Slippage has become a common problem in DeFi exchanges, where billions of dollars of cryptos are transferred without any intermediary. Therefore, a small slippage would be huge, and it is impossible to complain or return the loss caused by the slippage. As a result, investors should remain aware of the risks associated with DeFi exchange trading by following enough precautions.

The slippage is a challenging factor for investors as it is directly connected to the spot price of a token. Therefore, it is high time to know how to minimize it to a tolerable level. Although it is impossible to eliminate the risk of higher slippage, investors can mitigate it as low as possible by maintaining some rules.

The following section will find the top five tips to gain from DeFi exchanges by reducing slippages.

What is slippage?

Slippage happens when there is a difference between the order submission and confirmation price on a blockchain network. If the price change goes towards the traders’ side, it is known as positive slippage. On the other hand, the negative slippage happens when the price change goes against the traders’ direction.

There are two reasons behind the slippage:

- The first is the high trading volume

- The second is the low liquidity

Decentralized exchanges do not process any order instantly, and it needs time to confirm the transaction from the blockchain network. Within that time, the price change might cause a slippage, incurring a loss to investors.

On the other hand, decentralized exchanges follow a protocol where the liquidity pool consists of a 50/50 split of two crypto assets. Therefore, when you input an order, it withdraws from a network and deposits another. If the volume remains low, it may incur a loss by slippage due to the unavailability of the best price.

Top five tips for trading with DeFi exchanges

Investors should remain cautious about slippage while trading through DeFi exchanges. However, it is straightforward to minimize the risk of slippage by following some rules.

Tip 1. Use higher gas fees

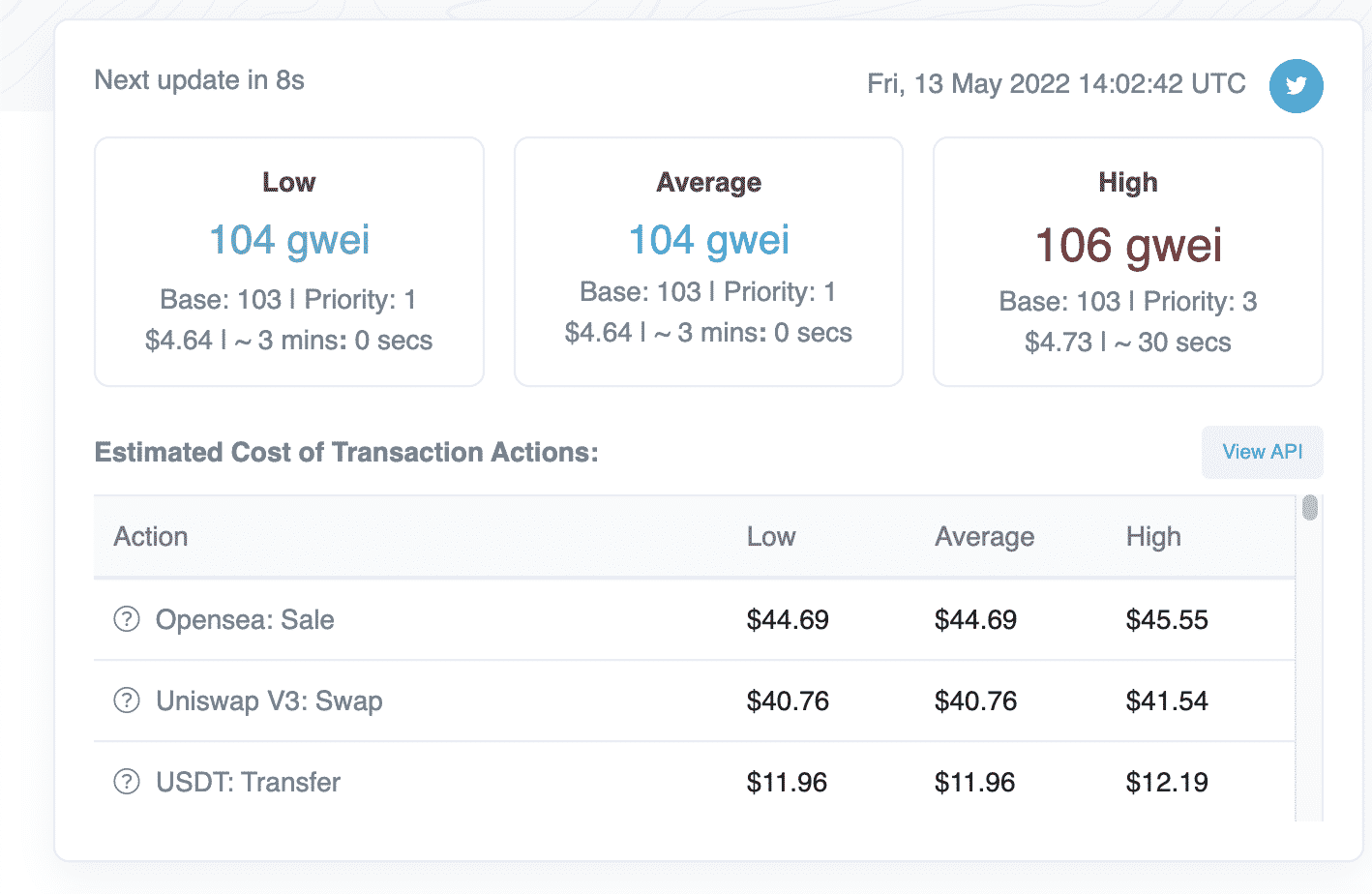

Gas fees are the transaction fee provided to decentralized exchanges during a transfer. The gas fee is controllable by investors, where higher fees ensure the best price to find during the transaction.

Why does it happen?

Exchanges with a lower gas fee need higher times to process a transaction. On the other hand, the higher gas fees ensure an immediate price. As a result, investors who do not like to pay higher gas fees would suffer from the price change during the transaction.

How to avoid the mistake?

Investors should find the current gas fee from the live rate and make sure to set the amount closer to it. Using a higher gas fee would take fewer times in the transaction by reducing the risk of slippage.

Tip 2. Layer-2 solution

In tip 1, you can avoid the slippage by using the higher gas fees, but it is often costly for investors. In that case, using the layer-2 scaling solution would make the transaction faster and cheaper than Ethereum.

Why does it happen?

Layer-2 accumulates bunches of ETH transactions from the main chain that helios investors split the transaction cost. Moreover, it processes the transaction instantly, as it does not rely on Ethereum’s speed.

How to avoid the mistake?

The example of a layer-2 solution is Polygon, Optimism and Arbitrum. Moreover, the Uiswap V3 offers a layer-2 solution using Optimism, while the Polygon-based QuckSwap is another solution for traders.

Tip 3. Slippage tolerance

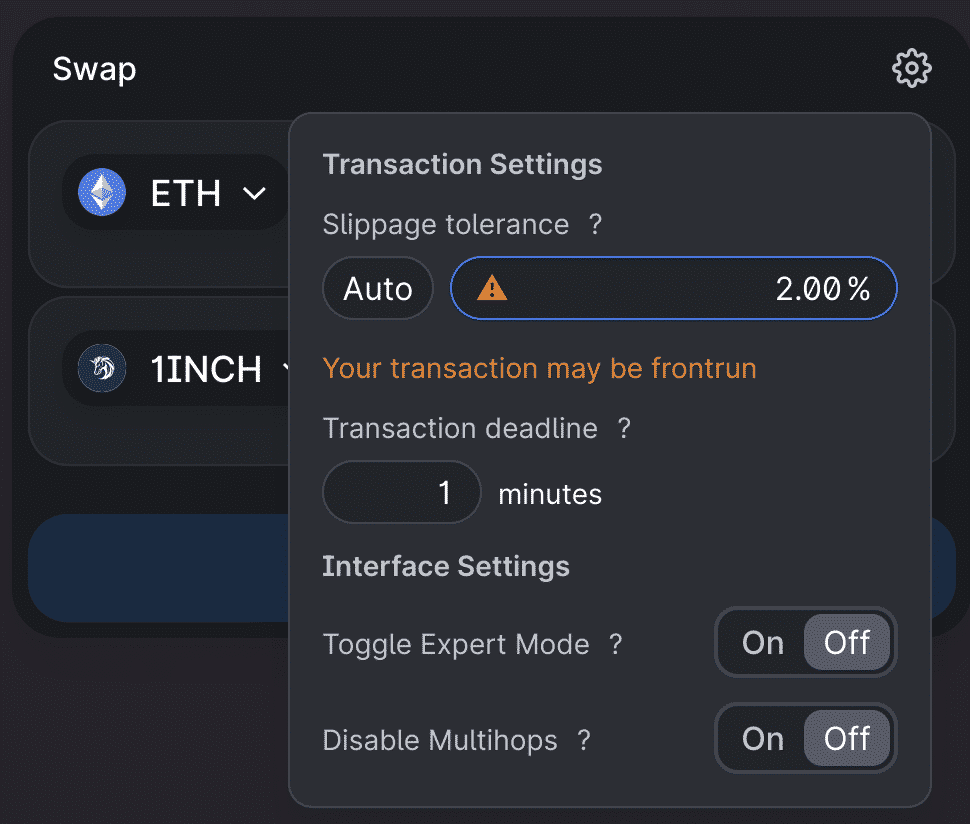

Slippage tolerance is the maximum loss during the transaction that a trader can set during the transaction. If the transaction costs reach the tolerance level, it will automatically cancel the transaction.

Why does it happen?

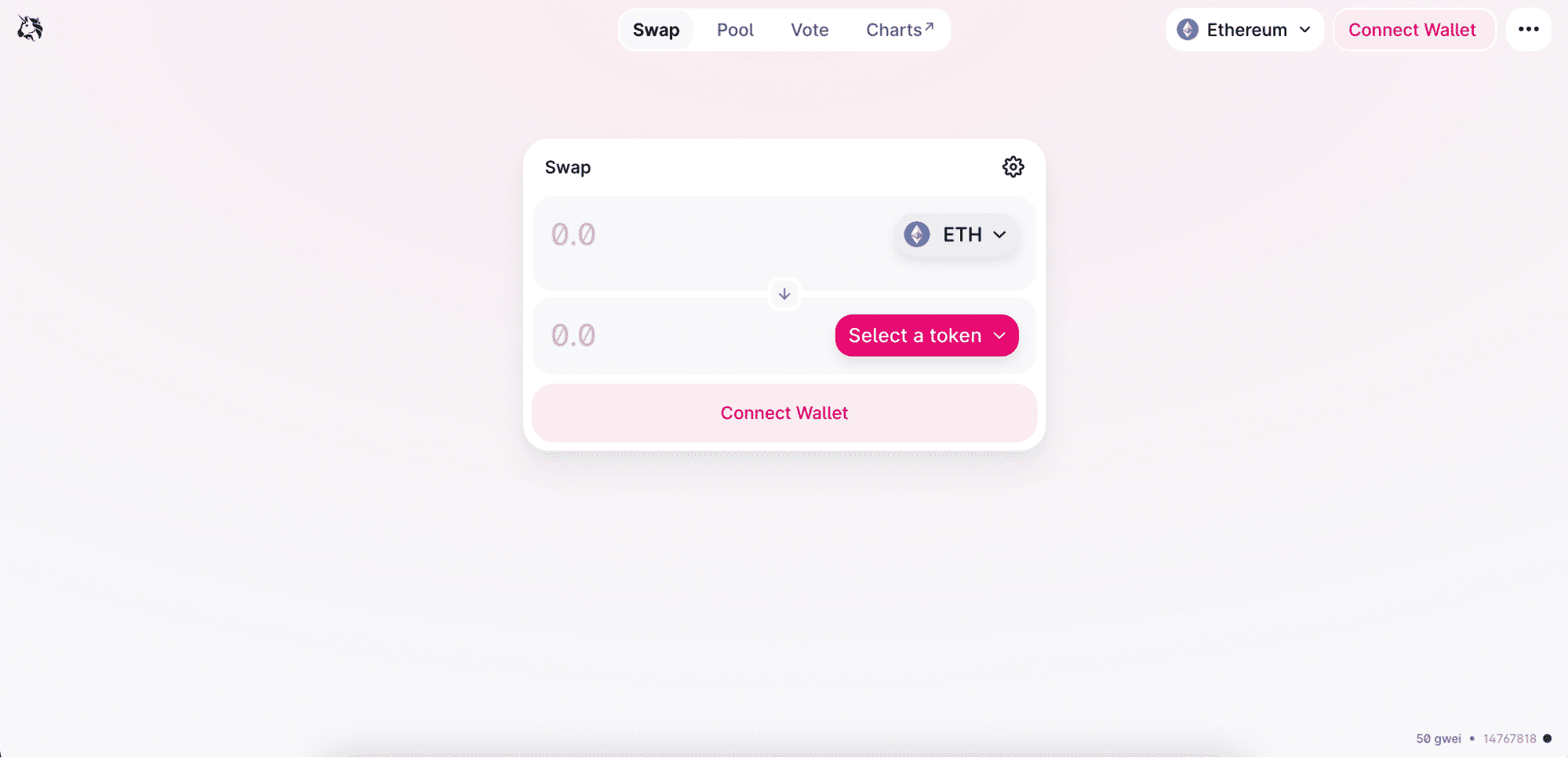

In most decentralized platforms, investors can set the slippage tolerance level independently. Moreover, they can increase or decrease the level to match their requirement. For example, adjusting the slippage tolerance level in the UniSwap platform is accessible from the setting.

How to avoid the mistake?

Investors should remain cautious about the upcoming price movement and the current requirement to find the best slippage tolerance level. If the coin price is likely to show negative sentiment, it is better to exchange it with other tokens, even if the gas fees are higher.

Tip 4. Transaction in smaller parts

In decentralized exchanges, investors have complete control of their investment, and there is no limit to making a transaction. Therefore, it is better to complete the transaction in pieces instead of making it with a higher volume.

Why does it happen?

Investors often feel hard to find the opposite part when the transaction volume is high. For example, exchanging 100 ETH would be harder in 1 transaction than exchanging 25 ETH 4 times.

How to avoid the mistake?

The gas fees will be lower if the available party is present on the other side. In that case, making a smaller piece of every transaction would increase the possibility of finding the opposite party.

Tip 5. Stick to large-cap cryptos

Large-cap cryptos are trading assets that have higher market capitalisation. As a result, a higher number of investors are present, making it possible to find buyers and sellers at any time.

Why does it happen?

Investors often struggle to find the opposite party in low-cap cryptos as these are less potential with higher risks. In that case, it is better to focus on significant cap cryptos to avoid the possibility of slippages.

How to avoid the mistake?

When there are enough buyers in a token, it is easy to sell it at any time. On the other hand, fewer investors are presently leading to lower liquidity in low cap crypto. Investors should keep in mind that the slippage might be higher if the token’s market cap is not strong.

Final thought

Slippage is a common problem in making a transaction through decentralized exchanges. However, following the steps mentioned above would reduce the risk of slippage as low as possible. Overall, the cryptocurrency market is volatile, where special attention to trade management is essential.