A forex trading strategy is a systematic approach to taking a trade based on multiple confirmations. Moreover, it includes a system regarding how traders can manage their deals using appropriate risk management.

There are thousands of trading strategies in the world. Many economists, philosophers, and mathematicians are behind the creation of them. Unfortunately, however, many trading strategies are not profitable.

The FX is ever-changing. The new technologies are implemented in the market, and using AI-based trading systems makes it more complex. Therefore, if you find that your trading strategies are not working, you should know the reasons behind this.

Let’s see a deep knowledge of forex trading strategies’ importance and the reasons behind the failure of them.

Importance of a forex trading strategy

The best benefit of the FX is that there is no one to stop you from making a trading decision. You have to invest money in a forex broker and take trading decisions using technical or fundamental analysis. However, many traders think that buying from low and selling from high is the ultimate knowledge that a trader should have, which is not correct.

Why do traders need a strategy?

An FX is a place where traders can buy and sell currency pairs. Most of the market participants in the forex are central banks and prominent financial institutes where the retail traders have little significance.

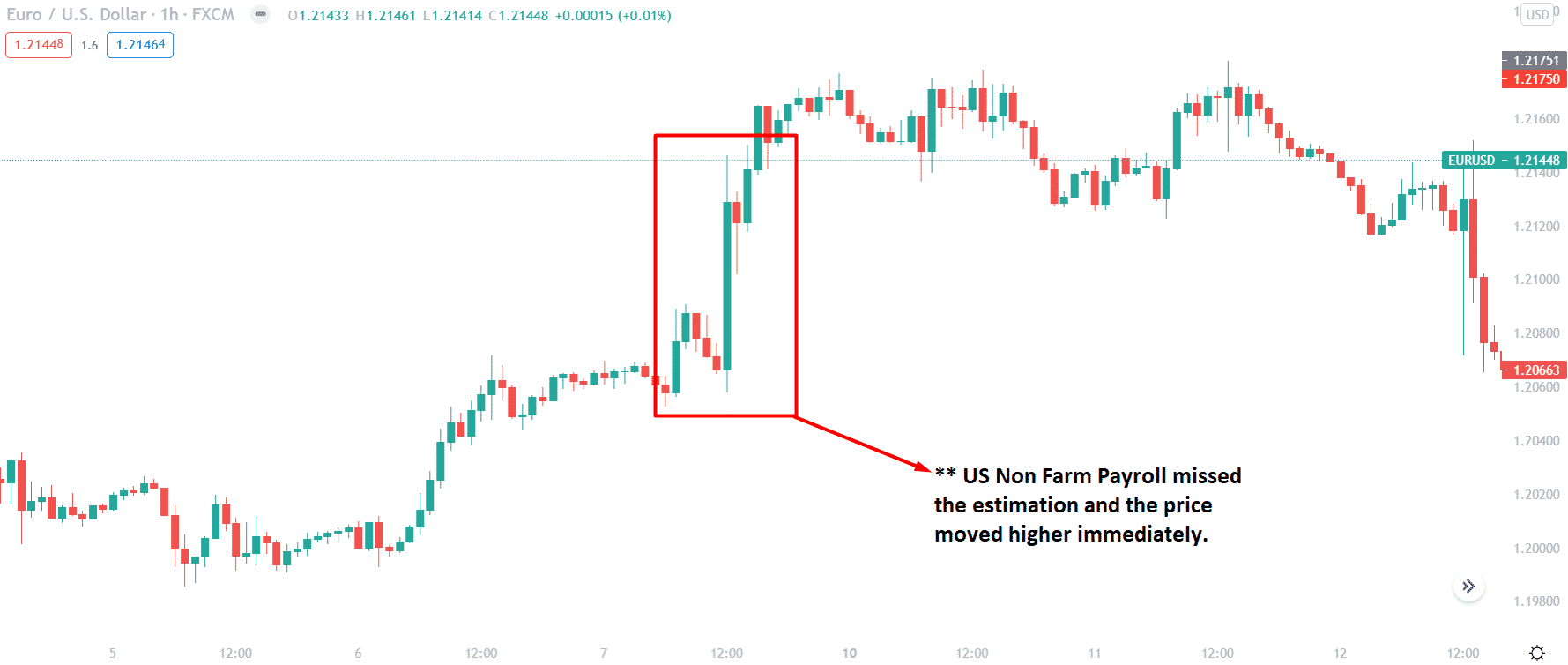

Let’s see the effect of fundamental news on the price.

Overall, this market holds a lot of risks that a trader can not ignore. All of your investments here are at risk as soon as you deposit. Therefore, if you fail to manage your money, there is a possibility that you will lose all of your investment.

Moreover, the forex is a leveraged market where you can increase your buying power by lending money from the broker. So it is another reason to believe that your money is at risk.

On the other hand, the trading strategy teaches you how to manage your deals systematically. The first approach of such a strategy is finding rules that are profitable with a strong history. Later on, managing the trade using appropriate money management and risk management systems are secondary. If your trading strategy does not have these qualities, you have to think twice before making trading decisions depending on your plan.

Why may your forex trading strategy fail?

In the above section, we have seen the importance of having a trading strategy. Now move to what may happen if you don’t have a proper trading strategy.

Lack of understanding of the market

In forex trading, taking a buy or sell trade using some logic is not enough. The FX consists of big investors who do not care about your trading strategy. Therefore, if you don’t know how the market works, it will be hard to make money.

The FX is the world’s biggest financial market, where more than $6 trillion worth of transactions happens every day. Moreover, the main activity occurs in the over-the-counter market, which is the wholesale market of currencies.

Let’s see other keys characteristics of the FX:

- Central banks are the most potent price driver in this market.

- The price in the forex changes with the change in supply and demand.

- The FX is a decentralized market where the transaction happens through some hubs rather than a central exchange.

- Fundamental events and geopolitical uncertainty directly affect the forex market.

Fail to get a proper education

The forex trading strategy is a process to take trading decisions systematically. The critical fact about the forex market is that it does not have an entry barrier. Therefore, people from every country and any profession can be involved in the forex.

On the other hand, thousands of websites provide forex trading education where most of them are useless. As a result, it is often difficult for traders to have proper knowledge that is effective.

How to find a reliable forex trading education?

Make sure that the mentor of the education provider is chartered in trading. Moreover, you can ask them to show the trading history of their system to ensure that they are profitable. Lastly, the right trading strategy has all elements of a trading system, including entry/exit ideas and trade management rules.

Understand the weakness of the strategy

There is no holy grail in forex trading. There is no way to avoid loss here. Moreover, all market conditions are not suitable for every system. Therefore, you must identify when your trading strategy works well and when not.

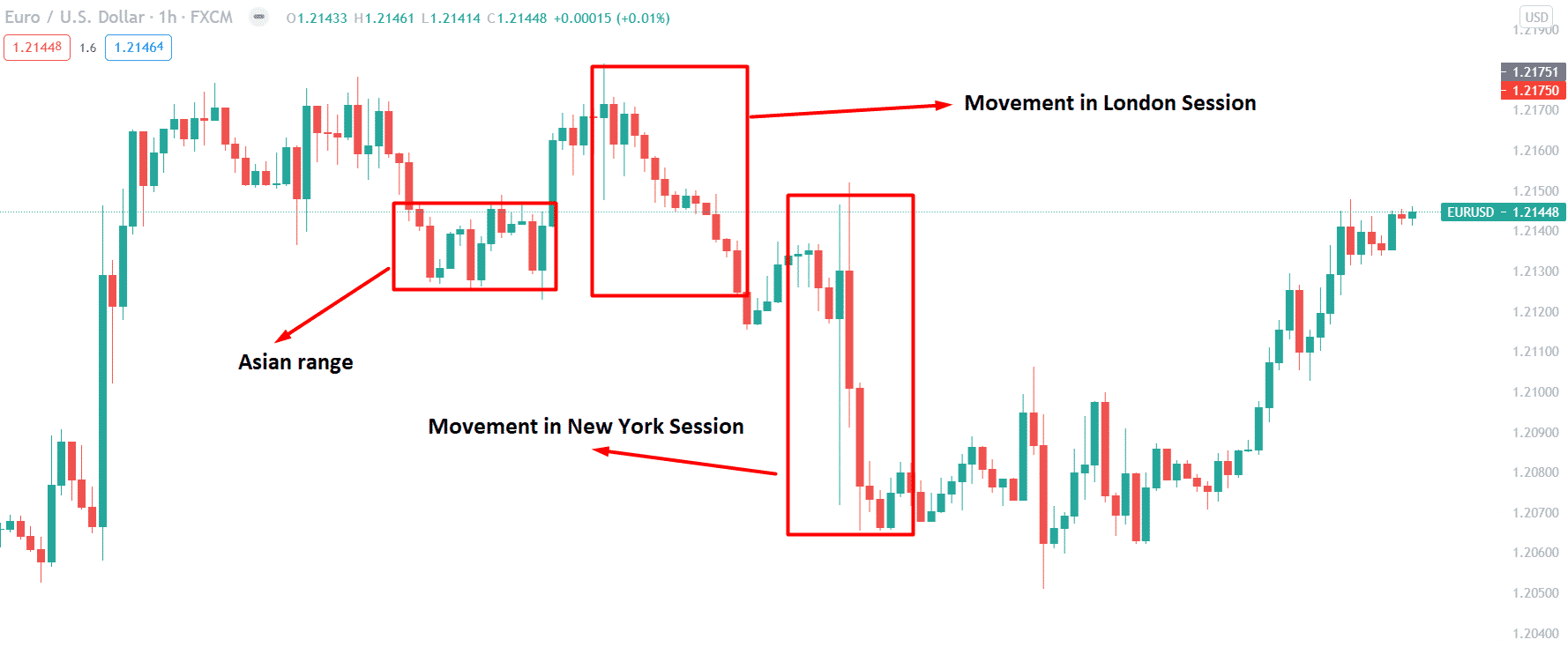

The FX is open 24/5, but every hour is not suitable for trading. If you are a day trader, you have to make trades in an active session. Most of the practical trading sessions are in London and New York, where liquidity remains at maximum.

The above example is proof of market movement in London and New York sessions, but it might not happen every day.

Lack of risk management skills

Your profitable trading strategy might fail if you don’t know how to manage trades. First, you should not take many risks on a single trade. The general idea of a liquid market is to take 1%-2% risk per trade.

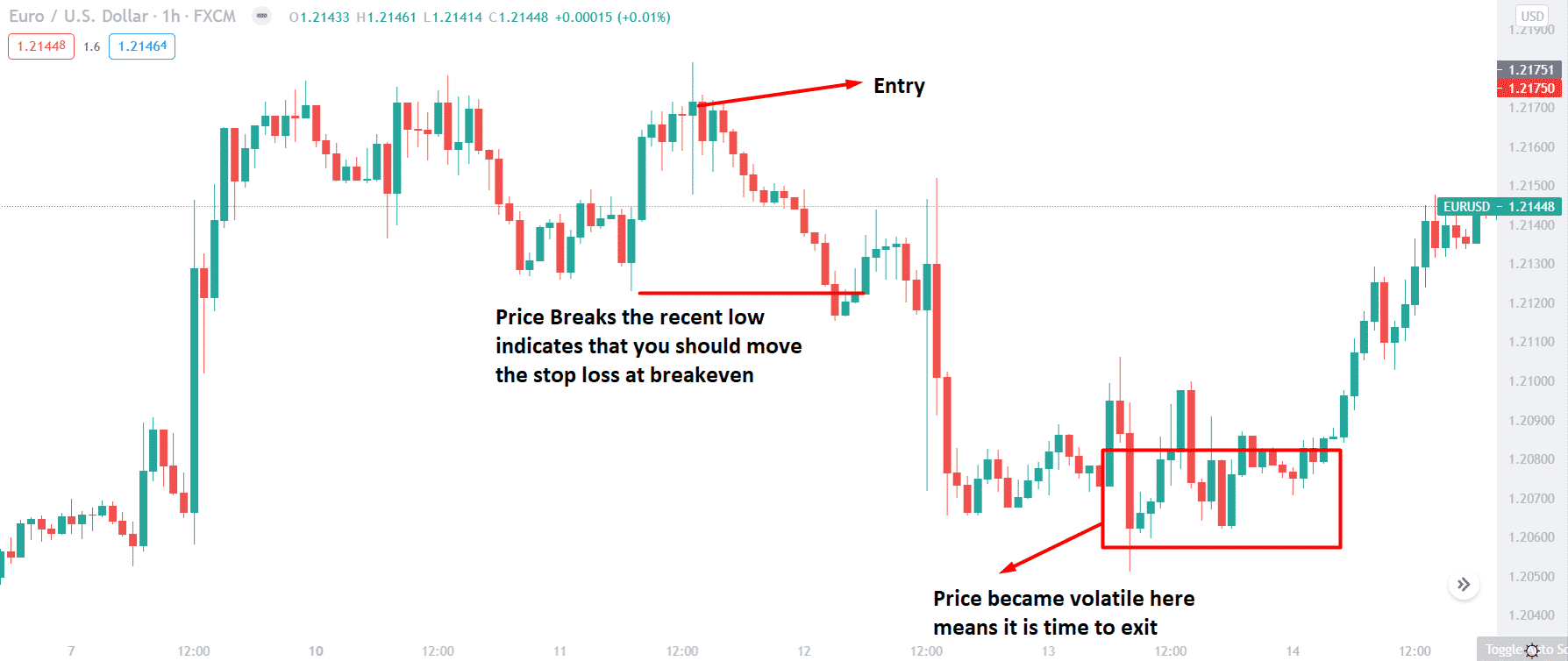

Moreover, after taking an entry, you should manage it properly. For example, if your trading plan does not include when to close the trade or move the stop loss at breakeven, you may fail.

Here is a simple example of trade management from EUR/USD selling.

Ignore trading psychology

Trading psychology is the essential element that many traders ignore. Moreover, education providers do not teach a sound trading psychology system.

You have to match the trading system with your personality to achieve the ultimate goal. If you are making an indicator-based system, it is entirely reasonable.

Moreover, you should know what to do after making some consecutive loss or minimize the risk in a volatile market. Having strong trading psychology needs patience and practice. You can achieve it by reading books about human psychology or doing meditations.

Final thoughts

After the above discussion, we can conclude that forex trading requires a proper education with a profitable strategy. Moreover, you have to apply the strategy in the market with appropriate trade management rules.

Overall, the ultimate success in forex trading depends on the combination of using the strategy and having strong trading psychology.