Trading stocks and CFDs through automated software can help you increase the efficiency of your transactions by implementing your transactions more quickly for years now.

For example, algorithmic trader Albert Mate has been outperforming the S&P 500 returns. As a result, he earns an average of 23.5% in a year, which is much greater than any other trading instrument. Using this rate, his capital doubles every three years.

However, the good news is that several successful traders out there rule the market with technology implementation. With each passing day. The number of such investors increases.

Discover how to choose the right automated trading platform with several outstanding reviews of different automated software.

What to look for in software for automation?

There are few things that everyone must consider before purchasing software or signing it up to ensure that they are present before you deal in anything. Great ATS does not require a download from anywhere. Instead, you can access them via your browser without the need to download them.

Binary robots can even be customized to work at various broker platforms. Additionally, they can be used by both novice and experienced investors. The trades you make on the ATS and what you do with it should be entirely under your control. It will be helpful for you to go through the broker reviews before choosing them to trade and researching before deciding.

Last but not least, ATS must be free to set up, have a robust copying system, and have high win rates to be worthwhile to you. Reading on, you will find the best ways to choose an ATS with reviews on some reliable automatic exchange software.

How to choose the best automated trading system?

It is critical to know yourself even if you are performing algorithmically. Trading is a mental game like anything else, which sounds strange, but it’s true. It is possible to lose all your investment with ATS. Hence, the crucial thing is to choose the best Robotic Stock Trading software before you start trading through it.

Build automation system conditions based on the theory of trading psychology

Before we go into the details of trading software, it’s essential to know what is involved. The ATS trading required a great deal of discipline, neutrality of emotions, patience, similar to the other investing methods. Therefore, it is advisable to test yourself mentally if the software is according to your skill level.

Determine your trading strategy

The next step is to understand what kind of trader you are after setting up your brain for investing. Then, you should test how much time you can spend on the trade investments. The automation in the investing software could prove to be best for the people who have additional time.

Investing in financial capital that is affordable

In general, a compatible strategy should have a minimum investment of $50,000. According to the strategy and algorithm used, the amount may vary. Further, to absorb drawdowns in high-frequency strategies, sufficient capital is required.

Build a cutting edge automated trading software

For tradable algorithmic software to work well, it is necessary to have programming skills. Thus, you must be aware of different programming languages like C++, Java, and Python. You will need to perform several tests to eliminate bugs once you have this knowledge. It is vital to control your technology stack as you explore the high-frequency options. Code up the infrastructure is much more time-consuming and requires more concentration. To succeed in the automation career, you should put in a lot of effort as a beginner.

Top 3 best-automated software

Let’s learn about the best three software with their pros and cons so that you can decide independently for yourself.

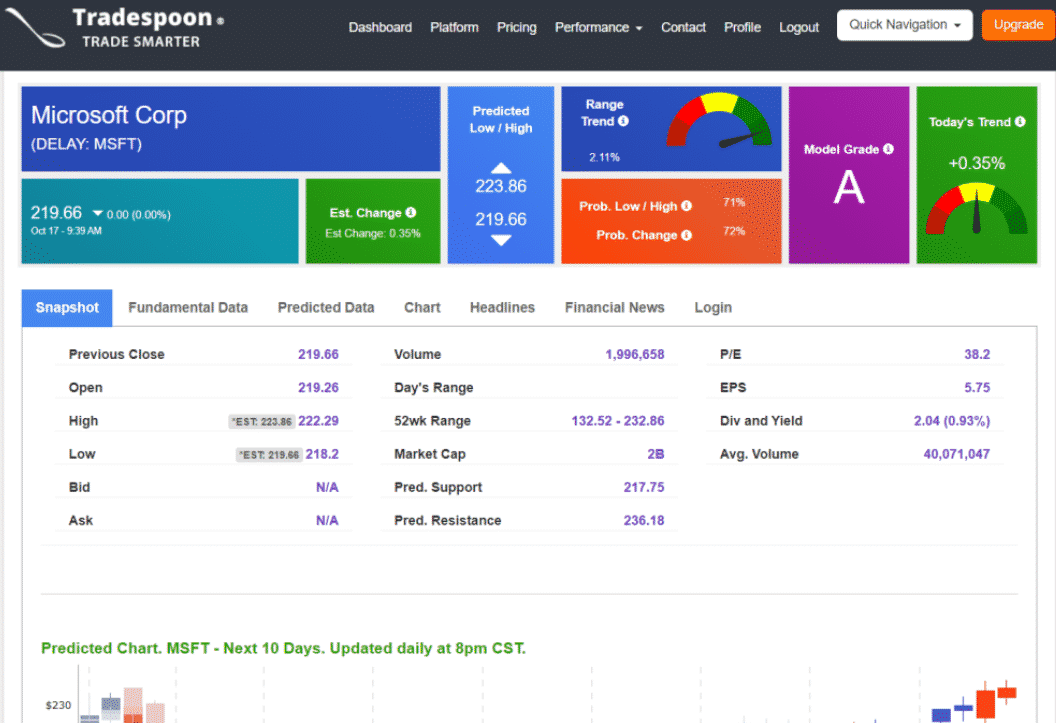

TradeSpoon automated trading software

Its price ranges from free weekly live webinars and video training library to 197 USD monthly for its premium packages. However, three subscription packages are Stock Forecast, the tools package, and the last one is the premium package.

Pros

- Invest your money at less risk.

- It is globally applicable.

- There is a chance for you to test.

- Sources are available in a diverse range.

Cons

- A large number of options make it difficult for you to choose the most suitable one.

- Currently, there is no method available for backtesting and evaluating the algorithm’s future performance.

- It is difficult for the layout to customize and navigate.

Though the price range is very variable, this platform still has all the effective and beneficial features that traders can use for efficient and risk-free trading.

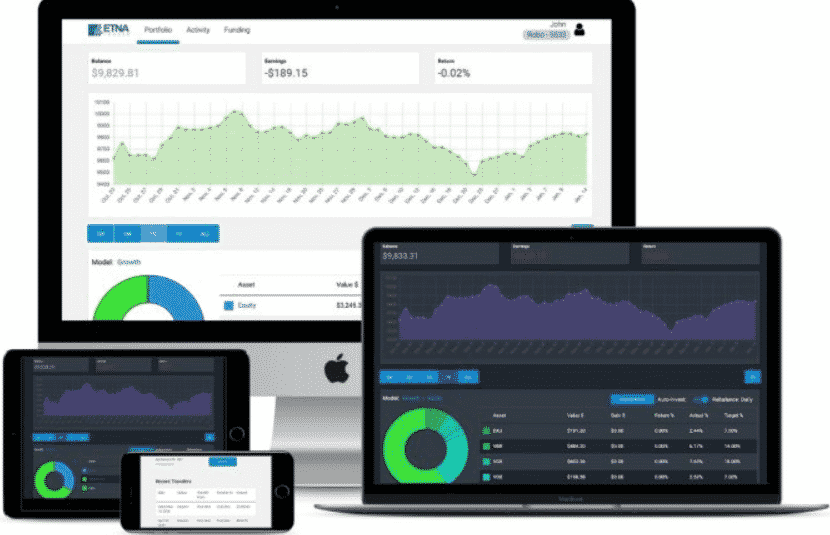

ETNA automated trading software

Its price range varies from the free first trial with a bonus of 25 USD, and then prices become variable every month.

Pros

- It is an award-winning trading software with a reputation for reliability and excellence.

- The availability of a wide range of text alerts and various data feeds.

- A real-time view of charts is available for you.

- It offers various additional features for efficient trading.

- It has multiple languages.

Cons

- Users have to install and download it for its activation.

- Due to its focus on corporate customers, this trading software is not exceptionally user-friendly.

- Sometimes, mechanical failure could happen in the software.

This software is beneficial and quick to locate information. Additionally, the quality of its financial services can be evaluated through its reputation in the market, giving the new trader confidence to trade with it.

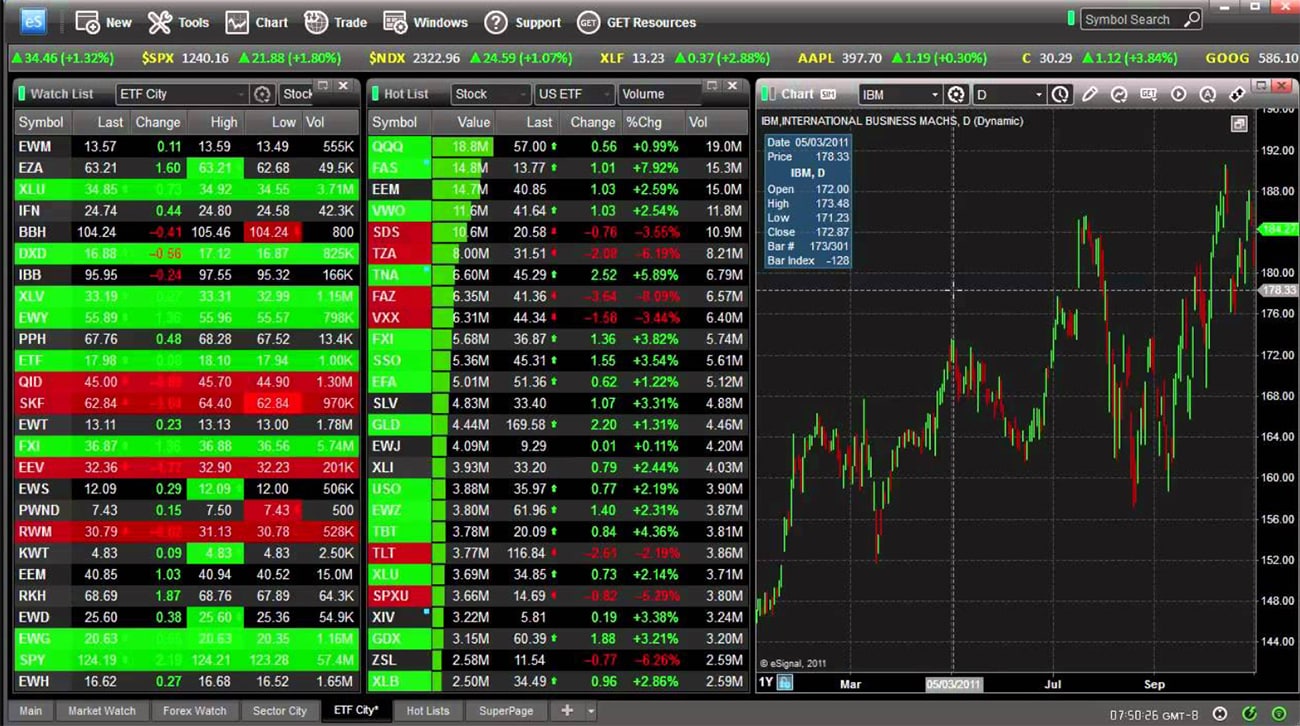

eSignal automated trading software

Its price ranges from free to $295 each month.

Pros

- It is well known for its excellence in its services.

- The platform contains handy tools for online trading.

- Its tools can be used to analyze technical information.

Cons

- The monthly fee is relatively high.

- There is no complete automation of services.

The online exchange platform of this award-winning service comes with a lot of handy tools. However, you will find out that it is not fully automated, but it has analysis and drawing tools that help you to obtain optimized results.

Tips to avoid scams in automated trading

Systems that have not been tested or verified have obvious potential to make incorrect trades. It wouldn’t be uncommon for unethical companies to incorporate a deliberate bias into their software, negatively affecting traders’ results. We must always exercise caution when dealing with any system that offers high profits at a low cost.

It is essential to test a tradable system’s parameters because an incorrect setup will result in an unprofitable random signal. Cost is not the actual issue here; it’s just that in the past, ATS was very costly to use, making them unaffordable to many traders. It has changed quite a bit today, and in fact, the overpriced results cannot justify exorbitant prices really should raise red flags.

Final thoughts

So, here is all you need to know about what to look for while searching for the best online trading software. Having knowledge of programming language and education about using the algorithmic actions at the platform, you can have a bright future in the world of automated trading.