Traders in the FX have unspoken rules that all beginners should follow. Such observations, practices, conclusions did not appear just like that but were the result of the trial and error of many traders. As a rule, beginners repeat about the same path in mastering the market as traders before them.

FX trading rules are more like advice, and therefore, this is how they are best treated. These are not strict restrictions or axioms but the observations and conclusions of people who have been familiar with forex for a long time.

When it comes to trading, money, and trade management are also unavoidable parts besides finding the best trading positions. Forex trading carries a high level of risk for invested capital, and profit is not always guaranteed. Moreover, the FX is volatile, and for its uncertain characteristics, new traders often lose their money by chasing up losses. It is where trade and money management comes.

Trading in the FX involves uncertainty, risks, stress taxes, losses, expenses, etc. Therefore, you must have research and sort out the best strategies to maximize your business potential. This article discusses trade management: what it is, what rules do, how to make the right trade decisions.

Is trade management critical in FX?

Trade management is essential to success in the FX because it can grow you or break badly. Once you learn to trade forex with highly profitable strategies like “price action,” you must learn to manage your trades after your trade is live. As an old saying, one bird in the hand is better than two in the bush.

How does this relate to forex trading?

The answer is simply money management. Even sometimes not entering for any trade is also a position as you don’t lose money this way.

If you ask ten new traders, what it would take to become a professional trader, or what is their focus on being an experienced one. Nine of them will respond that they seek a good setup, entry, or strategy to enter the market.

Most beginner traders ignore a vital fact like money management in trading. As a result, they end up losing their money or can’t be profitable as they deserve. It’s logical that if someone wants to profit, they should buy the asset before moving higher and selling before declining. It only takes countless hours of experience to know that profitability doesn’t always depend on finding good setups; you need to care about some more things.

Top 3 trade management rules

Imagine two traders:

- Trader A has decent money and trade management, simply entry-exits are well defined.

- Trader B is not so well disciplined but has a stable strategy.

- Trader A is always on the advance to being a successful forex trader.

So we already know that trade management is somehow a significant part of forex trading. This part will discuss the top three trade management rules that successful traders or professionals follow.

Rule 1: Set and forget

It is a common rule or way of trading that professional traders use so often. The idea is elementary:

- Find out the entry, stop-loss, take profit levels based on your trading strategy and analysis and set.

- When the price meets your predicted level, automatically, your position gets closed with profit, or stop-loss gets hit.

- By this rule of trading management, you can reduce your stress during trading.

This method is suitable for swing traders or position traders who don’t see their price charts very often.

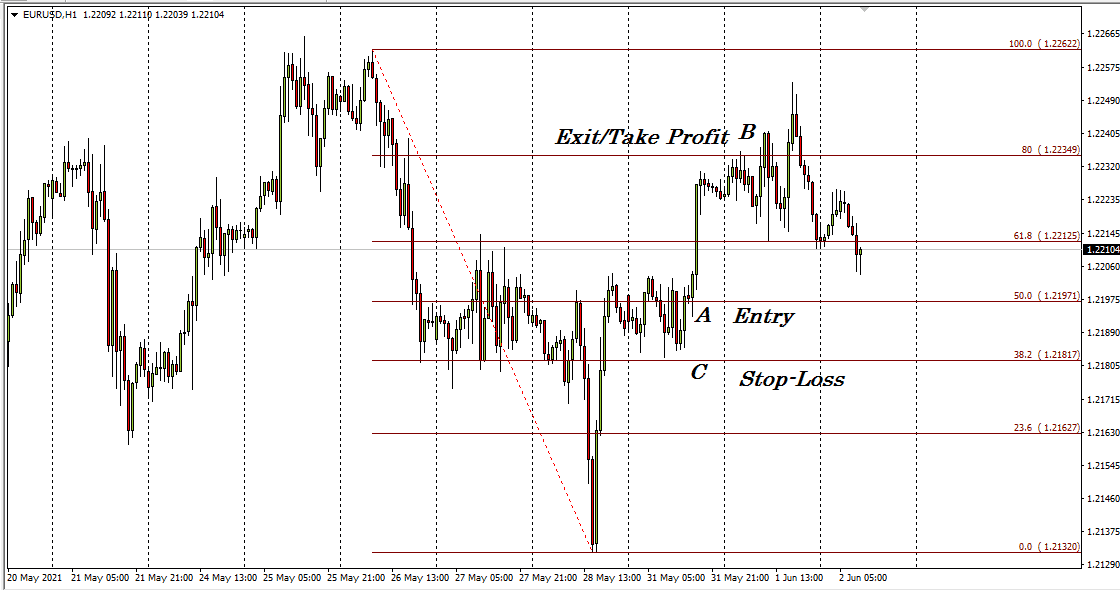

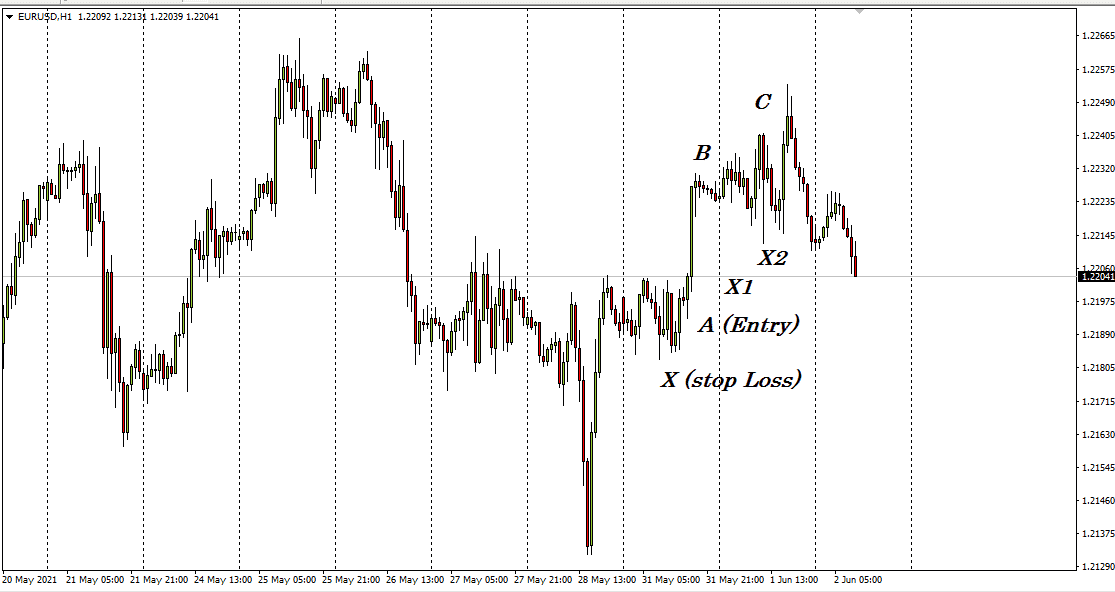

For example, look at the fig above, which is a 1-hour chart of EUR/USD. It shows that price took some retracement from a clear uptrend, got back to bullish on the same day, and crossed daily highs by the end of the New York session.

Suppose you are an intraday trader looking for a buy order from here.

- The next day, place a buy order at the beginning of the London session near point A.

- Set stop loss below the low near C of that day.

- Take profit position can be upside near B: 80% Fibonacci retracement level of the previous high.

So you can easily make 60+ pips by the end of the day!

If the opposite happens, the price refuses to go upside down, your stop-loss gets hit, and you lose money.

Rule 2: Trail with swing

Swing trading is the idea to enter when there is a particular swing or “one move.” The experts often find swing moves based on their trading strategy and analysis. Somehow it’s a “little pain” to exit from trade before the opposite pressure occurs.

This rule or way of “trail with swing” helps traders to avoid that pain. Swing trading relates to volume shift stop-loss or profit target when the volume decreases. We suggest shifting stop-loss near 50% Fibonacci retracement level of the swing point.

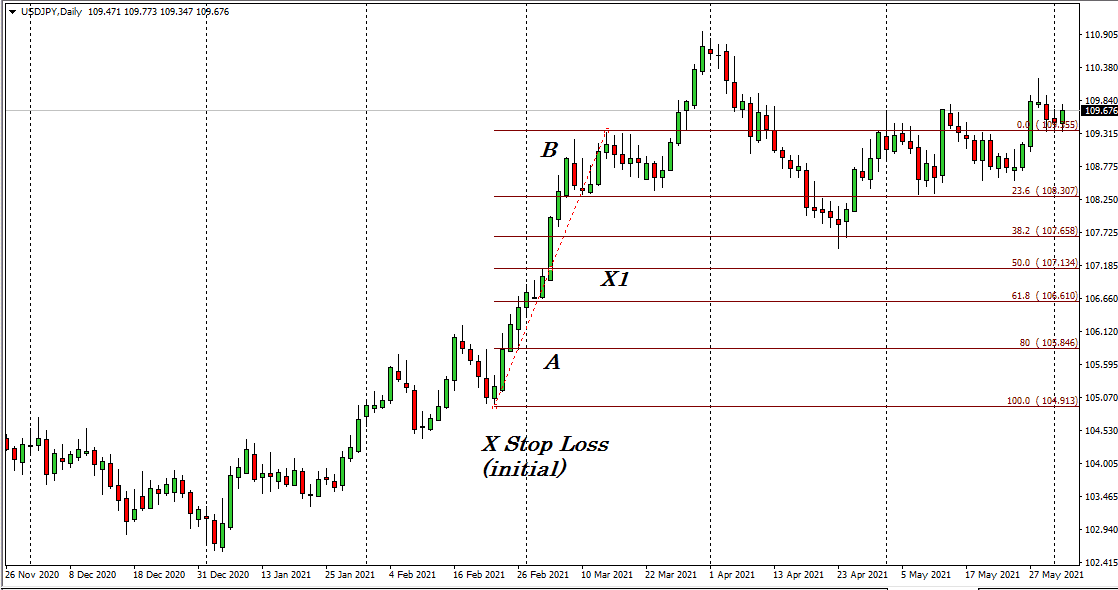

- As the chart of USD/JPY above shows, suppose you catch the swing position near point A.

- An initial stop loss may be near X.

- We suggest moving your stop-loss near point X1 after the price completes the first swing near B.

- You can close the buy position at point C or continue shifting the stop-loss near X2 (near low swing AB and 50% fib level of AC).

- If the price fails to move higher than point C and starts to reverse near point D, your stop-loss X2 gets hit, and your position closes with profit.

Rule 3: Trail with time

Time is a very relative fact for FX. Top forex trading strategies depend on time as the trading duration is not the same for all market participants. For example, an intraday trader may hold a position for a day or a week. Still, professionals from institutes may continue the same position for a few weeks or months. It is a dependable fact with strategies, trading balance, expectations of profit, etc.

We suggest setting a trailing stop-loss when you take a position from a specific price, so if the price starts to move against your order, your trade closes with your desired amount of profit or loss.

- You can automatically trail the price by stop-loss — by setting value on trading software.

- Or manually — shifting the stop loss or profit levels.

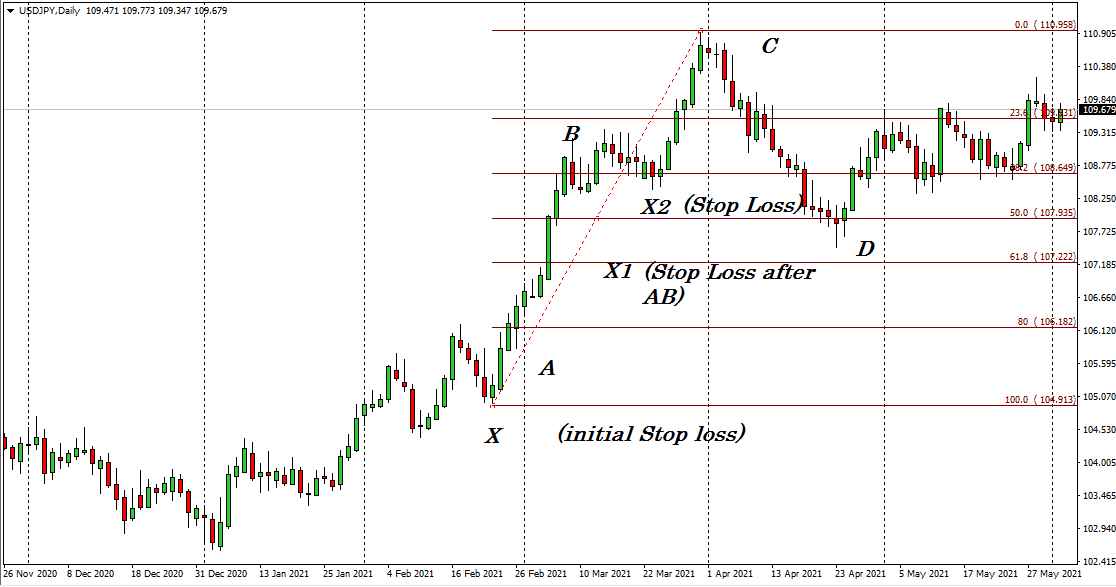

- An intraday trader may catch the swing position from point A.

- An initial stop loss may be near point X.

- Then shifts the stop-loss near X1 (above 20 pips from the entry-level) after price makes the first higher high near B.

- Holds that order for the next 24 hours and has a chance to close that position at the point C with 90+ pips in total.

- If you shift stop-loss X2 above another ten pips after making another higher high near point C, your trade gets closed automatically by the end of the day with 30 pips profit.

Conclusion

Finally, it’s unavoidable to follow proper trade management rules besides a stable trading strategy to be a successful forex trader. We suggest you research and practice more. You must check the plan on the demo chart before applying it to the trading account.