Market participants must learn how to identify trends and trade according to them to make money constantly. As a result, you may get a chance to hear some typical phrases like trade with trends. The trend is your buddy, but the question is, how much time does it last?

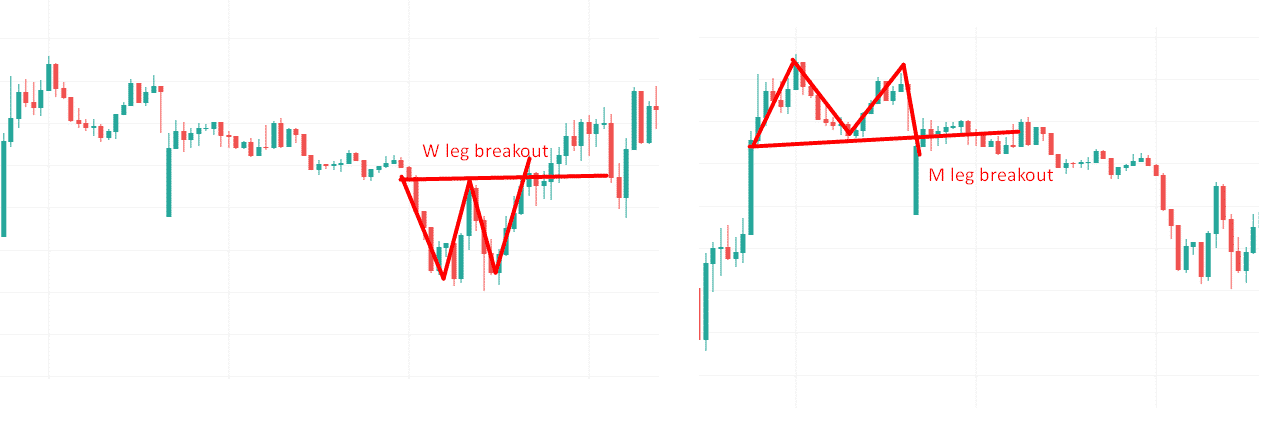

The most popular chart pattern, double top, and bottom pattern, generally occur when the underlying asset moves within a similar pattern. This movement has to be in the face of the letter “W” (double bottom) or the “M” (double top).

So, if you want to trade with the trend, try W and M patterns. Once you recognize the W and M patterns, grabbing the fresh trend or trend reversal will be at your fingertips. The article will explain the abovementioned patterns and use them in real trading.

What are the “M” And “W” trading patterns?

You should make sure you add the “M” and “W” pattern to your trading toolkit since it happens with enough frequency. It resembles a triple top or triple bottom.

But in contrast to the triple top and bottom, we are attempting to break into the market on the legs’ bottom on M pattern and leg’s top on W pattern. Usually, by using the triple tops or bottoms, you are focused on getting in on a neckline’s break or a neckline’s pullback once it has been compromised.

This pattern will minimize the risk level by getting in on the right leg’s top for the W pattern and the bottom of the right leg for the M pattern.

Bullish setup

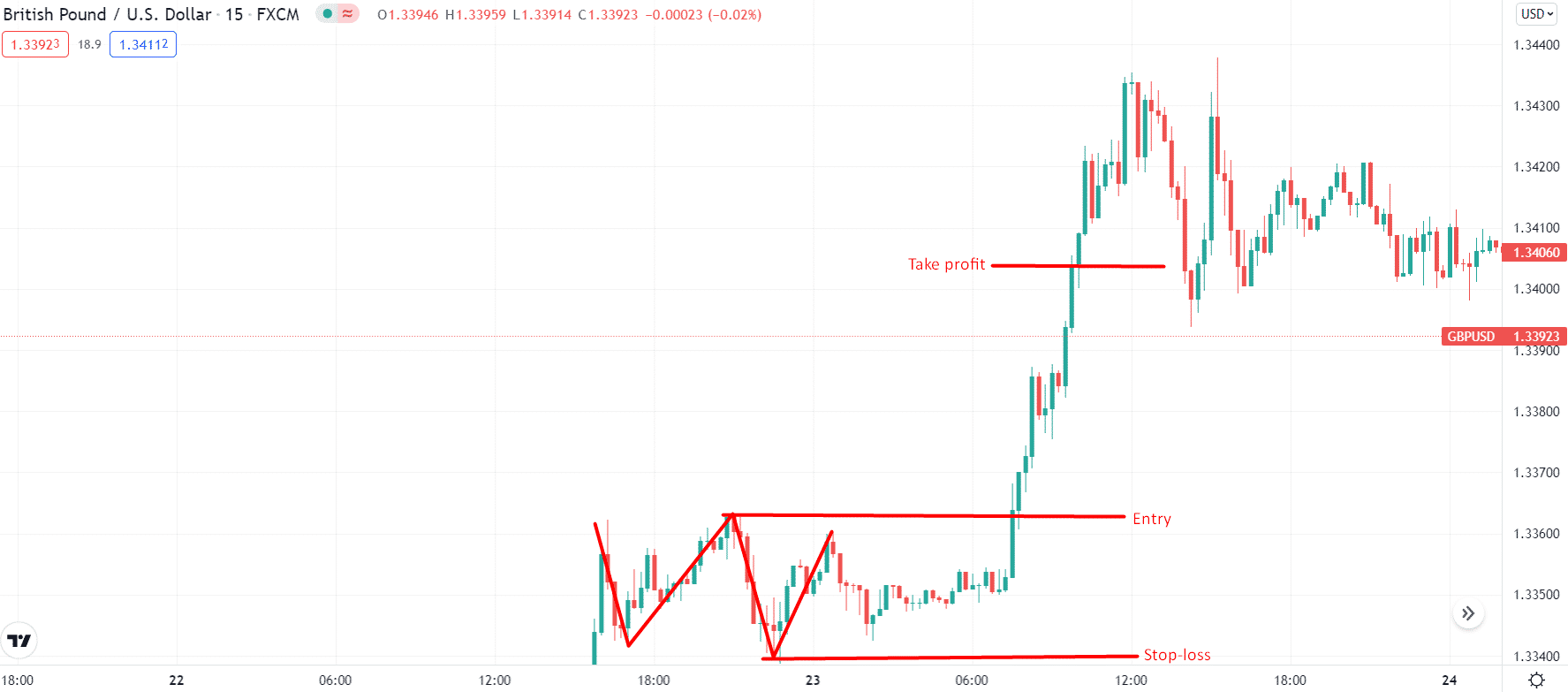

The “W” pattern is bullish in nature. So let’s explore how to find one.

Best time frame to trade

The best time frame depends on the trading style. For example, for intraday traders, 15-minute and 1-hour are better time frames, while 4-hour and daily time frames are recommended for swing traders.

Entry

Wait for the price to break the double top of the W pattern. Then, you may enter using the buy stop order.

Stop loss

You can place the stop-loss just below the low of the pattern.

Take profit

Keep the take profit twice the stop loss.

Bearish setup

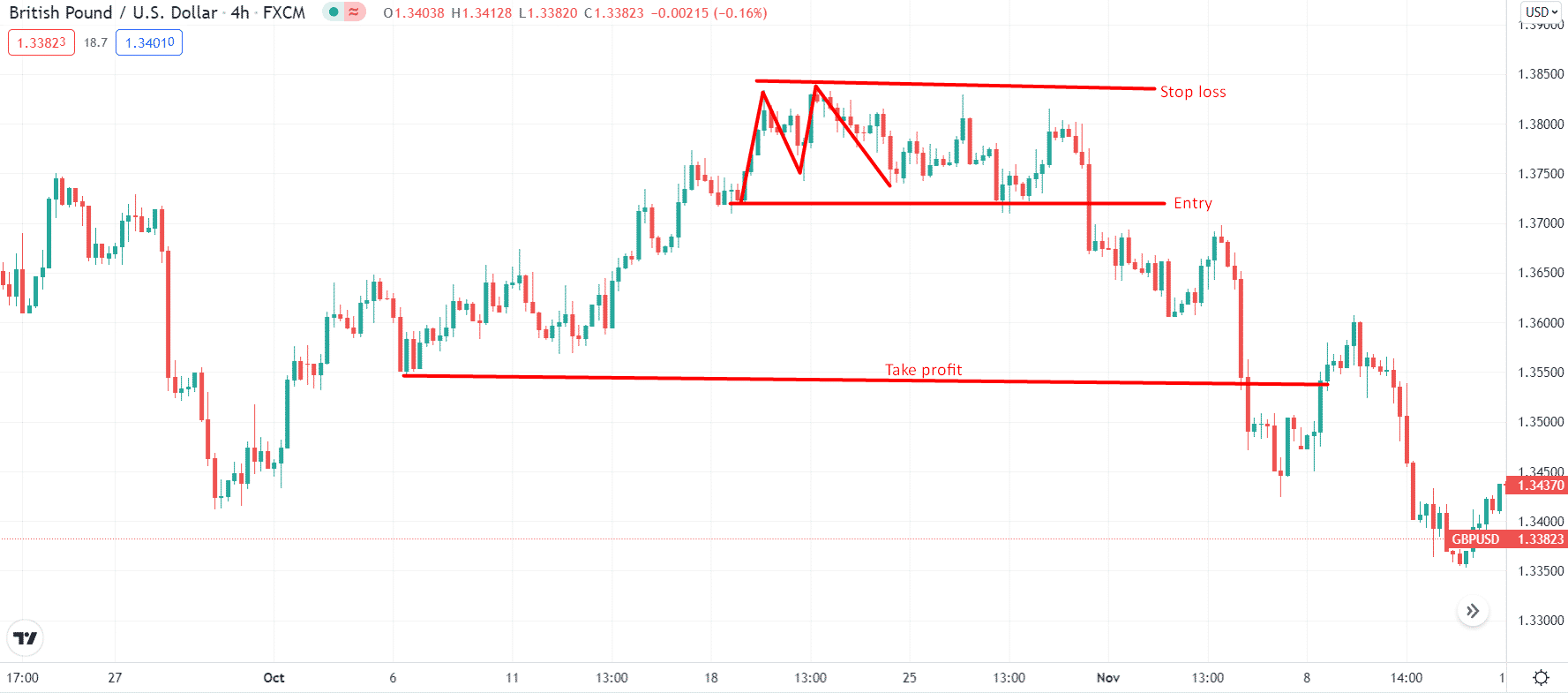

The “M” pattern is bearish in nature. So let’s explore how to find one.

Best time frame to trade

The best time frame depends on the trading style. For example, for intraday traders, 15-minute and 1-hour are better time frames, while 4-hour and daily time frames are recommended for swing traders.

Entry

Wait for the price to break the double top of the W pattern. Then, you may enter using the buy stop order.

Stop loss

You can place the stop-loss just above the top of the pattern.

Take profit

Keep the take profit twice the stop loss.

How to manage the risk in trading?

While trading the M and W patterns, make sure not to risk unlimited. No matter the high success probability, always manage your risk in terms of percentage. It is recommended not to exceed 2% risk per position. Moreover, keep your reward at least twice the risk.

Pros & cons of “M” and “W” trading pattern

We support this trading pattern because it effectively over multiple time frames, i.e., H1, M15, D1, or H4. It can be best used by any swing trader, day trader, or position trader to gain more profit.

In addition, they do act as the universal pattern, which can work greatly with commodities, forex pairs, stocks, or cryptocurrencies.

Being the technical pattern, if they have some metrics, they come with certain drawbacks. One major drawback is that neither M nor W trading pattern will ensure that the new trend you have formed will consolidate. However, traders can use certain risk management tools such as stop loss to consolidate it.

Final thoughts

All in all, the timing solutions for swing traders provide you with an excellent technical analysis of your trades and a financial Astrology checklist, including several points.

The main aim of this checklist is to provide newbie and expert traders with reliable references considering the market trends. In a bullish trend, the reading will be more optimistic, while the reading will be more pessimistic in a bearish trend.

Moreover, with the W and M pattern, you can analyze the uptrend and downtrend to get reliable results in the market.