The golden cross happens when a moving average with a lower value crosses another moving average with a higher value. First, however, the crossover has to pass some qualification to consider it as a golden cross.

In the following section, we will see everything you need to know about the golden cross in the forex market, including profitable trading strategies.

What is the golden cross?

A golden cross (GC) is a price behavior when a lower-valued MA crosses a higher valued MA. The most useful moving average value for the GC is MA 50 and MA 200. When MA 50 crosses over the MA 200 from the downside, it indicates that short-term traders became active in the price.

The core idea of the golden cross strategy is to follow the current bullish trend. If the price is trading above the 200 SMA, it indicates that long-term buyers and investors are active in the price. Therefore, we should focus on buying trades only.

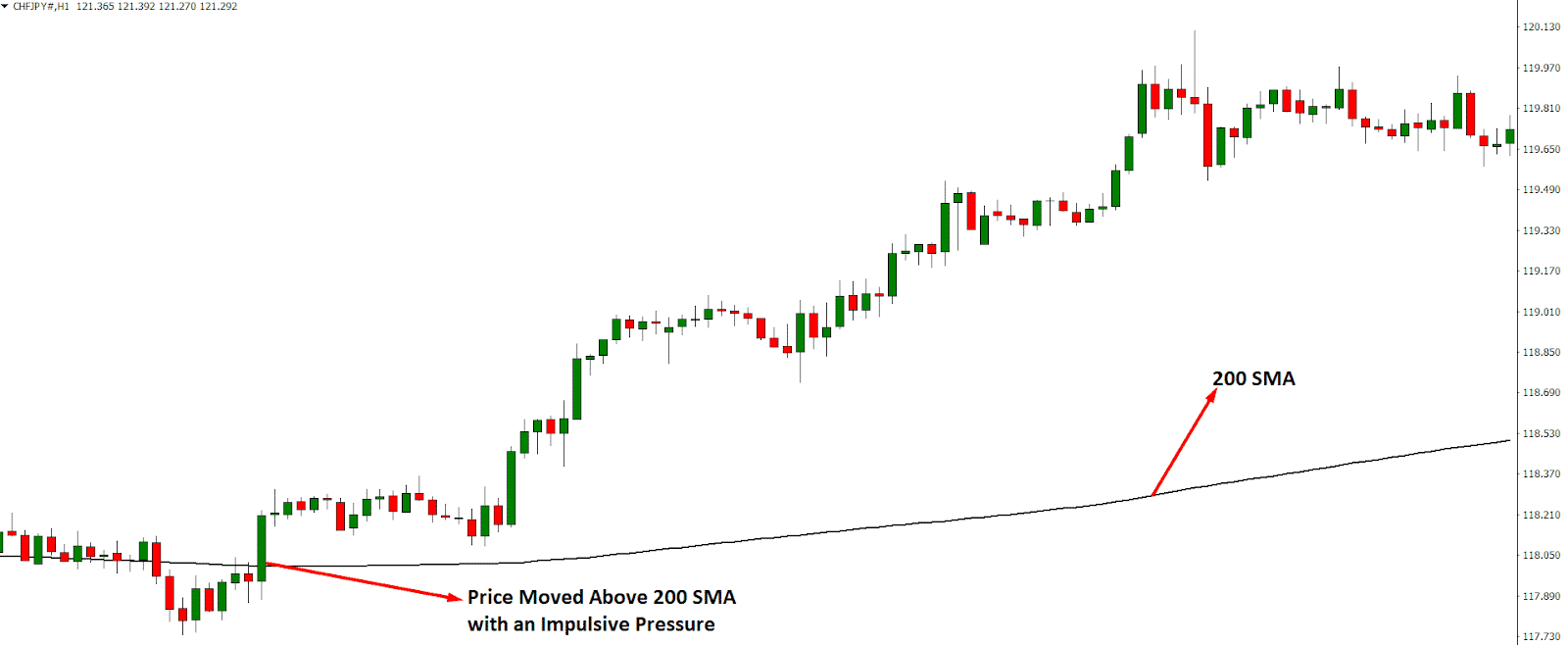

Here we can see the price chart of CHF/JPY, where the price moved above the 200 SMA with an impulsive bullish pressure that increased the bullishness in the future.

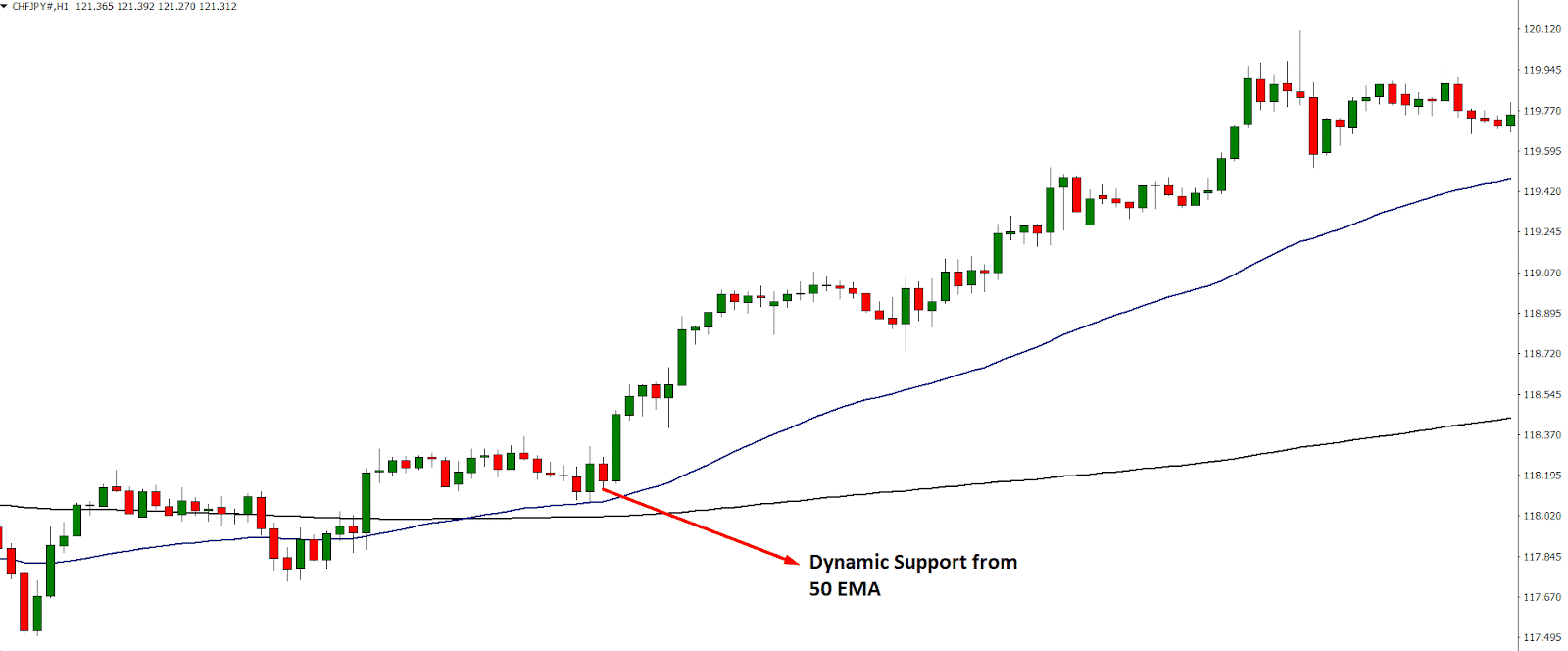

Now plot MA 50 on the chart and see how it looks like.

We can see how the price moved up in the above image, and 50 EMA worked to support the price. On the other hand, the same price action is applicable in the bearish market, known as the death cross.

Top 3 Golden Cross Strategies

Now move to the three profitable trading strategies based on the GC in the forex market.

№ 1. 50 EMA crosses over the 200 SMA

It is a simple and profitable trading strategy in any trending market, where the price usually makes new highs and lows.

The SMA 200 shows the average price of the last 200 candles. Therefore, if the price remains above the 200 SMA, we may consider the long-term trend as bullish. On the other hand, EMA focuses on the most recent price, so EMA with a lower value works well.

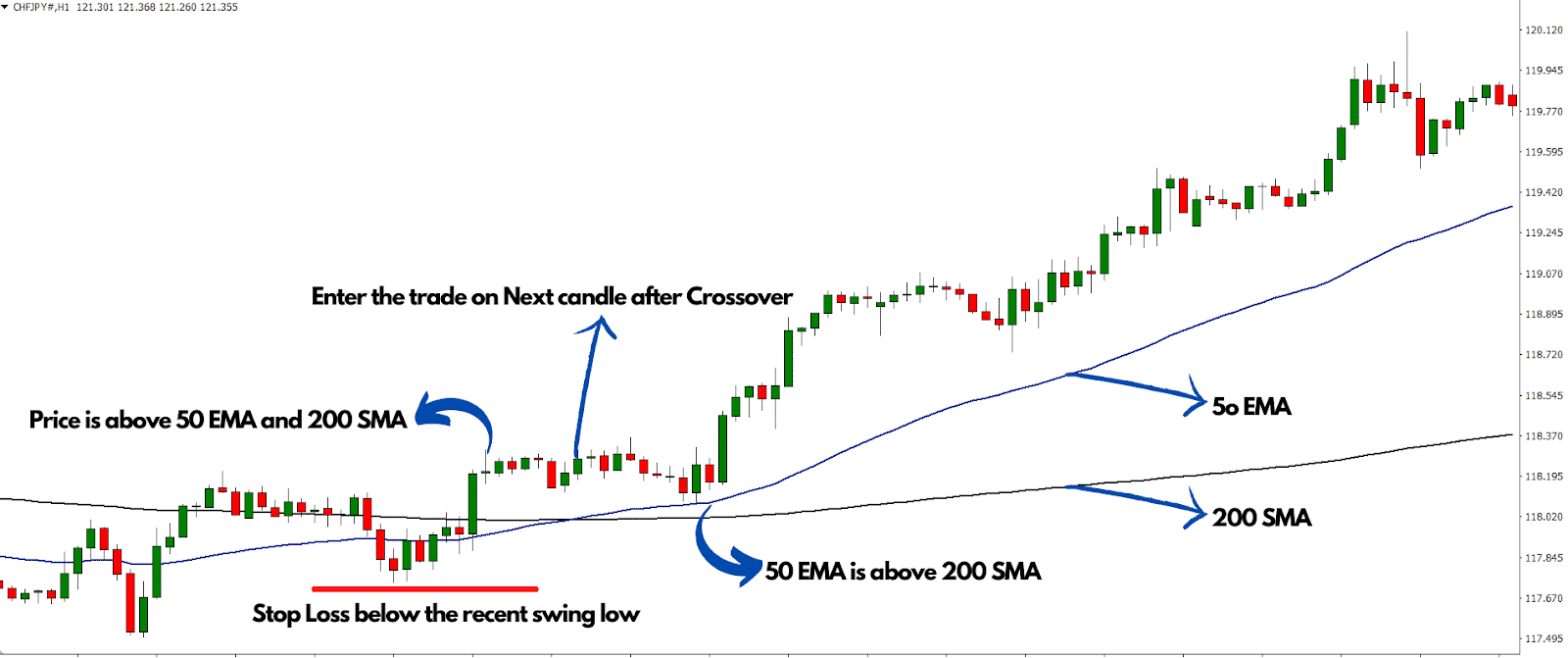

We can see how the price moved up in the above image, and 50 EMA worked to support the price.

Let’s how to enter a trade based on this strategy:

- Wait for the price to move above the 200 SMA and 50 EMA

- 50 EMA should be below the 200 SMA before the crossover

- Wait for the crossover when 50 EMA moves above the 200 SMA with a candle close

- Enter the trade on the next candle after the crossover

- Set the stop loss below the recent swing low

- Set the primary take profit based on 1:1 R: R and near-term resistance

№ 2. Golden cross with 50 EMA carry

The market may not move as per our expectations. For example, if the price moved up above 200 SMA and 50 EMA but did not move higher immediately, we can use this trading strategy.

Here the GC indicates a long-term bullish trend in the market where you can enter any time based on your risk management system. Moreover, if you miss the first trading entry, you can open another position from the 20 EMA carry.

What does the 20 EMA carry?

In a trending market, 20 EMA may work to support the price and carry it upside, known as 20 EMA carry.

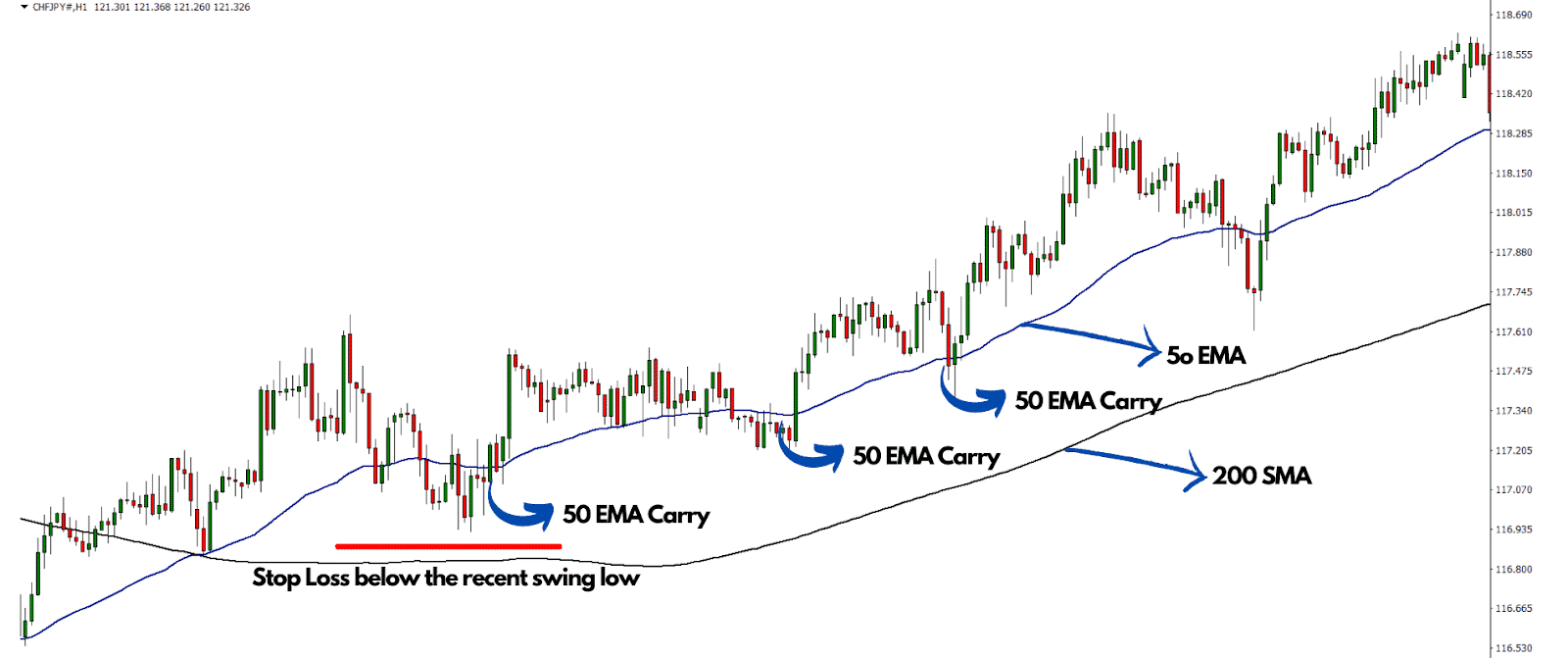

Let’s see the visual representation of the golden cross with 50 EMA carry.

We can see how the price moved up in the above image, and 50 EMA worked to support the price.

Let’s see how to enter a trade based on this strategy:

- Wait for the price to come lower to the 50 EMA after the crossover

- Find a suitable price rejection from the 50 EMA

- Enter the trade as soon as a bearish rejection candle closes above the 50 EMA

- Set the stop loss below the recent swing low

- Set the primary take profit based on 1:1 R: R and near-term resistance

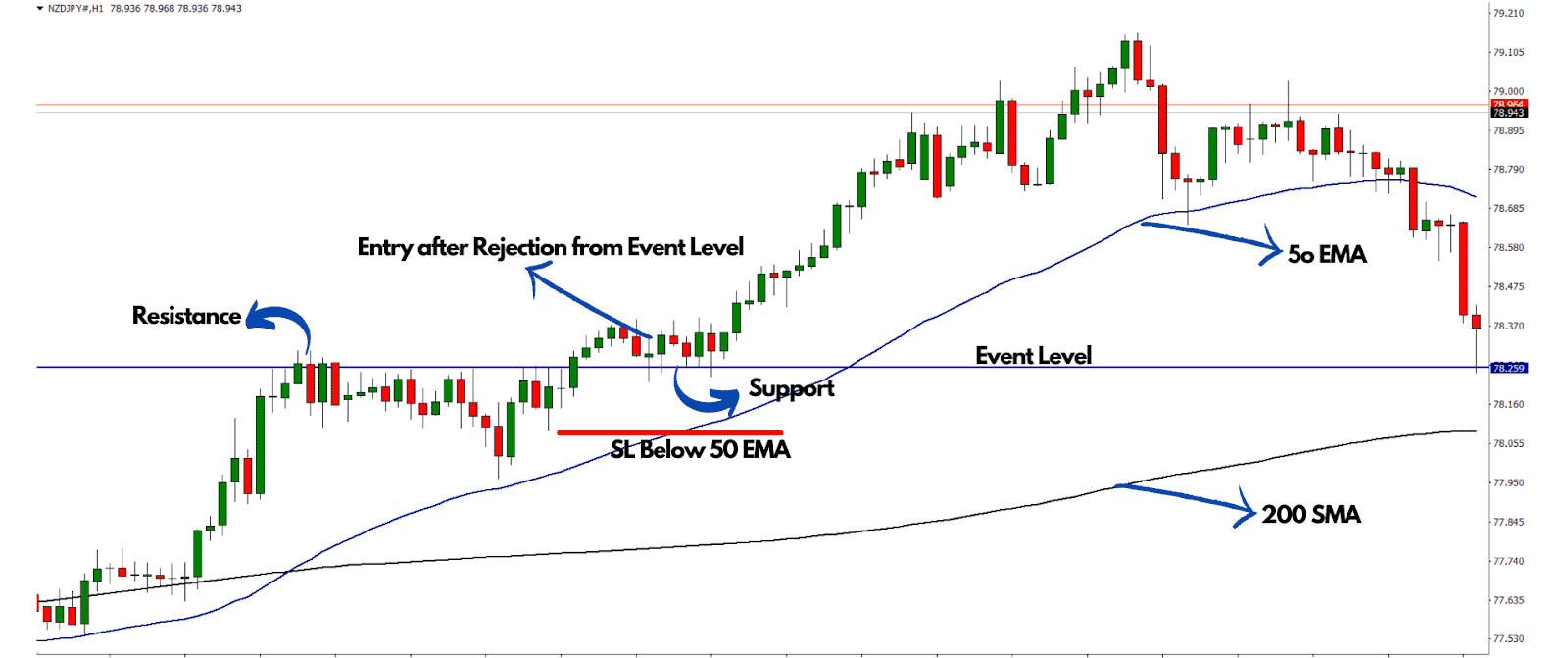

№ 3. Golden cross trading from the event level

It is another profitable trading strategy where traders should find an appropriate price rejection from any significant event level.

The event level is a price zone that works as both support and resistance. Therefore, it is vital for traders as both buyers and sellers remain active at the event level.

Let’s see the visual representation of GC trading from the event level.

Let’s see how to enter a trade based on this strategy:

- Wait for the golden cross to happen and find a price level that works as both support and resistance

- Identify the price above the event level and wait for a correction

- The price should come lower towards the event level and show a bearish rejection candle

- Open a buy order as soon as the bearish rejection candle closes from the event level

- Set the stop loss below the 50 EMA

- Set the primary take profit based on 1:1 risk: reward

- Close the total trade if the price rejects any critical resistance level

Final thoughts: trade management

In the above section, we have seen profitable trading strategies that are effective in any trading instrument. However, the forex market has some risks that no one can ignore. For example, if you cannot manage your trade, no one will make money from financial trading. Here trade management is a crucial part that most traders ignore.

There is no alternative to setting a stop loss at breakeven after getting some pips and using a systematic lot size in every trade. But, overall, the ultimate success from the golden cross strategy depends on your trading personality and implementation of knowledge in the chart.