Let’s start with the basic question. What is money management? It is a process of defining your risks and rewards.

People consider it the unattractive part of trading, but this distinguishes a successful trader from the rest. Having the itch to overspend is natural in humans, but those who learn to control these temptations end up making it big in the trading business. As the famous quote goes, “When money realizes it’s in good hands, it wants to stay and multiply in those hands.”

Smartly managing your funds can help you in the long run. You can quickly lose your capital in trading if you carelessly manage your account. Keep reading to find out the top five tips to manage your funds smartly.

Why is money management critical?

Being a successful forex trader is not about how much you are making but about your keeping. If you trade big one day and lose a significant chunk of it the next day, what good is it? If you don’t define your profits clearly, you will be trading at random. This will put you at a more significant threat of losing. Wisely managing your funds can save you from losses.

Let’s move on towards the tips you should be employing for a healthy financial life.

Tip 1. Cut your trading cost

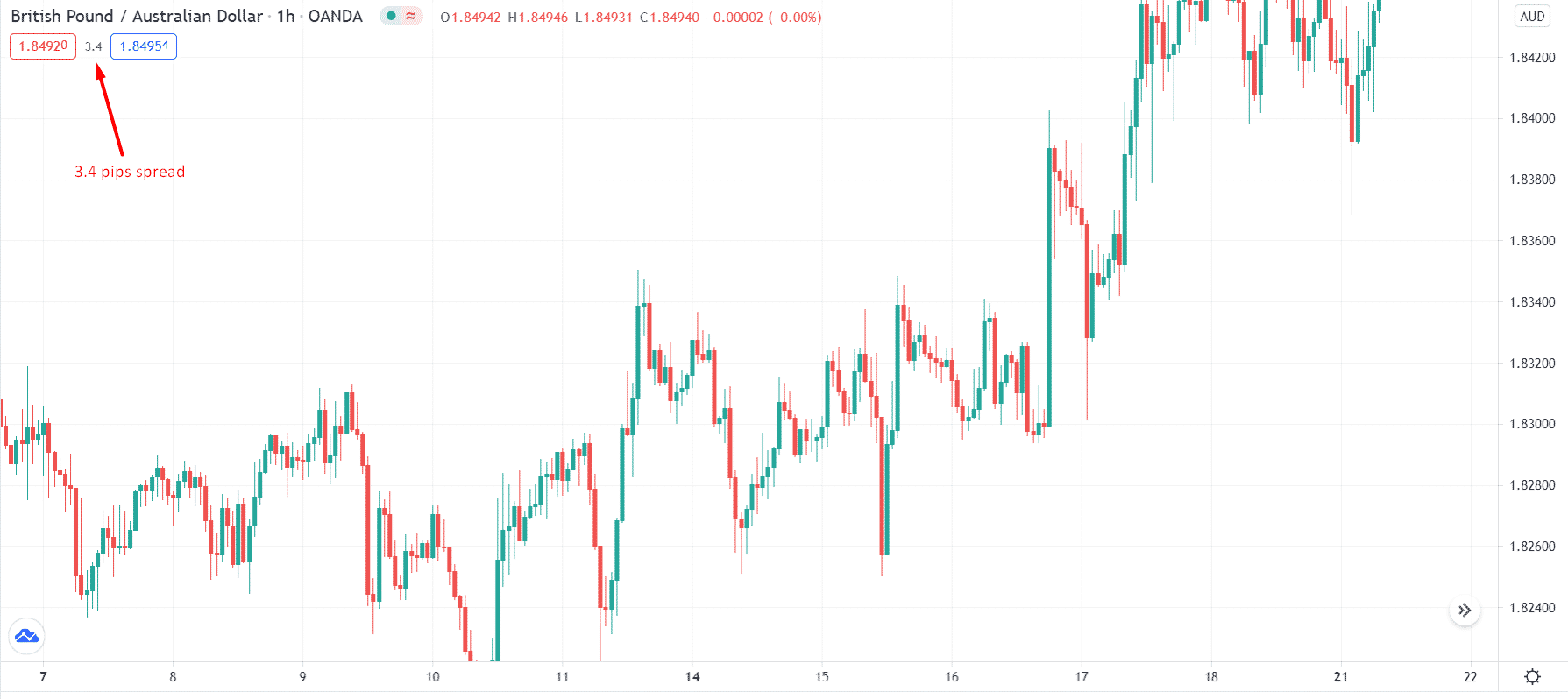

The trading cost goes up when you are trading with an expensive broker. You have to compare trading costs like swap-fee, spreads, commissions, deposit/withdrawal fees.

Why does this happen?

Usually, traders do not consider spreads as a significant variable in trading. Suppose you open and close two positions every day, and the broker charges you three pips on average for each trade.

It means the broker charges you 40-44 pips every month. If you trade with a standard lot, your monthly expense is $40-50. Although it is not a significant amount, if you have a $1000 deposit, $40 makes 4% of your total capital, which is a considerable sum.

How to avoid the mistake?

The first tip is to look around. You might be working with the same broker for a long time who has been charging you more spreads and commissions than the market value. Search for a cheaper broker. Some offer bulk discounts for trading frequently.

Choose the broker whose spread and commission are less. Review your frequently traded instruments and ensure the charges are competitive. Don’t be afraid to switch if they are not.

Another method to cut down on the trading cost is to avoid over-trading. As a trader, you need to be pretty confident. Do not jump in with your money at every rise or fall. Sit back and ask yourself what the probabilities of winning in particular setups are.

Tip 2. Reduce non-trading risks

Such likelihoods are associated with the broker. If your broker is not regulated, you have a greater probability of getting scammed.

Why does this happen?

Non-regulated brokers lure you to invest and trade with them. They attract newbies with fake promises like getting rich quickly or making huge sums. Such brokers can disappear any time with your money.

How to avoid the mistake?

Make sure to invest with a reputed broker. Losing money to scams could be the most foolish of all moves. It brings emphasis to our previous point. Search around. Weigh your options and go for the highly regulated.

Tip 3. Play with the percentage model

It would be best if you define your risks and rewards in terms of percentage. For example, if you are allocating risk of 1% with every single position, your reward should also be at least 1%. It would be best if you focused on the percentage rather than the pips.

Why does this happen?

Trading conditions are not always the same. Sometimes, you have a stop-loss of a few pips in a position, and sometimes, it is quite high. If you do not cater risk in percentage, your risk will always fluctuate.

The above chart shows typical breakout setups. One has 13 pips risk, and the other has 24 pips risk. If you keep your lot size fixed for both positions, you may not enjoy a higher reward than you could do while allocating risk in percentage.

How to avoid the mistake?

This risk to reward ratio helps the traders to keep the losses capped. It tells how much you stand the profit for every unit of the risk. A risk to reward ratio of 1 to x means that you stand a chance to reward x dollars for every dollar you bet.

Sticking to the percentage model would help you in tracking your interests at all times. Once you are aware of the risks involved in attracting profits, you are less likely to take some foolish steps.

Tip 4. Divide the money into portions

A wise man would never put all his assets in one place. To perform better, you need to divide your money into equal portions.

Why does this happen?

Usually, traders enter the market with their initial funds to trade without any backup for failure. In trading, disappointment can happen. Hence, you should divide your funds into portions so that you can survive longer in the market. For example, you were buying when a severe market crash appeared.

You might fall into the buying trap again in the hope of prices recovering, but it failed. You could have lost all the capital in such a move of more than 300 pips. But smart traders invest their money in chunks.

How to avoid the mistake?

Let’s say you have $1000. Divide the capital into four equal parts. You invest the first portion in some trades. If it blows off, you will suffer a loss of $250 which is acceptable than that of $1000.

You can now re-evaluate your risks and strategize for improved outcomes. Dividing the funds gives you time to test your techniques and to monitor the market. Four small gains are better than a single significant loss.

Tip 5. Fix the number of trades

Self-control and discipline is the key to success in the trading business. It would help if you decided on a certain number of trades for yourself daily and then stick to it.

Why does this happen?

If you lose one or two trades in a day, you will probably attempt to recover your losses. In doing so, you may trade more aggressively, putting your entire capital at stake.

How to avoid the mistake?

Let’s say you decide to make three trades in a day. It would help if you stopped yourself from trading more than three trades in a day.

This will help in keeping a check upon your profit and losses. You will be better able to categorize the won and lost trades. Stepping into too many trades at once can be overwhelming. The more you are engaged, the harder it is to keep up with.

Final thought

Once again, trading is all about taking chances. You never know what would happen next. You can assume some calculated guesses but what’s going to happen is pretty unpredictable. Calculated steps are the ultimate trick. Earning big is not the equivalent of success. You need to continuously monitor the cash flow to understand what you are genuinely producing.

The tips mentioned above will help in the smart management of your funds. Try teaching in your trading life one after the other and see a drastic effect on your finances.