Planning the day is a common practice, but pre-market trading is still a question for most market participants. The traders need to analyze the market in the early hours even if they don’t trade to track the market movements. In addition, it helps in understanding the market structure for the remaining day.

It also helps in trading strategies planning to ensure maximum profit in less possible time and with fewer efforts. This article aims to offer you an insight into how you can do pre-market trading and what it holds for traders.

What is a pre-market trading strategy?

Trading other than the regular market hours sounds riskier, but the traders can make it profitable. For example, you would probably know that the trading market remains open five days a week and gets closed at 4 pm EST daily. Trading before the opening time or during the weekends goes under the pre-market trading. This strategy allows the traders to further plan for the whole day that, besides saving time, will allow you to invest in the right position and at the right time.

The pre-market trading strategy is a method of examining the market movements before its opening hours. It is beneficial because changes in price actions are usually due to external factors and occur before or after the trading market opens. Therefore, it is suggested to analyze the overall market structure beforehand. It also opens an opportunity for the traders to earn profit by readily evaluating the market in pre-trading hours.

How to trade with the pre-market trading strategy?

The best time for pre-market trading is between 4 am to 9:30 am ESt. It is usually employed through ECNs or Electronic communication networks or, in other words, the buyers and sellers digitally interact with each other. The key point of trading in off-hours is to research properly. For example, it may include research about the price action news or market movements.

Usually, the financial releases and news are updated an hour before the market opens. According to the reports, the news reports highlighting market movements are issued at 8:30 am European time. So, through the pre-market trading strategy, the traders can track the news or releases of indicators or earnings to avoid negative reactions and undetermined investments that, in turn, lead to surprise unnecessary loss.

Here, the economic indicators are the major source of price movements as their release greatly affects the market. It is because when they issue unexpected prices, the market’s volatility rate also increases. It is the only drawback of trading in closed hours. However, it shows comparatively less liquidity.

The pre-market trading strategy also requires a detailed analysis of the volume levels of the market before the regular trading and looks for the possible breakdowns in the market. Moreover, finding safe exit positions from the pre-trading hours is also essential to benefit from the recently opened positions in regular hours.

Bullish trade setup

There can be several ways to identify and strategize your trading using the pre-market method. First, however, let’s explore a simple way to profit from the market using this strategy.

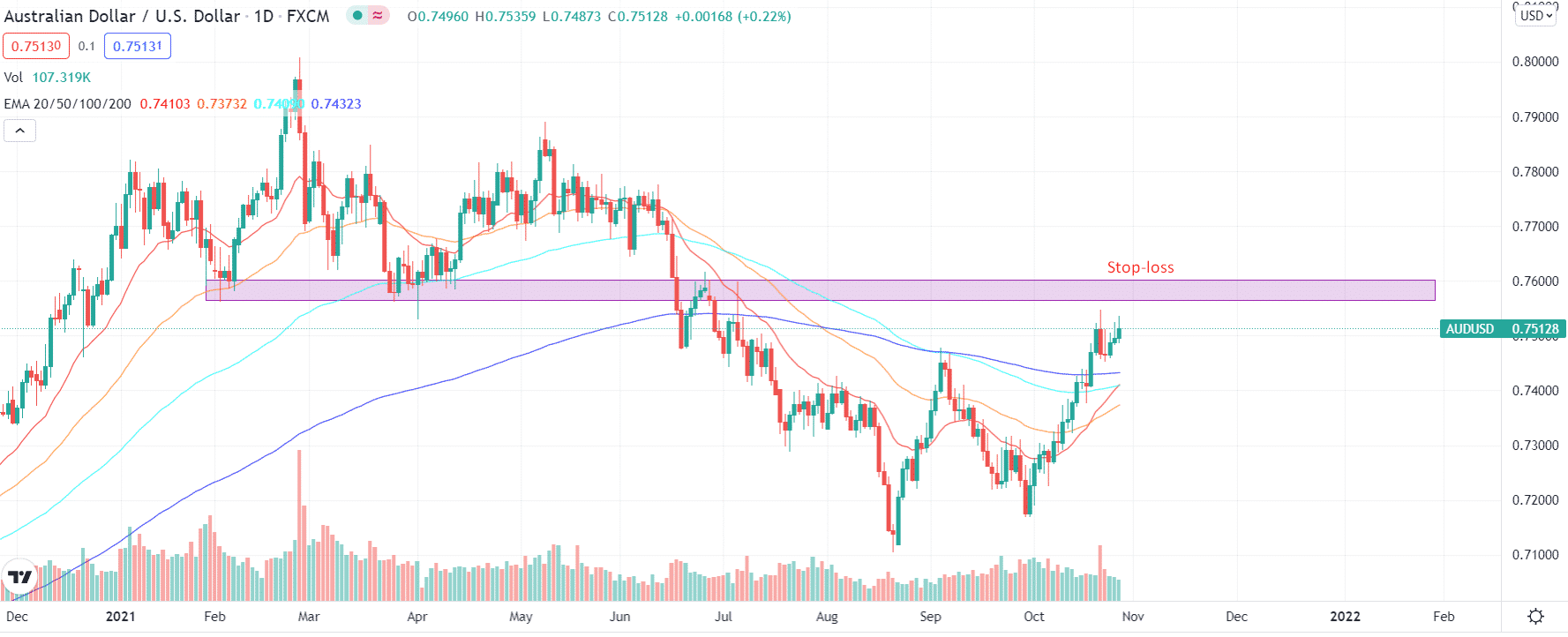

You have to choose an asset that has been consistently bearish and falling since the last several trading sessions. You have to identify the sweet spot where you can enter the market. You have to anticipate the way before the price reaches the sweet spot.

Enter and exit points

To find the sweet spot with a very high probability of entry requires you to mark the demand levels on your chart. You are recommended to use the daily chart for this purpose. Zoom out the chart and find the price zones where the price found support and reverted in recent history. Mark the area with a rectangle and extend it to the right in the future price zone.

You can place the buy limit order in that area. Once the price hits the area, your buy limit order will trigger and have an open position. Next, you have to place stop-loss slightly below the demand zone.

Take profit

You may place the “take profit” around the first resistance level on the upside.

Bearish trade setup

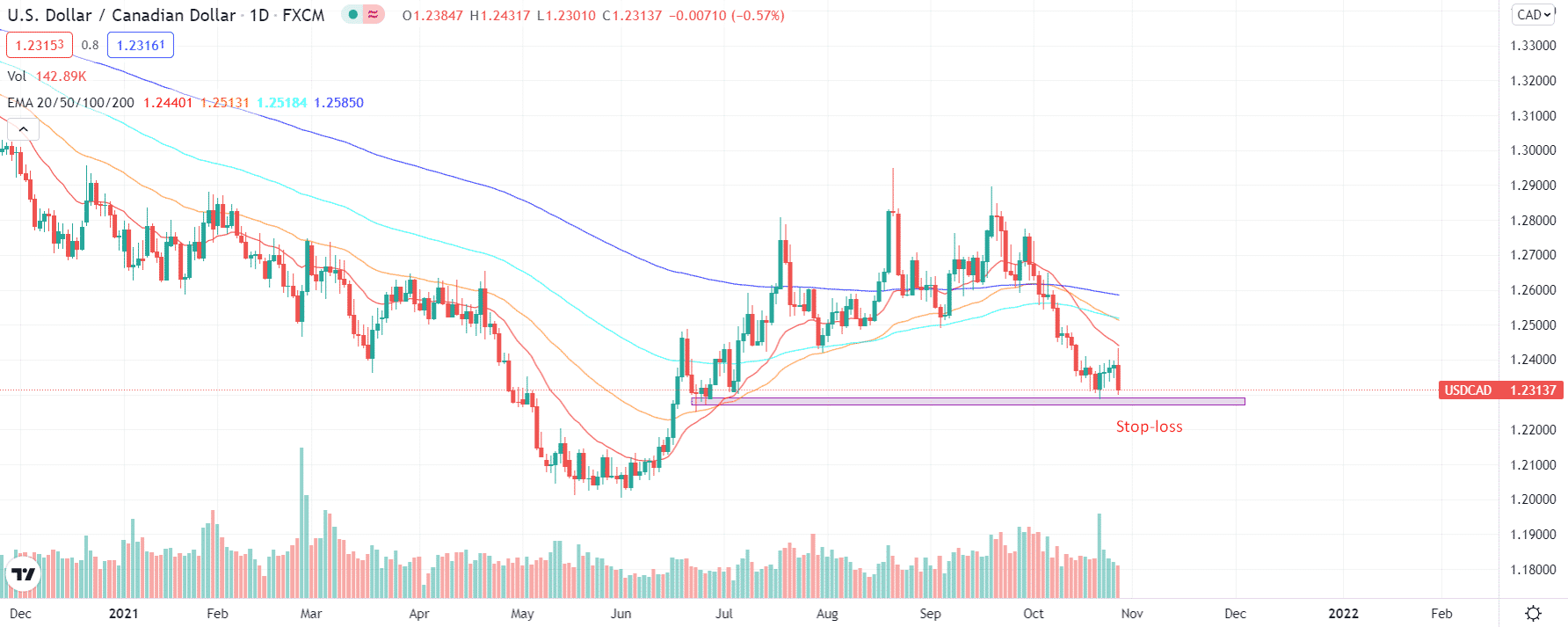

For a bearish setup, look for an asset that has been rising for the last many sessions. Now search for a strong supply zone where the market found rejection and price reversed its uptrend. Mark the supply zone on a daily chart by zooming out and finding the area of rejection in the recent past.

Enter and exit points

Place a pending sell order around the supply area with a stop-loss slightly above the supply zone.

Take profit

Place the “take profit” around the first support area on the chart.

How to manage risk in a pre-market trading strategy?

Risk management is essential to avoid loss of money from trade accounts while trading. Most traders do this by planning the trade that allows them to play with informative and calculated strategies. With this, you can ensure maximum profit and limit the loss.

Other than this, if a trader manages margin settings, there is less chance of losing money. Traders should also keep protective put which can be used as a hedge while trading.

Final thoughts

The pre-market trading strategy is beneficial on the one hand and risky on another. It depends on the trader’s diligence and strategic management of the risks that follow trading in pre-market hours. Understanding the upward or downward movements of trends in the market and the ideal positions of entering and exiting the pre-market is essential to gain maximum profit.