AX Trader promises a profit of 39% per month without requiring any manual intervention. As per vendor claims, this EA is capable of trading accurately in 6 different currency pairs. These are bold claims that need to be verified independently.

This EA is backed by verified live trading results and a money-back guarantee. However, there are no backtesting results available, and the trading results are not too impressive, as we will see later. To us, it does not look like a trustworthy system.

Vendor Transparency

This robot has been developed by the LeapFX team. It is a company that is known for building systems like The Fund Trader, Easy Money X-Ray Robot, Trade Explorer, Bounce Trader, The Skilled Trader, and others. The company headquarters is located in Astoria, New York.

Since the vendor has not revealed the identity of the developers and traders, we don’t know what kind of experience they possess. To get in touch with this team, you can drop a mail to [email protected]. You can also send a message using the contact form on the website.

How AX Trader Works

After purchasing the software, you need to install it on your MT4 platform. Then you should open the charts for the currency pairs you wish to trade in, and attach the software to each chart. The EA then starts trading automatically.

AX Trader has a news detection technology that lets it monitor relevant news related to the Forex market. The vendor provides all users with technical support and an installation guide. It has been claimed that the robot can adapt to changing market conditions, but this is something that every vendor says about their EA. It also has an automatic money management system that selects the trading lot size according to the size of the account balance.

Timeframe, Currency Pairs, Deposit

AX Trader mainly deals in pairs like USD/CHF, USD/JPY, USD/CAD, AUD/USD, GBP/USD, and EUR/USD. The vendor has not shared any information about leverage but for the live trading account, the EA uses a leverage of 1:200. It is recommended that you start with a minimum balance of $1000.

Trading Approach

This robot determines the direction of the trend and adjusts its entry points accordingly. It uses Fibonacci ratios for this purpose. The vendor provides no further explanation for the trading strategy, which is disappointing. In the absence of proper strategy insight, many traders might not feel confident about spending money on this robot.

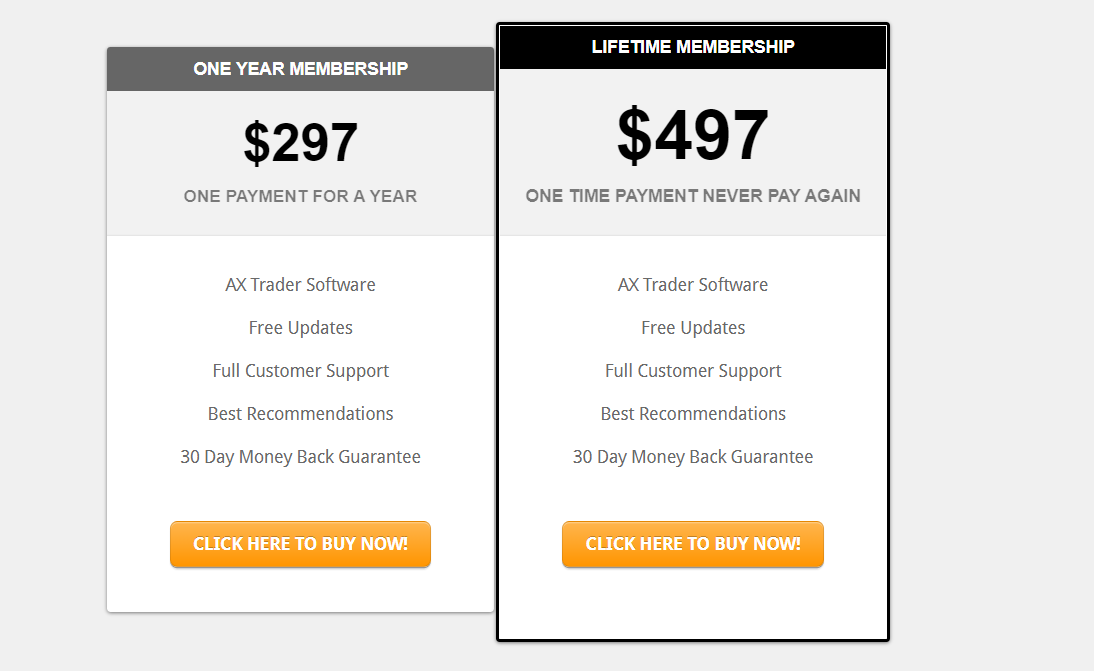

Pricing and Refund

AX Trader has two distinct pricing plans. The first one is a yearly plan that costs $297. If you wish to purchase the EA for life, you have to pay a one-time fee of $497. We think this is a bit expensive, especially considering the short track record this system has. The vendor offers a 30-day money-back guarantee for this EA.

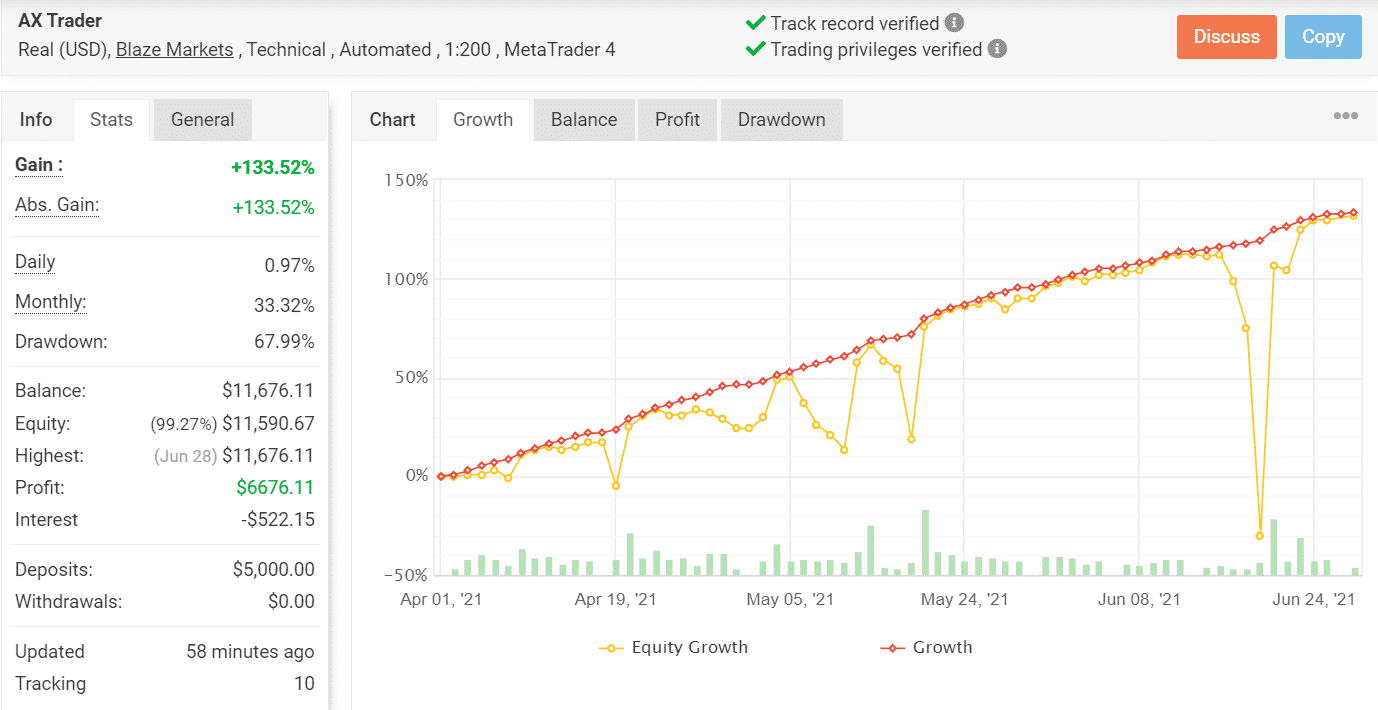

Trading Results

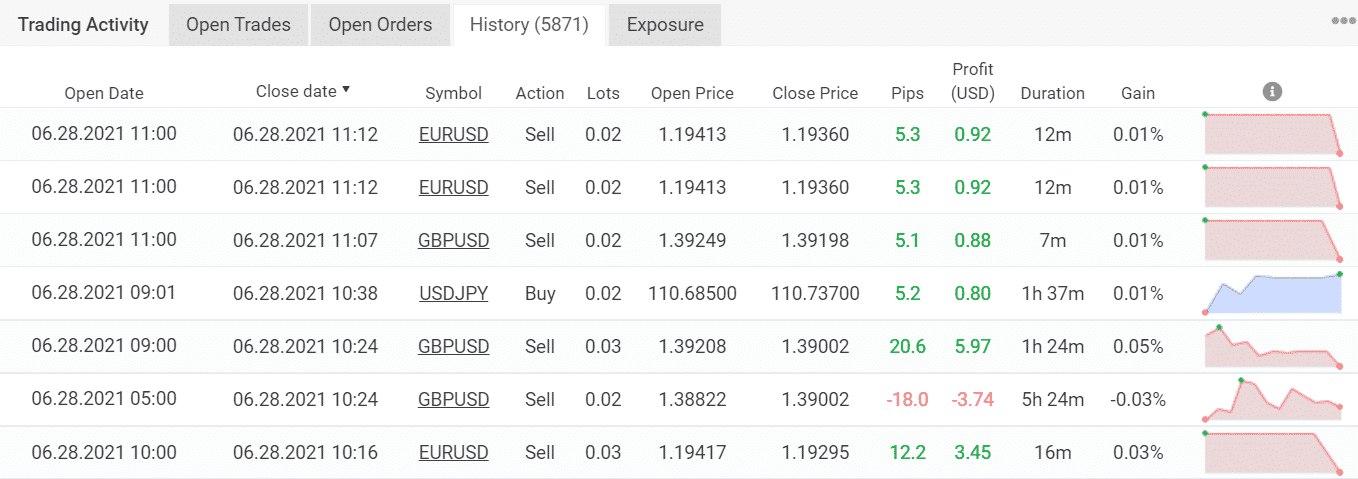

This is a live trading account on Myfxbook that has been active since April 01, 2021. In this short time, the robot has placed 5870 trades, which tells us that it follows a high-frequency trading approach similar to scalping. Currently, the daily and monthly gains for this account are 0.97% and 33.32%, respectively. It has a massive drawdown of 67.99%, which indicates a high-risk trading approach.

The robot has won 79% of all trades placed through this account, generating a total profit of $6676.11. However, the monthly profit is slightly less than what the vendor claims on the official website.

Looking at the trading history, we can see that the EA generates very small profits from each trade. So if you are looking to make large gains within a short span of time, this system is not suitable for you. The profit factor is 1.63, which is quite mediocre.

We don’t have the backtesting data for AX Trader. The vendor has not shared the historical performance of this system, which makes us wary of investing in it. Historical results reveal the robustness of an EA, and there is no way you should trust a vendor that does not share them.

People say that AX Trader is…

Doubtful. We couldn’t find any customer reviews for this Forex EA on websites like Quora, Myfxbook, Trustpilot, and Forexpeacearmy. Clearly, not many people want to invest in an EA that has a short trading history and high drawdown.

Verdict

| Pros | Cons |

| Verified live trading results | No backtesting results |

| High drawdown | |

| Lack of strategy insight |

AX Trader conclusion

AX Trader is an EA that uses a risky strategy, as is evident by the high drawdown exhibited in the live trading account. Moreover, the vendor does not share the backtesting data for this system, so there is no way we can consider it reliable.