Often you deal with questions like “What happened overnight”? “How did I miss this”? “Did I forget to place the stop-loss order?”

The most common approach is to utilize a crypto trading bot that makes orders for you while you are sleeping, spending time with your family, or relaxing. Along comes a MATLAB to help you build a few lines of code, so you can execute the trades while sleeping on a hammock.

This guide will talk about MATLAB moving average strategy, crypto, and the top five tips for receiving money.

What is the MATLAB crypto moving average strategy?

MATLAB is a programming language that analyzes enormous data quantities and presents it visually attractively using calculations and algorithms. It provides us with a fully automated trading environment. Automated trading is a trading approach in which computers make trading choices for you in the crypto and other markets.

Mathematical models that identify and exploit crypto market fluctuations must be developed, backtested, and deployed by developers and users of automated trading systems.

A moving average is a widely used indicator in technical analysis and day trading. It simply smooths out price data in a chart by creating a consistently updated average price based on historical data.

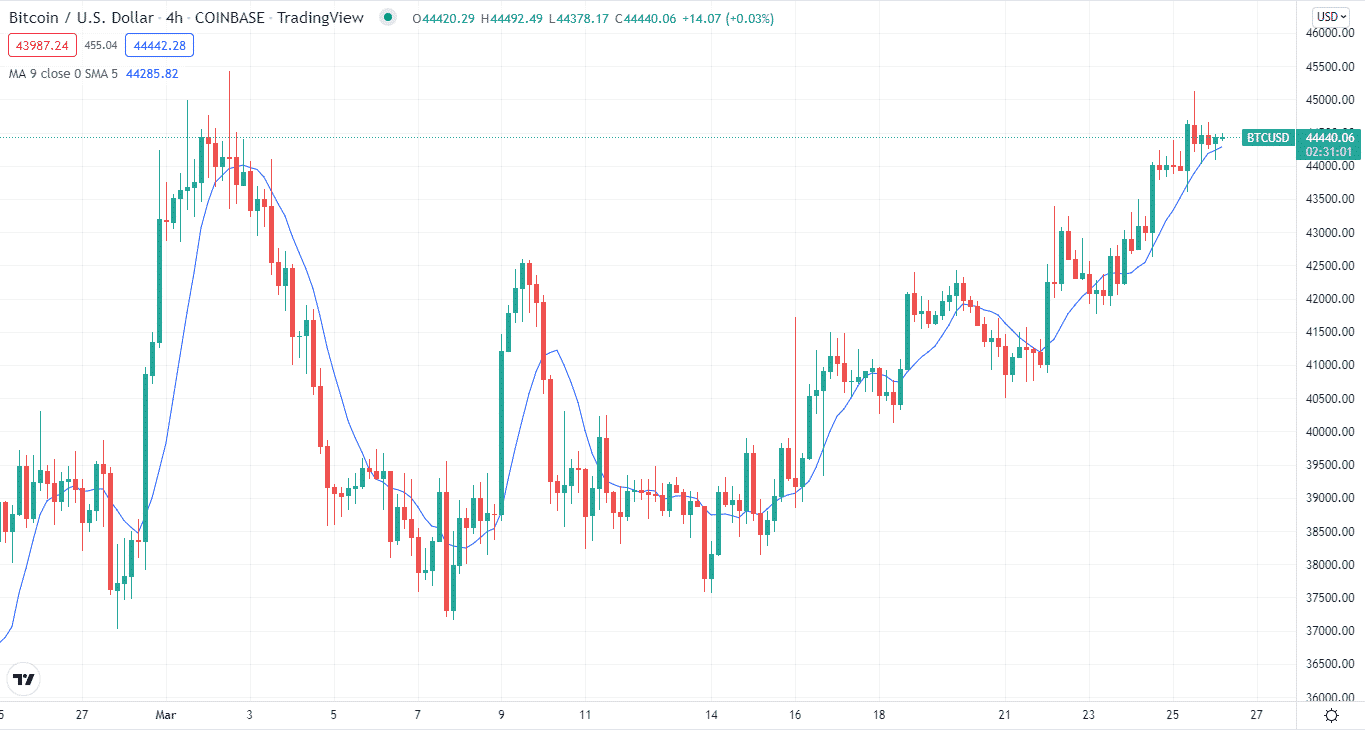

It can help identify price trends or identify potential support and resistance levels while trading. For example, when the price is above the MA line, we consider the instrument to be in an uptrend; conversely, if the price is below the moving average line, we consider it to be in a downtrend.

There are two main types of MAs:

- Simple moving average

- Exponential moving average

SMA is also referred to as arithmetic moving averages. EMA, also called “exponentially weighted moving average,” works differently from SMA. Both kinds are calculated using data from previous days, making them “lagging indicators.” In other words, they only display changes that have already occurred.

Combining MATLAB with MAs helps us cut through the crypto market noise because of the backtesting of the market data. Cryptocurrencies are especially susceptible to extremes. MA is helpful to lessen the impact of potentially unpredictable or short-term fluctuations in any asset’s value.

Moreover, it allows an investor to analyze the trend of a crypto in the future by utilizing prior prices.

Top five tips for trading with MATLAB crypto MA strategy?

Now that you know what MATLAB’s MA is let’s talk about the top five tips for crypto trading.

Tip 1. Follow the trend

The most typical MATLAB trading methods include moving average trends, channel breakouts, and price level predictions.

Why does it happen?

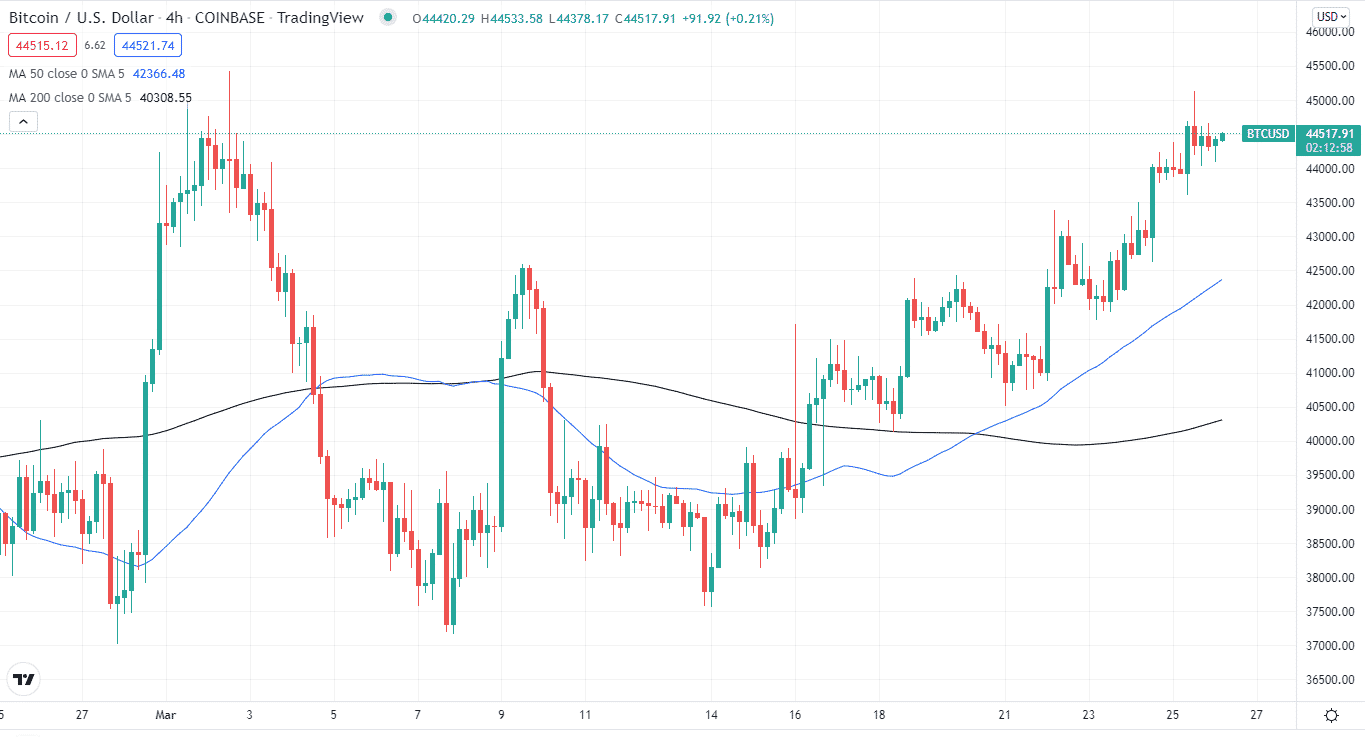

Without entering into the complexities of predictive analysis, trades are made based on the appearance of favorable patterns, which are simple and basic to apply using algorithms. For example, a popular trend-following method uses 50- and 200-day MAs.

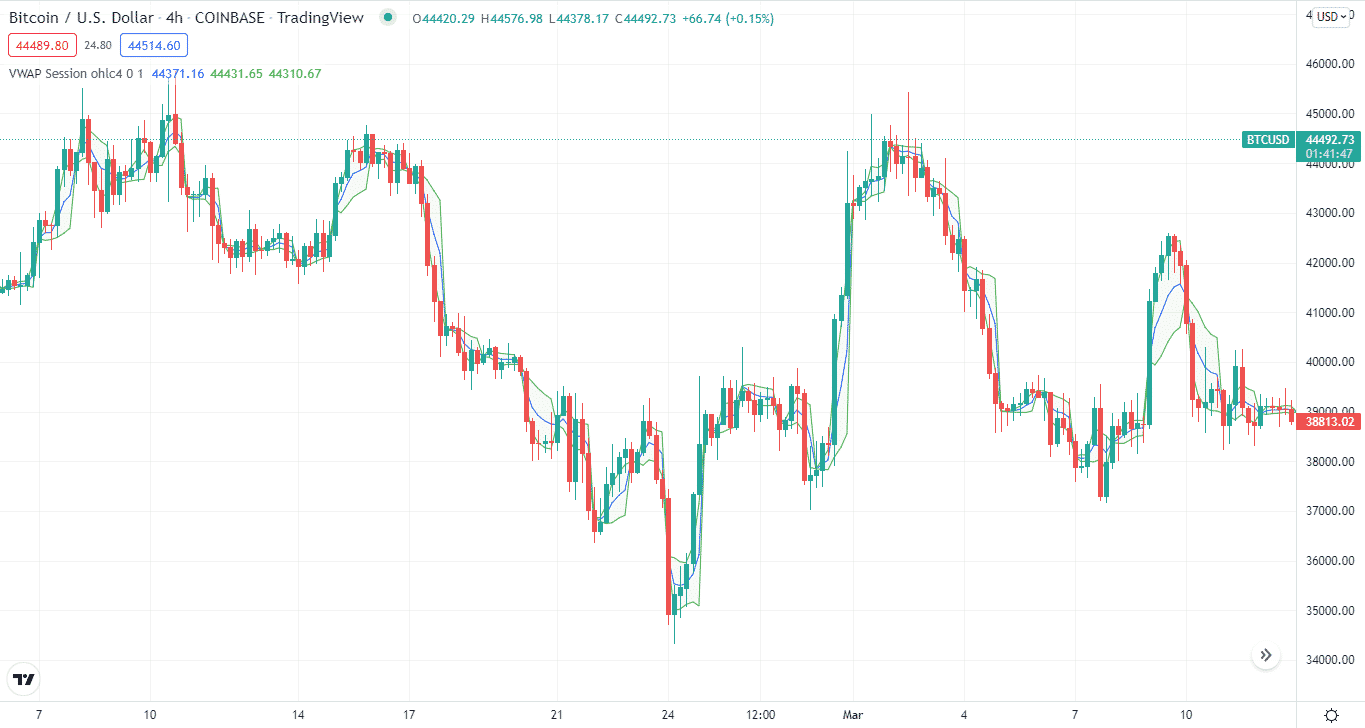

Below you can find a 50-day and a 200-day MA on the BTC/USD chart.

How avoid the mistake?

As a trend follower, you’re always looking for and riding the latest market trends. However, because markets spend most of their time consolidating, there will be extended periods when no trend occurs.

Tip 2. Finding a crypto arbitrage

Before introducing the crypto market, arbitrage was a pillar of traditional financial markets. Despite this, there appears to be a greater buzz in the crypto world about the possibility of arbitrage possibilities.

Why does it happen?

All a trader has to do is detect a differential in the pricing of a digital asset across two or more exchanges and write a sequence of operations in MATLAB to profit from it.

For example, let’s assume the price of USDT is $1.00 on one exchange and $1.02 on the other. In this scenario, crypto arbitrageurs might spot this disparity and buy USDT on the first one and sell it on the second. We can use moving averages to find the current trends to find a crypto arbitrage and apply it on both exchanges.

How avoid the mistake?

Arbitrage possibilities’ low-risk character influences their profitability; lower risk delivers lower rewards.

Tip 3. Mean reversion

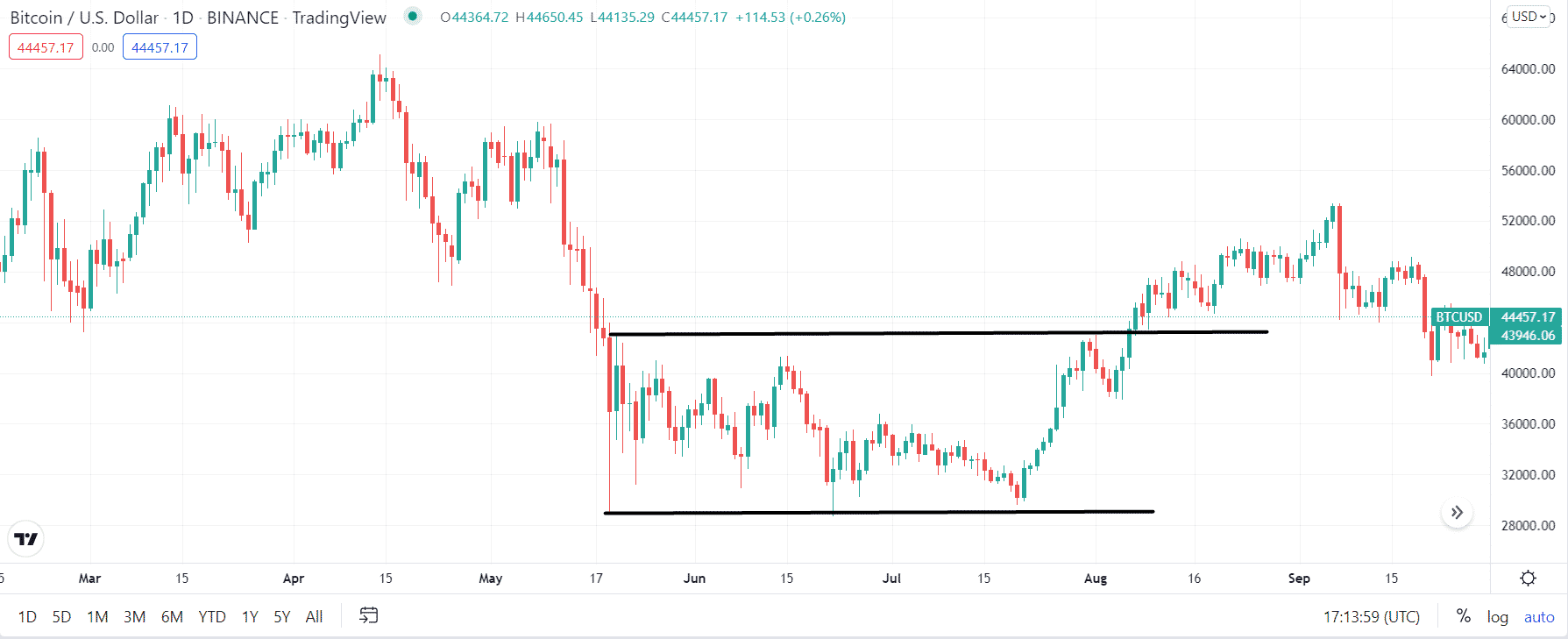

The notion behind a mean reversion approach is that an asset’s high and low values are a transient occurrence that regularly reverts to its mean value.

Why does it happen?

When a price range is identified and specified, and a moving average method based on mean reversion is implemented, trades may be made automatically when the price of a crypto breaks in and out of its designated range.

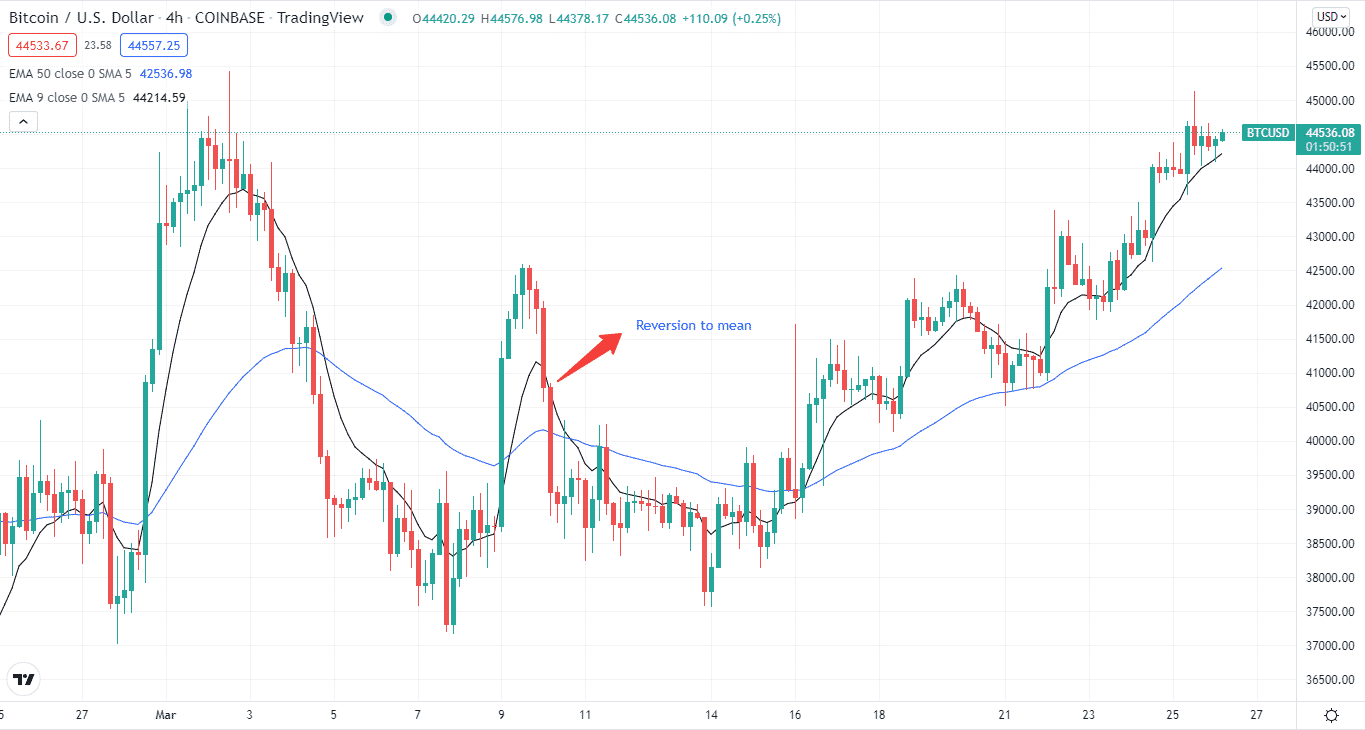

The chart above shows the BTC/USD on the 4H time frame with the 9 and 50 EMAs applied. Notice how the black 9 EMA in red follows price action much closer than the blue 50 EMA.

How avoid the mistake?

Overextension is the opposite of a reversion, a market reverting to the mean. Instead, it denotes a market that has deviated from the mean for a lengthy period. It is thus likely to return to the mean.

Tip 4. Finding the volume-weighted average price

VWAP is the average price of a crypto that has traded over a day, depending on volume and price, and it’s essential since it gives traders visibility into a cryptocurrency’s trend and worth.

Why does it happen?

Using crypto-specific historical volume profiles, the volume-weighted average pricing technique splits up a big order and periodically calculates smaller portions of the order to the market.

Using the MATLAB software, the aim is to execute the order close to the VWAP. You can code to go long only when the price is below the VWAP and short when the price is above VWAP.

How avoid the mistake?

Remember that the previous day’s support and resistance zones might be important marketplaces for future days when the price is going sideways.

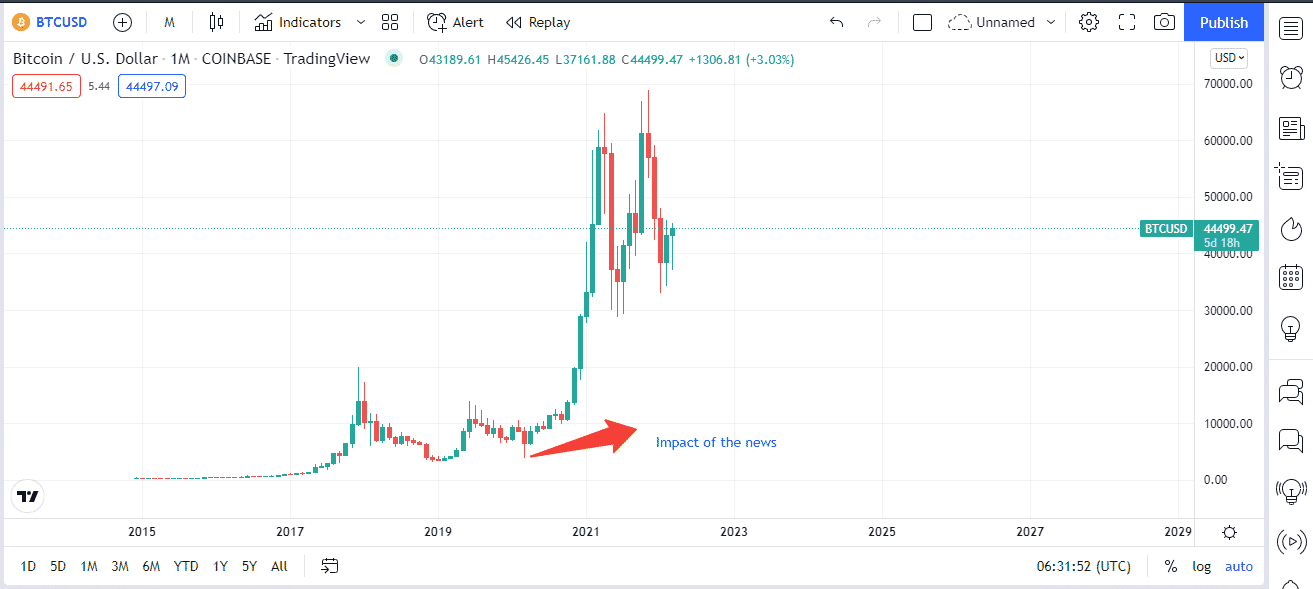

Tip 5. Keeping an eye on the news

Creating an automated news strategy is always helpful, especially in a volatile market like crypto.

Why does it happen?

Like social media interest, news and other variables strongly impact the Bitcoin market. Training a bot to recognize optimistic phrases like partnership news, for example, can allow someone to enter the market before the price begins to climb. A user may train a bot to react to particular terms it picks up from news sources using MATLAB.

How avoid the mistake?

Social media buzz should never be used to make investment decisions. Unfortunately, because crypto is such a trendy issue, misleading information spreads rapidly.

Final thought

It’s important to remember that if one trader can place a MATLAB-generated trade, so can others. Therefore, if you go with the more complex MATLAB code, you need more backtesting.