Trade management is a process to alter trading decisions after opening a buying or selling position. The FX is requiring changing decisions from changing the price, especially for price action traders.

Price action is a process to anticipate the price movement of a currency pair using the characteristic of price. The best part of such trading is that it does not require any help from indicators. Instead, price action traders determine big players’ movement and read their footprints by observing candlesticks with levels.

Price action traders can change their decision at any time with the change in the market’s behavior. Therefore, trade management systems for price action traders are different from fundamental or indicator-based traders.

The following section will see a complete guide regarding the money management tips for price action traders.

Why is trade management critical in forex?

Before moving to the core part, we should have deep knowledge about trade management systems that most traders ignore.

“Trade management is a process to alter any trading activities once the trade is executed.”

Most of the traders spend a lot of time analyzing the market, and once the trade becomes active, they start to reduce monitoring. The forex market is very uncertain where any unexpected behavior may happen. Therefore, price action traders should keep themselves ready to cope up with any uncertain situation.

There are two types of risks in the financial market:

- Avoidable risk

- Unavoidable risk

The inevitable is not controllable by traders as it is related to the broader market. However, avoidable risks are associated with a specific trading instrument, and a trader can minimize them by using appropriate trade management rules.

Trade management tips for price action traders

In this section, we will see some practical ways to manage trades that can change your view over the market:

- Play with price levels

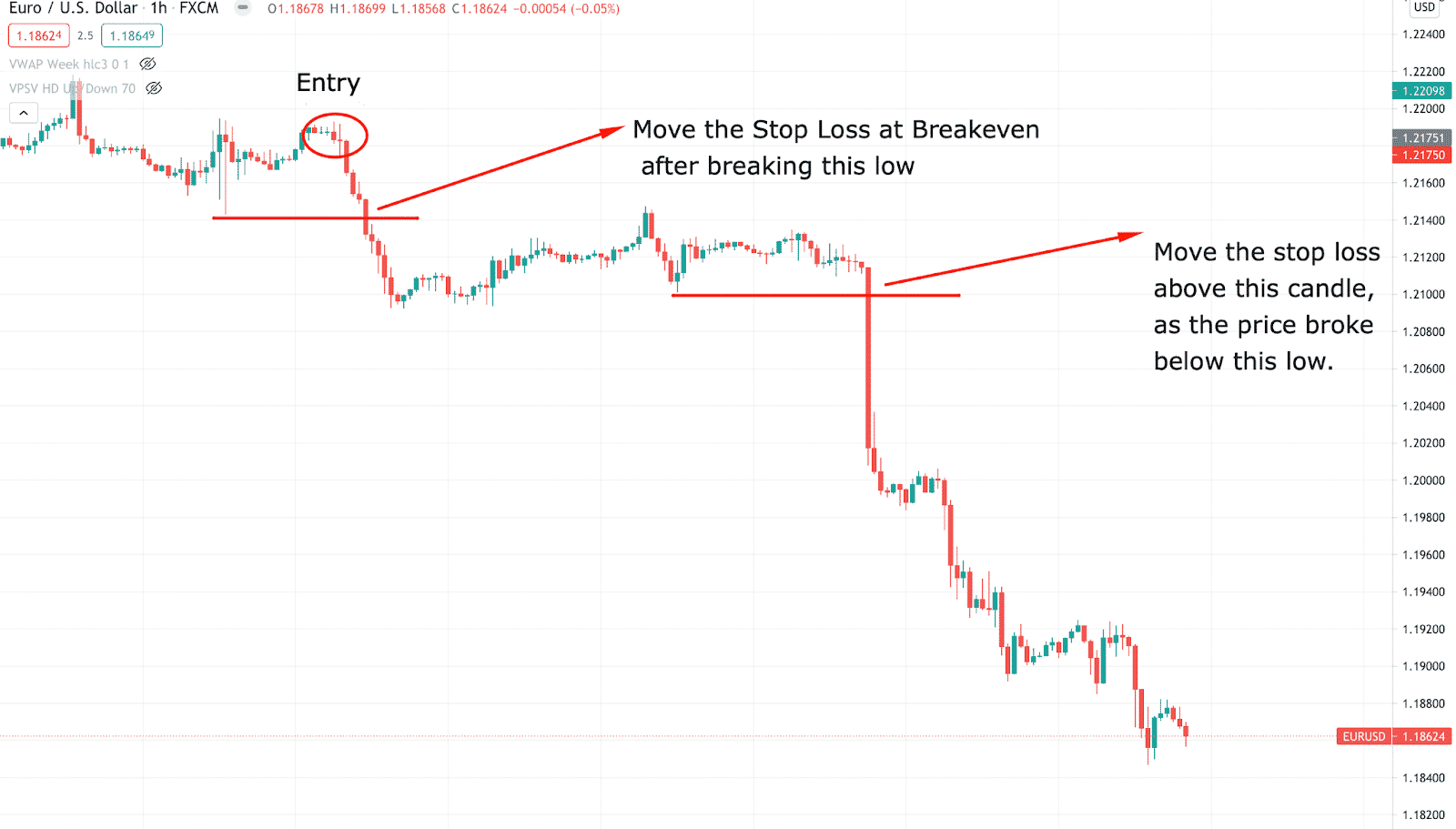

These are the primary trade management rules where traders should move the stop loss with price swings. For example, when the price will move towards your desired direction, you should move the stop loss at breakeven, and when the price will make a new swing, shift the stop loss to the next swing.

Let’s have a look at an example.

The above image shows that the price broke below the new swing low, and the stop loss was shifted following the direction. This method is perfect when traders want to take the maximum benefit from trade.

This method applies when the price moves to support a robust fundamental release that can create a solid trend for the price.

- Play with the risk per trade

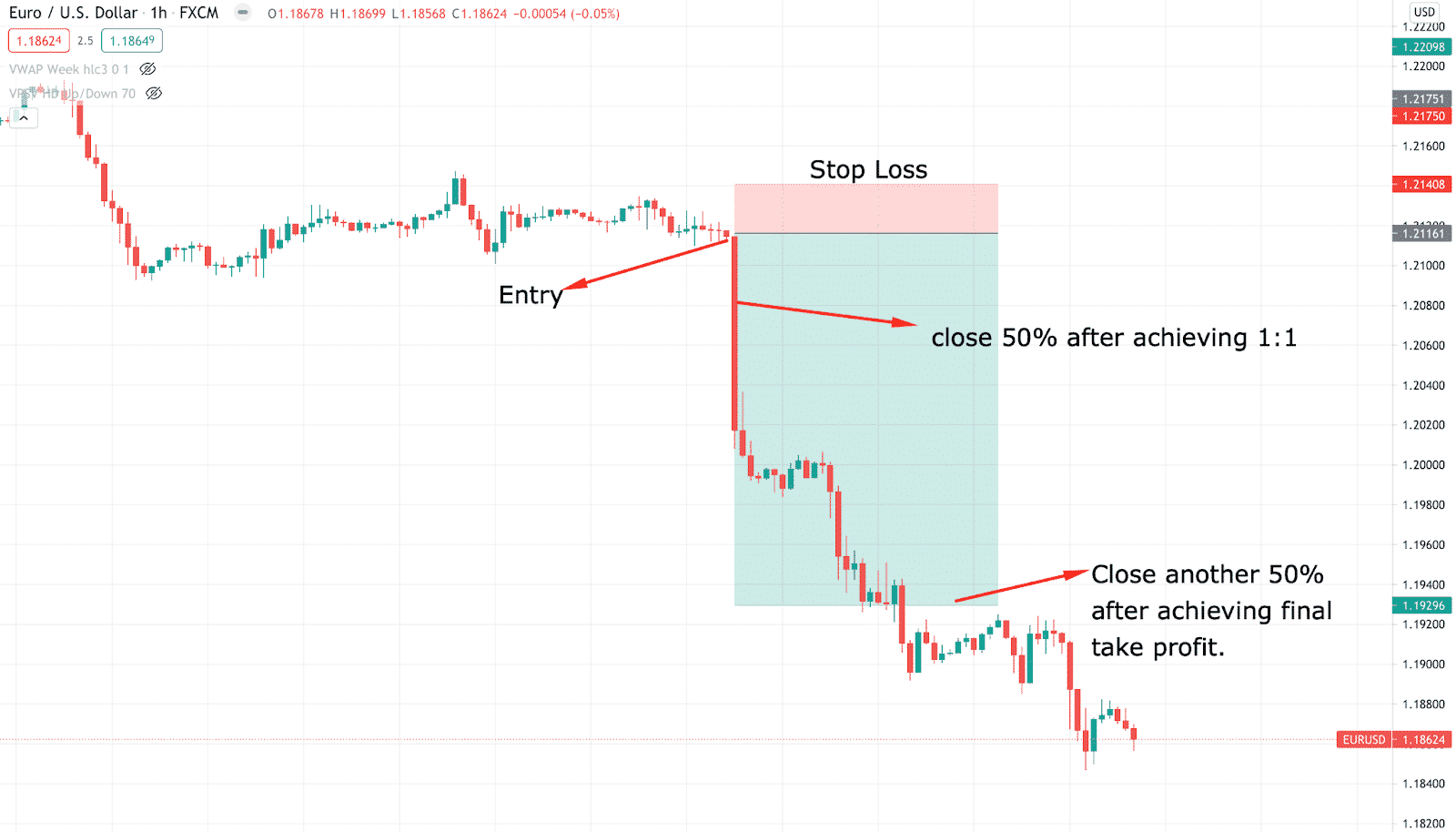

This approach is conservative, where traders should close a portion of trade once the specific target level is achieved.

For example, if you risk 1% of your balance as a risk with the target of 2-3% gain, you can close 50% of the position when the price reaches 2% profit and allow another 50% to get the full benefit. In that case, you have already gained 1:1 R: R from your first trade, as shown in the image below.

This trade management tip is applicable for those who want to keep their accounts safe by grabbing some pips. If the price reverses after hitting 1:1 RR, the trade will be closed but with some profit.

- Play with timing

If you are an intraday trader and follow trading sessions in your strategy, the following trade management system is for you.

It is the most important and effective way to manage any trades in the forex market. Here timing does not mean the holding time of the trade after taking an entry. Instead, the timing is a way to change trading decisions with the trading session.

In FX, most of the market movement happens when big players are in action. Banks and financial institutes remain active in a running trading session, usually in the London and New York sessions. Therefore, a decent movement happens during the London and New York session.

If your trade is in profit that came from the London sessions movement, you should close some pips before the London close or New York open. Because once New York’s trade comes, they may change the direction at any time.

Based on our findings, the following approach is the best for intraday trade management:

- Pre-London trading — partial close after London open

- Post London trading — partial close before New York open

- Pre New York trading — partial close after New York open

- Post-New York trading — partial close before New York close

- Post-Asian session trading — particle close before London open

Let’s have a look at an example in the price chart.

Here, we can see that the price moved down with an impulsive bearish pressure before the London session and rebounded after the London session. The same theory applies to the New York and Asian sessions.

Final thoughts

Let’s summarize the top three trade management tips for price action traders:

- Play with price levels is a way to catch the full juice from a trend.

- Play with the risk per trade provides profit for the invested amount more than the pips count.

- Play with timing is an intraday approach to manage deals that require close attention to the trading sessions.

Overall, trade management is the most important feature of trading that requires close attention from professional traders. Successful traders are experts in managing trades, and it is the only way to keep yourself on the list of them.