Now that you have built an auto trading system, it’s time to move onto how you can optimize your trading strategy. If you haven’t created a strategy, you can check our guide here. Go through the post first, and then come back. For those who have completed a system, give yourself a tap on the back, and let’s optimize our trading approach.

Tip 1. Drawdown reduction

You probably have heard about drawdowns. They are an essential part of FX trading, like profits. Drawdown represents your account’s balance reduction after a series of losses. For example, if you have a $1000 account balance and lose $500, your drawdown is 50%.

As an auto trader, you have to build a trading system that will minimize your drawdowns.

Why does this happen?

Drawdowns are part of trading. You can’t escape them with Jedi’s mind tricks. Mostly, drawdowns appear because of an inadequate risk-management approach, like not using stop loss (SL) or not defining your risk appetite.

Drawdowns can also make your life itchy if you are using too much leverage. The problem with high leverage is that all it takes is one bad trade, and boom, down goes your dollars. And when traders experience losses, something triggers in their head, and they start revenge trading, leading to more drawdowns.

How to avoid the mistake?

You need to develop a system that will set SL orders and automatically limit your drawdowns.

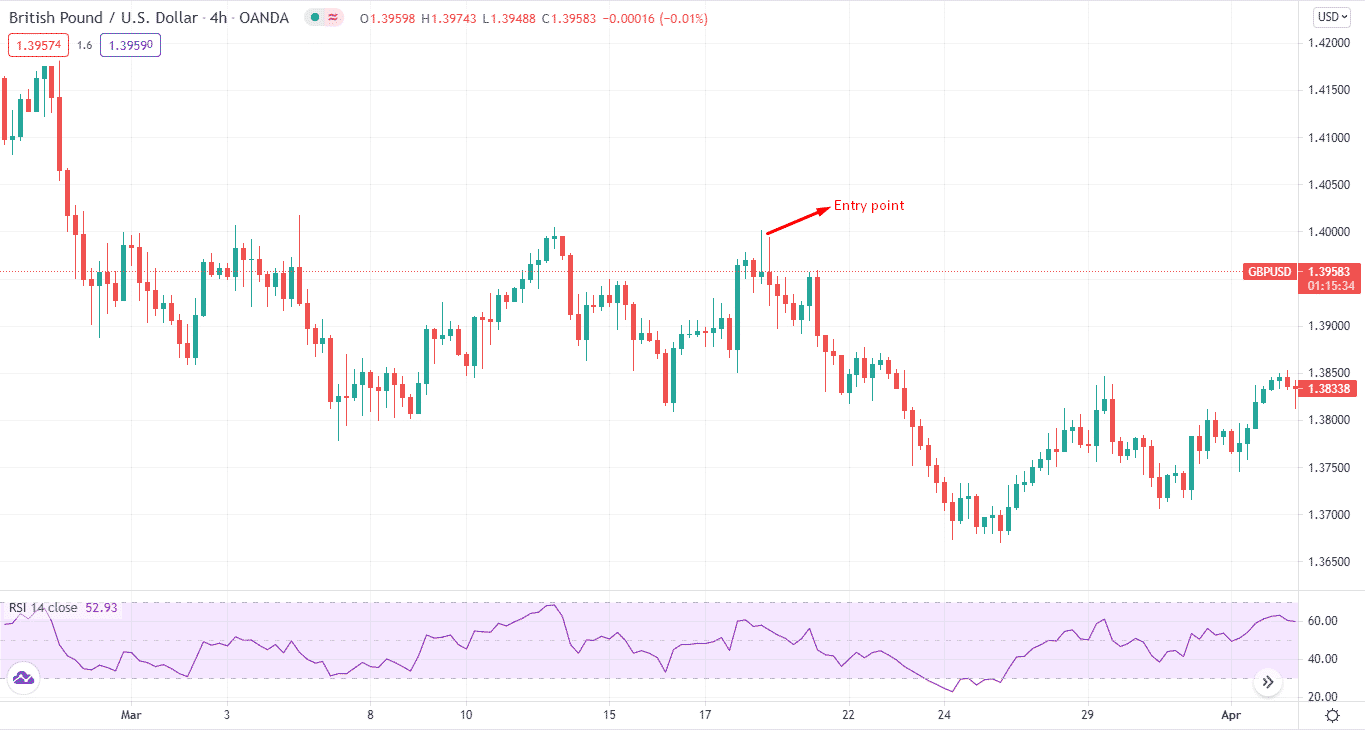

Also, come up with a strategy that allows you to risk a small percentage of your account. For instance, if you have a $10,000 account, you should not risk more than 1% or $100 on every trade. Let’s present this on the chart.

A newbie locating a bullish trend would have entered the “entry point” mentioned on the chart. But after hitting the ceiling, the price comes down. In this case, if you haven’t programmed your system for SL, then your account balance would have vanished like a phantom.

Tip 2. Profit factor assessment

PF defines your average earnings and losses throughout the entire trading period. It calculates profit according to your risk.

The formula for profit factor

PF = total earnings during the trading period / total losses during the trading period

- The average earning is the entire profitable trades

- The total loss is the overall losing trades of your trading system

The rule of thumb is if the profit factor is more than two, then your trading system is profitable. On the other hand, if it has a profit factor of less than one, then it’s back to the drawing board.

Let’s say you in one year, all your winning trades are $1000, and all your losing trades are $500. Applying the above formula, you have a profit factor of 1000 / 500 = 2. You have a lucrative trading system.

One thing to note is you should apply PF on annual, quarterly, or monthly trades. This is because your hourly profit factor won’t make much of a difference.

Why does this happen?

When you backtest historical data or implement your trading system on live markets, profit factors allow you to assess the overall situation. If your net results aren’t profitable, you need to tweak a bit.

How to avoid the mistake?

There’s a reason why PFs are a big thing on Wall Street and at significant hedge funds. You can apply a similar approach and find out how your system is doing. If the profit factor is less than two, then there’s something wrong with the system, and you have to adjust it. You can use additional filters to reduce false signals.

Tip 3. Equity stop loss

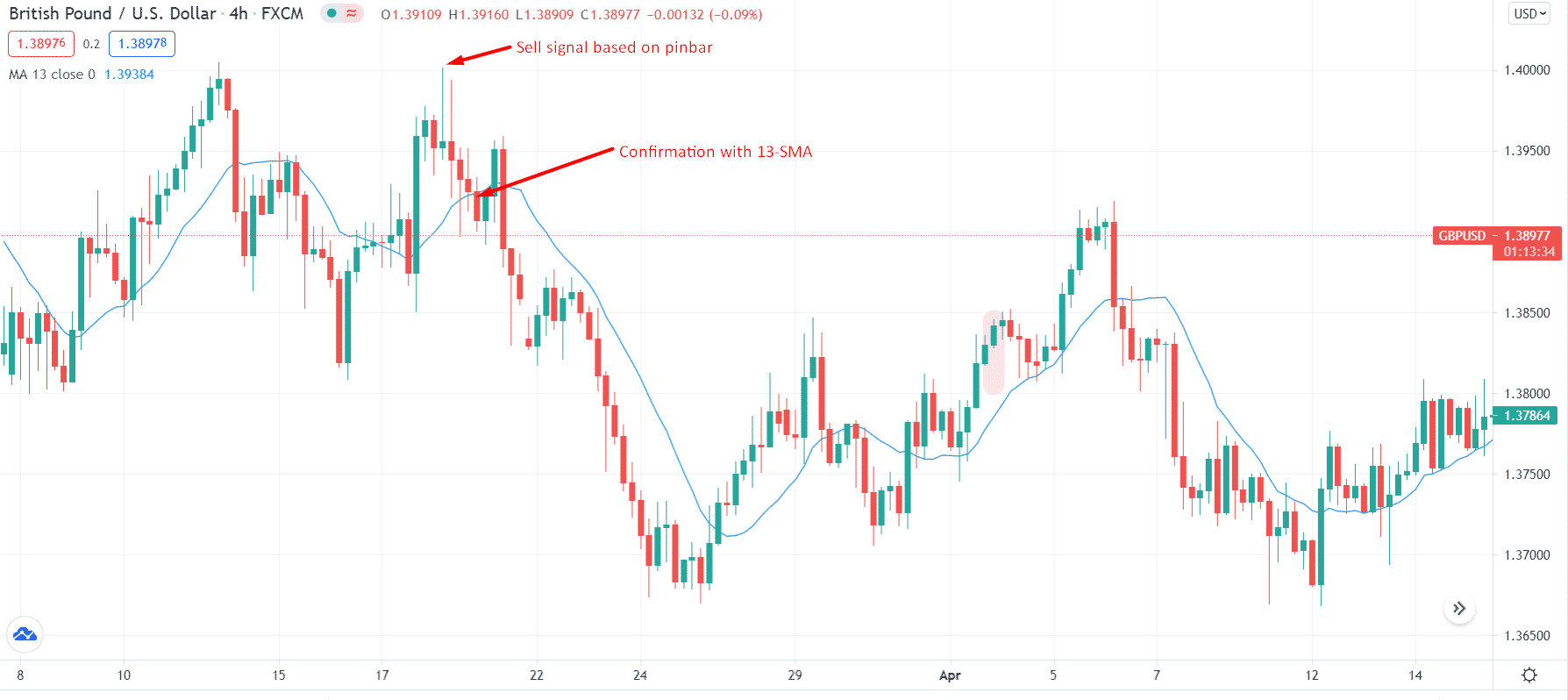

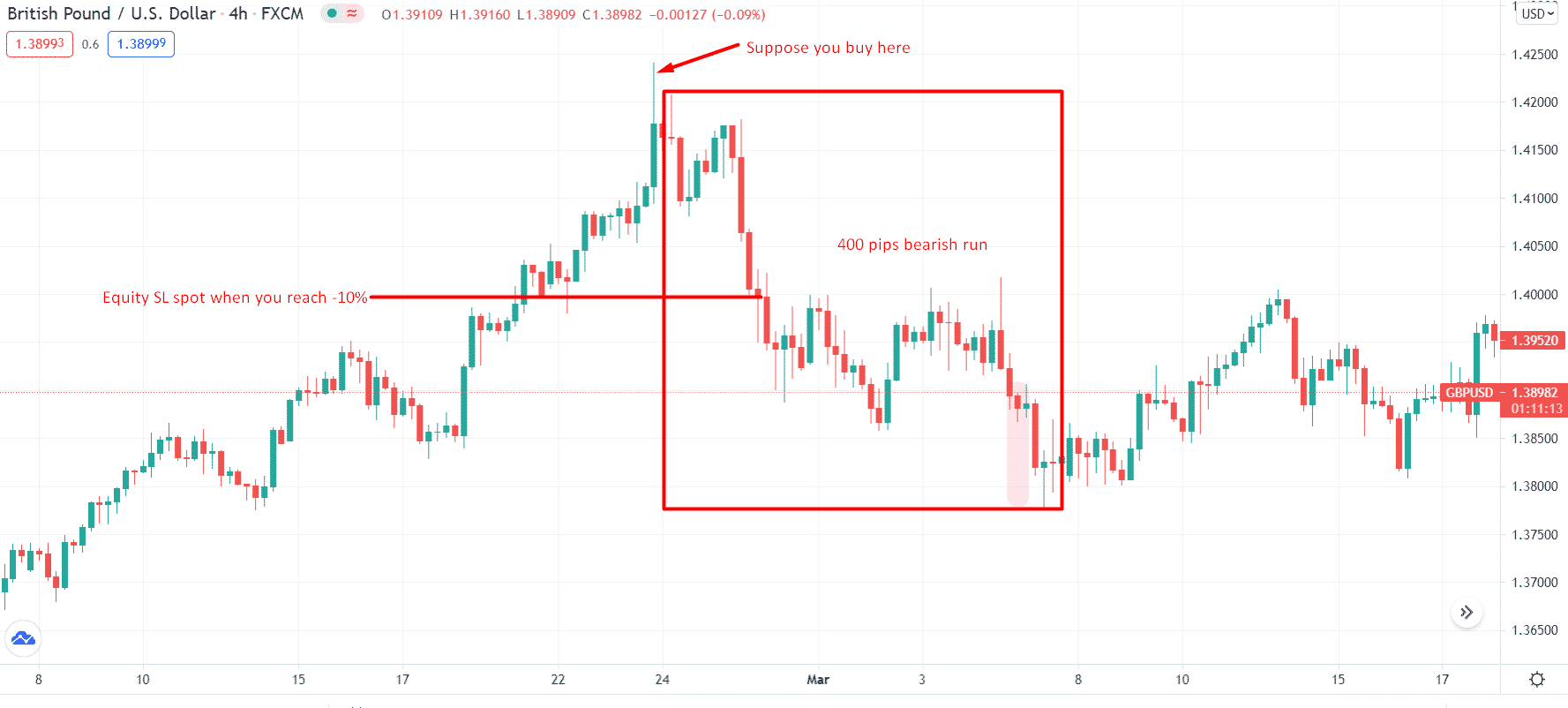

If your account’s equity drops below the SL, you have reached the equity stop loss level. It’ll close all your positions. This is also known as a “hard stop.”

When you set your stop loss, you set it according to your equity. Generally, it is 1 or 2% of your account’s equity. When this level reaches, your SL hits, and your trade ends up in a loss.

The equity stop loss level provides you with a barrier. If the price crosses this barrier, your positions will be closed. For example, if your account’s equity is $1000, and you set an equity stop loss level at $700, then your positions will be closed at $700 or below it.

Why does this happen?

Equity updates with every price tick in your trading platform. If you don’t have an SL, all your equity will vanish like a shooting star.

How to avoid the mistake?

You can program your system to close all positions when equity dips to a certain level. This happens when your drawdown increases a lot amid a substantial rise or fall.

Tip 4. Diverse portfolio

You probably heard in your English class like me that you don’t put all your eggs in one basket. Back then, I was a bit confused, but forex trading has summed this up.

Diversifying forex investments is an excellent risk allocation tactic. This is because you won’t be affected by adverse price moves. For example, if your system chooses a basket of currencies rather than acting on a single one, then your account won’t bump if a single currency shows volatility.

Why does this happen?

From economic downturn to political instability, anything can tickle the FX. This increases the volatility of the forex pair.

How to avoid the mistake?

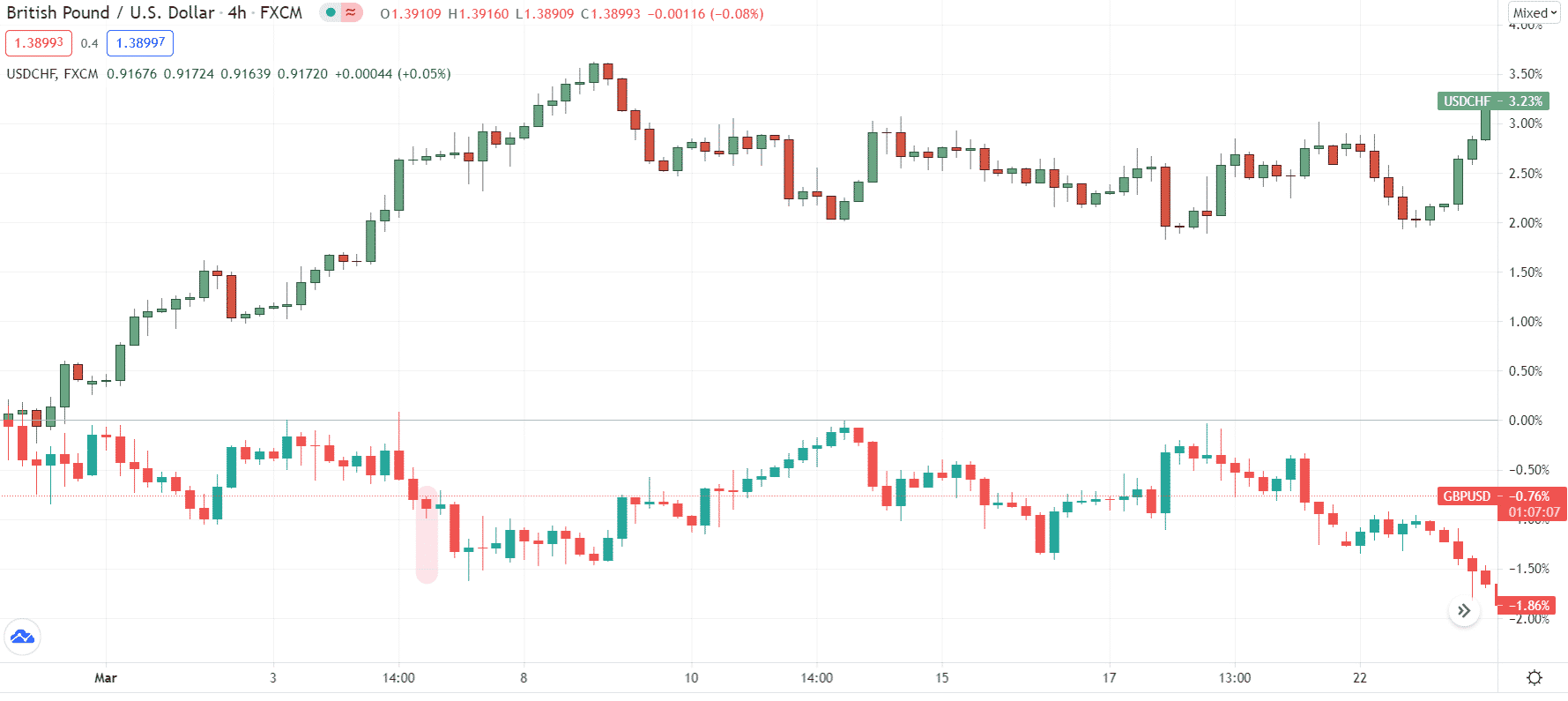

Instead of relying on one pair, you can pick up a basket of currencies to diversify your portfolio.

See the comparison of USD/CHF and GBP/USD. Applying one strategy on both pairs will yield different results.

Tip 5. Time frame test

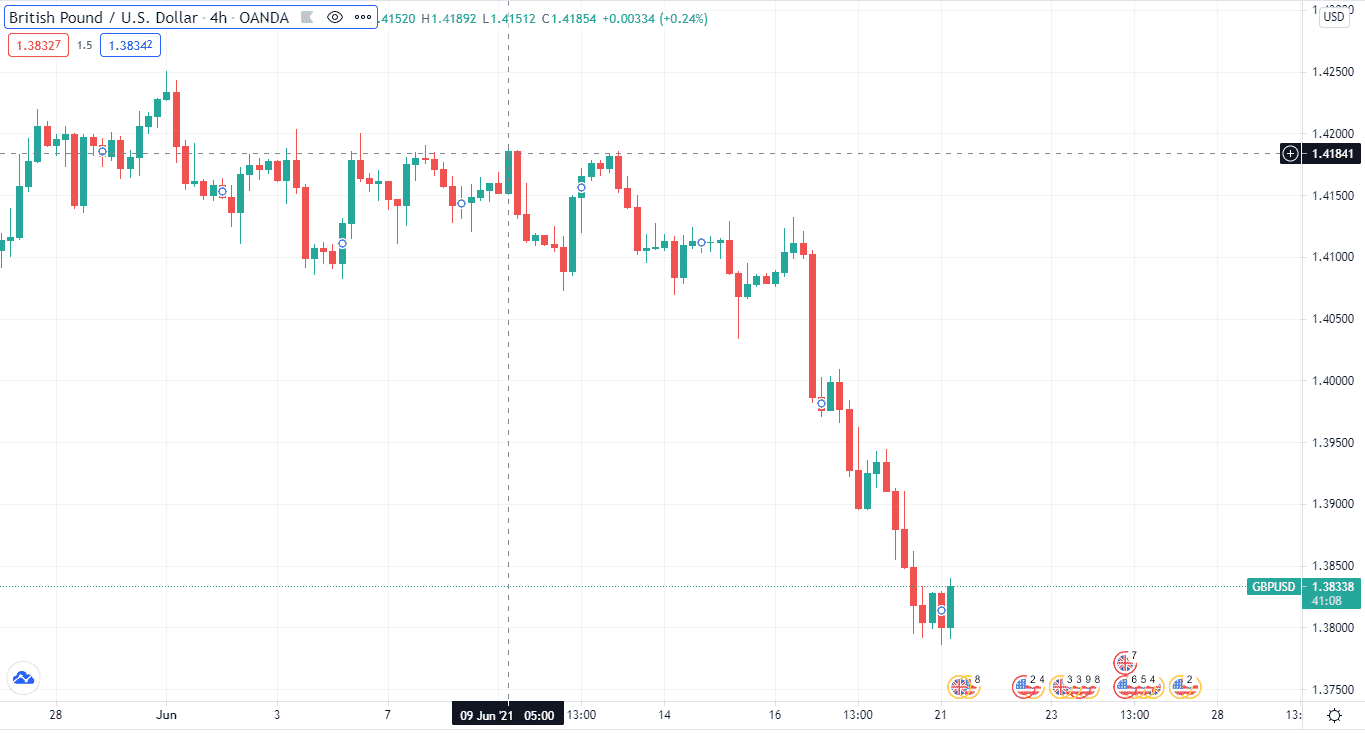

The time frame (TF) you choose helps you in boosting your trading method. Many newbies make the mistake of trading in the wrong time frame. They pick shorter TF, like 5-minute or 1-minute, to see the price action. However, they end up in a loss. Let’s explain this on the charts.

As the above chart illustrates, on June 9, there was a big bullish candle on a 4H chart. You might have taken a bullish position, considering this candle.

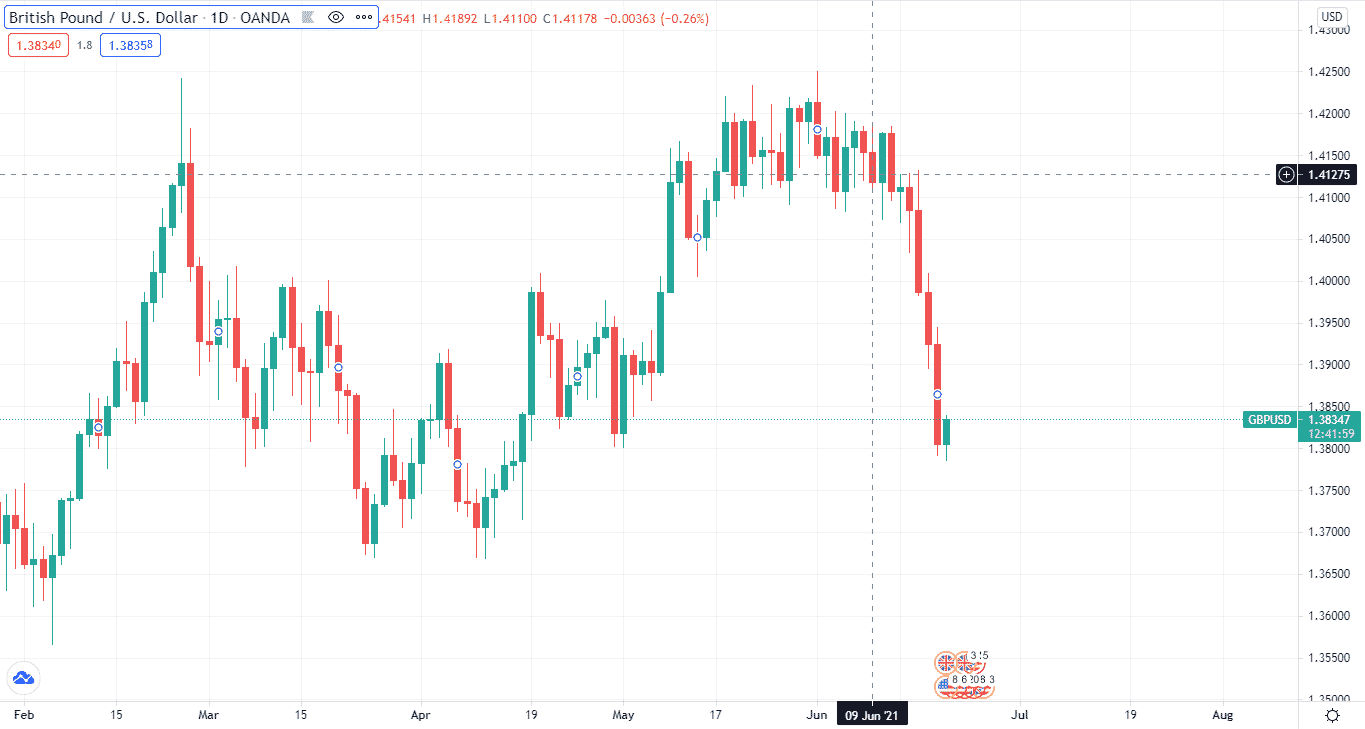

But wait, let’s see what’s on the daily chart. Should you go long?

Not quite! As you can see, the daily candle is bearish. That is why TF testing is part and parcel of your auto trading strategy.

Why does this happen?

Several time frames are starting from the 1-minute to the yearly. Smaller time frames tend to show more false signals than more extended time frames.

How to avoid the mistake?

You can take a TF test by setting your system to locate the trend on more extended time frames like the daily or weekly charts. This way, you’ll have fewer false signals.

Final thought

If you follow the above steps, optimizing your trading strategy won’t be that difficult now. However, remember that you should always follow your trading plan.