The Volty Expan Close strategy uses two different parameters to obtain the market context. Financial investors frequently rely on this concept while making trade decisions. So it makes sense that this technical method becomes attractive to crypto investors for its accessibility and other useful features.

However, it requires having a particular level of understanding of components and calculations while implementing any technical concept to execute successful trades. Moreover, any crypto investor, including newcomers, can most efficiently use any technical strategy by following professional guidelines. This article enlights the crypto Volty Expan close strategy and lists the top five tips to use this concept.

What is the Crypto Volty Expan Close strategy?

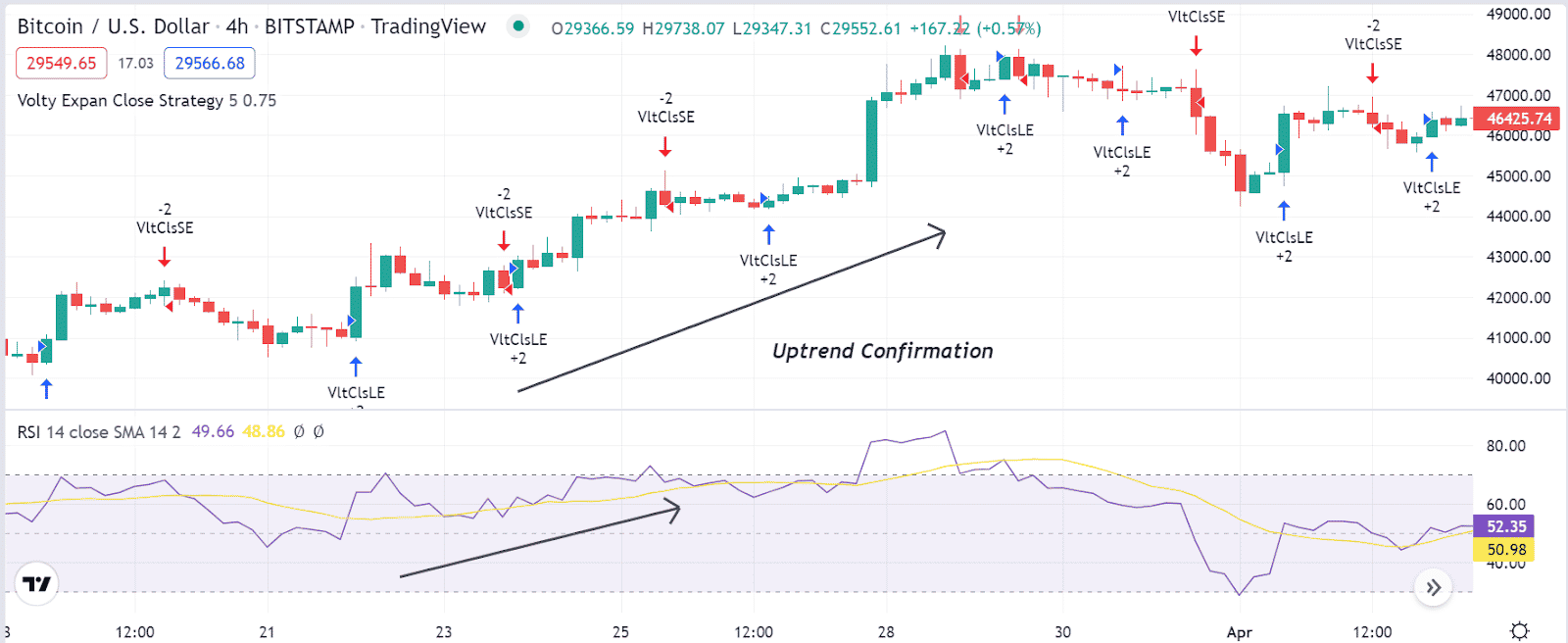

The Volty Expan Close or volatility expansion close strategy makes a channel depending on the ATR value of a particular number of price candles, and a factor multiplies the data. The channel usually collects the closing price data of price candles and shows results by subtracting or adding those resulting values.

You can modify or change the parameters of this trading method according to your desire by the setting function. You can easily use this concept to generate long/short trading positions, detect sideways, breakouts, breakdowns, etc.

The top five tips to gain

When using the Volty Expan Close strategy for crypto trading, you should have a prior understanding of the crypto marketplace alongside technical terms such as support resistance, volume, bullish/bearish momentum, etc. This part will list the top five tips to use the trading strategy most effectively in crypto trading.

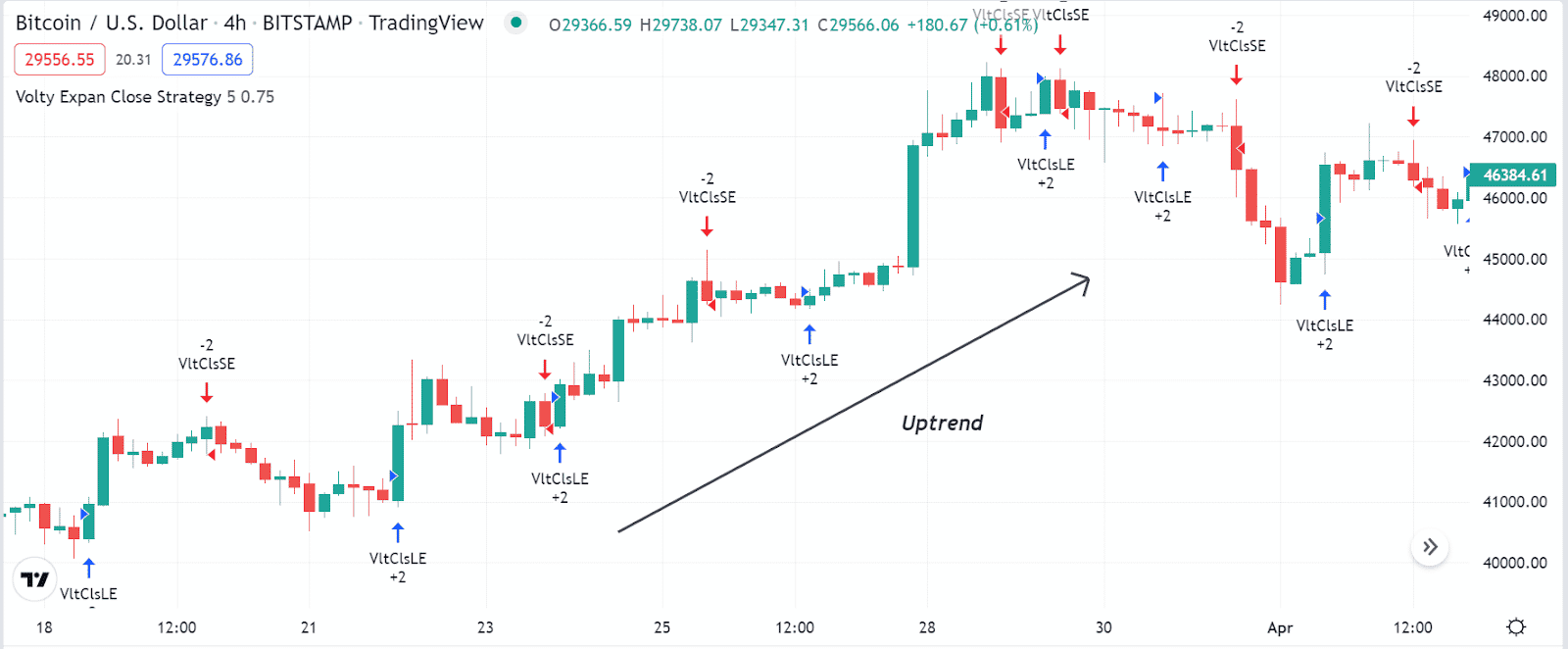

Tip 1. When entering long positions

Seek to open buy positions when the price reaches near the finish line of an uptrend or starts rejecting from any support level. The volatility expansion close indicator will create a blue arrow below the price candle, and the VltClsLE value will be positive (+2) when it detects significant buy pressure. Open a buy order when your chart matches the scenario.

Why does this happen?

The volatility expansion close strategy suggests opening a buy position when the price of the current candle is above the average true range of the previous candle closing range. When the price reaches above the range, it declares a bullish momentum and suggests opening buy positions.

How to avoid mistakes?

When using this concept for crypto trading, try entering buy trades near support levels. It enables making considerable profits and reducing risks as the initial stop loss level for the buy order will be below the current bullish momentum and support level.

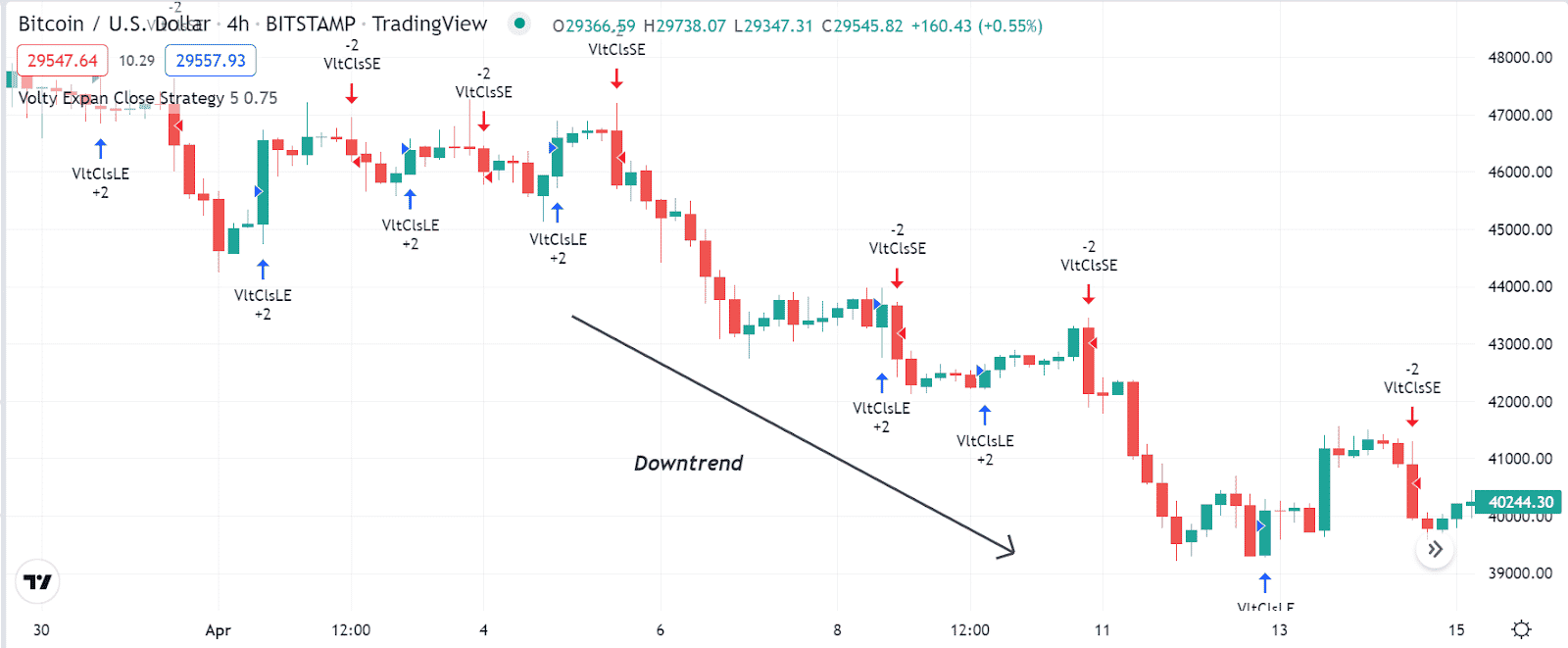

Tip 2. When entering short positions

Crypto investors quickly determine potential sell positions using the Volty Expan Close strategy. You can open a sell position when you mark these on your target asset chart. When the price movement faces a declining pressure, it creates a red arrow above the swing point, and the VltsSE value will be negative (-2).

Why does this happen?

The volatility expansion close method suggests opening sell positions when the price of the current candle surpasses below the average true range of the last price candle. As the price reaches below that range, it indicates a declining pressure on the asset price.

How to avoid mistakes?

When using this method to open sell positions in crypto assets, try opening sell positions when the price reaches near any resistance level or starts declining after getting that level. In this case, you must set a tight stop loss for your sell order above the current bearish momentum.

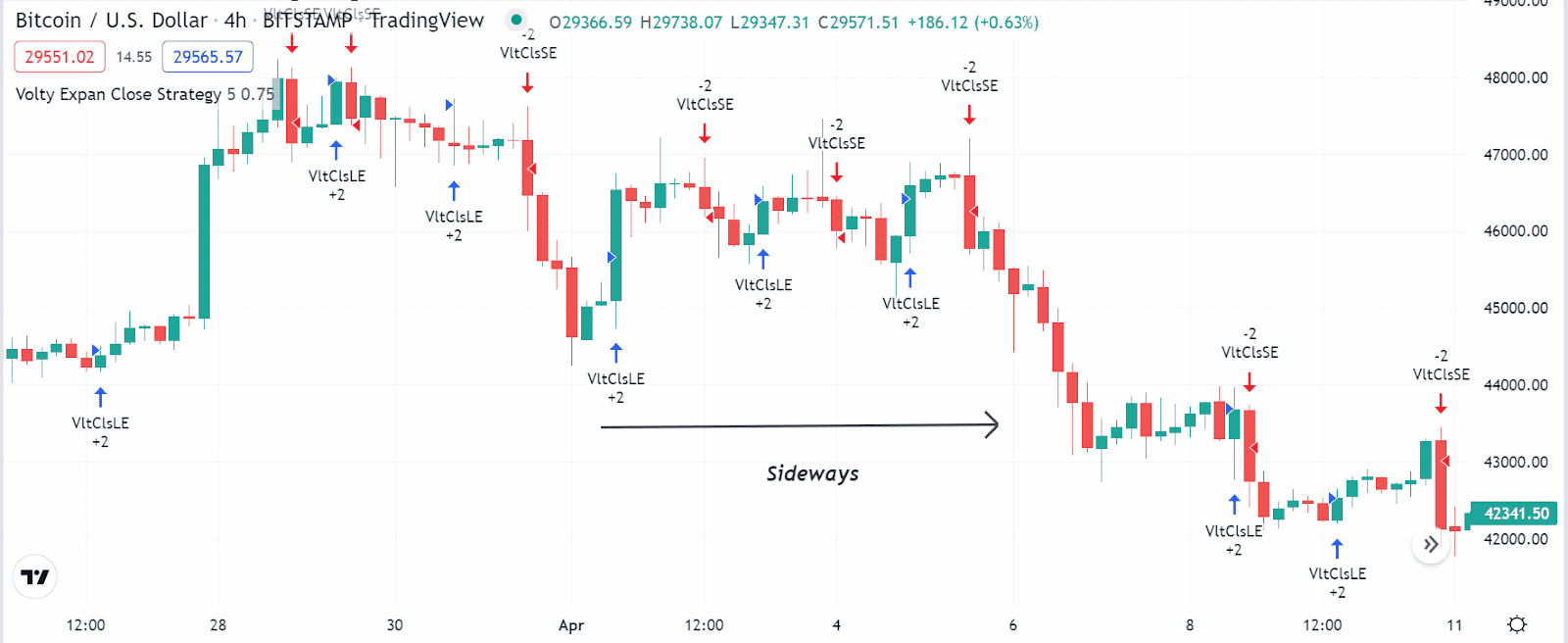

Tip 3. Detecting sideways

The price moves sideways or remains in consolidating phases during any trends. Detecting sideways is essential for expert investors as, in most cases, it enables catching swing trades. This trading strategy allows determining sideways; when this strategy creates frequent blue and red arrows above and below price candles, the price may remain sideways.

Why does this happen?

Frequent arrows occur as the price reaches above and below the ATR. Every time the price goes beyond the range, the method creates different arrows, and in consolidating phases, the price does that more often due to low volatility.

How to avoid mistakes?

Expert financial investors who like opening frequent positions avoid sideways entering trades. In most cases, they wait till a breakout occurs in either direction as it increases profitability.

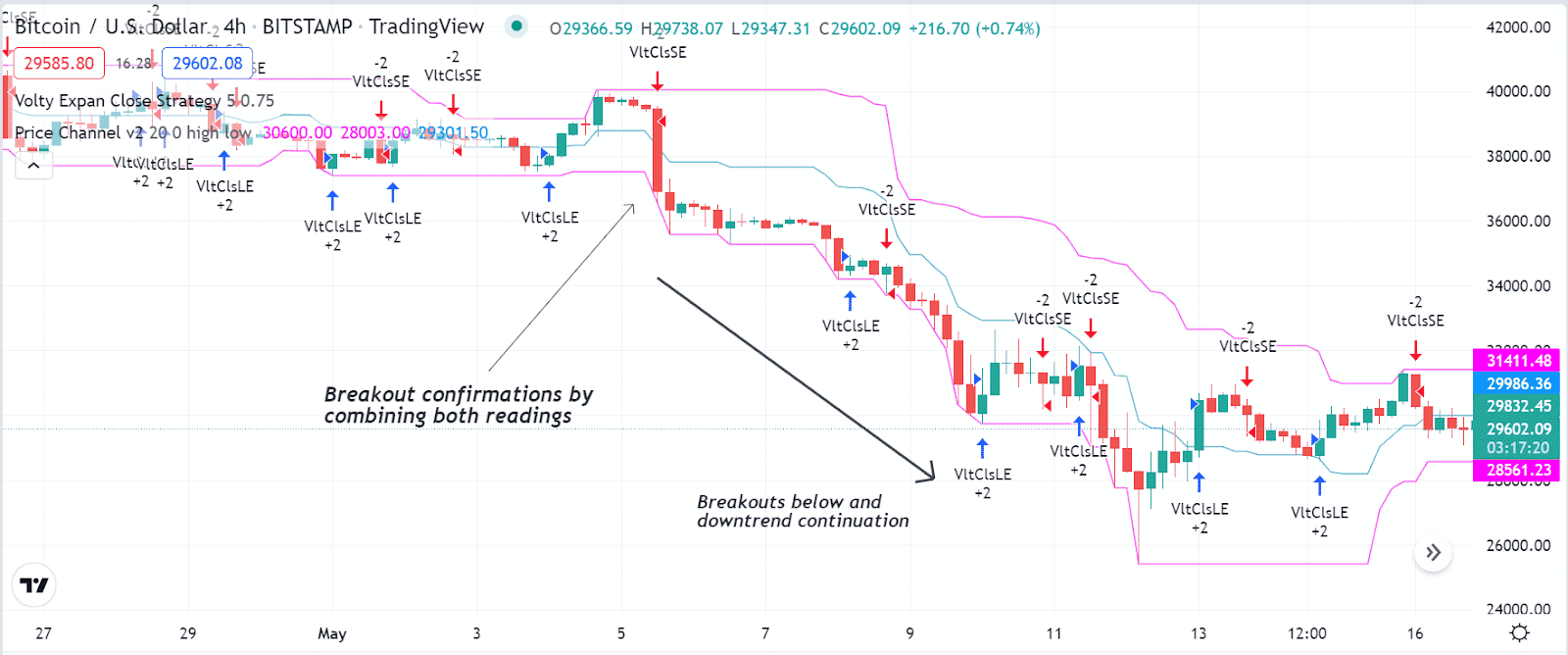

Tip 4. Determine breakouts using the price channel

This strategy determines breakouts or significant price movements in the initial phases. You can use another supportive technical indicator: the price channel with three dynamic bands. For example, suppose the Volty Expan Close declares a declining price pressure on the asset price and the price reaches below the mid-band of the price channel indicator, declaring an upcoming bearish trend.

Why does this happen?

First, the Volty Expan Close defines the swing points; the price channel indicator confirms the price direction and strength.

How to avoid mistakes?

When combining both indicator readings confirm all conditions that satisfy your trading strategy. Moreover, follow appropriate trade and money management rules when entering trades using this concept.

Tip 5. Combine the RSI indicator for efficient trading

You can use the RSI indicator alongside the Volty Expan Close strategy to generate trade ideas. For example, the Volty Expan Close indicator suggests potential bullish movement through the blue arrow. Meanwhile, the RSI dynamic line remains near the central (50) level, and heads on the upside declare positive price pressure on the asset price.

Why does this happen?

The Volty Expan Close arrow defines a bullish momentum, and the RSI, a popular momentum indicator, confirms the momentum.

How to avoid mistakes?

When using this concept to generate trade ideas, combine both indicators readings carefully before executing any trade. Moreover, use proper stop loss to reduce risk on capital.

Final thought

Finally, this article introduces you to a most potent technical trading strategy that allows the execution of consistently profitable trading positions in many trading instruments, including cryptos. When you follow these tips above appropriately, it will increase your profitability. Just don’t stake as much as you can’t afford.