One way of examining market data is through technical indicators. By analyzing historical data such as currency price, volume, and market performance, indicators attempt to predict how the market will behave and if any patterns will repeat themselves.

The same is the case with the crypto Wave Rider indicator. It works very well with all time frames. The strategy is also quite responsive to the price changes and has limited issues with lagging. In this article, we will discuss the indicator in detail. Also, you can find top tips to trade effectively.

What is the Wave Rider crypto indicator?

Wave Rider crypto trading system uses EMA-based CarterMAs of different parameters to develop a trend-following trading system. As a result, this strategy is more responsive to price changes and has fewer lagging issues.

It works with all time frames, and you can apply it to forex, stocks, and cryptocurrency as well.

Even a beginner trader can efficiently execute trend-based market entries with the Wave Rider indicator because it offers excellent simplicity in trading. Moreover, as a trend-following trader, this strategy helps you stay aligned with the market momentum.

Top 5 tips for trading with crypto Wave Rider indicator

Here are the top five tips for trading using this indicator.

Tip 1. Trade with trending markets

To trade the crypto market effectively, you should stay on trending markets.

Why does this happen?

Trading with the trend also means you will face fewer headwinds. This is because few traders are trading against you until a powerful reversal signal triggered by solid support or resistance occurs.

You can identify waves in many ways. Traders familiar with price action rely on the swing highs and lows to determine the direction. Identifying trends this way, however, is highly subjective. There are many different trading indicators available to traders today. Many of these work well, while others don’t.

How avoid the mistake?

The best way to identify trends might be right in front of us. We can use that old reliable moving average-based indicator.

The Wave Rider indicator, on its own, is a great tool to identify individual trends. The indicator lets you know whether the price is trending upward or downward by comparing its current to its average. The price must go up if the price is constantly higher, and vice versa.

Therefore, you should use the Wave Rider crypto indicator individually. Using these in a large number can significantly increase the chances of getting the trend direction right. We can figure out the advice of a trend by looking at the chart, and using several moving averages can help identify trends.

Tip 2. Traditional investment

Like investing in a stock market, you can also invest in cryptocurrencies using the indicator.

Why does it happen?

It is possible to have handsome returns when you buy a share of a business, or you could end up with nothing but a worthless piece of paper.

Cryptocurrencies are no different. In contrast to stocks, where investing in digital currencies is equivalent to owning stock in a company, you invest in a future-oriented currency that may one day replace regular fiat currencies.

How to avoid mistakes?

When you buy a digital coin, you are investing in believing that it will eventually replace traditional currencies such as the US dollar, UK pound, euro, yen, etc.

Many risks are involved, but the potential rewards are certainly worth it.

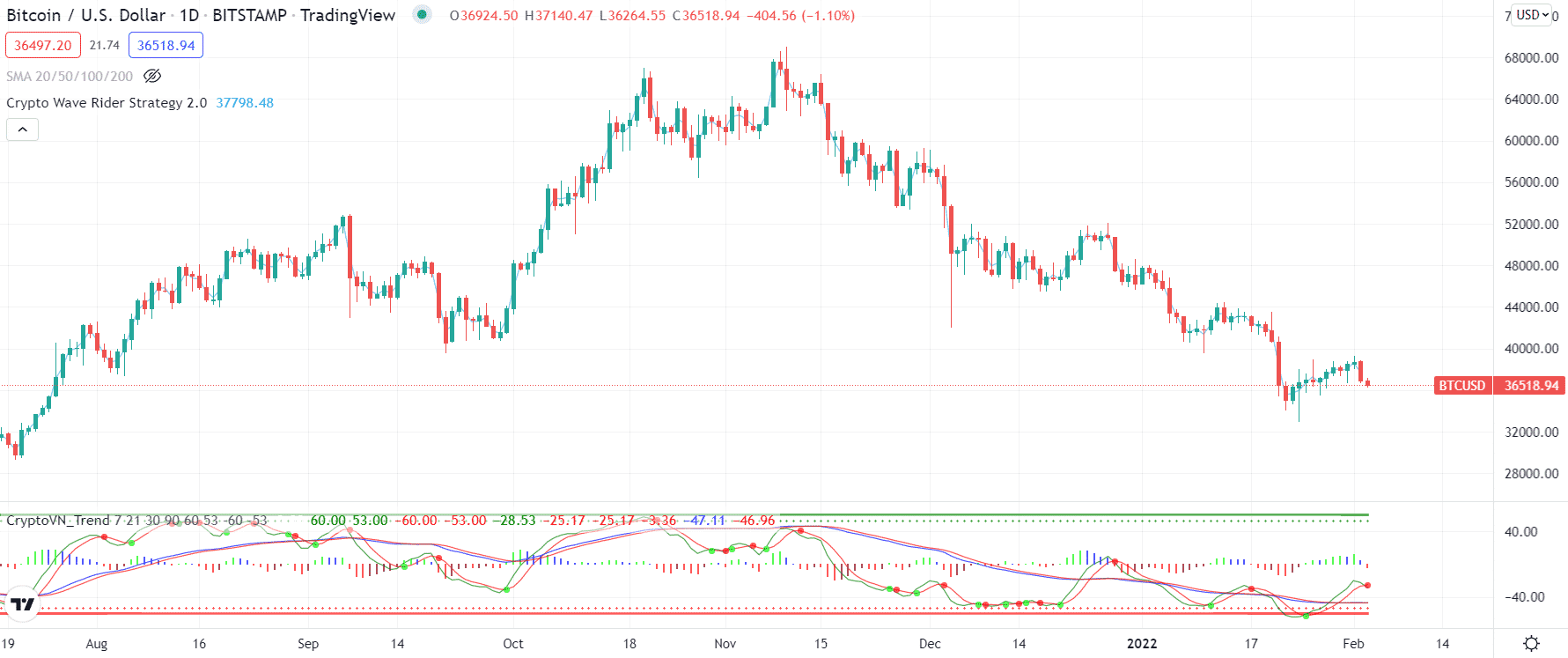

It is advisable to research and analyze a coin and the team before investing in it to avoid worthless currencies. Then, use the indicator on long-term charts to find the appropriate points to enter the market.

Tip 3. Dip buying and holding

The thumb rule of dip investing is to buy low and sell high, using the Wave Rider strategy.

Why does it happen?

The purpose of dip investments is to sell the digital currency when the price is high, as opposed to traditional financing, where you hold onto your assets for a long time. Or when you feel it has reached its peak. Unfortunately, many traders fall into the trap of pump and dump. They enter the market when the smart money has already started exiting.

How to avoid mistakes?

The best way to invest in dips is to keep an eye on the price of a particular currency. First, make a note of the average cost of the money. You procure the cash when its price falls below the average. You sell it as soon as the price recovers or rises above average.

Depending on how much money you have saved and your risk appetite, you can buy at a big or small dip.

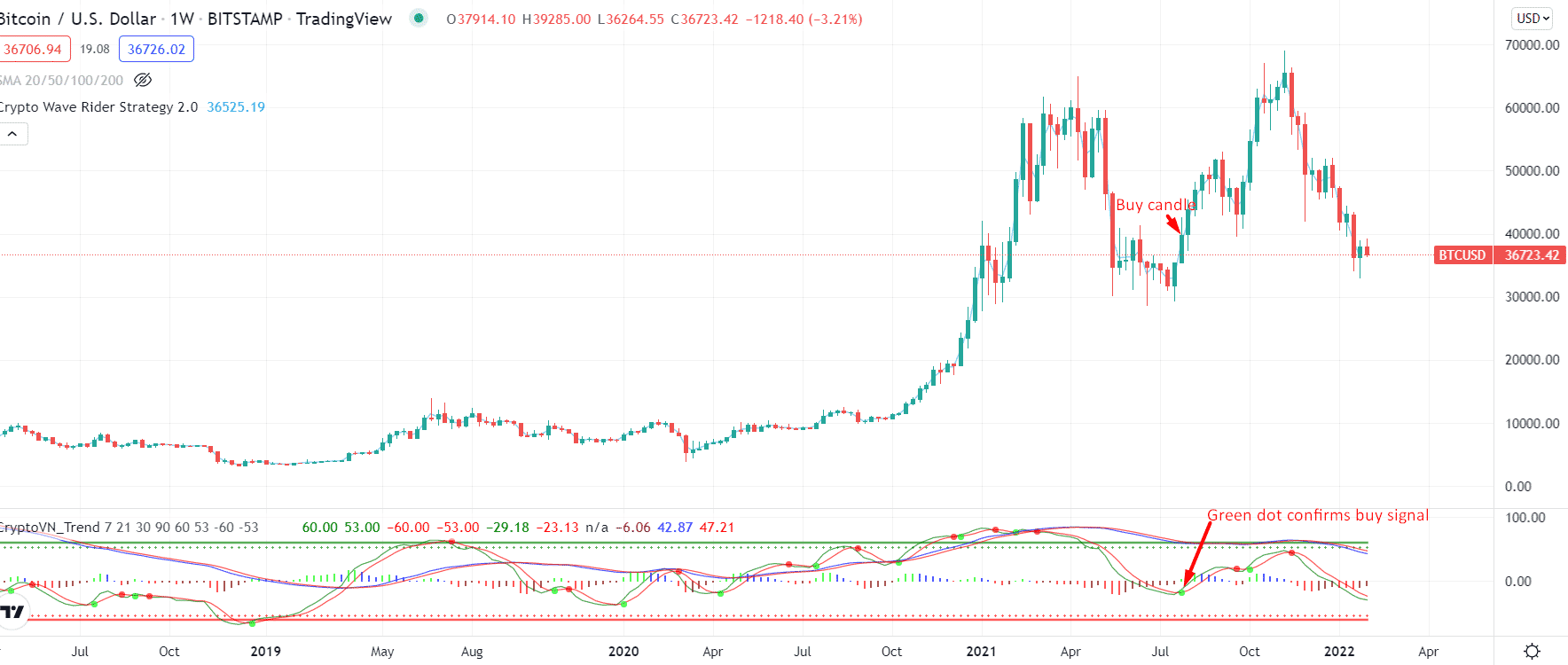

You may use the Wave Rider indicator on weekly charts to learn the broader picture. Just enter the market as soon as you see a reversal signal on the weekly chart.

Tip 4. Confirmatory analysis

There is no single ultimate indicator in trading. So, you need another way to confirm the entries and exit.

How does it happen?

Relying on a single indicator may not be a great idea. Therefore, you have to check other tools to enhance your winning probability.

How to avoid mistakes?

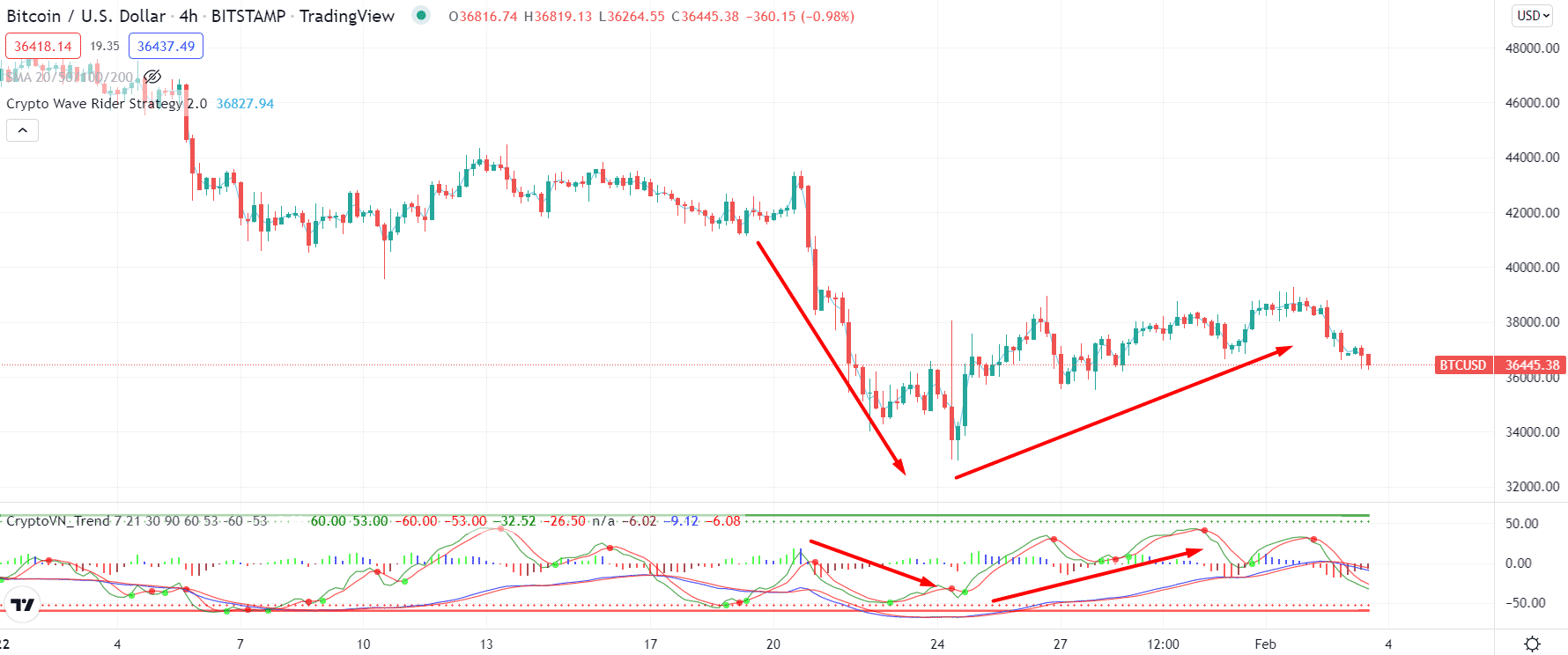

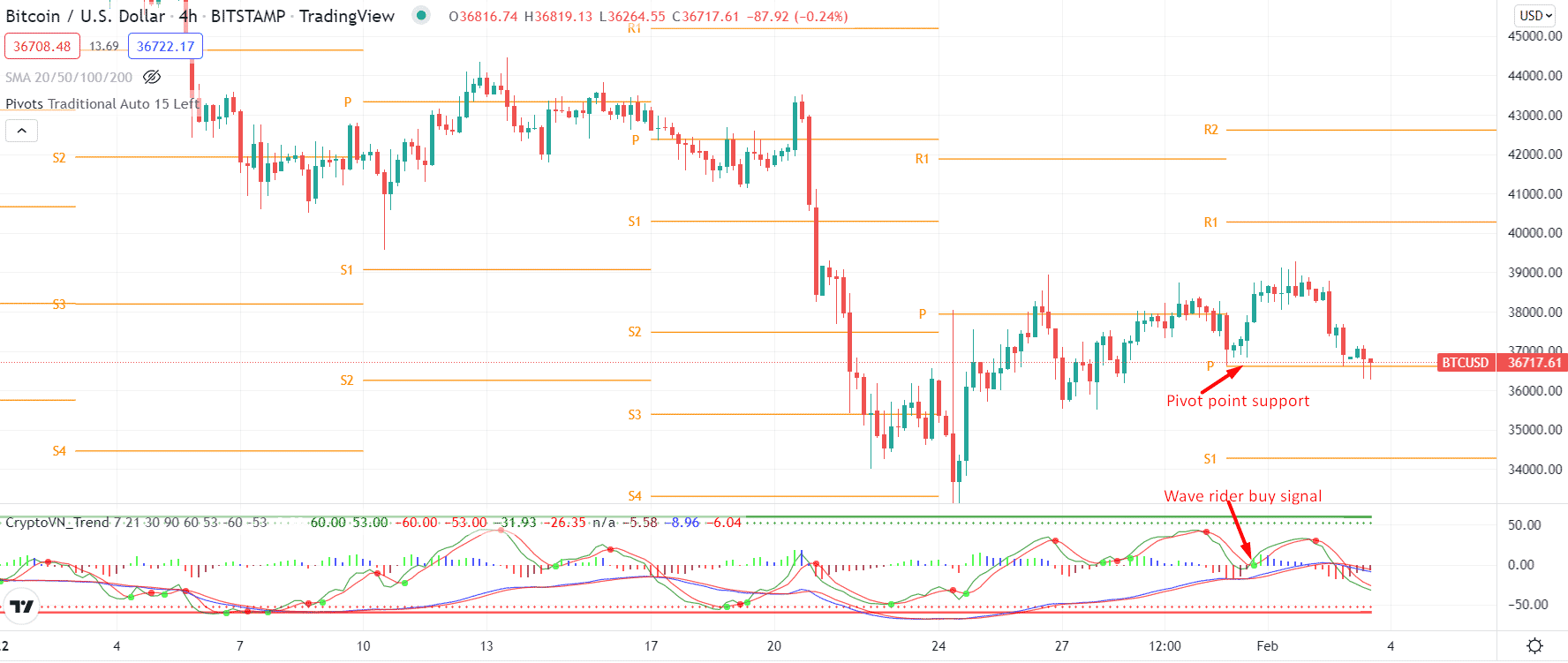

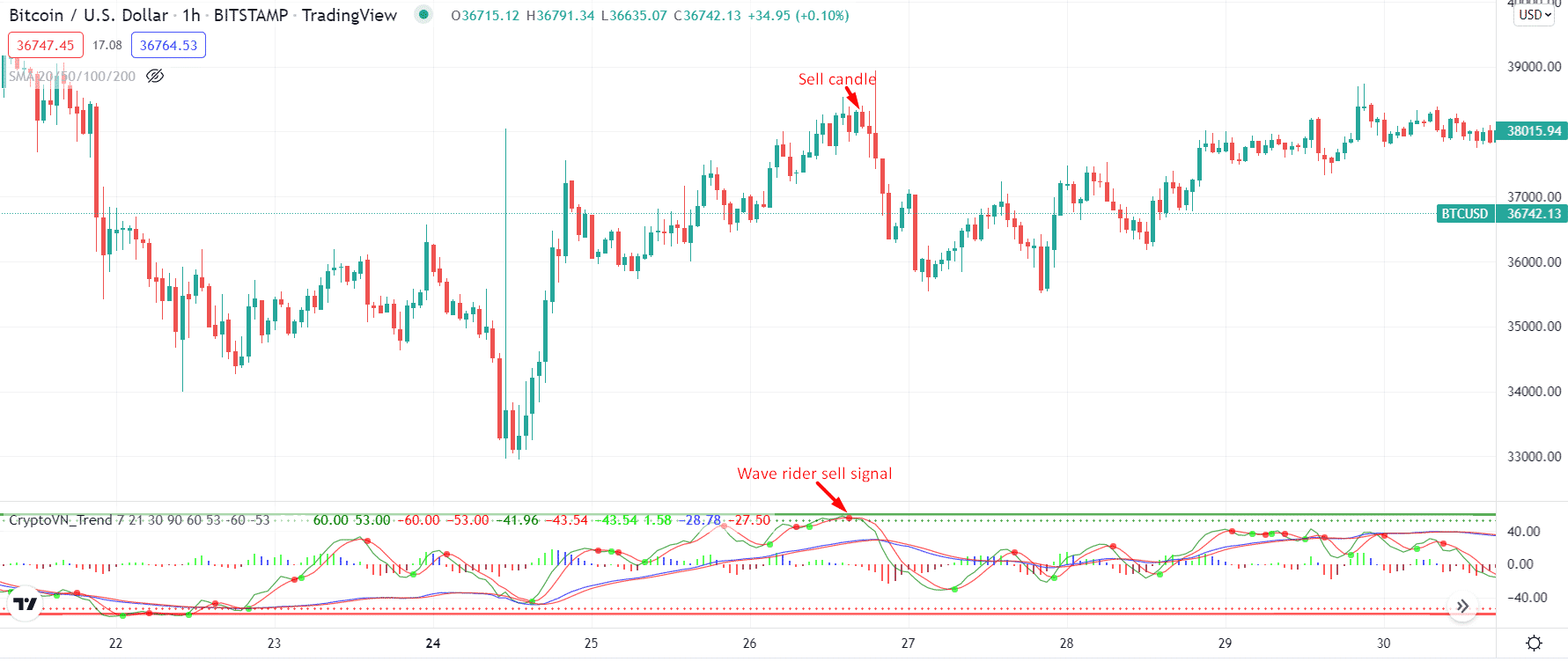

You can use a pivot point indicator with the crypto Wave Rider to add another layer of confirmation. For example, take a look at the following chart.

Tip 5. Capitalize the futures market

Since the indicator is trend-centric, you can benefit from movement on the downside.

Why does it happen?

The market does not retain movement in one direction. Instead, the price ranges in both directions. So at the time of the bearish phase, you can either remain out of trading and waste the opportunity or look for short-selling opportunities in the crypto market.

How to avoid mistakes?

Enter the crypto futures market. Choose 5x or 10x leverage depending on your risk appetite and look for selling opportunities on your chart. However, since this is a leveraged market, keep the risk management intact and use lower timeframes like 15-minute to 1-hour.

Final thoughts

Taking advantage of trending markets is one of the best ways to trade with the crypto Wave Rider strategy. This is because trading in the trend also means fewer headwinds. This indicator may help you grasp the direction initially and give you an edge over other retail traders.