refers to two things:

- Open a trade without hesitation when your system provides an entry signal.

- Close the trade without hesitation when your system gives an exit signal.

The 5-13-62 trading system requires discipline to work out. If you do not have discipline, this system or any other system out there will not work. Follow your plan day in and day out. After a good sample of trades, you can analyze your trades to find patterns and arrive at conclusions. Your goal is to reduce your losses and either maintain or increase your strike rate.

Final thoughts

The 5-13-62 trading system is suitable for trending markets. You will succeed with this system if you trade currency pairs with trending propensity rather than ranging tendency.

- Open some charts, set the time frame to the daily chart.

- See if the condition is trending.

- Use the 28 currency pairs generated from the eight major pairs as a starting point for your investigation.

Trading ranging markets with this system is not a good idea.