It can be hard to choose among so many different indicators when trading. Indicators sometimes can send opposite signals. So, which one should you follow? Some traders have an exciting answer: none.

Naked FX trading is the strategy in which you only use price action and left behind indicators to make your calls. As a result, the naked FX strategy allows you to make faster decisions based on the things you see on your candlestick chart. In this article, we will tell you what this strategy is all about, so you choose whether it is suitable for you or not.

What is the naked forex strategy?

Naked forex strategy is another name for Price action trading. In this strategy, traders forget about all the indicators and follow the price movements on their charts. Naked forex traders say that while indicators base their results on past data or secondary factors, this strategy goes right to the point by analyzing the price at the exact moment. So, the only charts traders use to decide which will be their next move is the Japanese candlestick chart, where they get the information they need.

Now, this trading strategy is not for everybody. While it is true that it is not a matter of luck nor guessing, a key component of this trading is experience. Whoever applies this strategy should be familiarized with patterns and with the behavior of the market they trade. Naked forex trading is not for beginners.

How does the naked forex strategy work?

By now, it should be clear that the tool traders use to operate with this strategy is the Japanese Candlestick chart, the type of chart with the most information and easier to read. On this chart, instead of using software to draw moving averages or Fibonacci retracement levels, traders rely only on patterns they can draw with the price action.

So, the way to trade is, once you have your chart in front of you, you look for known patterns to predict what the price will do next. There are many patterns you can use to predict the price movement, but among the most popular we have:

- Engulfing pattern

- Hammers

- Wedges

- Support and resistance levels

Another tool these traders use to make their calls is fundamental analysis.

Naked forex trading avoids all the mixed signals the different indicators give you, with fundamental analysis that’s not a problem. For example, when an event is coming, we know for sure that it will affect the price, and most of the time, we know how it will impact the quotation, so, since most of the time fundamental analysis is very straightforward, it doesn’t make sense to turn our backs to it.

How to trade the naked forex strategy?

The way of trading with the strategy is by looking at the chart and finding the patterns that could lead us to the proper conclusion. Another vital aspect of naked trading is considering the pricing cycles. In addition to the pattern most people draw on charts, traders know that prices are cyclical. In a longer time frame, this could be seen as a pattern itself. Good traders know how to identify those patterns in the markets they operate to make better calls.

FX trading allows us to profit from bullish and bearish markets. Let’s see how the setup is for each case.

Bullish trade setup

We want to enter before or right after this setup. The price starts trending up to get the most profit out of it. We’ll use a typical pattern to achieve this.

When to enter?

We will enter as soon as we see a bullish pattern on the chart, such as an engulfing pattern, or if we observe that the price has reached a support level.

Where to set the stop-loss?

Set the stop-loss just a few pips below the low of the last candlestick to avoid losses in case the trend goes against us. We recommend putting it five pips below.

Where to set the take-profit?

We need to find an immediate resistance level for the take profit and set our take profit there. However, to profit, even more, we will only exit 50% of our position once we reach our first profit. The other 50% will still be in the position, and we will set a second profit at the next resistance level we find.

Let’s illustrate this setup with an example.

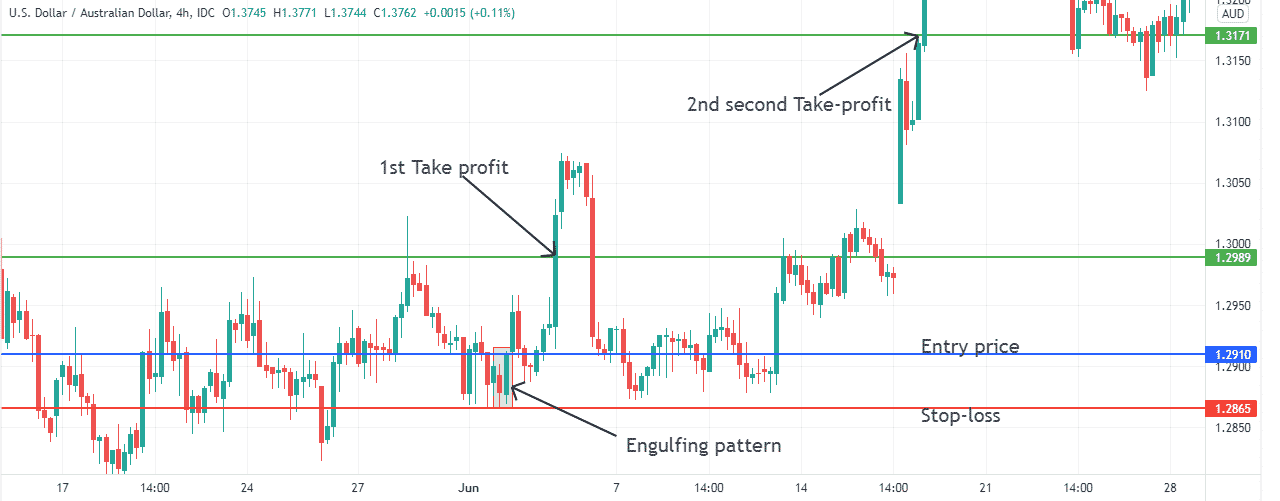

The chart above represents the setup of the naked forex strategy for this trade. In this example, an engulfing pattern triggers the trade. Once we recognized this pattern, we entered the trade at 1.2910. The limit orders were:

- Stop-loss: 1.2865

- 1st take-profit: 1.2989

- 2nd take-profit: 1.3171

At the end of the trade, the total earnings were 79 pips until the first take-profit and 261 until the second take-profit.

Bearish trade setup

In a bearish setup, we are looking for a bearish pattern to enter the trade.

Where to enter?

You enter a short position once a bearish pattern appears on the chart. Of course, the experience will tell you which patterns are stronger.

Where to put your stop-loss?

Contrary to the bullish setup, you set your stop-loss five pips above the high of the last candlestick.

Where to set the take-profit?

We find an immediate resistance level and set our 1st take-profit there. Once the price reaches our 1st take-profit, we will only exit 50% of our position. The other 50% will be still in the position, and we will set a 2nd take-profit at the next resistance level we find.

Let’s illustrate this setup with an example.

In the example above, we trade the pair USD/NZD. An engulfing pattern triggers the trade setup. Once we recognize the engulfing pattern, we enter the trade at 1.6721.

The limit orders were:

- Stop-loss: 1.6853

- 1st take-profit: 1.6470

- 2nd take-profit: 1.6261

At the end of the trade, the price reached the second take. As a result, profits and the total earnings were 251 on the first trade and 460 pips on the second half.

How to manage risk?

We recommend limiting your position to 2 or 3% of your capital as with any other strategy. This is a rule of thumb. But, in a more specific way, we recommend that, when applying the two steps of a take-profit, once you take the first step and reach the first take-profit, you should move your stop-loss to the level of the first take-profit. This way, you will lock your earnings.

Final thoughts

The naked FX trading strategy may look like an easy way to trade. While it is true that you avoid interpreting all those indicators and cracking your brain figuring out which signal is more relevant, those indicators are there for a reason.

Once you give up on them, you are left with fewer tools to make calls, and you rely primarily on your criteria. Naked forex trading depends mainly on the trader’s knowledge about the market and is not suitable for everybody.