Crypto trading has enabled several ways to generate income alongside traditional trading by allowing to profit from both selling and buying. The Annual Percentage Yield on a crypto token has become a popular way to make money online. On the other hand, yield farming offers a guaranteed profit, which is very potential for seeking a safe investment opportunity.

First, generating income through yield farming on crypto pairs depends on crypto values. There is always a “catch” to considering anything that sounds too good to be true. This article will introduce you to the APY of cryptocurrencies and the top five tips to generate maximum income.

What is APY in crypto?

APY refers to the interest percentage amount you earn from a bank in a one-year duration. When understanding the APY, it is mandatory to have basic knowledge of staking and blockchain technology. You may know about the proof of work system that currently powers the blockchain of Bitcoin, Ethereum, and many other major coins. In this process, the blockchain rewards miners when they add/verify transactions to the blockchain.

Meanwhile, the proof of stake system works differently.Here crypto holders put their money and hold it for a specific period, proving their integrity. Stakers usually act as a “node” and play the role of miners by verifying transactions without sacrificing their energy and time. This model is gaining popularity as it is energy efficient, and transactions are much faster.

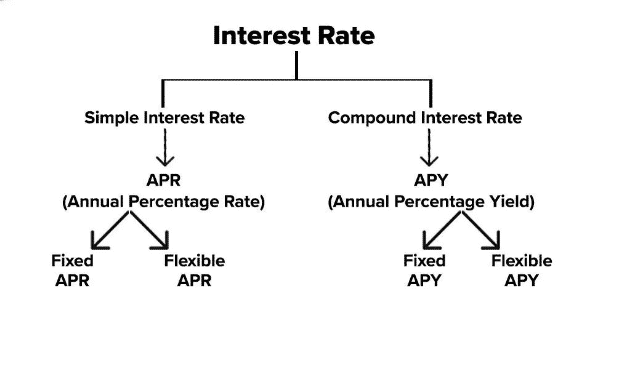

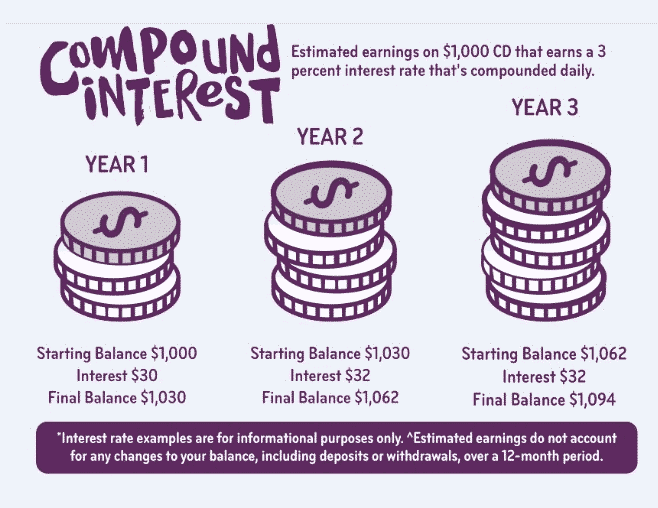

APY in cryptos enables earning compound interest, where you earn money from both the investment amount and the interest you receive from investments over time. In contrast, simple interest includes earning the same amount within a particular period. Crypto investors often use a savings calculator to check the amount they can earn by offering APY.

The top five tips to APY in crypto strategy

When crypto investors diversify their investments in several ways, it is worth checking on vital factors or following specific guidelines to obtain the best results. When choosing to earn interest from crypto assets, three factors affect this sector: inflation, supply-demand, and compounding period.

- Choose crypto exchange

- Choose crypto asset

- Estimate your investment amount and APY rate

- Lend some of your cryptos with CeFi

- Lend some of your cryptos with DeFi apps

Tip 1. Choose crypto exchange wisely

When deciding to earn interest rates from cryptos, exchange platforms are vital factors as they offer different APY percentages depending on several relative factors. Yield farming usually involves lending investors crypto assets for making more crypto. Yield farmers move their crypto assets to different marketplaces seeking high yield offerings from the platforms and treat it as an investment strategy.

How does it happen?

Investors usually invest a particular amount in any exchange platform and lock up that amount for a certain platform with expectations of earning interest. For example, you may invest $2000 with ETH on any crypto platform that may offer a 6% interest over three months. So you can’t withdraw your investment within this period.

How to avoid mistakes?

Check some major factors while choosing any crypto exchange platform, such as liquidity, security, transparency, fees, user experiences, legal aspects, etc.

Tips 2. Choose crypto assets wisely

The next significant fact is choosing the asset wisely that you want to invest for earning interest, as all crypto coins don’t offer the same returns. It can vary from asset to asset and exchange platforms. The most successful yield farmers always track APY and catch lucrative opportunities. They earn higher interest rates than traditional banking with fiat currencies.

How does it happen?

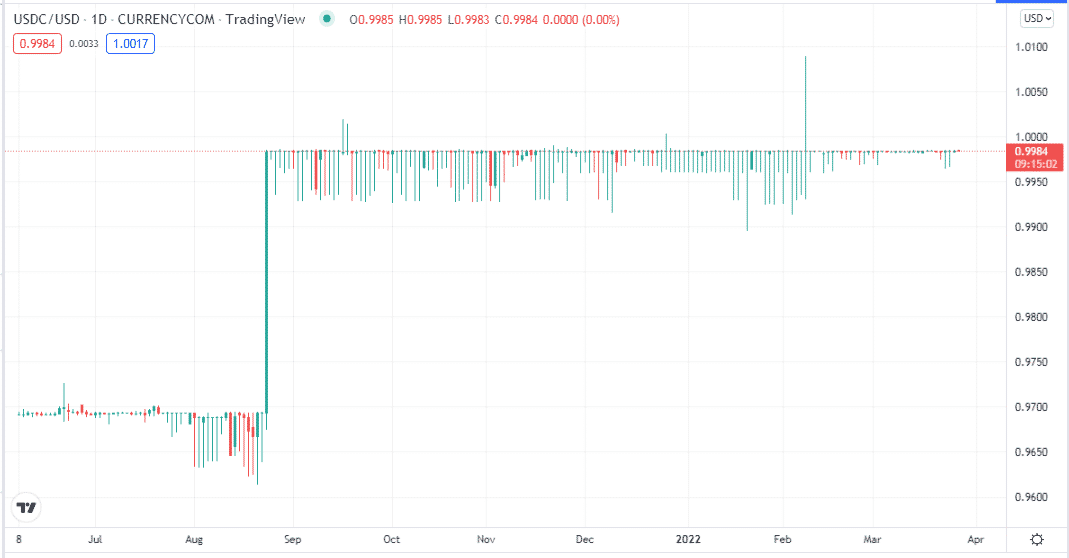

While traditional banking offers 1% interest on fiat currencies, many crypto wallets offer five times that amount for cryptocurrencies like BTC or ETH. There are two types of cryptocurrencies that allow you to earn interest: native coins and stablecoins.

How to avoid mistakes?

Choose cryptocurrencies that have the potential to grow in the future as APY in crypto involves earning compound interest. So if the value of your crypto drops, that would be your loss.

Tip 3. Estimate your investment amount and APY rate

When you choose your exchange platform and investment asset, it is time to estimate your capital and APY percentage.

How does it work?

You can use a savings calculator to know the interest amount you will earn from your investment. Then estimate your capital amount and match your return expectations.

How to avoid mistakes?

When estimating the investment amount, it is mandatory to check the capital amount, don’t invest all your capital for earning interests from single crypto; try to diversify your investment.

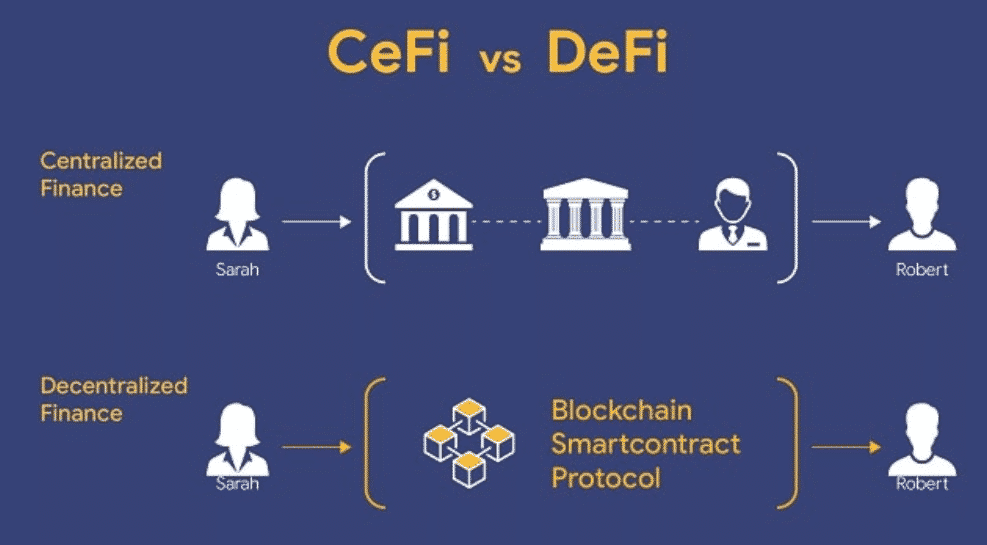

Tip 4. Lend your crypto with CeFi

Many centralized exchange platforms allow earning interest by depositing cryptocurrencies over a particular period. You may lend some of your capital to these centralized exchange platforms.

How does it work?

While fiat currencies offer lower interest rates in savings, you can turn your money into stablecoins and earn interest from them.

How to avoid mistakes?

Centralized exchange platforms have central authorities to monitor. So you can consider earning interest from stablecoins as low-risk investments than other native coins.

Tip 5. Lend your crypto with DeFi apps

How does it work?

Crypto investors usually invest cryptocurrencies to DeFi lending protocols and earn interest that the protocol charges to borrowers.

How to avoid mistakes?

When earning interest from cryptocurrencies, it is mandatory to have a crypto wallet. Choose crypto wallets wisely that allow more secure, faster transactions with lower fees/costs.

Final thought

Earning interest from cryptocurrencies or yield farming is rapidly popular with crypto investors as it only involves investing by checking on several factors. You generate income by investing and locking up your coins for a particular period. After the period finishes, your coins are yours with interest as APY percentages.