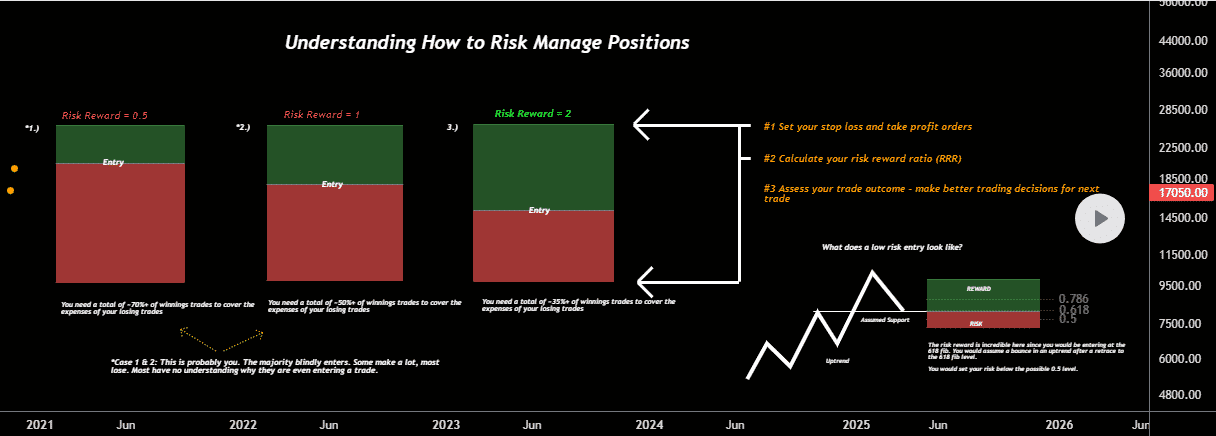

It shows how much money an owner could make for every amount they put into an opportunity. Many people use rRRs to compare the expected rewards of an undertaking with the risk involved. Take a look; this means that an individual is willing to stake $1 to get $7 back. Instead, an RRR of 1:3 means they should expect to spend $1 and get $3 back.

If the price of an asset moves in an unexpected direction, a speculator stands to lose capital (the risk). The risk-to-profit factor is the amount of gain the individual expects to make when the position is closed (the reward).

Do you know how to calculate RRR and the methods to avoid risks? Read on to find all the details related to a bullish and bearish trade setup.

What is the risk/reward ratio in FX trading?

Stockholders use the RnR percentage to determine how much RnR they take. The best RRR varies a lot between different types of transactions. The best RRR for a specific strategy is usually found through trial and error, but many companies already have a RRR in place for their assets.

A limit order is used to determine how much uncertainty there is in a specific type of deal. Here, we’re talking about the difference in price between the start point and the stop-loss order, which is what we’re talking about. Again, the goal of the deal is to leave with a profit.

The ideal RRR for many market strategists is about 1:3, which means that three units of expected gain for every one unit of added danger are the ideal. In addition, a stop-loss order can help investors better manage their losses and reward. Finally, derivatives like put options can also help.

How can I make money from the risk-reward ratio in FX trading?

The RRR helps people reduce the chances of losing money when they buy and sell things. It doesn’t matter how many winning transactions a broker has had if their win rate is less than 50% because that doesn’t matter. It’s important to consider the difference between a limit order and an order to sell or take profit when you figure out a deal’s risk/reward ratio. When looking at these two numbers, you can determine how much revenue you made or lost or how much threat you faced.

Using stop-loss orders, one can keep their downside to a minimum while still keeping an eye on their volatility and reward. It is automatically canceled if a position hits the level.

The order and the asset are both removed from a portfolio. Brokerage accounts let users set limits without paying extra trading fees. A person can profit from FX if they think about the RRR correctly.

The idea of giving up $50 to get $100 may be appealing to some people at first. Investors with more experience are interested in the 1:2 RRR because they can double their returns by more exposure. If you were given $150, the ratio goes from 1:2 to 1:3.

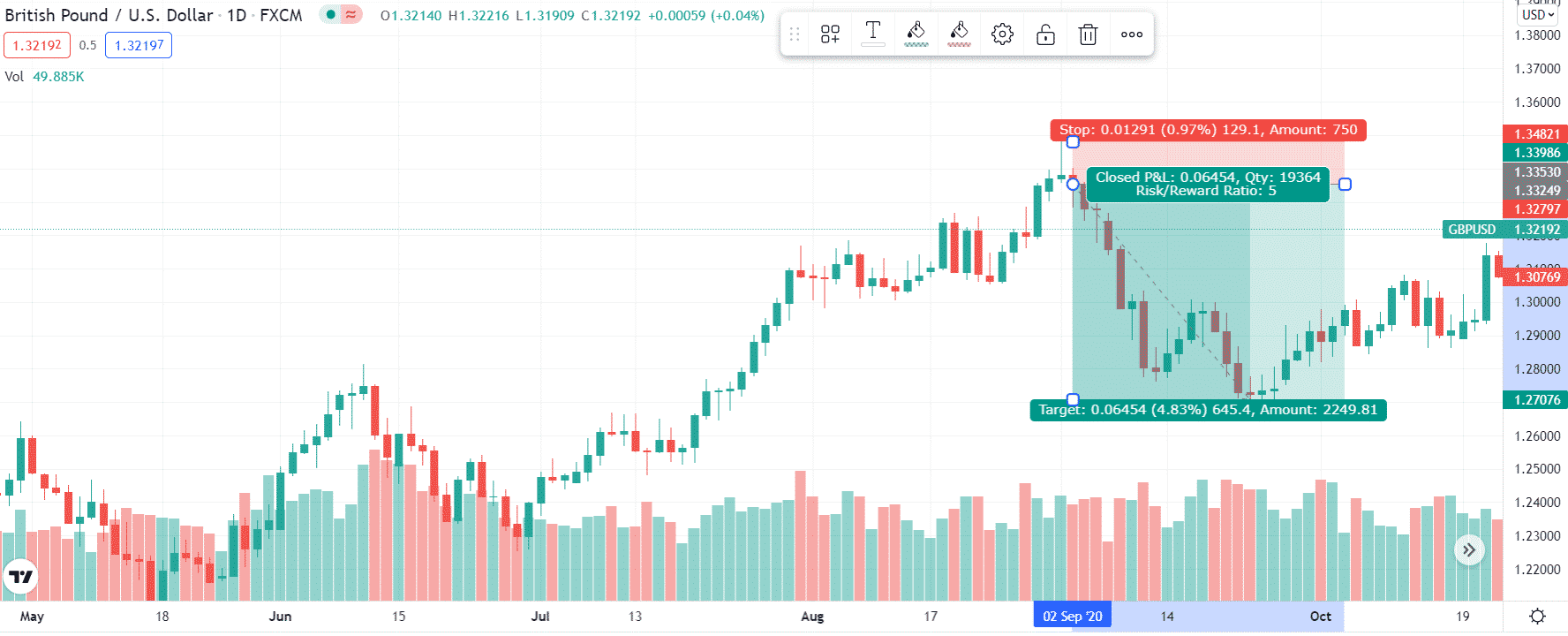

Bearish trade setup

Let’s look at a pattern-based trade setup for 1:5 RRR.

Entry

After a pin bar appears on top, you can enter the short position right after the candle closes. You can choose any setup or entry method.

Stop loss

Place the SL just above the high of the pin bar, which is equivalent to 75 pips from the entry point.

Take profit

Choose the take-profit level around the key support area at the bottom of the chart. In this case, the strong support is 375 pips away from the entry point. It means that the risk is 75 pips, and the reward is 375 pips. So, the RRR is 75:375 or 1:5.

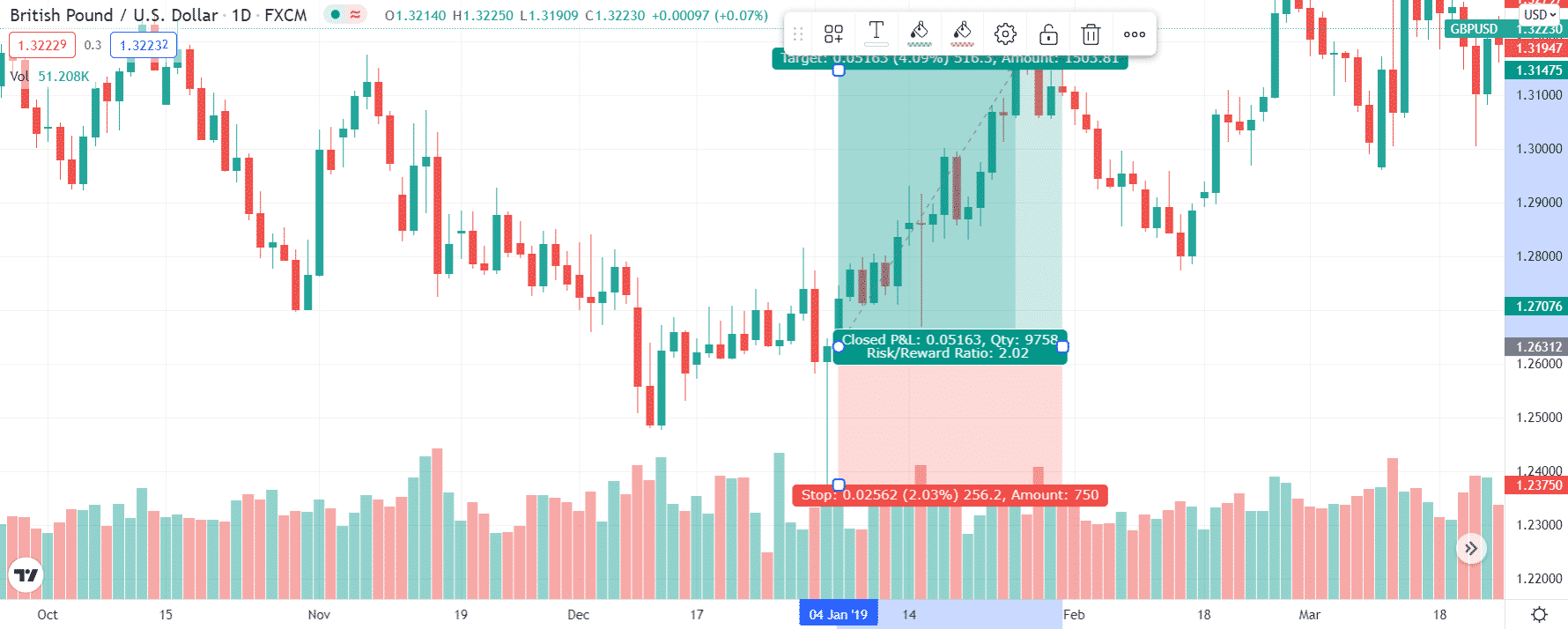

Bullish trade setup

Let’s look at an example of a bullish setup to illustrate 1:2 RRR.

Entry

Once you see a bullish pin bar with a long tail at the bottom, wait for the candle to close and enter the buy trade.

Stop loss

Keep the SL just below the pin bar’s low, which is 75 pips in this case.

Take profit

Look at the key resistance level at the top of the chart. Place your TP around that level. In this case, it is 150 pips from the entry-level.

How to manage risks?

A low RRR does not tell you everything about a position. You should also know that you will succeed in achieving your goals.

Before reviewing a trade, many day speculators make the error of having a predetermined R/R ratio in mind. A security’s stop-loss and profit objectives may thus be set based on the entry point instead of a security’s price, ignoring the broader marketplace.

Making the most effective use of RRR requires a careful balance between selecting transactions with high potential returns and avoiding those with too low a possibility of success.

Make your own choices, regardless of what the mainstream media outlets tell you to do. While many stock market participants are worried about the current market situation, experts prefer to think about the long term and are more concerned with how they do in the future than with how they do now. Therefore, to manage risks, you need to analyze the market correctly.

Final thoughts

The RRR is often used to measure success when buying and selling securities in investing. The ideal RRR varies a lot between different types of trading. While trying to figure out which risk/reward ratio is best for a particularly effective method, you usually have to try and try again. Many investors have a RRR in mind when they invest.