Trading without a plan is the same as throwing money into the trash. It doesn’t make any sense. But, like any project or business, you need to have goals, and to reach those goals, it is necessary to make a plan. There are almost 14 million traders in the FX market. To compete against them, you need something that makes you stand out.

Trading is hard. Most traders fail. You may think that the reason why they fail is that you need to be a genius or have years of experience to profit, but that’s not the case. Intelligence and experience are important, but where most traders fail is on the basics. Discipline is lacking, they do not study enough, and mostly, they do not have a plan.

Here will give you the top five tips to create an FX plan to succeed in trading.

Tip 1. Prepare before trading

There is a lot to do before you can even think about trading. Unfortunately, most brokers want you to think that it’s easy. Just open an account, and you will be making money in 15 minutes.

Why does it happen?

The trick is that it seems easy. For the inexperienced, it may almost look like a matter of luck. You think that guessing if the price will go up or down can’t be that hard. But it is. Trading makes you lose money every day, and if you have no preparation, you are just another one who lost money.

How to avoid the mistake?

You need to clean your room first. Then, if you want to trade, you need to get your basic needs in order. If you don’t have any savings or, worse, you struggle to get to the end of the month; you are not ready to trade.

This requires you to forget about the money you invest for a while. If the money you are putting into forex is the money you want to use to pay the rent, soon you’ll be with a broken FX account and kicked out of your house. You need to know that you won’t get rich overnight, and you need to know that this is like any other job. It takes time, discipline, and dedication to succeed as a trader.

Tip 2. Acquire knowledge

There is no perfect plan to trade. It depends on many variables like your trading time, your discipline, the markets you are going to trade in, but overall; it depends on you. The only way of knowing what is best for you is by searching all the strategies, techniques, and courses you can do.

Why does it happen?

There are many types of trades. You have the trader that wants to ride the long trends and those who are all about minimizing the risk. They all have a point, and you can discuss which type does better, but the important thing here is to understand that, no matter which kind of trader you are, the only way to profit is to dive into the path you choose and learn every day about the market.

How to avoid the mistake?

Technical analysis is the most popular trading system, but the fundamental analysis is the easiest to understand. The best thing is to combine both to get the full picture and make the best possible decision. To achieve this, try every idea, technique, or strategy you find on a demo account first. By doing this, you will avoid expensive mistakes and improve your chances of profiting.

Tip 3. Set your goals

The only thing you can do when you don’t know where you are going is to get lost. Getting rich is not a real goal. I mean, you can get rich, but setting it as a goal is a recipe for failure. You want to make things that get you closer to your ultimate goal. Even if your goal is to get rich, you won’t get there at once. You need to set little goals like improving your winning rate, making trading your main activity, having 5% profit every month, etc.

Why does it happen?

Not having clear goals not only keeps you away from success but doesn’t let you know when you are failing and how bad you are failing.

If you don’t have a goal, you don’t have a parameter to measure your success, which will quickly get you to the wrong side of the trade. As a result, your earnings will look smaller, and you’ll risk greater amounts of money so you can see profit attractive enough for you.

How to avoid the mistake?

Set SMART goals for your trading. SMART stands for specific, measurable, achievable, relevant, timing. If you can define your goals in terms of those parameters, you’ll be closer to reaching your ultimate goal and make the way to it easier.

Tip 4. Entry and exit point

Once you set all the previous steps, defining this key point in every trade is easier. You can’t expect a trend to go up forever. Also, you need to identify when a trade is a lost cause. Defining entry and exit points are necessary steps you need to take before you get into a position. If you don’t know where to set your entry and exit levels, you better not enter the trade.

Why does it happen?

Many traders are forecasting the price of a pair is about to rise or fall. They want to profit from that potential. The truth is that prices go up and down all the time. The only difference between a trade and another is how you manage it. Not having entry and exit points is not having a plan to trade.

How to avoid the mistake?

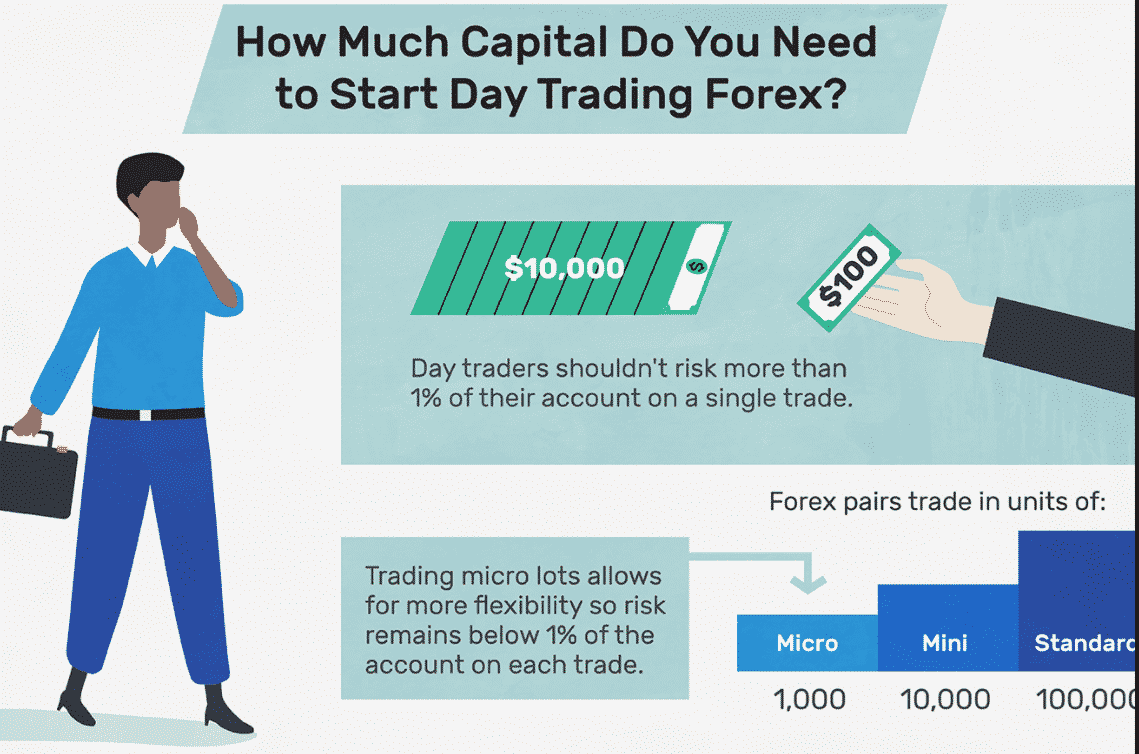

Define your entry and exit points right before you get into the trade. There are some rules of thumb you can use to define stop-loss. A simple one is the 1% rule. According to this, the stop-loss should allow you to lose only 1% of the money you have in your account.

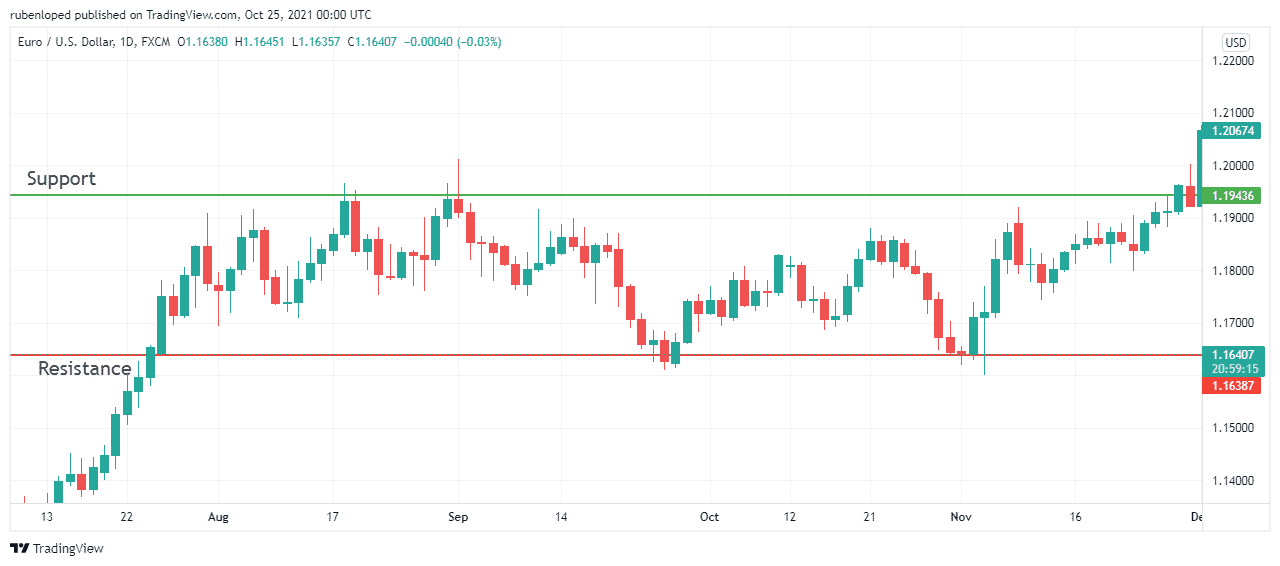

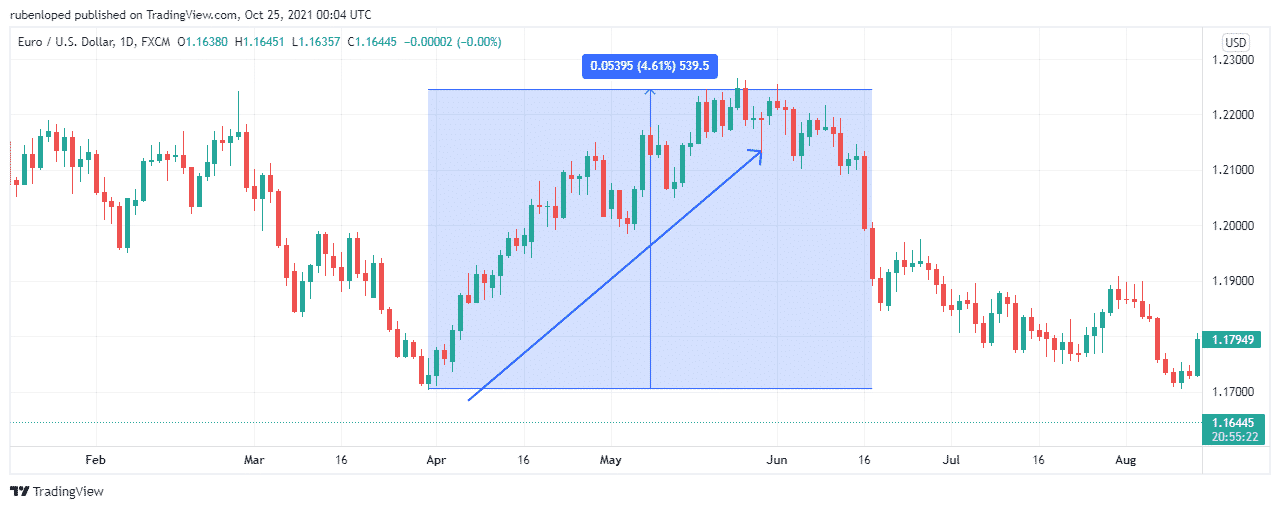

The take profit level is a little trickier. You want to go with the trend as much as you can, and every trade is different. The best way to define the take profit level is using indicators like Fibonacci retracement or previous resistance levels.

Tip 5. Risk/reward ratio

A trade is only worth it if the risk-reward ratio is attractive enough. It doesn’t make sense to enter a trade if the risk is much higher than the reward. Of course, there is another variable intervening in this equation, that is, the winning probability.

Why does it happen?

Forex is difficult, and the probabilities of losing are high. The few times you make a successful trade, the reward should be enough to compensate for all the losses you had before.

How to avoid the mistake?

A 1:4 risk/reward ratio is only attractive if your winning probabilities are higher than 20%. That means that of every five trades, you’ll be making a profit in at least one and losing four. But that one winning trade will give you a profit big enough to recover from your previous four losses.