In their presentation, the devs imply that Big Poppa EA makes steady and consistent profits while ensuring that your capital is preserved. However, the team’s decision to incorporate martingale into the system was misguided. As you will see in this review, the approach has significantly contributed to the downfall of the account being controlled by this EA.

Vendor transparency

A company called BenderFX is responsible for creating this tool. It is based in South America, and its team possesses different qualifications, including data analytics, machine learning, programming, and genetic algorithms. Another claim is that they have been trading in Forex for more than 5 years.

How Big Poppa EA works

The system has several features, which we have outlined below:

- Applies money management such as trailing stop, hedging, limiting the number of trades, and equity stop

- Traders are encouraged to deploy the robot on a VPS

- It is user friendly

- Free updates are offered

- Is completely compatible with other EAs

Timeframe, currency pairs, deposit

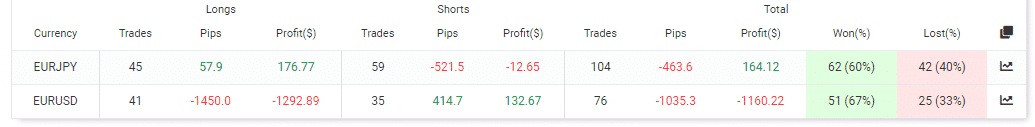

The vendor does not mention the currency pairs used, but based on the trading results on Myfxbook, the bot mainly supports the EURJPY and EURUSD symbols. The timeframe used is 1h 15m, while the minimum trading deposit is $500.

Trading approach

Apart from martingale, Big Poppa EA has Fibonacci and Price Action as its trading strategies. The former technique involves mixing the Fibonacci Golden Zone and the probabilistic zones. The system is able to seize the retracements and assess their extensibility over time. The latter approach monitors price movements to determine entry and exit points. The devs note that the tool does not rely on the crossover entirely. Instead, it only focuses on this point when it has established numerous profits can be produced.

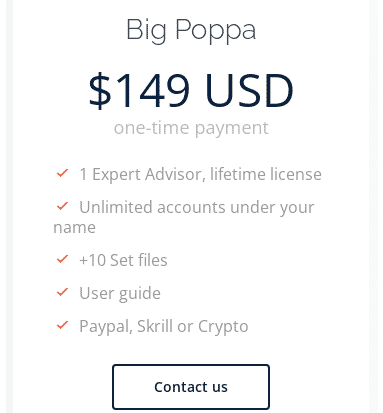

Pricing and refund

The current retail price of Big Poppa EA is $149. Although this pricing is fair, we still believe that the robot is not worth it, mainly because it cannot keep your investment intact.

Trading results

There are no backtest results. We suspect that the system was not subjected to any tests, and that’s why it has faulty algorithms that only produce losses. See what we mean in our analysis of the live results below:

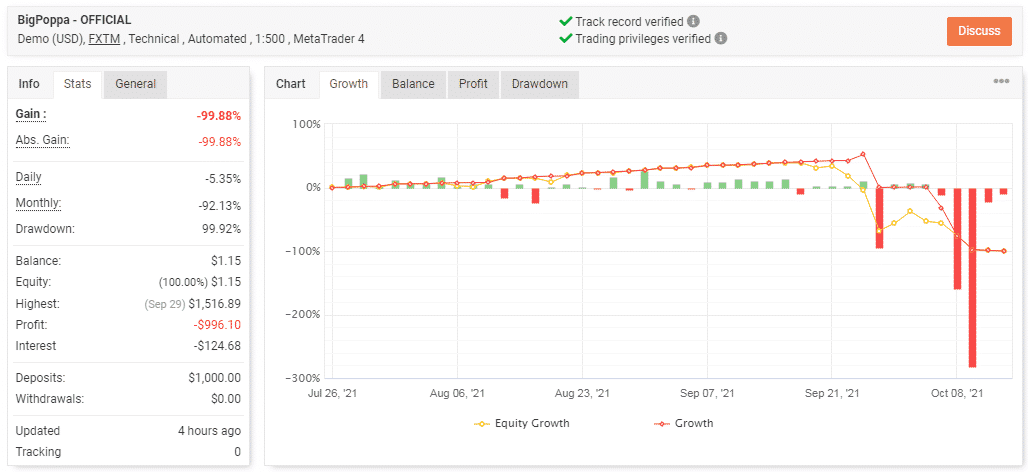

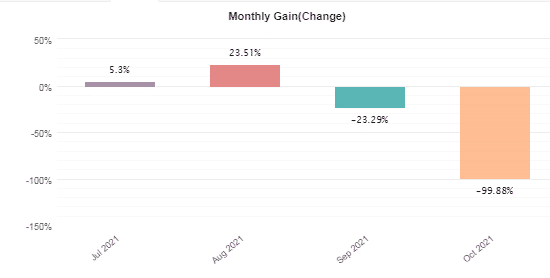

This account was launched on July 26, 2021, and deposited at $1000. Unfortunately, the investment has not been managed well. Rather than increasing it, the EA has done the opposite. So, we now have a loss of -$996.10, which has, in turn, devalued the account by -99.88%. The drawdown level (99.92%) was sky-high, which led to the account ruin.

A total of 180 trades have been completed. Out of the 86 buy orders placed, only 52 have succeeded, representing a 60% win rate. For short positions, the success rate was 64%. There was a profit factor of 0.43, which means that the system risked a lot and didn’t get any profit in return. The negative pips (-1498.9 pips) further show the high losing streak associated with the robot.

The system had been profitable for 2 months only.

All the buy orders placed using the EURUSD pair did not bring any winnings.

People say that Big Poppa EA is…

Uncertain. We have established that the system has zero reviews. No customer has commented on it on any of the well-known platforms — Trustpilot or FPA.

Verdict

Pros

- Comes with free updates

- Easy to use

Cons

- Martingale on the board

- Lacks customer reviews

- Insane drawdown

- Poor win rates

Big Poppa EA Conclusion

Obviously, Big Poppa EA cannot be trusted to trade efficiently. It produces many losses that lead to insane drawdowns. The presence of martingale means that the system gambles with your capital, exposing it to many trading risks. Although we are told several protection systems are in place, they seem not to be working. Otherwise, they would have prevented the account from being reduced to nothing.