That markets trend only about 20 percent of the time is a fact familiar to most traders. This is true of any market (i.e., currency, commodity, crypto, stock, etc.). You might be wondering what markets do about 80 percent of the time. The answer is that they move sideways. It stands to reason then that if you do not know how to trade ranges, you miss many opportunities.

To make the most of your time watching the markets, you must be versatile. You must understand the market condition at any given point and trade accordingly. If the market is trending, you can use trend strategies from your toolbox. If the market is ranging, which happens most of the time, you should pull out a range trading strategy.

Trading a ranging market is the thesis of this article. You will learn five rules and five tips to avoid mistakes when trading with the range strategy. Trading is not easy, but you can use simple strategies with simple rules to navigate the markets successfully. Plus, you have to get rid of beginner mistakes that hold back many wannabe traders.

Tip 1. Identify a ranging market quickly

How about the lower time frames? It is easy to identify a trading range on a higher time frame, such as the daily chart. You can use the same technique to identify a trading range in any time frame quickly. What you need is your keen eyes and a pair of horizontal lines.

Why does it happen?

Many uninformed traders recognize a ranging market a bit late. When they do discover the range, they already miss some trade opportunities. At other times, they would enter a range trade when the market is working out a breakout.

How to avoid the mistake?

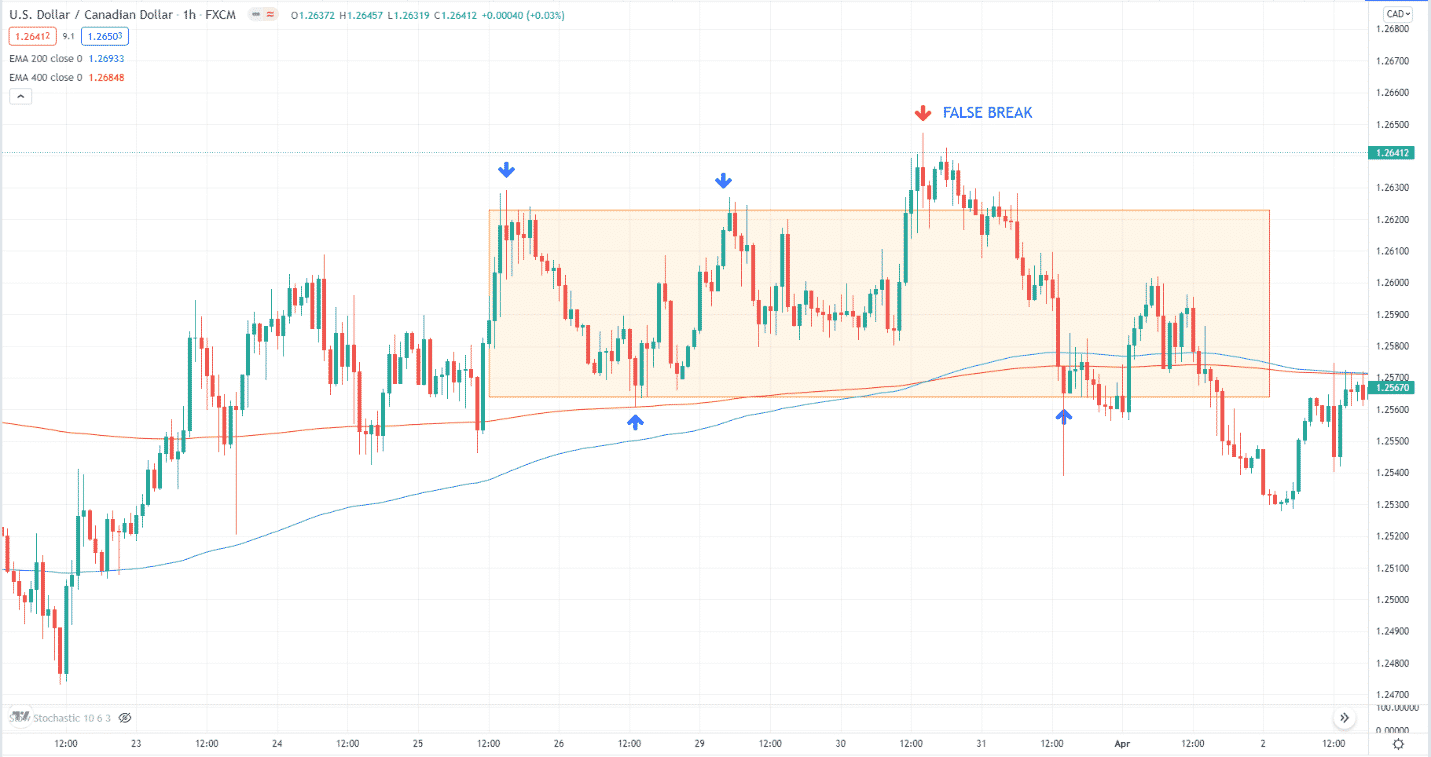

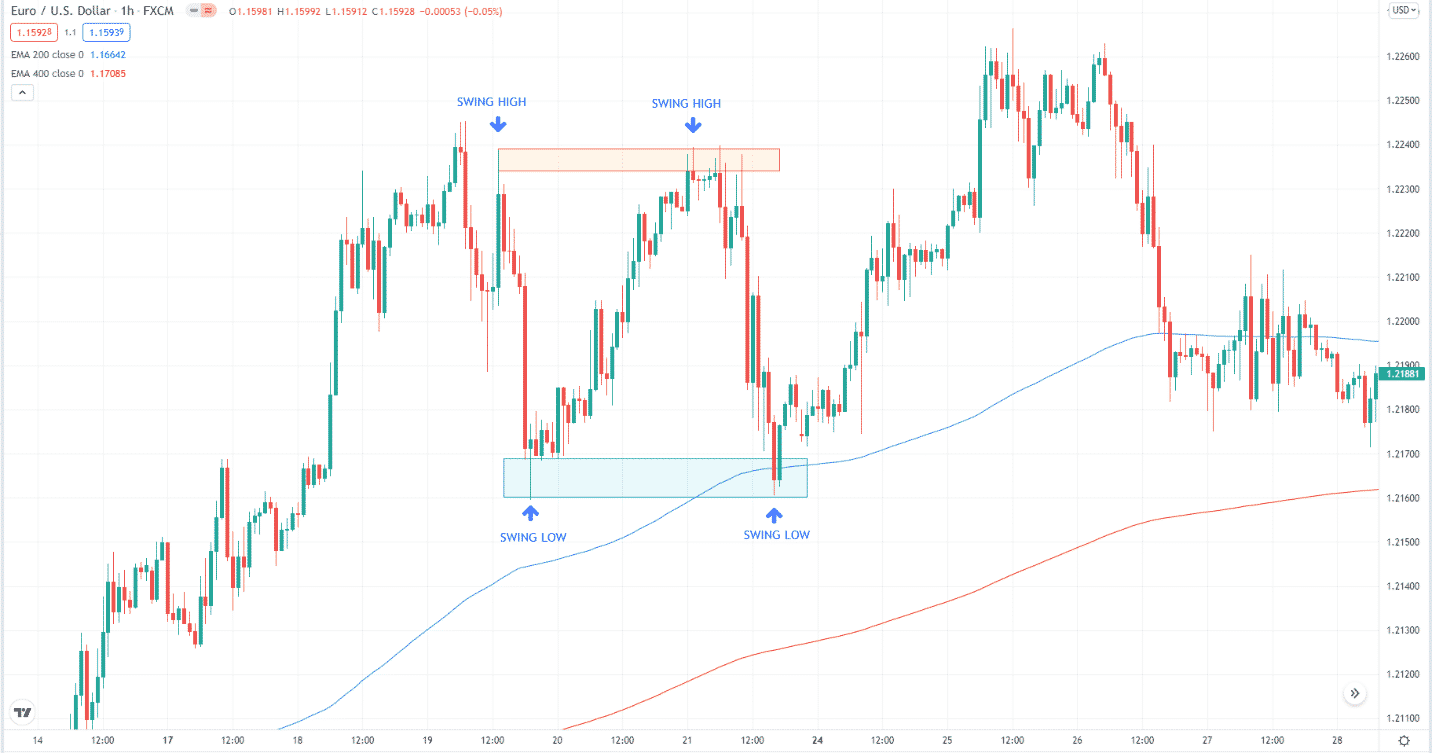

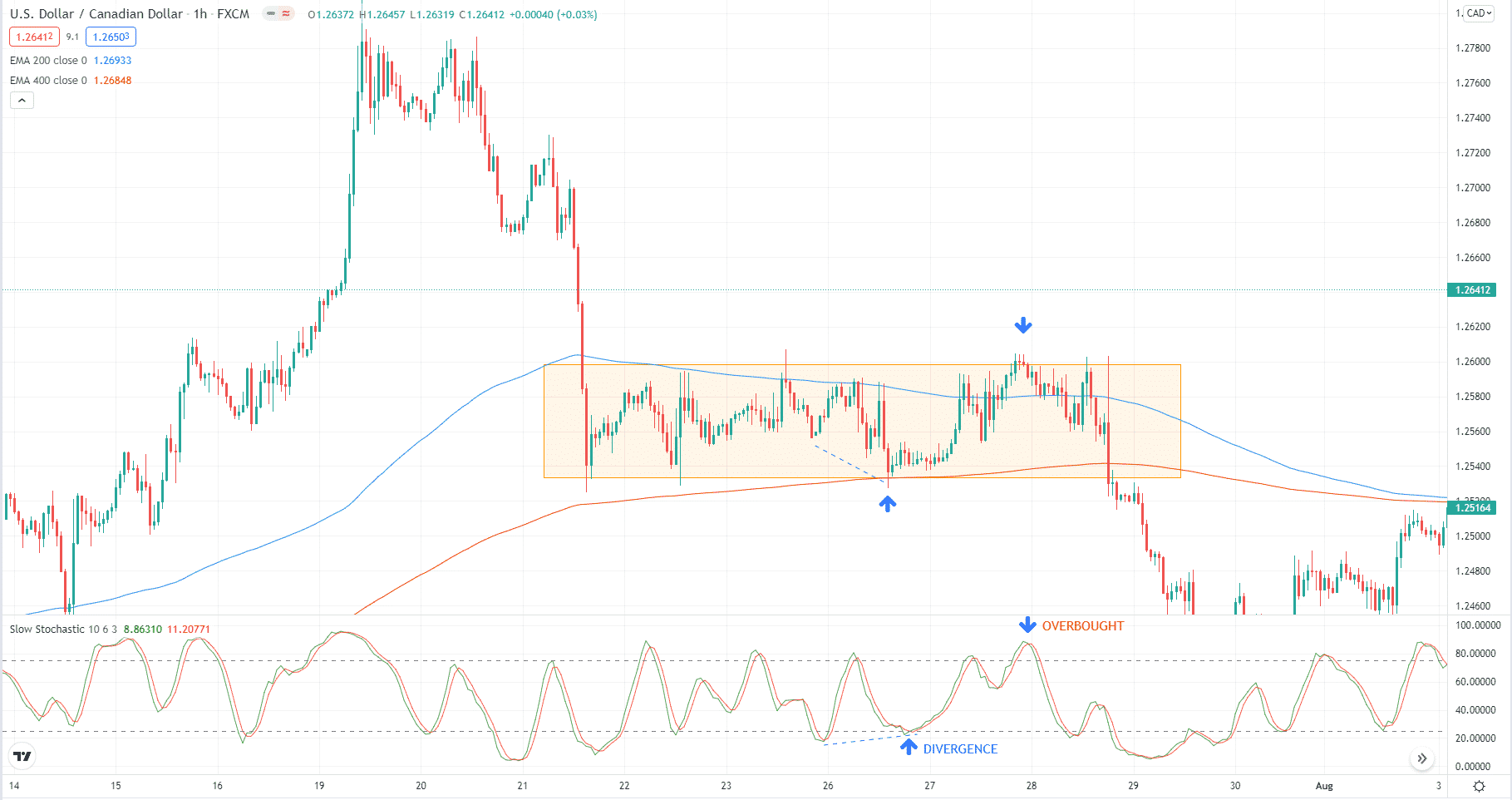

Here is the secret to identifying a sideways market ahead of the pack. A trading range consists of support and resistance. It will take two swing highs to form resistance and two swing lows to form support. When this happens, you can say the market is ranging in the timeframe under consideration. Then you can apply your range trading techniques. See an example in the image below.

Tip 2. Do not overstay the welcome

You can trade ranges as long as they last. While a trading range can persist for a long while, the price will inevitably get out of the zone. Be aware that markets transition from ranging to trending and vice versa. The market condition is constantly changing, though with varying durations.

Why does it happen?

New traders fall into the trap of thinking support or resistance will hold forever. They must have heard somewhere that support or resistance only gets stronger the more times it is tested. When it breaks, they are in for a surprise. See an example chart below.

How to avoid the mistake?

You have to count the number of times that price touches the upper and lower boundaries of the range. Eventually, either boundary will collapse to make way for a new trend. You can tell from the backtest how many times, on average, support or resistance will hold. Doing this will only give you a ballpark figure, though. The only way to find out is to check if price respects or shatters the level.

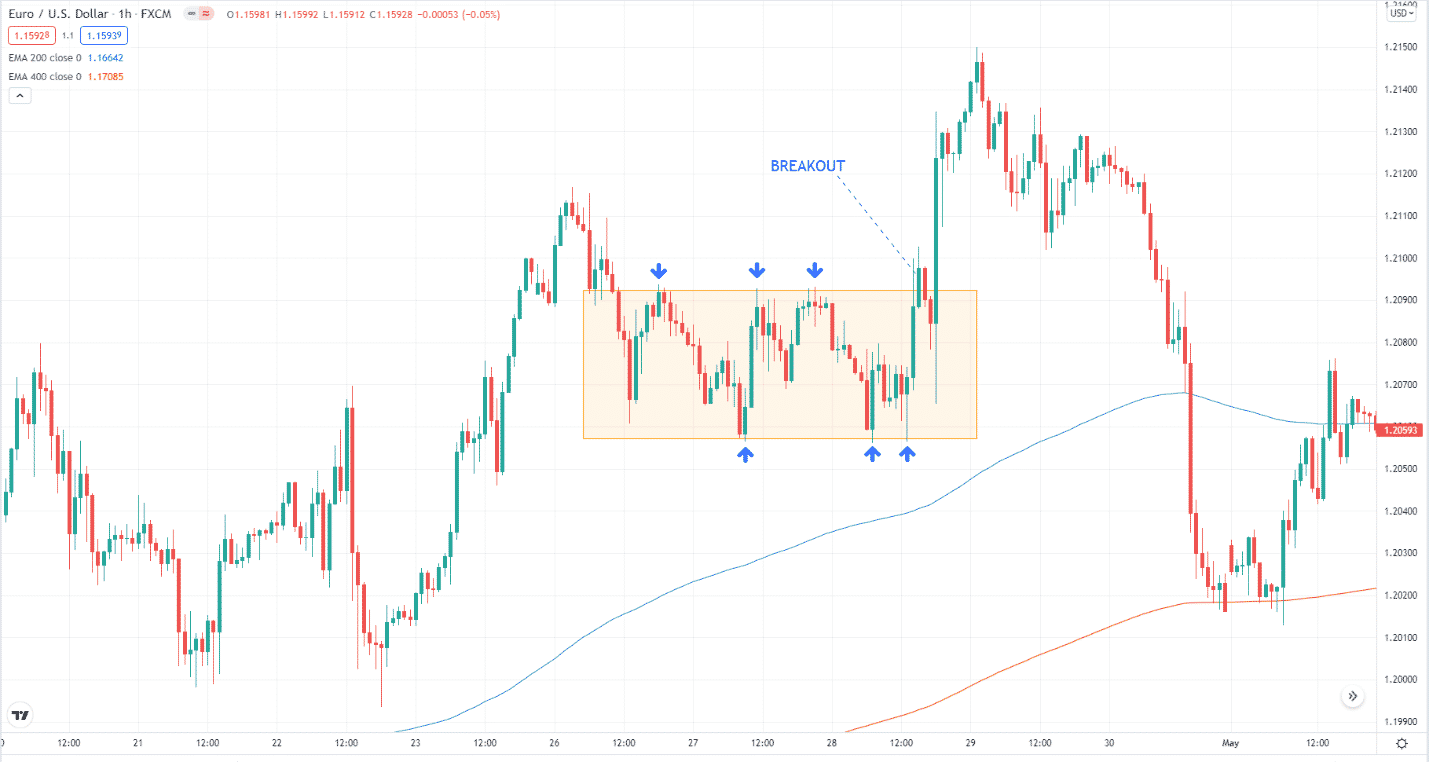

Tip 3. Price may range in the middle of a trend

Even when the price is trending in one direction, it might pause a bit before continuing the move. This happens when the participants who joined the initial movement book their profits and stay on the sidelines while looking to re-enter. When this occurs, you can see the market forms a small horizontal trading range.

Why does it happen?

Some traders are hard-wired to trade reversals rather than continuation trades. When they see a bearish pattern in an uptrend, such as a descending triangle, they immediately take a sell trade when the price breaks down. Later, they may find that the price gets back in the range and breaks on the opposite side.

How to avoid the mistake?

When you see a trend and price stalling, it is good practice to favor a continuation rather than a reversal. You can score more wins if you take continuation trades than reversal trades. While this is true, it is best to wait for confirmation before you place an order. Watch price action closely as it is caught in a range. When it breaks out in the trend direction, you can enter a trade.

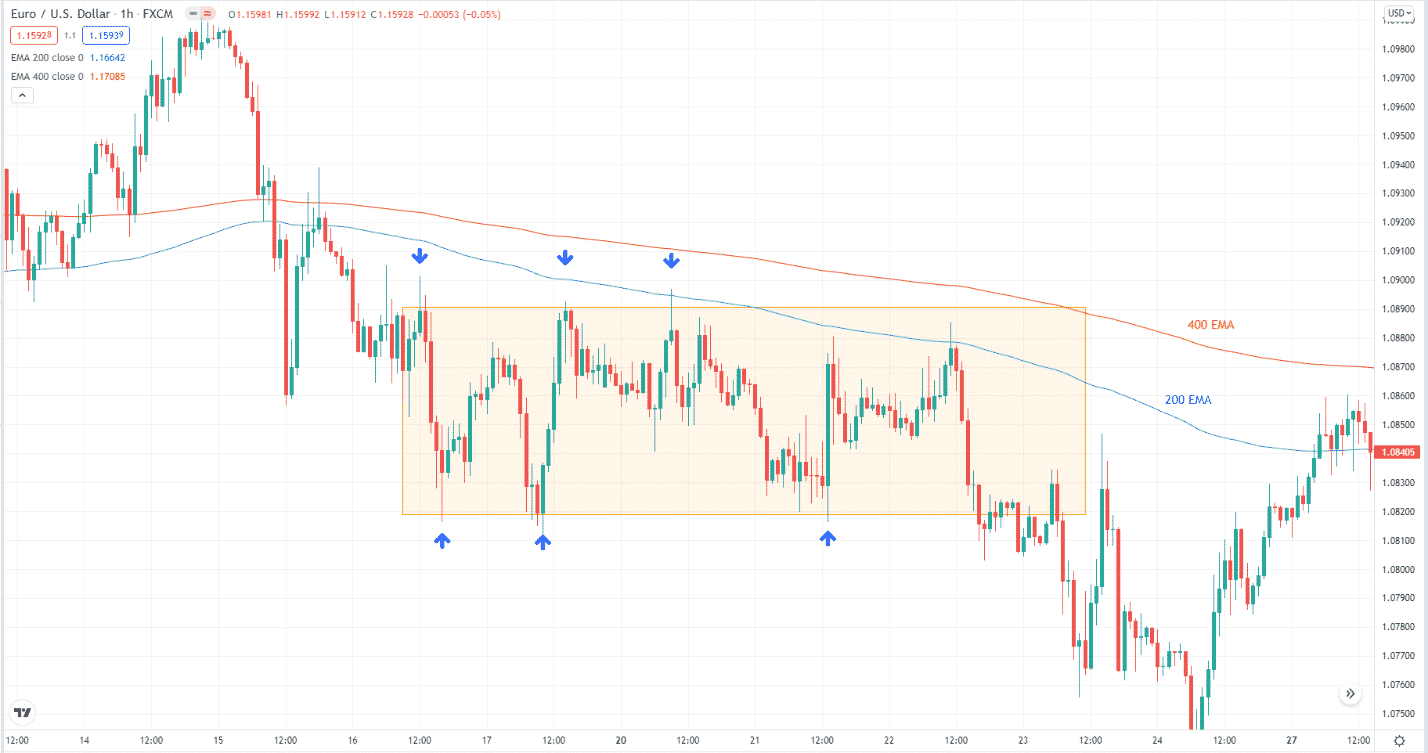

The above chart shows a bearish trend on the hourly chart. The trend is bearish because the price is below the long-term moving averages, and 200 EMA is below 400 EMA. When the bearish trend stalls a bit, you should look for a trend continuation setup. In this case, wait for a breakout to the downside.

Tip 4. Combine range-trading strategies

When a trading range has been confirmed, traders expect to buy on support and sell at resistance. While this is an effective strategy, you can improve your win rate by combining other factors. You can use the following strategies in combination when trading ranges:

- Candlestick patterns

- Oscillators giving overbought or oversold readings

- Indicators providing divergence signals

Why does it happen?

The market is a battleground among various participants with different trading capacities. Some use technical analysis, while others use fundamental analysis. In addition, news events come now and then and bring volatility into the market. Market sentiment beats technical analysis.

How to avoid the mistake?

You must have multiple reasons before you decide to take a trade. Opening a trade when a pin bar rejects support or resistance is a decent method. The trade entry only becomes more vital when you add the overbought/oversold factor or divergence into the mix. See example scenarios below.

Tip 5. Be aware of false breakouts

When price touches a level of support or resistance, one of two things can happen. Either price will break the level, or it will bounce back. However, breakouts have two flavors: legitimate and false. False breakouts are common and unavoidable.

Why does it happen?

The currency market is the playground of big players. They concoct tricks to confuse retail traders and provoke them to commit mistakes to beat other market participants. Because they command substantial positions, big players can move the market in their desired direction.

How to avoid the mistake?

You should monitor price closely as it approaches an edge of the range. When the price rejects the level, you can trade the bounce. If it breaks through, you may trade the breakout. If it returns to the range on the next candle, that is a false breakout, and you have to accept the loss. Losing is just part of trading. See a sample scenario below.