Adaptive EA is compatible with the MT4 and MT5 platforms and can be trained to trade on any currency pair via the built-in neural network. It is possible to tweak multiple robot settings such as lot size, no of grid orders, spread filter, and stop loss. We will analyze the EA to see if it is profitable for us in the long run by going through its characteristics, trading results and reliability.

Vendor transparency

The vendor is based in the US, named Svetlana Visnepolschi. The seller has sold more than a hundred products in the MQL 5 marketplace and has one year of market experience. The dealer has 18 subscribers only and 2 out of 5-star in terms of ratings. She can be contacted directly through the website by sending a message.

How Adaptive EA works

Traders can optimize the robot in the following steps:

- Run the robot in the tester for it to learn according to its neural network

- The system is trained to perform random transactions during the first pass of the tester

- Using your trained neural network, you may examine the trade results during the second pass

Some of the essential features of this EA are given below:

- This robot has VPS migration which should be turned on before shifting to VPS from MQL.

- There is a time filter to enable or disable trading as necessary.

- An information dashboard is provided.

- Directory for trained neural web is available in the form of an adaptation folder.

Timeframe, currency deposit, leverage

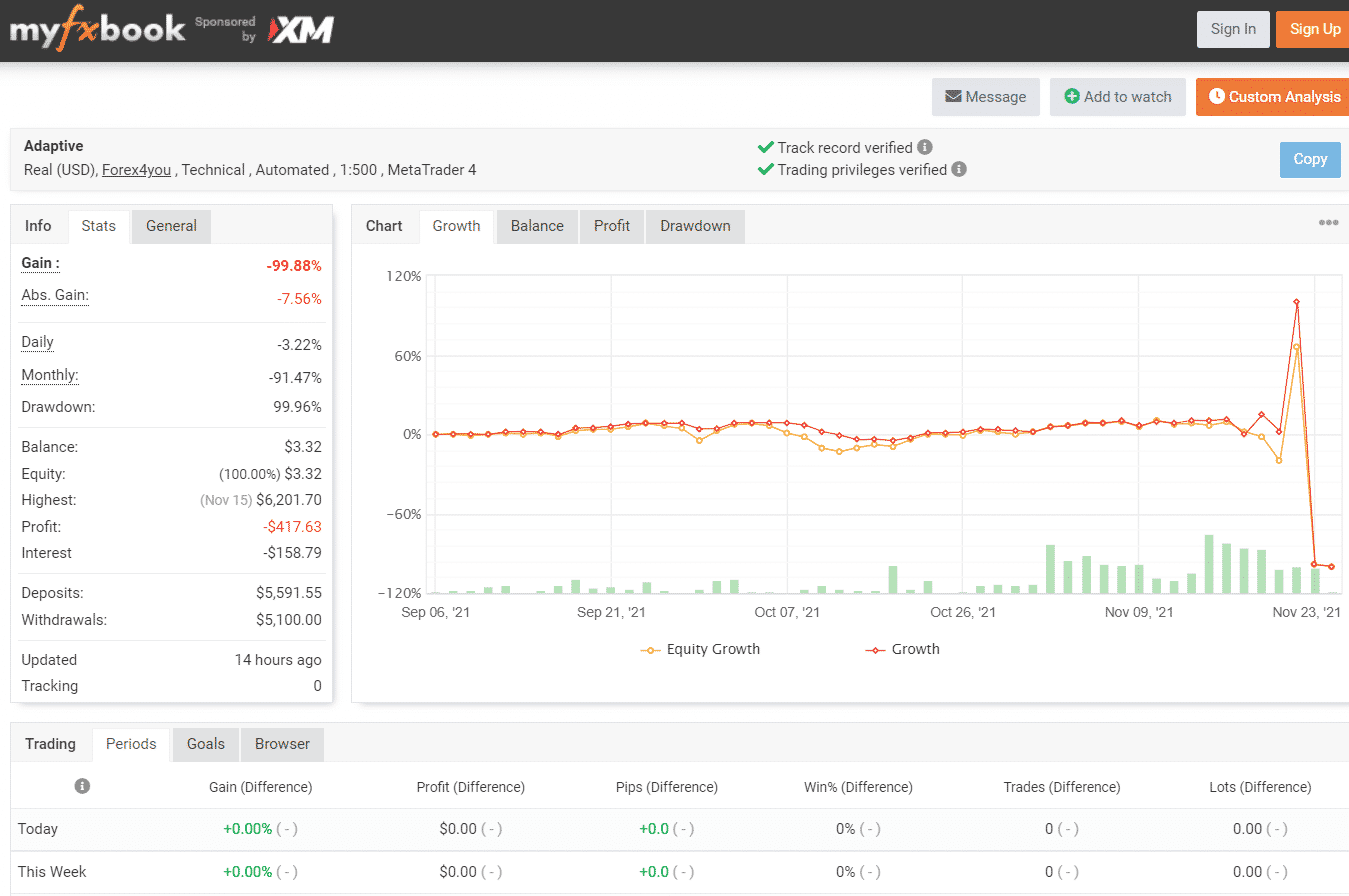

The leverage used for this EA, as visible from the live records on Myfxbook, is 1:500. It can be used for any currency pair, and there is no information about the timeframe to run the system.

Adaptive EA trading approach

The developer is not clear on the strategy of the EA and only states that it works on multiple instruments. From the settings, we can observe that it implements averaging strategies as there is an option to set the grid count.

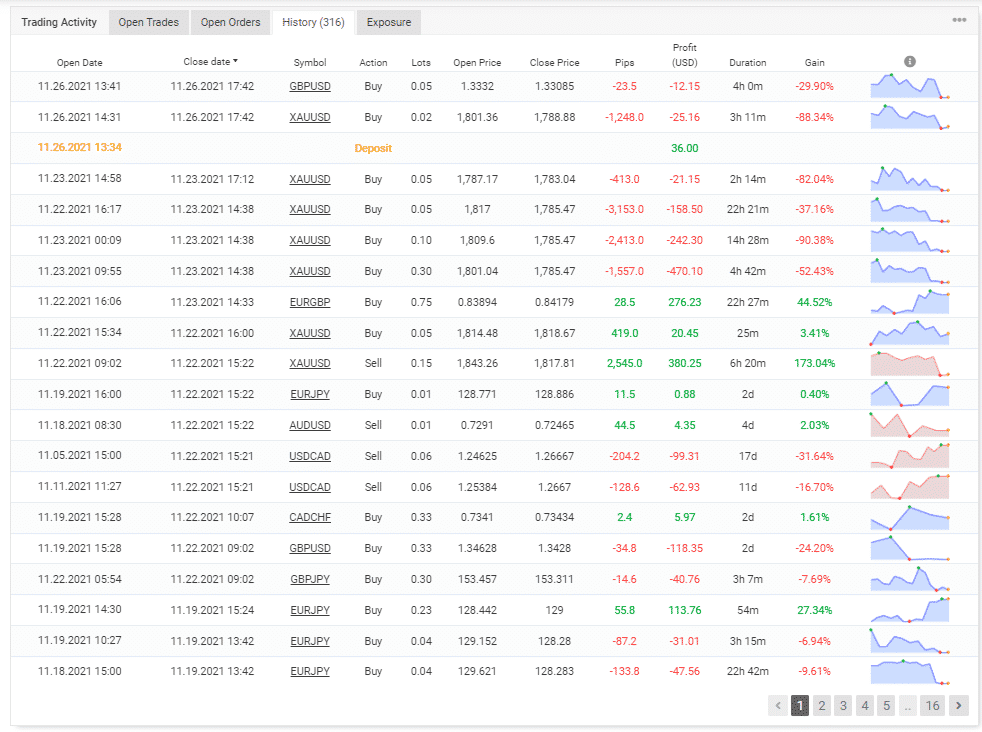

The live records on Myfxbook show us the use of martingale in combination with a grid. There is no fixed stop loss attached with trades, and the average trade length is 3 days.

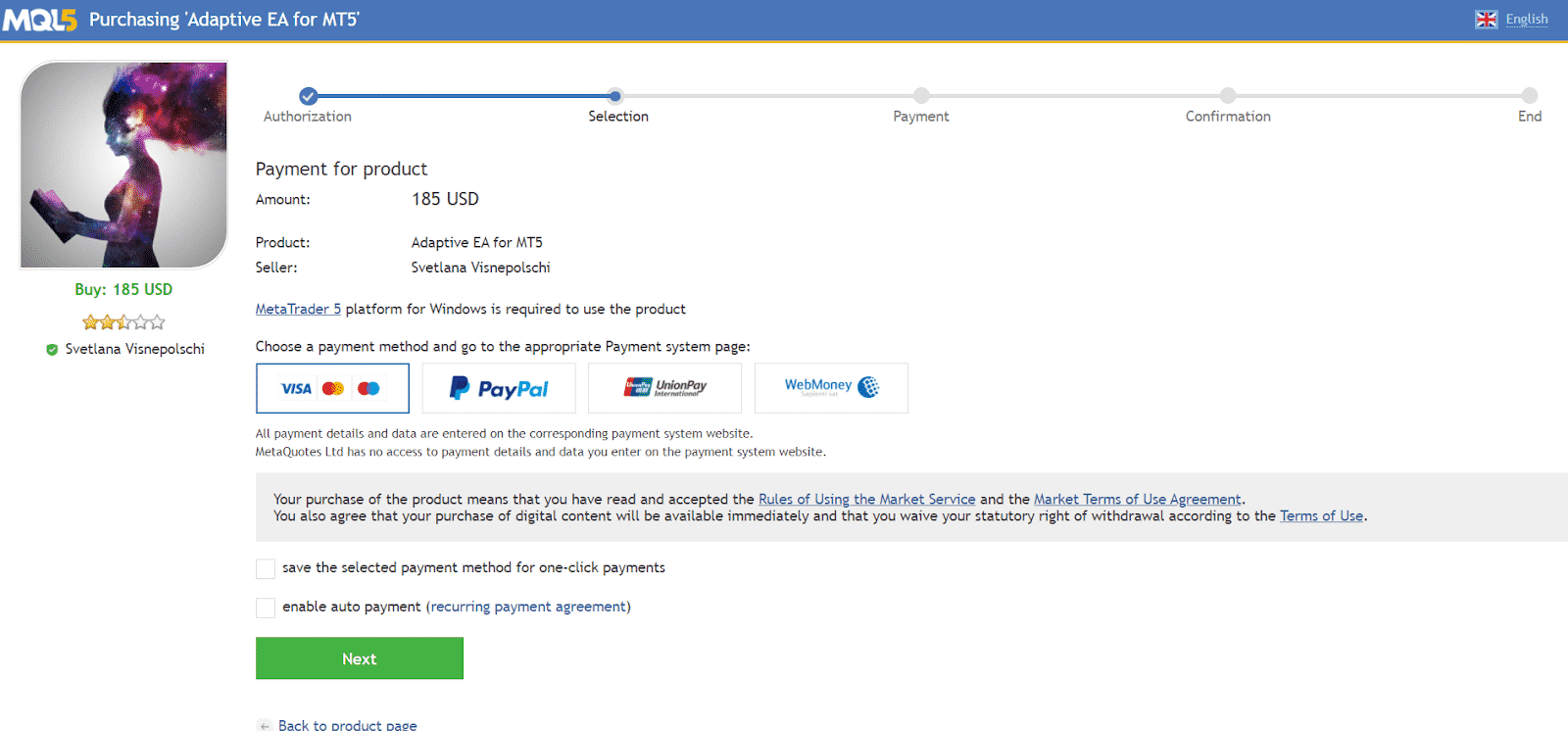

Pricing and refund

Market participants can buy the Adaptive EA for $185. The purchase is not trustworthy enough because of a lack of return or exchange policies.

Various payment options are available for the traders, like Paypal, Visa card, Unionpay, MNR, and Web money.

Trading results

The EA does not provide any information regarding the backtesting results making it and the company less trustworthy.

Live trading results are available from 2021.09.06-2021.11.23 for USD on Myfxbook. According to the latest statistics, drawdown stood at 99.96%. The total profit was -$417.63, and equity was $3.32 (100%). Gains for the robot are -99.88% which shows us that the account has resulted in a margin call. The profit factor was 0.93, with a winning rate of 55%.

People say Adaptive EA is…

Bad. Investors are cautioned while using Adaptive EA as the reviews available on MQL5 are extremely negative. One investor states that traders should stay away from the robot.

Verdict

| PROS | CONS |

| The algorithm is 100% automated | No customer support |

| The robot operates on the MT4 and MT5 platforms. | No statistics are available for live trading results |

| There is no information regarding the drawdown | |

| No data regarding the timeframe is provided |

Adaptive EA Conclusion

Adaptive EA does not give any information about backtesting records, and there is little information about the sellers. Furthermore, the reviews available on the site are not positive. The customer support is minimal, and the pricing is a bit high.