The current stock market makes investors wonder if they can make money by buying stocks. The answer to this is yes. With low prices and higher volatility than before, now is a great time to start trading on the stock market.

Tim Grittani started to trade stocks about three years ago with the investment of only $1500 with automated penny stock trading. Now his portfolio is worth more than $1 million at such a young age of 24.

Suppose you are confused about how stock trading systems can help you make a stock investment and grow money. In that case, you should read more about automated trading platforms, robotic trading software, and online day trading systems.

Review the below-given criteria to choose automated stock trading systems and choices among different software to select the best for yourself.

Making the right choice when choosing an ATS

Let’s explore some variables that help you find an ATS that fits your needs.

Backtesting

Selecting an ATS requires good backtesting software as two classes of backtesting are available, i.e., research one and event during testing. The backtesting is a simulation of how an algorithmic trading strategy would have performed on the past data. It is typically possible to quantify a strategy’s return on risk, usually some popular performance strategies like Sharpe ratios or informational ratios presented in the backtesting outcomes.

Languages for programing

Choosing the correct programming language is very important in selecting the best algorithmic trading software. DIfferent languages come up with other pros and cons. Algorithmic trading is primarily carried out in C++, C#, Java, MATLAB, Python, R, etc. Knowing these languages is a plus in choosing the best platform for automation in stocks.

Statistics

The ATS offered by different vendors permits foreign exchange and backtesting of some securities only, while others provide access to specialized data feeds such as Thomson Reuters and Bloomberg.

To decide which automated market-trading platform is the best for you, ensure that you know exactly what it offers. For example, some platforms are specific in exchanging fore and equities in particular markets. It is also crucial to consider the frequency of data you would need. For example, EOD data is required daily in some cases, while other strategies need intraday trading stats.

Functional interface

Several automated trading platforms allow the ability to carry out investments and backtest on the functional interface, making accessing the platform from anywhere highly convenient. It also provides a web-based platform in addition to a desktop exchange platform.

Intricacy and complexity

It varies from platform to platform how easily they can be used. It may be necessary to have programming experience to use some of them. Demo versions are usually available on most platforms to help you choose the one that suits your style. For a particular asset class, platforms can have a different level of complexity, and users should check out the tools and features offered by each of them.

Strategies permitted

Some accounts might have limitations on how many strategies can be loaded, and you will need extra accounts if you have to get access to more techniques. If you want to use multiple accounts on our computer, please have sufficient memory on your computer. Platform-specific trading strategies can also be bought as subscription add-ons, which can be paid via several periodic manners.

Price histories

Your trade commissions can significantly impact your profits. Therefore, consider your trade requirements carefully when choosing a plan. To make sure you are only paying for services you want, check if an initial or monthly fee is charged and what is offered in place of it.

Customer support and technical service

Platforms for algorithm trades have high uptime and are seldom down. Consider the history of the platform’s outages, how quickly resolved those issues, and how helpful and knowledgeable the staff behaved. Consider all these criteria before planning to get a subscription to any automated market-making software.

Let’s discuss an overview of different trading platforms, their pros, cons, and pricing ranges.

Webull automated stock trading system

In 2017, Webull launched in the US as a commission-free broker. A mobile app was initially released, but the broker rolled out a web interface to accommodate desktop users shortly after. The interest rate starts at as low as 7% and drops to just 4%, depending upon your account balance.

Pros

- Transacting without commission and no account fees.

- Dealing with global stocks, ETFs, options, and cryptocurrencies.

- Technically sophisticated charts are included.

Cons

- Only US traders can avail of the benefits.

- No forex, CFD, and commodity markets.

- Payment methods are limited to bank or wire transfer.

Price ranging

Unlike other brokerages, WeBull has no commission or fees.

SoFi

With SoFi, you can invest actively or automate. Those who choose ATS can trade stocks, ETFs, and cryptocurrencies whenever they wish. In addition, the SoFi ATS service operates as a robo-advisory service around the US.

Pros

- No fee stocks.

- Speedy and innovatively digital account opening.

- Worthy customer service.

Cons

- It can be used in the US exclusively.

- Have a limited product portfolio.

- Specific research tools.

Price ranging

The company SoFi offers zero-fee or discounts brokers through SoFi Invest.

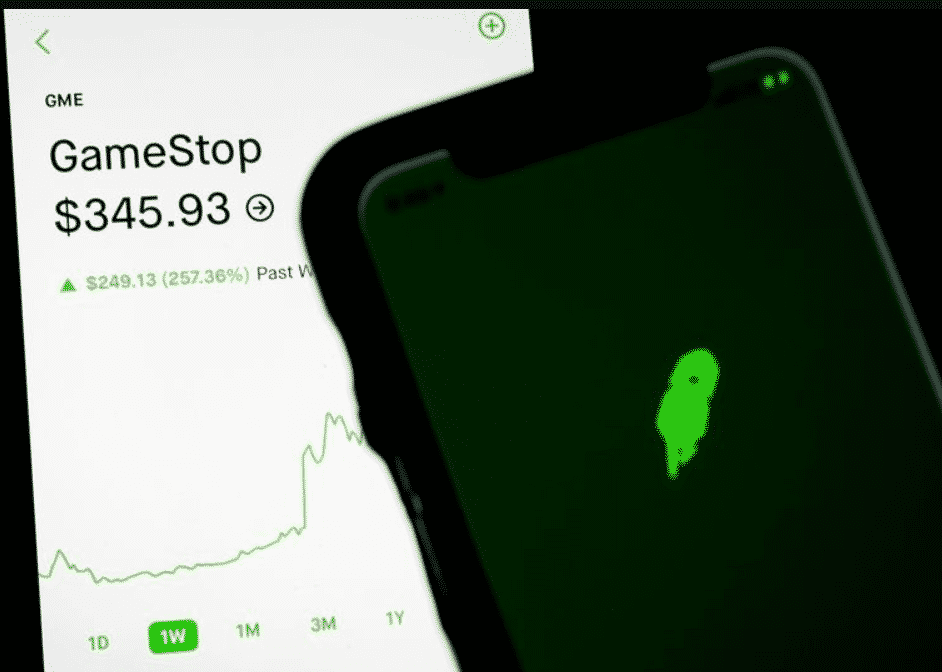

Robinhood

A no-fee discount broker based in the US, Robinhood was established in 2013. Various financial authorities oversee the securities and exchange company, including SEC and FINRA. Robinhood offers clients cash management in addition to its brokerage service, thus assisting traders in earning interest on their uninvested funds.

Pros

- No fee US stock and exchange of ETFs.

- A specialized platform for mobile and web trading.

- Speedy and digital account opening.

Cons

- Low ranges of products.

- Customer service and technical support are not very fast and user-friendly.

- Limited material for education.

Price ranging

The broker doesn’t charge withdrawal fees or inactivity fees for US stock exchanges.

Tips to avoid scams in trading stock

Performing extensive research is one of the most important aspects of avoiding stock trading scams. Do your research about the investment platform, and don’t rush to make decisions before you understand the rules and regulations.

There are many trading brokers in the market, and they all claim to be the best. But all you have to do is be aware, having consideration and comprehensive research. So choosing an appropriate, reliable, and trustworthy automated training software is a difficult task. You can not only avoid scams by investing time in the research, but you also increase the chances of profit in the world of computerized markets.

Final thoughts

Choosing the best-automated stock trading software can be challenging, but you can find the best with comprehensive research. You can select the software by considering the above-given characteristics among several platforms.