Almost every forex trader is keen and waits for the non-farm payroll (NFP) data release. It’s just like a holiday season for those who trade NFP data release, but it’s a no-no for someone because of the sudden high volatility in the market.

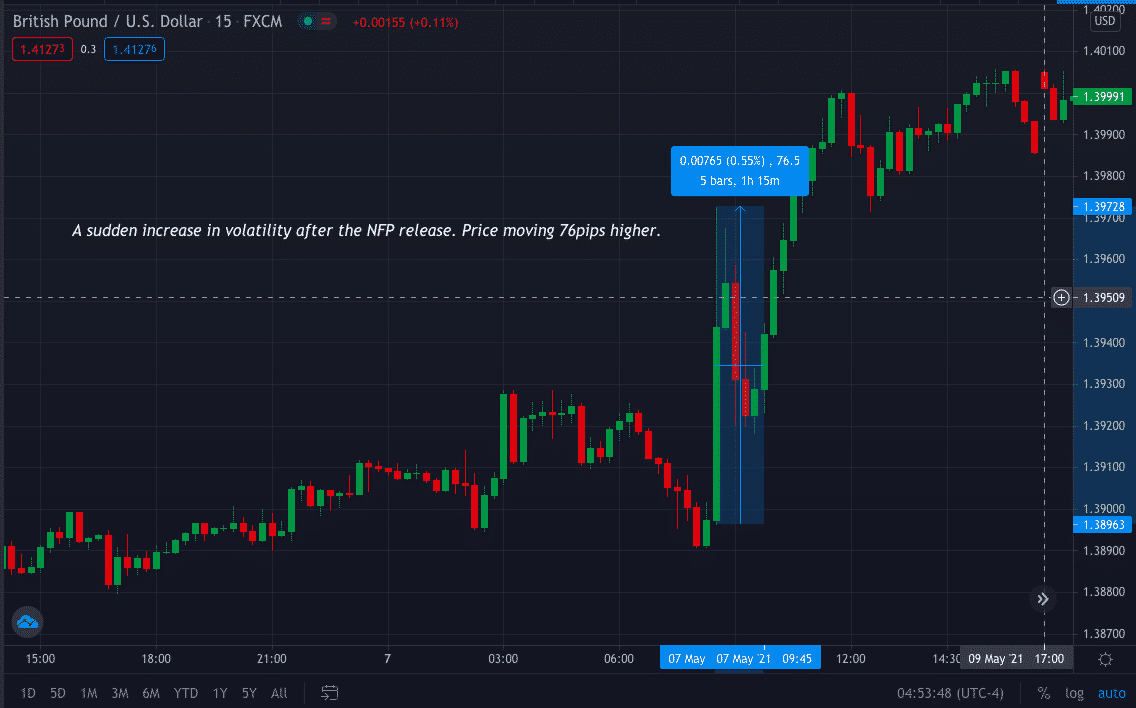

The leading reason traders look for the NFP lies in the opportunity to catch the sudden big moves in the market, as this report causes a tremendous change in positions, making it highly volatile. As a result, witnessing an 80 to 120 pip movement in the GBP/USD or 60-80 pips in EUR/USD in the minutes and hours following the announcement is very common.

If the market is already volatile, the NFP makes it more drastic and can cause moves of 200 pips or more. So, now let us dive into the article and master the NFP strategy.

What is NFP?

Non-farm payroll is the most noteworthy news event that makes the most noise in the FX. The Bureau of Labour usually releases the NFP data every month on the first or second Friday at 8:30 AM EST.

NFP data release measures the total number of employed US citizens, excluding the private household employee, government officials, and the non-profit organization employee.

Effects of NFP news release on the market

NFP is a significant determinant of US economic stability. Its impact on the foreign market can cause some currency pairs, typically those involving USD, to experience a high spike or massive price decrease. As a result, currencies such as the EUR / USD, GBP / USD, USD / JPY, and others tend to be significantly affected by the release.

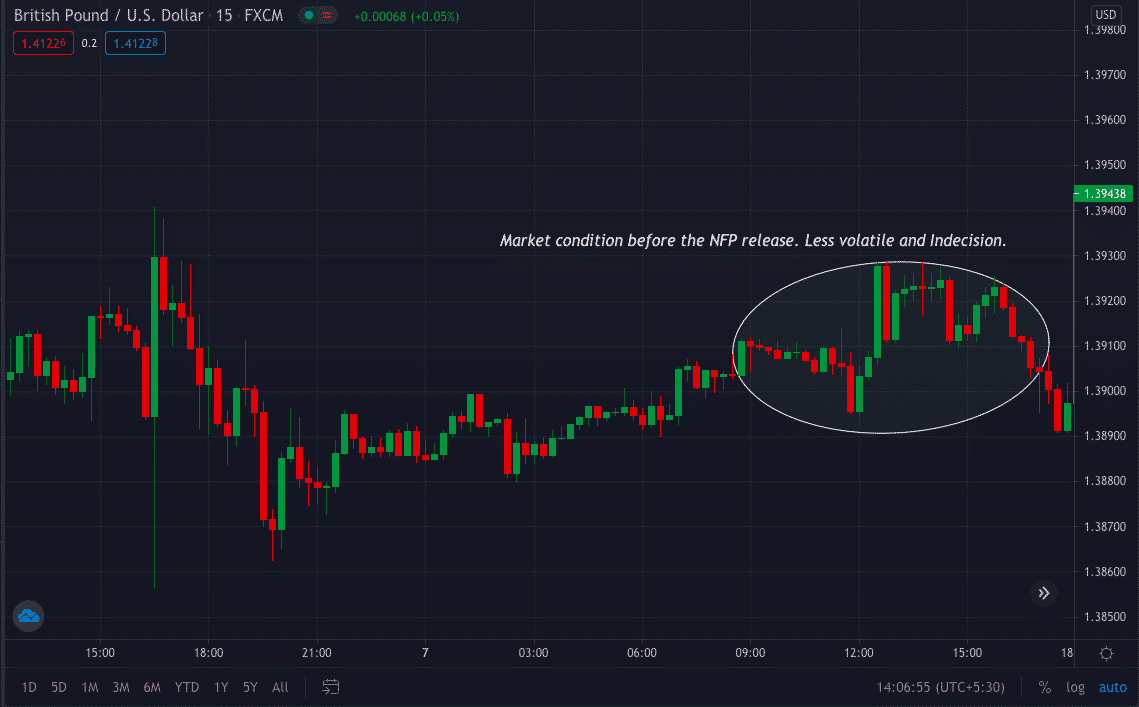

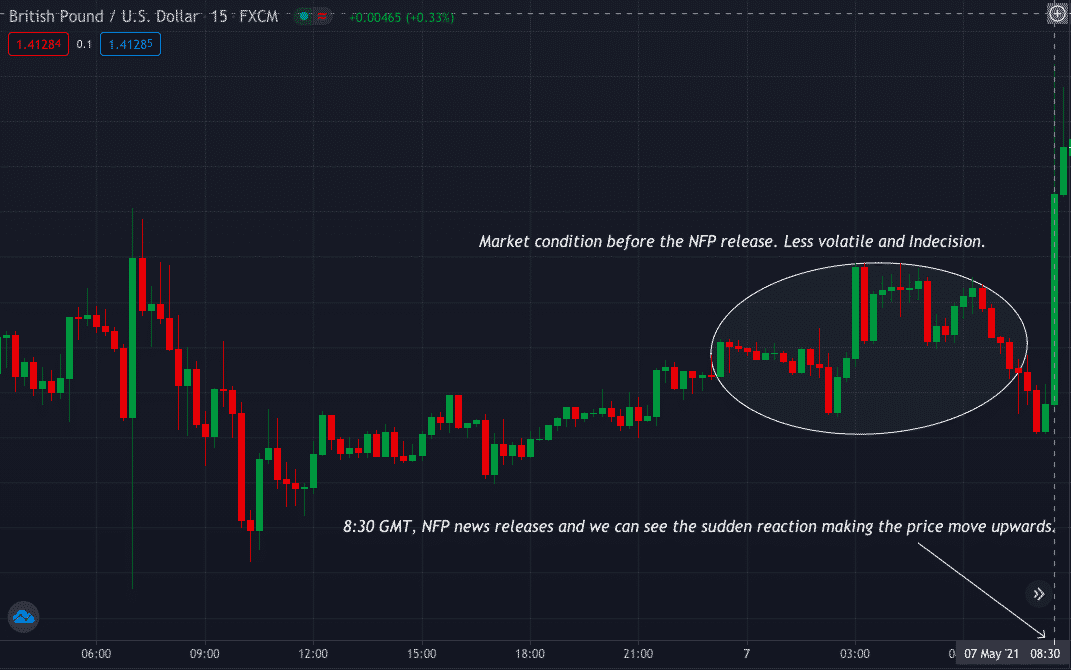

GBP/USD chart, showing indecision and no market movement.

The NFP news release can be either positive or negative:

- If the report is positive, there is an increase in the economy’s growth. This term signifies that the currency will be solid and competitive against other currencies in the market.

- Whereas if the report is negative, it will make the economy fall. Thus, the USD will weaken with respect to other currencies.

To make it very simple to understand, let us get some basic questions cleared.

Who should trade NFP?

Trading any market depends on your style at a significant level. Trading NFP is a plus point for scalpers, followed by a swing trader. However, if you are an intra-day trader, you must stay away from the market and wait until it and volatility settle.

What pairs to trade?

The most popular pairs to trade during NFP news are EUR/USD, GBP/USD, USD/JPY, USD/CAD, NZD/USD, and USDCHF.

Which position to take: buy or sell?

- If the news is negative or superficial, the data is lower than the estimated value so that you will sell in USD.

- If the news is positive, or the data is higher than the assessed value, you will buy in USD.

Strategy to trading the NFP

We will be using GBP/USD as an example in this strategy. So GBP/USD is a minor pair but still is very heavily traded and has high volatility. Therefore, if you are a day trader and have any position open, it is advisable to close the trades at least 5-10 min before the news release.

The news comes out precisely at 8:30 PM EST on Friday. The initial movement will help us determine the direction either to go, long or short.

In the initial move:

- If the price rises more than 35-40 pips, we will see it as an indication of a buy position

- If the price falls more than 35-40 pips, we will be looking for a sell.

After this is clear, we need to understand that the market becomes highly volatile and must not hurry to take a position because the market is moving up or down. Here we must wait for a proper setup of our strategy.

With this strategy, traders can avoid taking a position too early, and it’ll also help decrease the odds of being whipped out of the trade before a confirming direction.

Finding the trade setup

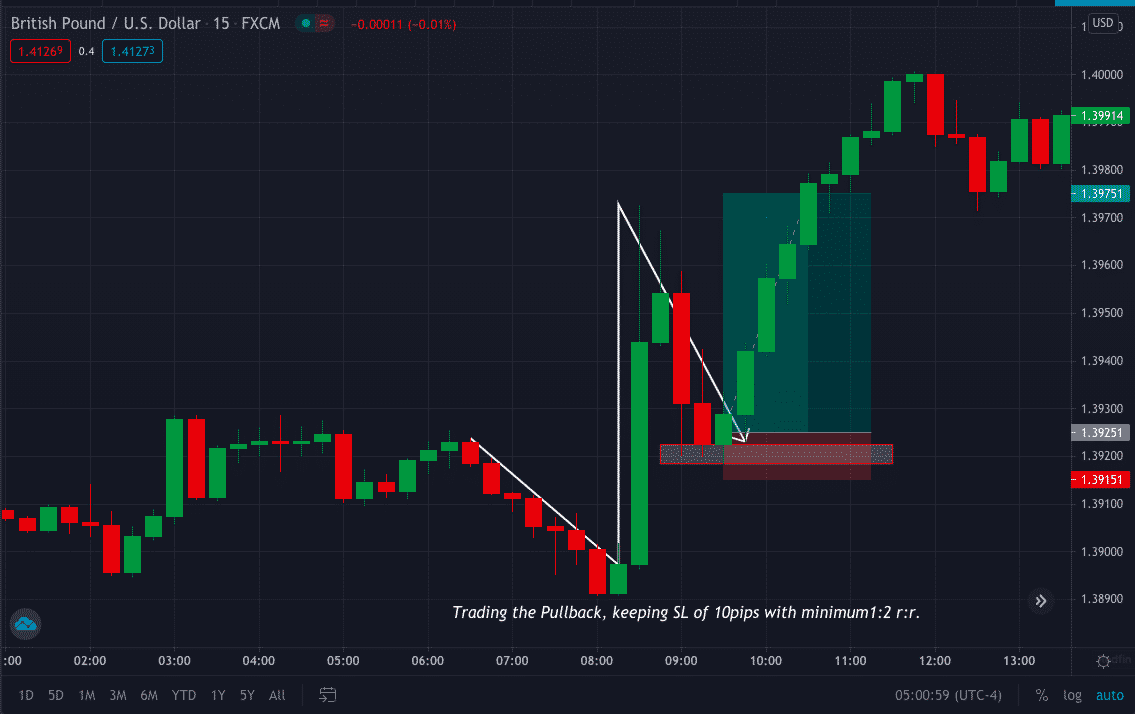

To trade this strategy, we will use a 15min time frame.

- When we know which direction to trade-in, we will see how to figure out the trade setup and enter the market.

- After the news release, we will encounter high movement in the market.

- After we see 40 or more pips rise, we know we have to go long, but not immediately.

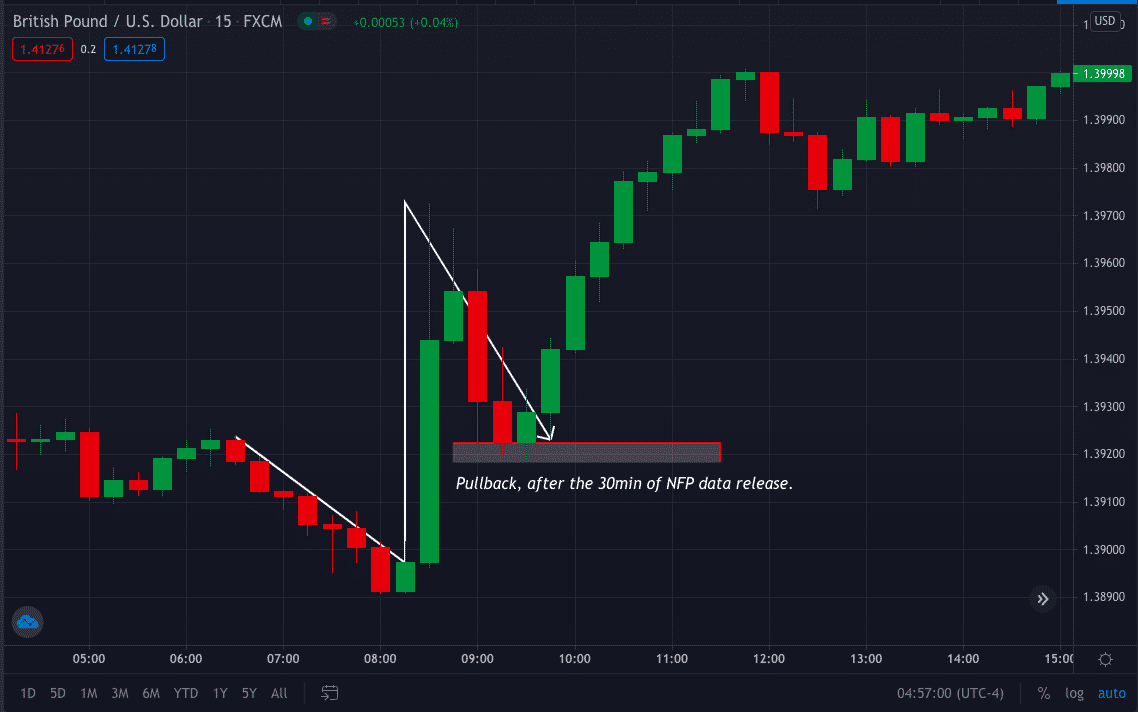

- Instead, we will wait for the price to pull back.

- This pullback has to be till the initial price when the movement started.

- Although we will see the pullback, this must not cross below the 8:30 AM initial movement price.

- If the pullback went too low, we need to see it should not cross the previous major swing low.

Entering the trade

When we have a perfect pullback, we will then take the buy call putting five pip stop loss in the opposite direction.

GBP/USD chart showing a perfect pullback after 30min of NFP data release, giving us an ideal opportunity to go long.

- If we see the initial movement was down, we will follow the same trading guide and take the sell position.

- We will be taking 1:1 or 1:2 risk: reward or ride the trade until the next support or resistance.

Note that it’s better not to wait for an enormous profit if the market is quiet and less volatile. Otherwise, it may lead the price to reverse as the market will calm down after — a sudden reaction stopping you from the market.

Advantages & disadvantages of trading the NFP news

There are some advantages and disadvantages of trading the NFP.

Advantages

- For experienced traders or beginners to know how to read news, NFP is an excellent opportunity because of its volatility to make quick money.

- NFP also is the chance to utilize fake-outs.

Disadvantages

- NFP is very volatile, and trading is inappropriate for beginners or at least for someone who has never known of NFP. There could be spikes in both directions that may lead to confusion.

- Due to emotions in this environment, key levels have less influence.

- Due to high fluctuation, the stop-loss size can be more prominent and might not be respected, depending on the broker.