DSC Price Action is an EA created to work on the EURUSD pair. This MT4/MT5 tool uses the M5 time frame and a hedge account, promising a high winning rate. As per the developer, this FX EA takes advantage of Forex leverage to multiple client capital. While the developer has backtested and live results for this FX robot, the results are not satisfactory. From our review of the performance and the strategy used, our initial conclusion is that this ATS is not trustworthy.

Vendor Transparency

Diogo Sawitzki Cansi has created this EA and published it in June 2020. The expert advisor has 673 demo versions downloaded up until now and 5 activations. It is in its version 1.7 now with the recent update being done on June 8, 2021.

The developer is based in Brazil and has more than 5 years of trading experience. He has created 9 products, which include free and paid versions, 90 demo versions, 20 signals, and 149 subscribers. The MQL5 site reveals a rating of 3.3/5 for this developer. While no location address is present, the developer furnishes an email address and a WhatsApp number for customer support.

How Dsc Price Action Works

We could not find much info on this EA as the developer fails to divulge any pertinent details. Other than mentioning that the FX robot can leverage the account quickly and multiply your capital there is no further info present. For more info on the features, functionality, and strategy, you need to contact the support email or the message via the WhatsApp number provided. This lack of transparency on the part of the developer makes us suspicious of the product’s reliability.

Timeframe, Currency Pairs, Deposit

A time frame of five minutes is used by this Metatrader 4 tool and the EURUSD is the only currency pair it supports. This hedge account-based EA uses a leverage of 1:500. There is no recommendation on the minimum deposit. The developer recommends using XM or the ICMarkets brokerages for better returns.

Trading Approach

The hedging approach is the main strategy as per the info the developer provides. The approach uses a long and short position on a currency pair simultaneously. This type of approach helps reduce risk but can minimize profits too. This is because there is not much flexibility allowed by the approach for reacting to the market trend. Further, the longer time needed for the investment to bring returns is also a drawback. However, the developer does not elaborate on how he manages to increase the profits while reducing the risk.

Pricing and Refund

You can buy this EA for $499. A rental option is also available at the cost of $99 per month. The developer also offers a free demo. We find this ATS is overpriced as many of the competitor FX robots in the market are available at half and some even less than half of the price. No money-back guarantee is present. The steep price and absence of a refund raise a red flag.

Trading Results

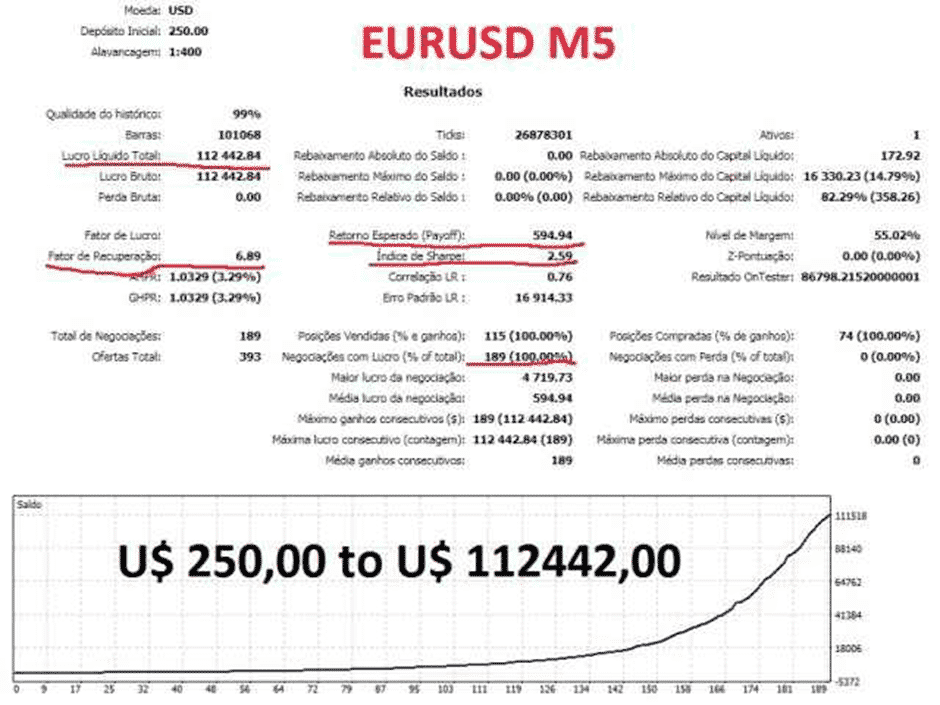

A backtesting result is found on the MQL5 site. Here is a screenshot of the results done on a modeling quality of 99%.

From the backtesting done on the EURUSD pair on the M5 timeframe and using the leverage of 1:400, we can see a 100% profitability. The deposit of $250 has resulted in a profit of 112442.84 with a profit factor of 6.89. A maximum drawdown of 0% is present for this backtesting report.

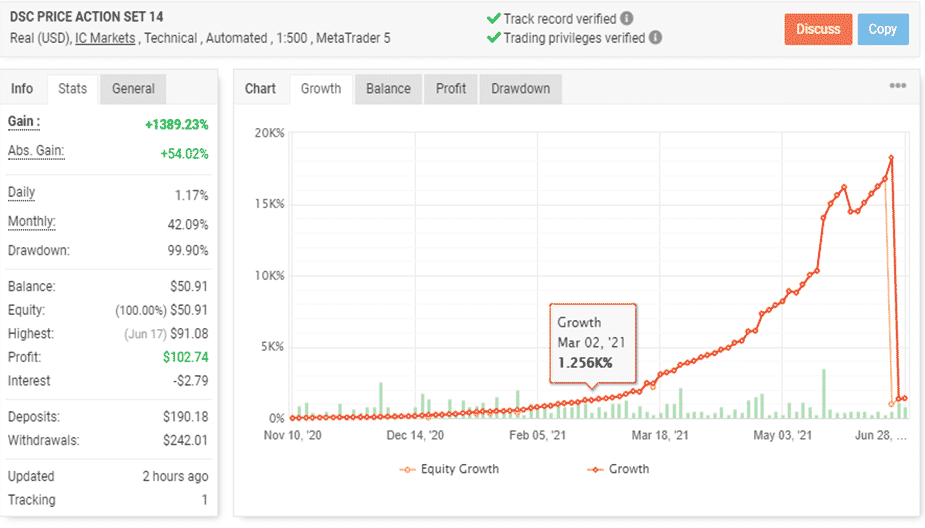

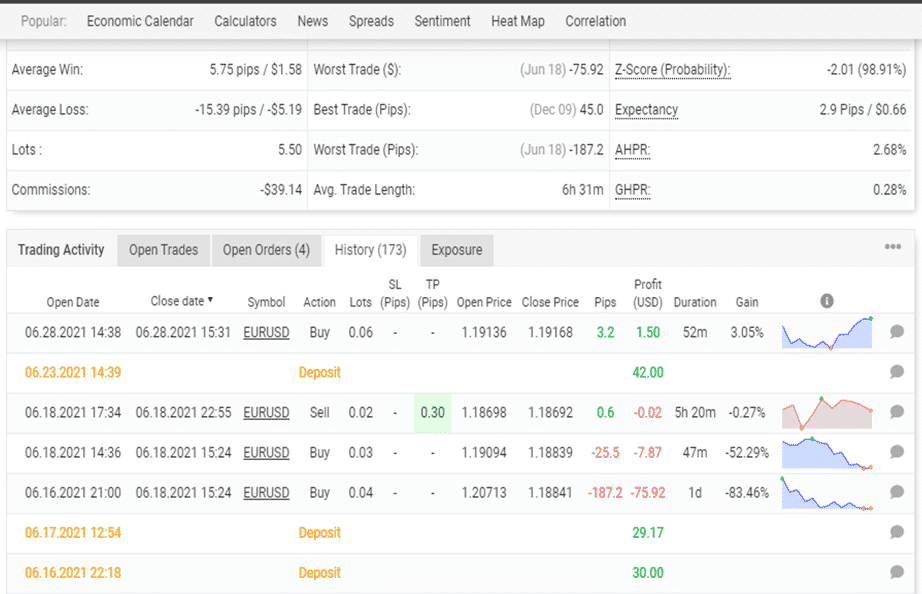

A real USD account verified by the myfxbook site for this EA is shown in the screenshots here.

From the above trading stats, we can see a total gain of 1389.23% and the absolute gain value is 54.02%. The huge difference in the two values indicates that the account is a high-risk one using a poor strategy. A drawdown value of 99.9% is present for this account that started trading in November 2020. During the trading period, 155 trades have been completed with a profitability of 86% and a profit factor value of 1.94.

The trading history reveals lot sizes ranging from 0.01 up to 0.06. Such high lot sizes indicate the risk is high which is contrary to what the developer claims. The high drawdown and big lot size are indicators that this system is not a trustworthy ATS. Compared to the backtesting results, we can see the real account trading has been dismal with the account losing all of its money a few months back.

People say that Dsc Price Action is…

An EA that does not trade much. For traders who want quicker results, the long-term positions can be frustrating. The reviews below although positive point to the low trading frequency and the need for better money management settings and the use of appropriate set files.

Without proper guidance, an account can easily go into a high drawdown. For an EA that claims to use the low-risk hedging approach, the contrary trade setup makes it look untrustworthy.

Verdict

| Pros | Cons |

| Fully automated EA | Undisclosed trading approach |

| Hedge account | High drawdown |

| Expensive price |

Dsc Price Action Conclusion

Dsc Price Action claims to be a profitable EA but the real account trading results look disappointing. With a high drawdown, big lot sizes, and discrepancy in the absolute gain and total profit values, we find the system is risk-ridden. The expensive price, lack of refund, and absence of explanation of the approach further confirm our suspicion that this is an unreliable EA.