The net unrealized profit/loss or NUPL effectively measures the difference between the overall market capitalization and the realized market capitalization. This concept allows investors to learn the difference between net loss and net profit. So it makes sense that crypto investors can use handy technical concepts to generate investment ideas.

However, crypto investors use many matrices to generate trade ideas to make money from the marketplace. It is mandatory to have a particular level of understanding when using any technical concept to generate trade ideas. This article will introduce you to the NUPL concept alongside listing the top five tips to use the concept effectively in crypto assets.

What is the Net Unrealized Profit/Loss or NUPL?

It is a technical concept that determines any asset state, as it is an overall profit or loss situation.

- Any reading near the zero level declares a neutral situation.

- Any reading above the zero level claims positive pressure.

- Any reading below the zero level indicates declining price pressure.

When the reading reaches near the greed level indicates profit-taking, and a reading near the red level declares buying opportunities on any trading asset.

Top five tips for using the NUPL concept in crypto strategy

When using the NUPL technical tool to generate trade ideas on crypto assets, following specific guidelines is mandatory to achieve the best results. This part will list the top five professional tips to use NUPL effectively.

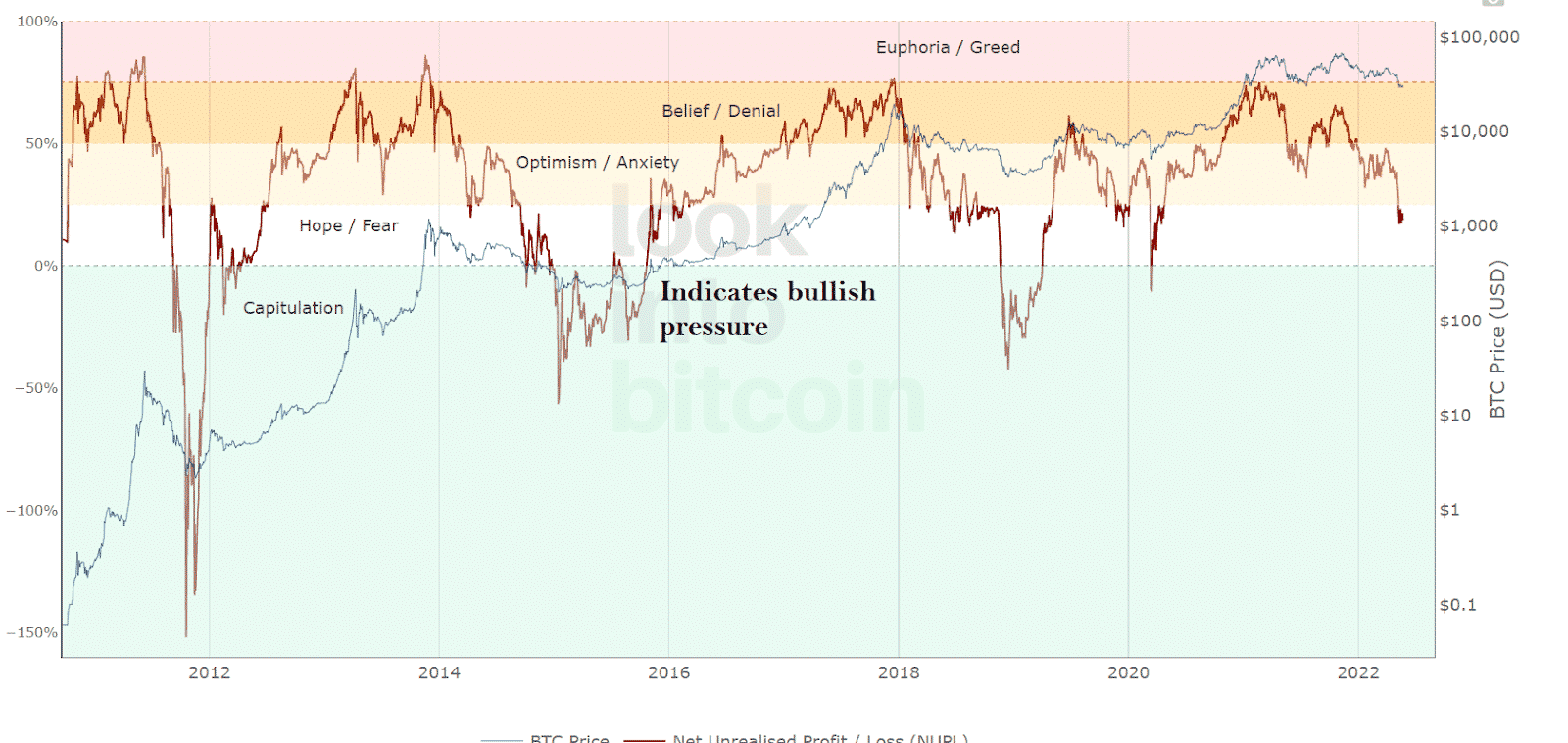

Tip 1. When entering a buy trade

When the reading reaches the red mark zone or below the zero level, seek to open buy positions. Observe the price movement and wait as the price gets above the 0% or the hope fear level. In this phase, it indicates potential bullish pressure on the asset price.

Bullish pressure indication

Why does this happen?

The NUPL indicator calculates the market data using its unique calculation and matrices to obtain the market context. This indicator subtracts realized value from the market cap value and detects the market trend.

How to avoid mistakes?

Using this concept to generate crypto trading ideas, set an initial stop loss below the current bullish momentum. Moreover, for short-term traders, we suggest checking on upper timeframe charts to confirm the actual trend and seek to exit from trades before the price reaches the red zone or denial zones.

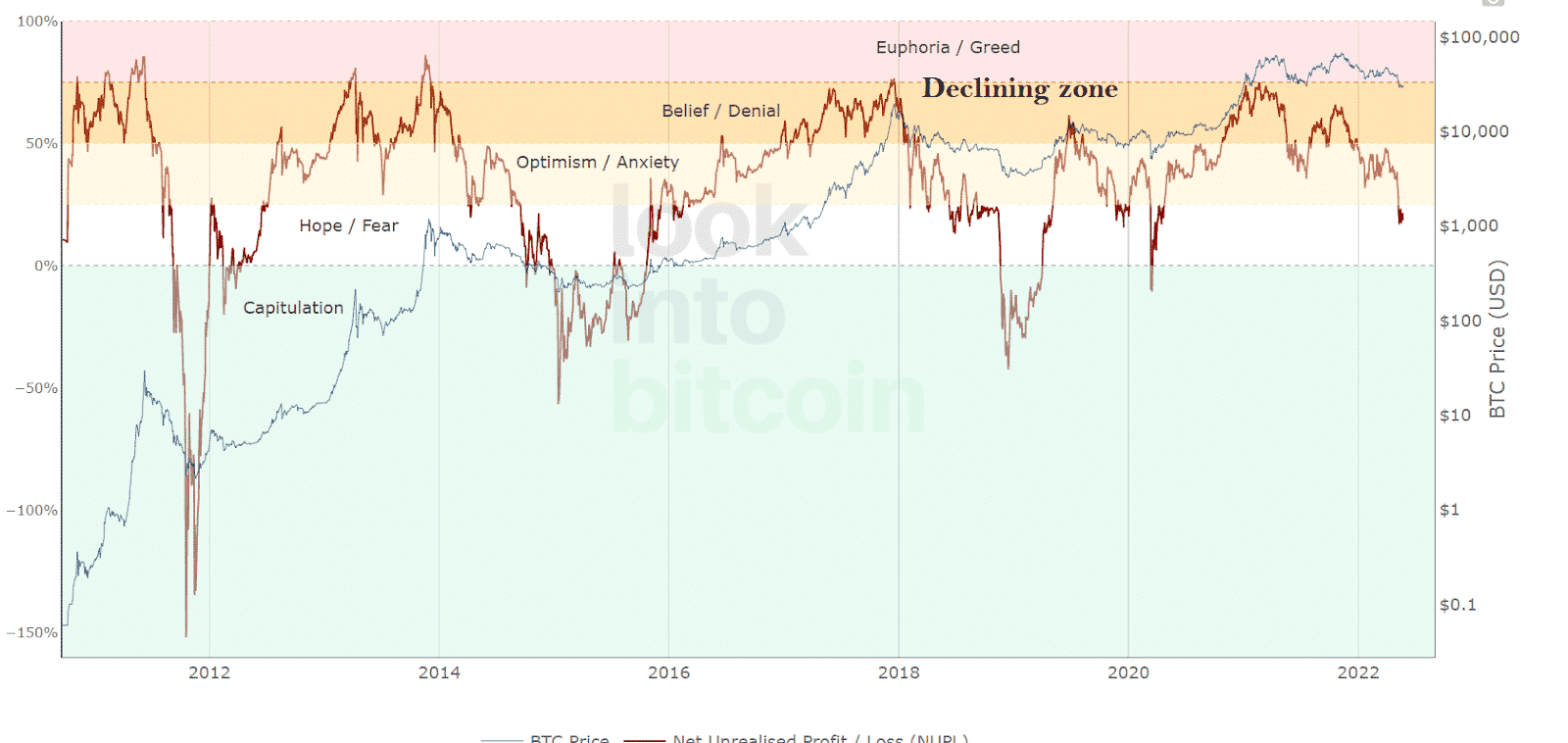

Tip 2. When entering sell trade

When seeking to open sell positions using the NUPL indicator concept, wait till the price reaches near the denial zone or above. The price is getting to that level and starting to decline, a sign that the price may enter a downtrend. It enables entering sell orders for crypto investors.

Why does this happen?

The NUPL indicator subtracts the realized value from the market cap value and gets the idea of active investors’ sentiments. Following the demand and supply concept generates trade ideas or shows the market context.

How to avoid mistakes?

When entering sell positions, the price starts to decline. You can use many other technical indicators or technical tools such as Fibonacci retracements, support resistance, moving average, etc.

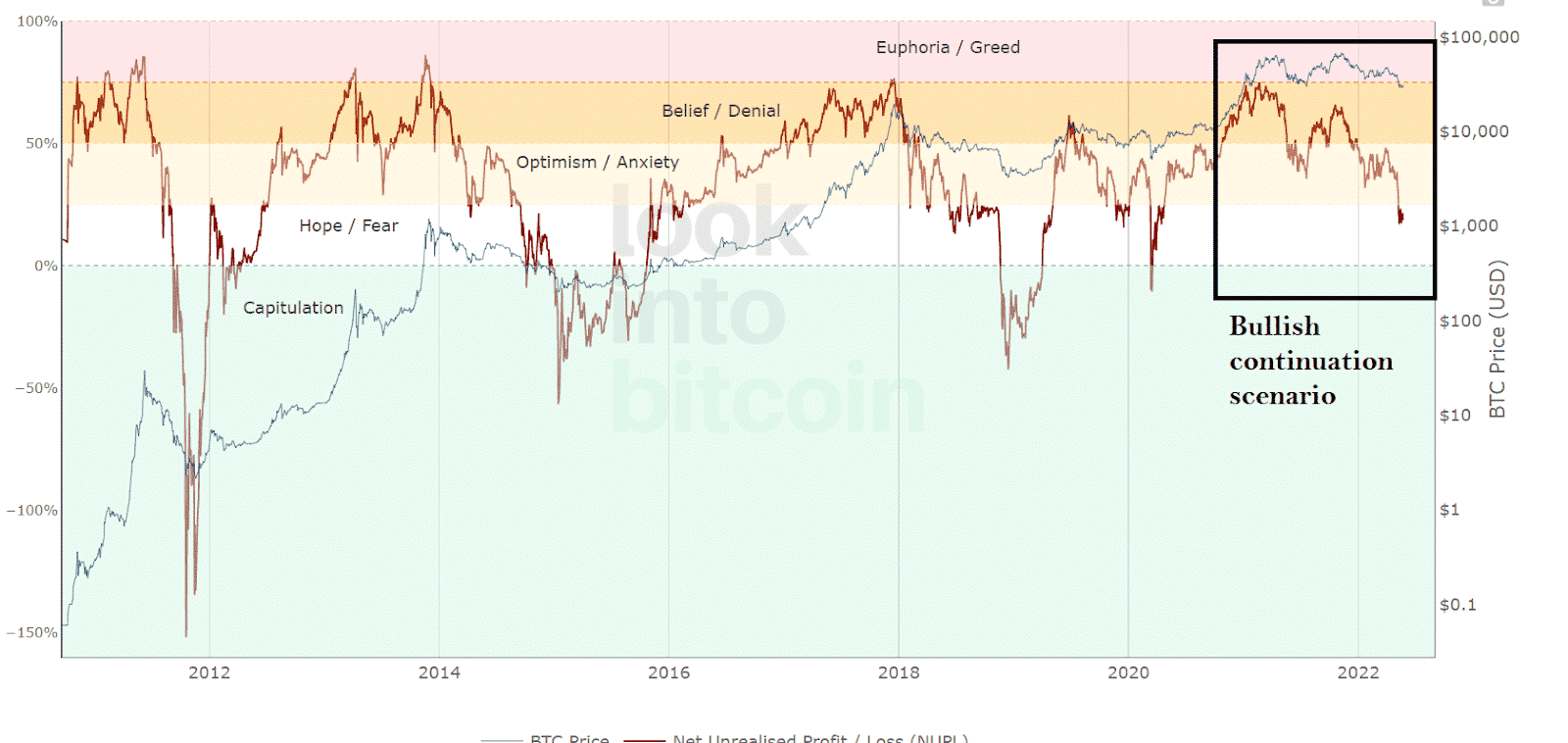

Tip 3. When continues buy trades

You can use the NUPL concept to continue your buy order. In this case, you may wait as the price reaches above the 50% level and continues to rise, indicating an increasing price pressure on the asset price. You may open a buy order or continue your current long position.

Why does this happen?

It happens as the price starts to rise with the increasing demand for certain assets. As the buy volume increases, you may mark the dynamic NUPL line again, reaching near the hope/fear level and indicating that the price may continue to rise.

How to avoid mistakes?

As the dynamic NUPL line reaches the greed level and starts to decline, you may shift your stop loss near or above the breakeven point as a part of trade management. It enables limit your risk on trade continuation.

Tip 4. Combining the volume indicator

You can use the volume indicator as a supportive tool alongside the NUPL indicator. In this case, open a buy position when the indicator reading reaches the red level. Meanwhile, the volume indicator shows an increasing buy pressure and vice versa.

Why does this happen?

When the NUPL indicator indicates a potential bullish momentum, the volume indicator confirms the bullish momentum and suggests possible profitable long/short positions.

How to avoid mistakes?

When opening any buy/sell positions, use proper tight stop loss for existing trades when using this concept. Moreover, we suggest conducting a multi-timeframe analysis to ensure the overall price trend.

Tip 5. Combining the RSI indicator

Many crypto investors use momentum indicators to generate trade ideas; you can use the RSI indicator alongside the NUPL indicator to generate trade ideas. For example, when the NUPL reading reaches near red or hope/fear level and the RSI dynamic line remains near the mid (50) level, heads on the upside declare potential bullish pressure and vice versa.

Why does this happen?

Combining both effective indicators readings helps determine effective trading positions. Moreover, both indicators are easily applicable in many trading instruments. So it becomes easier to make trade decisions using these efficient technical tools.

How to avoid mistakes?

When using two or more indicators to make any trading strategy, appropriately matching both indicators’ readings is mandatory to generate the most profitable trade ideas. Moreover, we suggest checking on fundamental info alongside these technical indicators to confirm future potentiality and price direction.

Final thought

Finally, this article introduces you to a most potent technical indicator alongside describing the top five professional tips to use this indicator for successful trade executions.

Before choosing any crypto assets, we recommend conducting some research by checking several fundamental factors, including utilities, usability, availability, blockchain offerings, future projections, community/founders/teams behind the project, etc.

Moreover, practice these concepts as the tips above for mastering before applying them on live accounts.