Choosing an appropriate strategy enables making frequent trading positions and constant profits from the financial market. The 50 pips a day forex strategy is an excellent and easily applicable trading method.

However, traders need to have a clear concept and master any trading strategy before applying it to real trading. This article will introduce you to the 50 pips a day FX trading strategy. Moreover, we describe bullish and bearish setup through this trading method with charts besides risk management ideas.

What is 50 pips a day trading strategy?

It is a short-term trading method, which works fine in any major FX pair with an average of 70-80 pips daily movement, including EUR/USD and GBP/USD. It is an easily implementable trading strategy that allows making trades every day with some simple understanding of forex trading. Novice traders often face confusion using technical tools, indicators, or chart patterns when making trade decisions. This trading method doesn’t involve any of those issues.

It is a suitable trading strategy for day traders. Traders who follow other techniques such as scalping, swing trading, etc., may seek different ways to make trades.

How to trade with the 50 pips a day trading strategy?

This trading strategy is applicable for 1-hour charts. You have to choose major currency pairs for sufficient volatility. You don’t need to use any indicator of trading tools to make trades with this strategy. You will get a chance to make trades every day with this strategy.

Find out a specific candle on the hourly chart. Place pending orders after closing of that candle and wait to hit any pending order. When any pending order is active, immediately close the other one. Set stop loss and take profit. This trading technique is as simple as that. This strategy involves some rules as follows:

- Identify the GMT 7 am candle on the hourly chart of the target asset. You can get the candle by performing a google search and match the time with your local time. Otherwise, you can contact your broker to know the timezone.

- Always choose major pairs to trade with this method as it requires sufficient volatility.

- Open pending buy and sell order after the closing of the GMT 7 am candle.

- When any one of those two pending orders is active, close another one without any hesitation.

- Place stop loss above or below 5-10 pips of the GMT 7 am candle.

- The profit target will be 50 pips for any active order.

- Repeat the process regularly in an average market environment at a specific time.

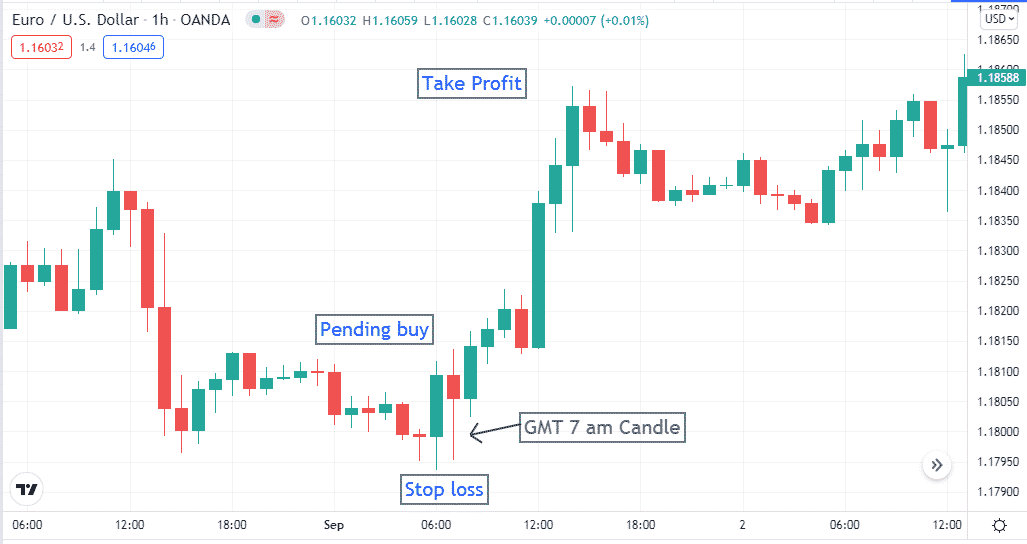

Bullish trade setup

There is no need to use any technical tool or indicator to trade with this strategy, as we mentioned above. Identify the GMT 7 am candle on the hourly chart of the target asset to get buying opportunity at the asset. We suggest checking on the current trend from the upper time frames charts such as daily or 4-hours before making entry.

Moreover, we recommend not trading with this trading method during trend-changing events such as interest rate decisions, inflation, deflation, GDP, employment data, etc.

Entry

After identifying the GMT 7 am candle, wait till the candle closes. After closing the candle, place a pending buy order above 2 pips of the candle range. Meanwhile, a pending sell order below 2 pips. Wait for the pending buy to be active.

Stop loss

When the buy order is active, close the pending sell order immediately. Put an initial stop loss below 5-10pips of the GMT 7 am candle.

Take profit

The profit target of this trading method is always the same. Set take profit above 50 pips of the active buy order and will till the take profit or stop loss get hit by the price movement.

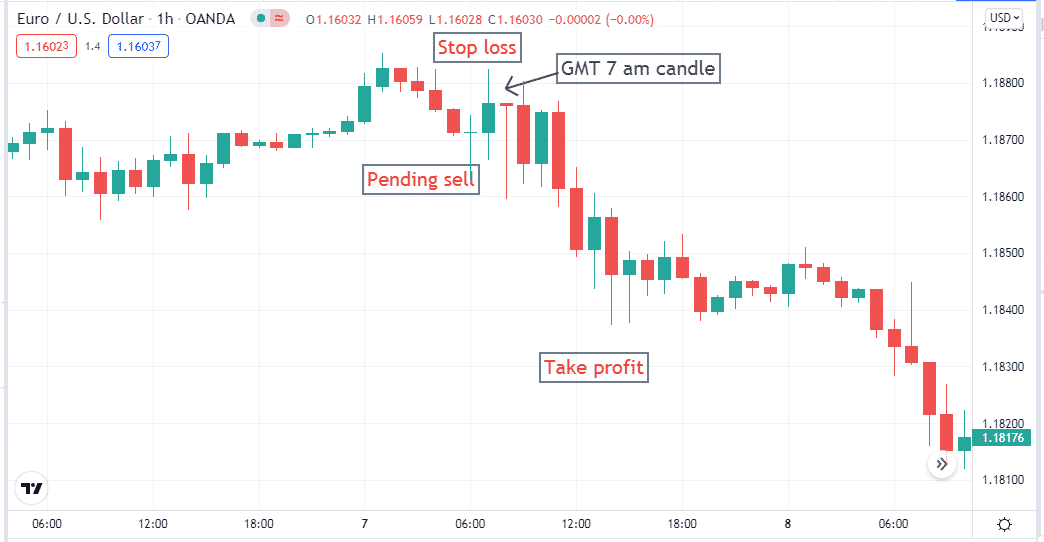

Bearish trade setup

The bearish trade setup is the inverse of the bullish trade setup. It is all the same till I put the pending orders. You don’t know whether the buy order or the sell order will be active. For a bearish setup, you have to wait till the pending sell order is active.

This easy applying trading technique doesn’t require any ultimate skill or requires no technical indicator or tool complexity. Identify the GMT 7 am candle on the hourly chart of your target asset and wait till the candle closes. It’s worth checking the current trend from upper time frame charts such as 4-hours or daily charts.

Entry

When the GMT 7 am candle closes, place a pending sell order below 2 pips of the candle. A pending buy order above 2 pips of the candle range. Wait until the pending sell order gets hit by the price movement.

Stop loss

When the pending sell order is active, close the pending buy order and place stop loss above 5-10pips of the GMT 7 am candle.

Take profit

The profit target will be below 50pips of the active sell order.

How to manage risks?

No doubt that the FX market is unpredictable. Some 2-3 pips uncertain price movement occurs for participants action and spread of different brokers such as dealing desk, market maker, etc. We recommend choosing brokers carefully beside the trading pair as you have to select currency pairs with sufficient average moves, so you don’t have to face any lack of volatility.

Place the stop loss and take profits carefully. Moreover, the major fact is to be careful that both pending orders don’t get hit. You can shift your stop loss at or above the breakeven point before the price reaches the profit target as a part of trade management, but that won’t be more than 20-25 pips.

Final thought

This trading method is not invincible, as the winning ratio is not so good. There are many other excellent strategies to make constant profits in the forex market. Performing the fundamental and technical analysis may increase profitability and enable options to enter at more accurate trades. This strategy works fine on an average price movement of forex assets.