Trading volume in forex is considered vague and unauthentic as the market doesn’t have contract settlement through an exchange. Despite the criticism, tick volume data can be a great indicator to predict the pause of a trend or a reversal.

This article will discuss the top five tips to make it easy for you to use tick volume in trading.

Role of volume in forex

Forex is an over-the-counter market. In FX, we don’t have a centralized volume which puts doubt over its accuracy. However, we can still use volume data in our favor if we play smartly.

What is tick volume in forex?

A tick shows a single change in the currency price. One tick represents one trade, so a considerable increase in ticks indicates that multiple traders have opened or closed in that particular time frame.

In simple words, tick volume measures the number of times the price ticks up and down. So, for example, if the prices change 100 times in five minutes, there’s a higher activity than if prices change only 50 times.

Tip 1. Liquidity of brokers

Let’s first learn what liquidity is? In forex, liquidity is the ability of a currency pair to be bought and sold on demand without causing a significant change in its exchange rate.

Tick volume reflects the liquidity of brokers. Thus, liquidity providers are the spine of forex trading. The two main types of liquidity providers are Tier-1 that includes global banks, whereas Tier-2 is the small financial institutions.

Traders fail in tick volume analysis because they are not specific while selecting the broker with top liquidity providers.

Why does it happen?

This usually happens when you choose a broker with only one liquidity provider, which is not a top tier. Having a tier-three provider or lower will automatically affect the tick volume data.

How to avoid the mistake?

While selecting a broker, go for the one that has multiple LPs. Moreover, observe their tick volume. High tick volume is directly proportional to liquidity.

Choose a broker that has many liquidity providers with strong tick volume data. Make a clear framework of your in-house requirements before you set out to search for a broker.

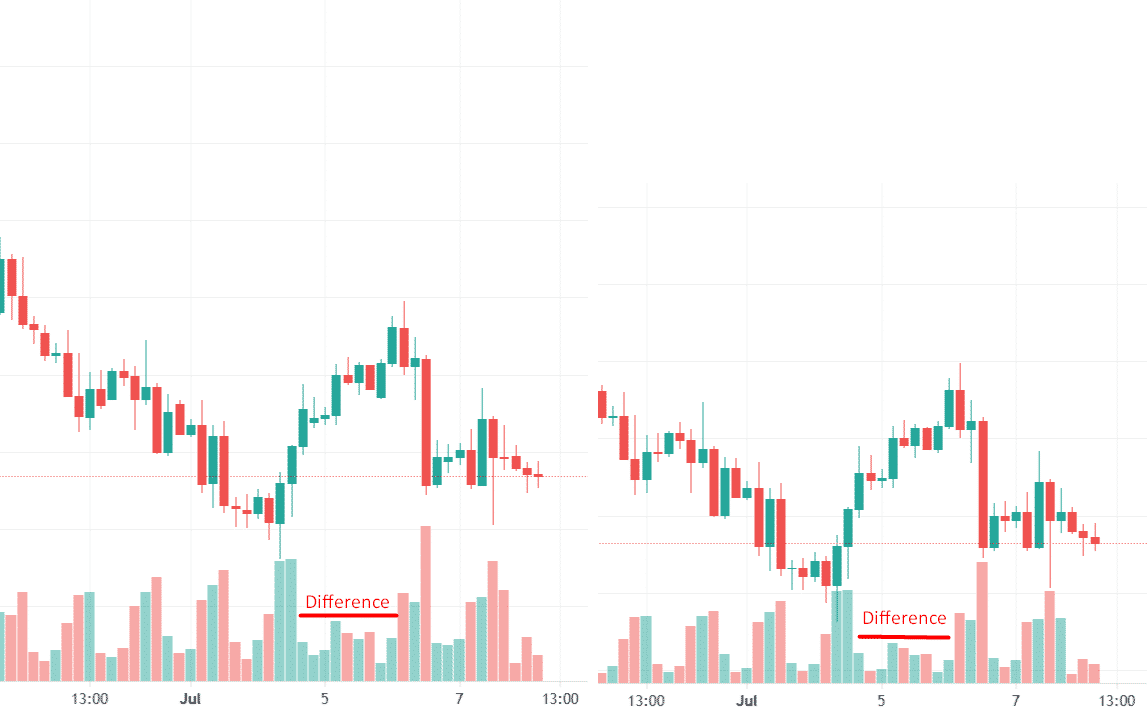

Let’s show you a comparison of two brokers with the same chart. You can see the difference in their volume. One has a higher volume than the other.

Keep these five things in mind while choosing the proper forex LP. First, look for a good offer that consists of a range of multi-asset options such as FX, commodities, index futures, etc. Second, search for fast trade execution without rejects and re-quotes. Find balanced pricing. Competitive spreads at a low overnight fee are the ideal combination.

Stable and reliable feeds are a must-have for a good forex LP. Lastly, make sure your liquidity provider offers complete reporting packages, including email reporting, full reconciliation reporting, trade reporting, etc.

Tip 2. Backtest tick volume and price patterns

Backtesting is the process of testing a trading strategy based on previous price data. It will help if you take the trade forward by correlating the price pattern with tick volume. You should check your strategy on historical data to measure its effectiveness before you apply it to the current market values.

Traders ignore this point in haste to invest.

Why does it happen?

Investors usually ignore testing. It requires thorough brainstorming to decide what forex strategy they want to test. More than often, investors start off the backtest while employing un-real assumptions. This can be because of a lack of understanding or some problem with timestamps.

How to avoid the mistake?

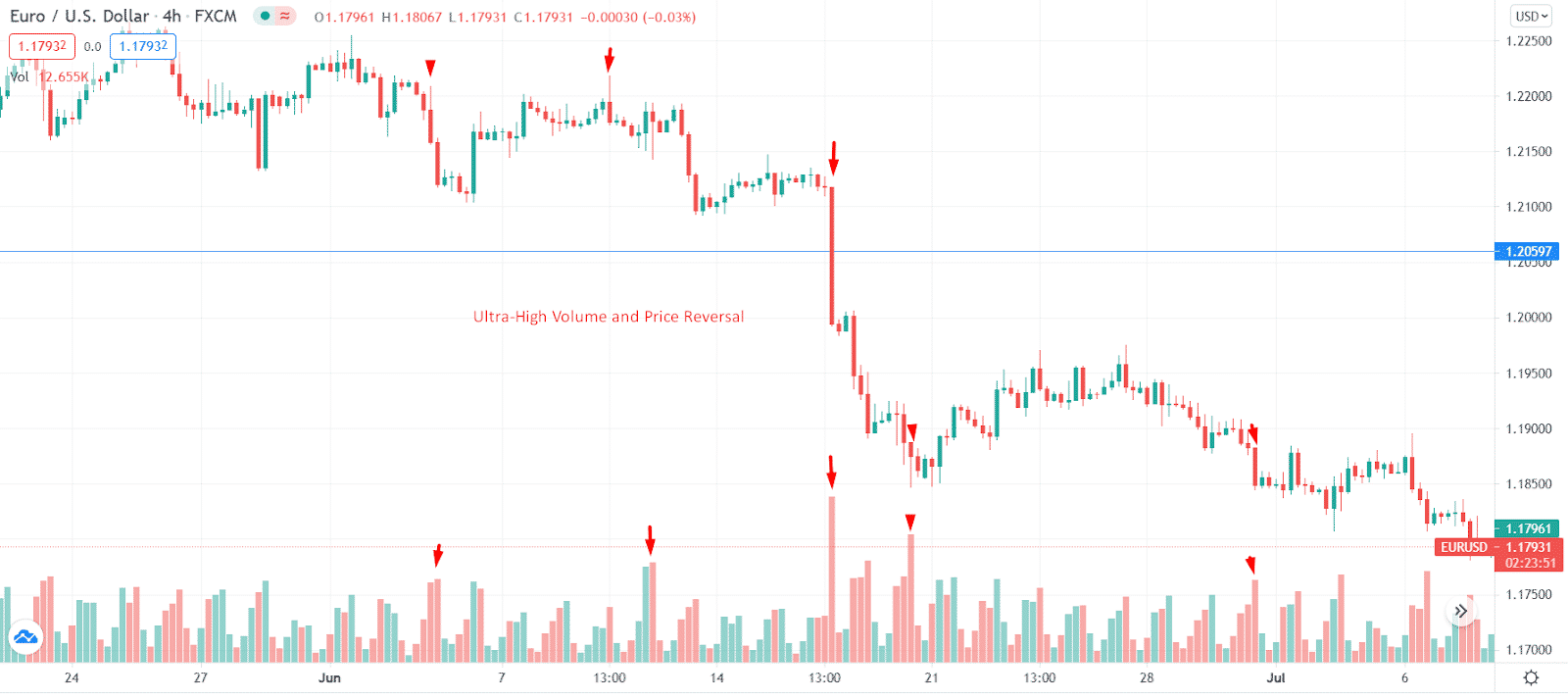

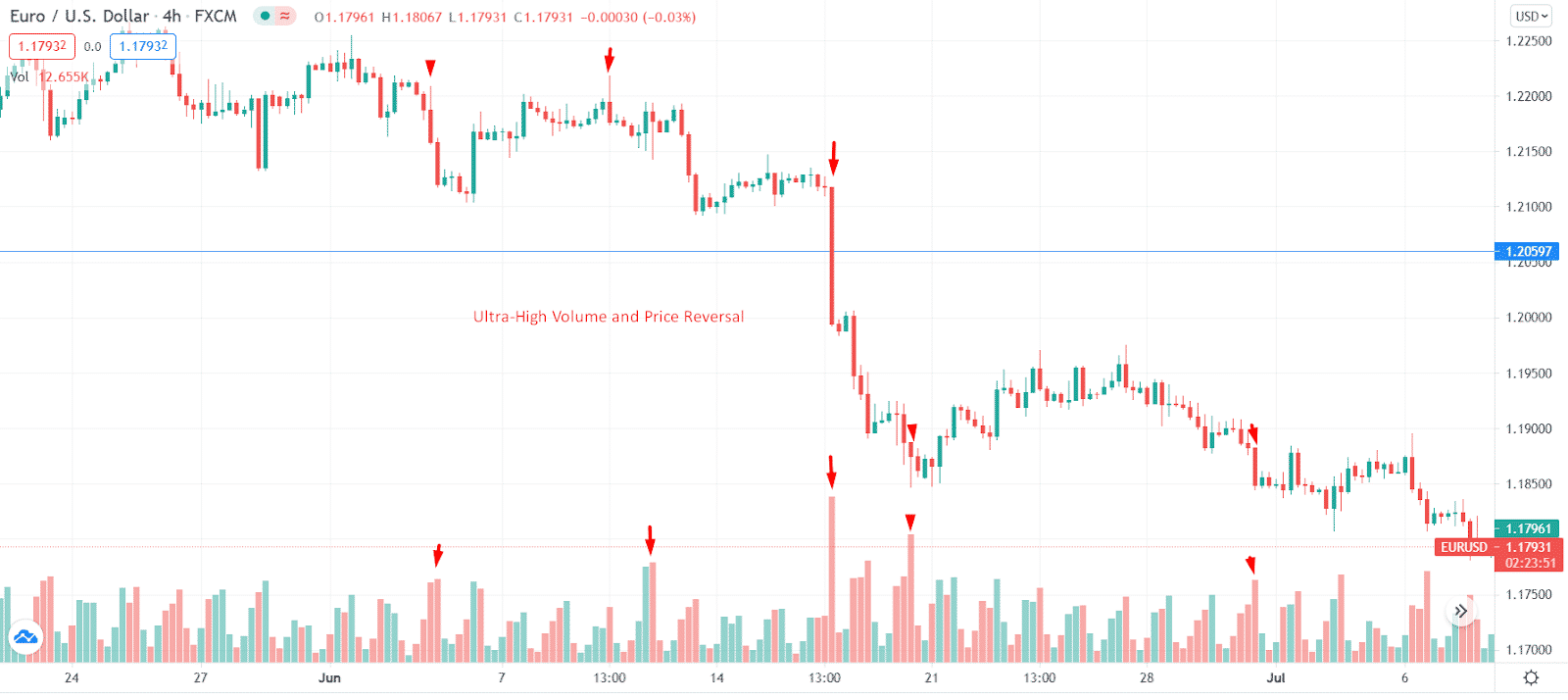

Keep scrolling back on charts, observing price patterns wherever you find the ultra-high volume.

You can take a major currency pair, say EUR/USD, for example. You see that it shows a high tick volume. Now, if the price pattern reflects a reversal pattern, then it shows potential for you. If you find that pattern frequently repeating in the live market, then it is safe for you to go forward with the trade.

Tip 3. Learn volume patterns

Volume has different patterns about the price. So it would help if you learned as much as possible to understand the market better.

Why does it happen?

Traders jump in forex without equipping themselves with the tools required to conquer the market. Therefore, it is essential first to learn the relevant patterns to make strategically correct decisions.

How to avoid the mistake?

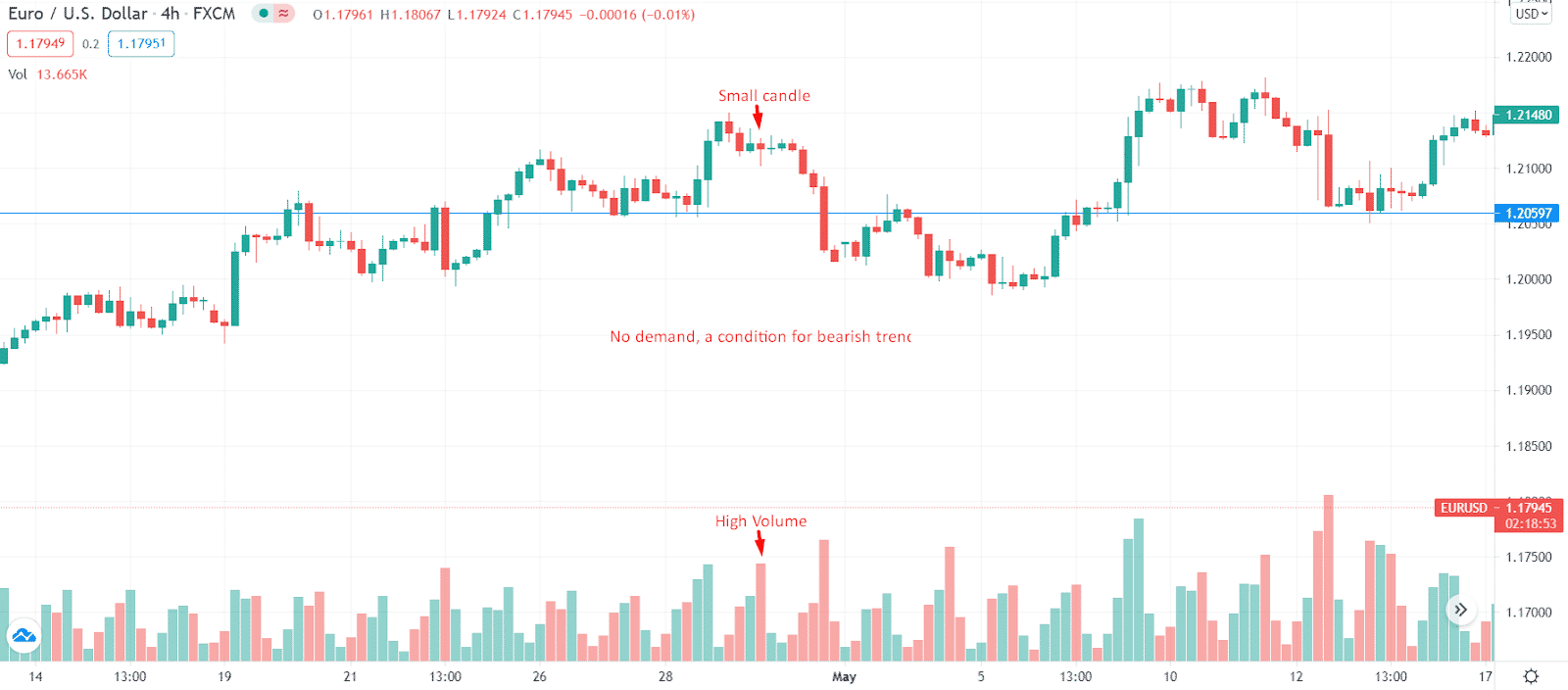

Study the volume and candlestick patterns to predict future trends better. For example, take a tiny candle when the volume is high. In such a case, the market either reflects “no supply” or “no demand.”

Tip 4. Master one instrument

You need to master at least one financial instrument such as GBP/USD or EUR/USD.

Why does it happen?

Investors do not develop their expertise in a single area which renders them amateur.

How to avoid the mistake?

Pick one pair, run a backtest, identify different patterns, mark recurring patterns that appear in a specific time frame. Observe the price behavior of the instrument. This will help you in assessing and applying volume.

Look at the example below. Ultra-high volume with a widespread candle appears to be a nice reversal for the EUR/USD.

Tip 5. Support and resistance

Support is the point where the prices cease falling, change direction and start rising. Resistance, on the other, is the point where prices stop rising, shift directions and begin falling.

Why does it happen?

Forex investors fail to study the support-resistance charts, which results in financial losses.

How to avoid the mistake?

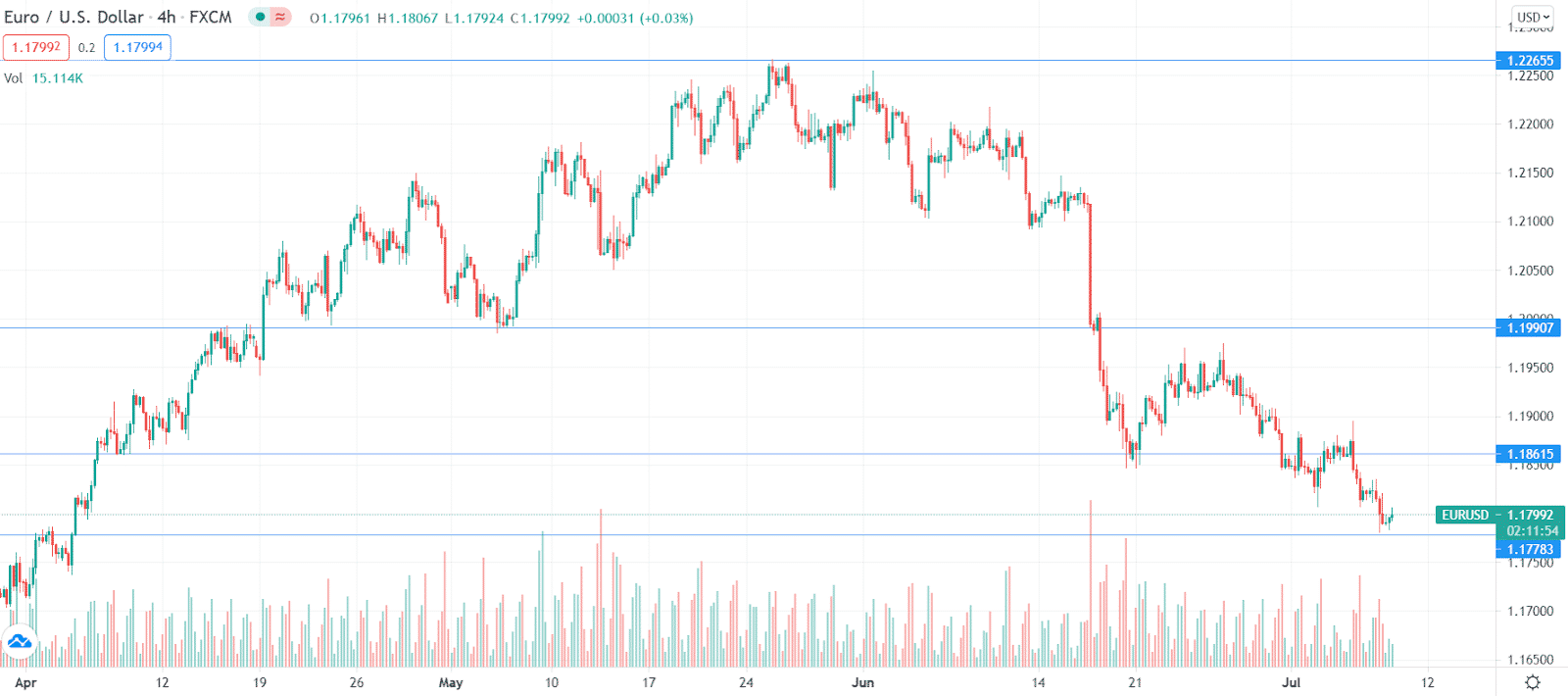

Follow broader time frames such as four-hour and daily time frames. Draw support and resistance zones on your charts beforehand. Make them bases for potential reversals zones.

Once price reaches either of the two levels, at this point, analyze the volume and price behavior to make your decision. Look at the below example.

Final thoughts

Tick volume, if appropriately used, can be an effective tool in trading. Employ the mentioned above methods to improve your trading strategy.