Volume spread analysis is one of the most important concepts of technical analysis. It tells you who is buying and who is selling at any given time. The market keeps shifting between the four phases, accumulation, markup, distribution, and markdown. Knowing which phase the market is in will allow you to trade with and not against the smart money.

Volume can be a potent tool because it provides another dimension for market analysis. However, it can be not so obvious for those who do not understand it.

Let’s discuss five tips that will help you understand the volume spread analysis in detail.

What is Volume Spread Analysis (VSA)?

Most traders are familiar with the fundamental and technical analysis of the two most popular trading approaches.

The former attempts to predict why something will happen in the market, whereas the latter suggests when.

Volume spread analysis is the third approach that answers both the questions simultaneously. It analyzes price bars and studies volume per candle to predict price direction by finding the demand and supply.

History of VSA

It is a refinement of Richard D Wyckoff’s work — a famous trader in the 1920s who stepped into the trading business in 1888 at 15.

Wyckoff published his weekly forecasts and had a reading audience of 200,000. He made his trading decisions based on the supply and demand in the market and how they are intricately related to professional activity.

Tom Williams, a successful trader in the 60s and 70s, studied Wyckoff’s work in detail and took it further. He called attention to the price difference between volume and the closing prices. He concluded that volume is the primary indicator for a professional trader.

Tips to understand volume spread analysis

Following are the five tips that you need to follow to understand the volume spread analysis better.

Tip 1. Learn principles

Learning the principles is the prerequisite for stepping into any field. The same is the case for volume spread analysis. It would help if you knew the principles before using the analysis technique to excel as a trader. The investors who jump in without overviewing the fundamentals tend to regret later.

Why does it happen?

Forex is a quick market. The haste of getting rich can tempt the traders to act irrationally. Moreover, principles can be a little complex to understand, which is why traders skip learning them.

How to avoid the mistake?

Traders should learn the law of supply and demand. The market plays along with the supply and demand movements created by professionals. If the buying ratio is greater than the selling, the market goes up. If the selling ratio is higher than the buying, the market will go down.

As simple as it sounds, financial markets are not practically that easy to analyze. The principle mentioned above is correct, but supply and demand work slightly differently in financial markets.

There should be more buying than selling for an uptrend, but there must be a shortage of sell orders, aka distribution for an actual uptrend. Similarly, for a genuine downtrend to form, there must be a decline in buy orders.

Professional traders buy considerably at lower price levels during the accumulation phase. This forms a bearish candlestick with a volume spike on charts. According to VSA, the bearish volume represents the strength of a market, and a bullish volume represents its weakness.

Only professional traders can cause a real downtrend. Therefore, selling by professionals is represented on the chart in bullish bars with a high spike in volume, while the weakness appears on the upper bar.

One must observe these minute details to excel at trading with the help of VSA.

Tip 2. Learn common patterns

The market shows similar repetitive patterns. These common patterns include no demand and supply, widespread down bar pattern, upthrust, shakeouts, etc. Therefore, a trader must learn them to become a successful trader.

Why does it happen?

Traders do not usually learn common patterns, which is why they appear lost. Therefore, it is crucial to understand the common patterns in the trading market.

How to avoid the mistake?

You have to do what the mistake committers are not paying heed to. First, you have to learn common patterns. This will help you analyze the market better.

Instead of studying each pattern separately, you will be able to categorize them in pairs or trios.

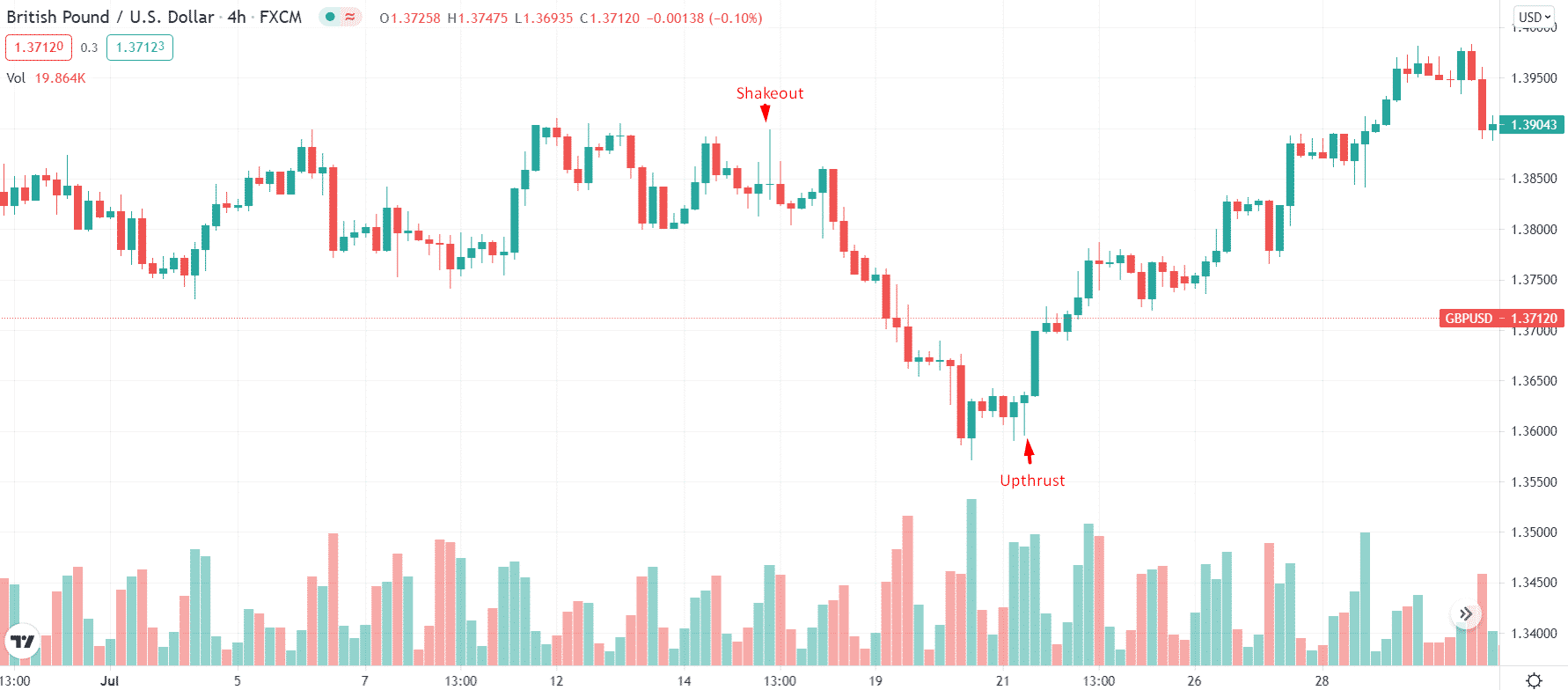

For instance, the upthrust and the shakeout are two patterns that almost mirror the other.

Both patterns show the market manipulation played out by expert traders. Both aim at taking maximum stop losses from traders who opened positions at the right side of the market. Similarly, both carry traders who have not taken positions in the wrong direction.

Tip 3. Backtest patterns

Backtesting means checking how well a strategy or pattern will perform based on historical data. This helps predict the future trends better and aids the volume support analysis.

However, many traders still do not practice it.

Why does it happen?

Traders get excited when they learn a new pattern. However, in sheer excitement, they forget to test the pattern on certain instruments. This can lead to random trading that may end up in losses. For example, as a VSA aspirant, you learn the no demand pattern. However, you have no idea whether the pattern works as a reversal or continuation for XAU/USD. Perhaps the same pattern works well in GBP/JPY but may not perform well for the WTI.

How to avoid the mistake?

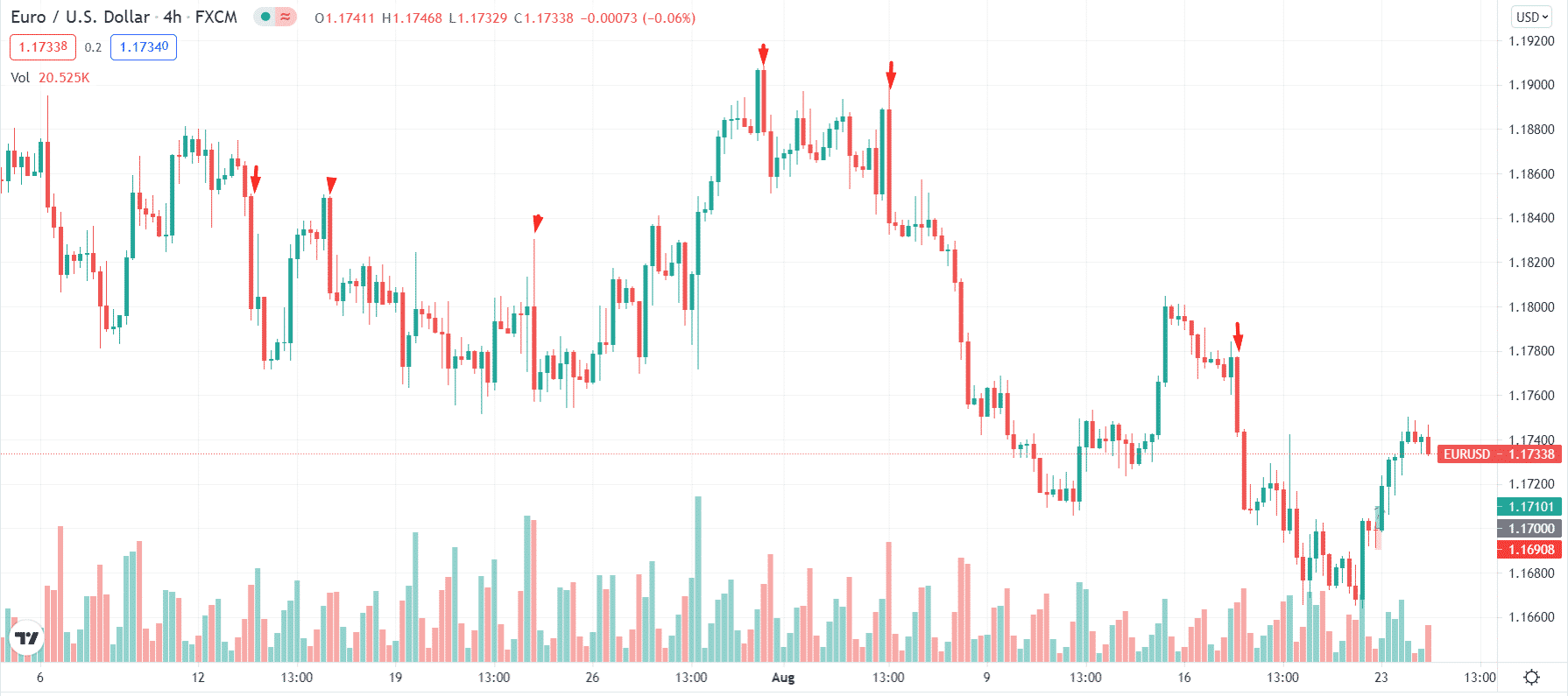

It would help if you backtested the patterns on some specific currency pair based on the historical data. For example, you can test a “widespread down bar though previous support” pattern on the EUR/USD pair. Note the results for ten instances.

If 7 out of 10 instances yield profit while only three bring loss, it means that the particular pattern is suitable for EUR/USD pairs. This saves the traders from bigger losses.

Tip 4. Carve strategy

Strategy is a crucial weapon to survive in the trading business. It is the anchor of a trader. Therefore, every trader must formulate a strategy that will help them in the volume spread analysis.

Traders who do not follow this tip are more likely to end in hot waters.

Why does it happen?

A strategy is like a framework for a trader. Their guiding map tells them when to enter a trade when to exit, and what moves to make. Without one, a trader won’t last long in the forex business. Volume Spread Analysis is not helpful if you do not transform it into a working strategy.

How to avoid the mistake?

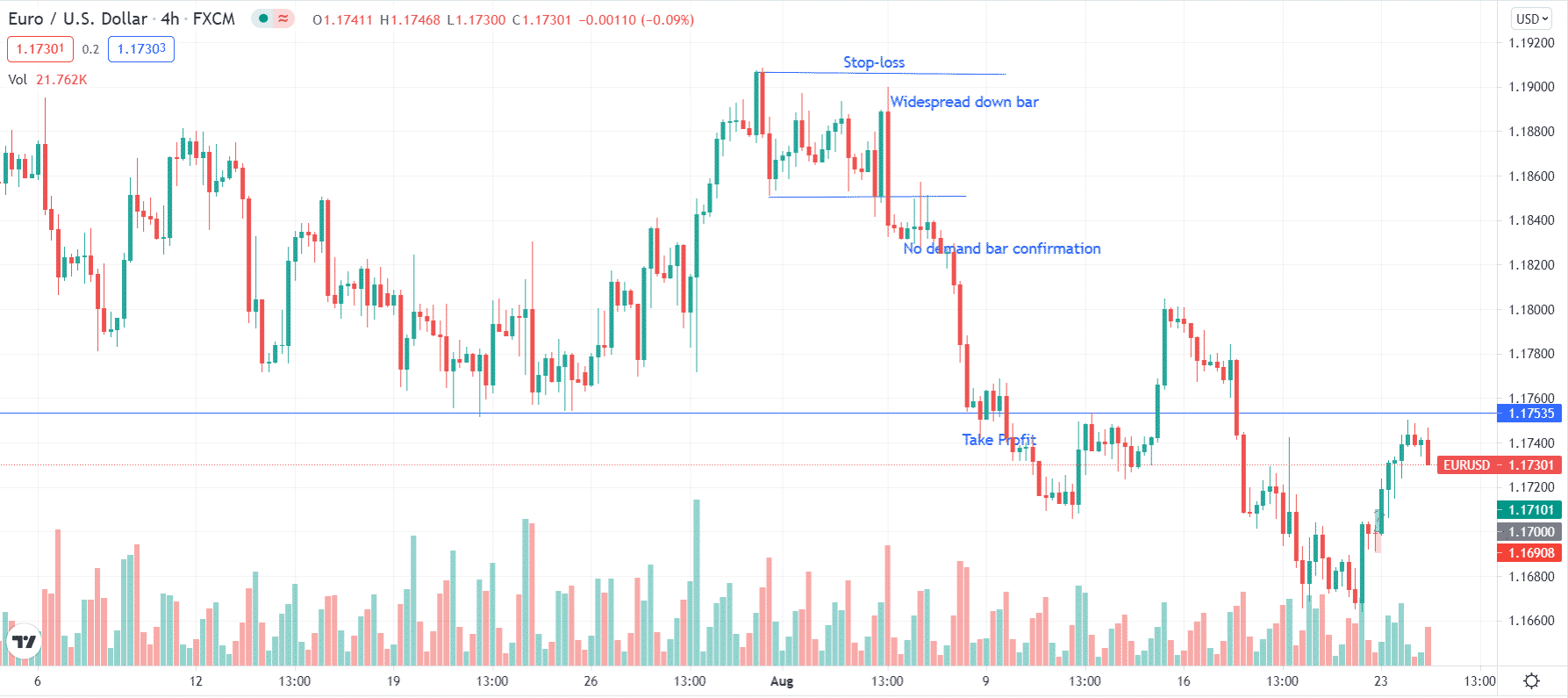

Once you are done backtesting on a certain pair, carve a strategy based on the VSA. Determine your stop/loss, take profit, and entry/exit points. No matter how good a strategy is, you won’t get efficient results if the stop/loss isn’t decided.

Tip 5. Learn confirmatory analysis

It would help if you acquired confirmation from different time frames in confirmatory analysis, which is vital for VSA, yet traders miss out on it.

Why does it happen?

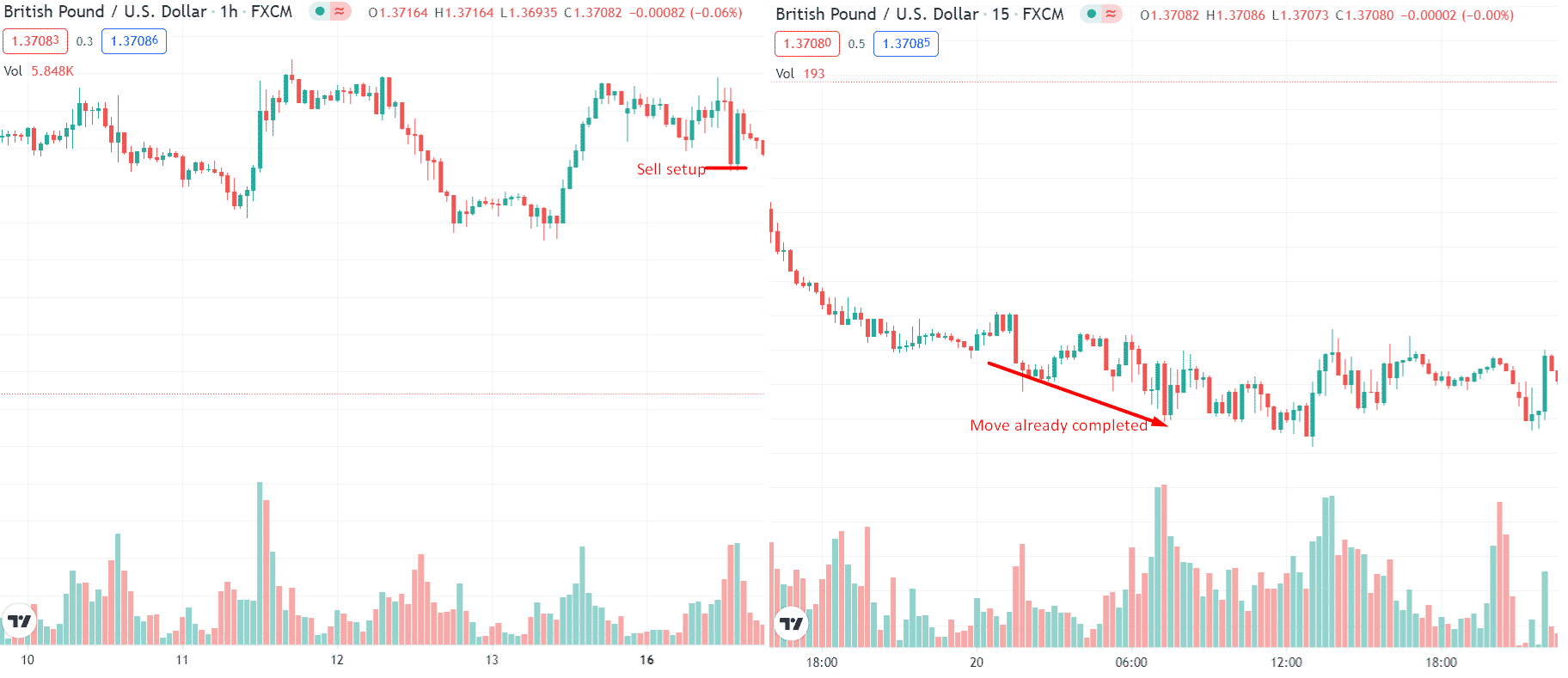

A single time frame should not tempt a trader. Even trading one financial instrument is not a good option. You should know what’s happening in other markets and timeframes. Perhaps you find a long trade setup on a 1-hour chart, but the price could be ranging on a 4-hour chart, or it may have already been done with the move on a 15-minute chart.

How to avoid the mistake?

If you have observed a pattern on the 1-hour chart, substantiate it in 30 minutes and the 4-hour chart. This will provide a higher probability regarding the stability of the pattern.

Final thoughts

Understanding volume spread analysis can be a game-changer for your trading life. So make sure to follow all the tips mentioned above, and you will ace the market pretty soon.