Euro Hedge is a robot that was released on the MQL5 market. The developer provides us with details about how the system functions and what we have to expect from it. So, we have decided to check it out.

Vendor transparency

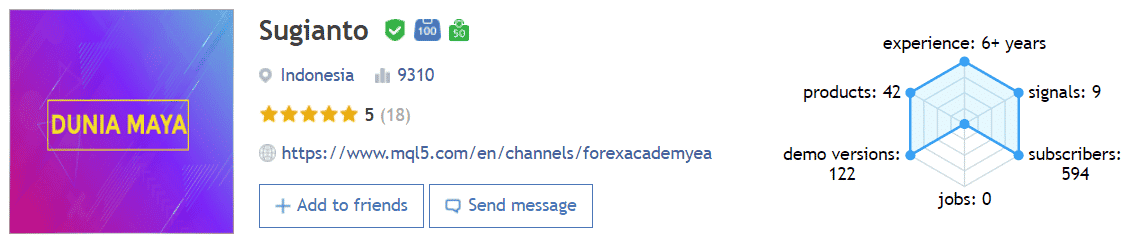

Sugianto is a developer from Indonesia who has six years of MQL5 experience. His portfolio includes 42 products and 9 signals. Its rate is 5 from 5 based on 18 reviews. Although it looks good, we cannot say that the systems he sells are safe and good to go without a detailed analysis.

How Euro Hedge works

The presentation includes various details about the system and its functionality. We have systemized them in the following list.

- The robot can provide us with executing deals on our terminal automatically.

- There’s a mix of Hedge, Cost Average, Martingale, and other risky strategies.

- It’s a rough combo that may not fit the expectations of conservative traders.

- It doesn’t like to keep orders on the market for a long time.

- The system has to work on a VPS server only.

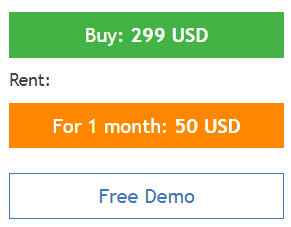

- The pricing was decreased from $499 half a year ago to $299 now.

Timeframe, currency pairs, deposit

- The developers don’t provide us with intel about a time frame.

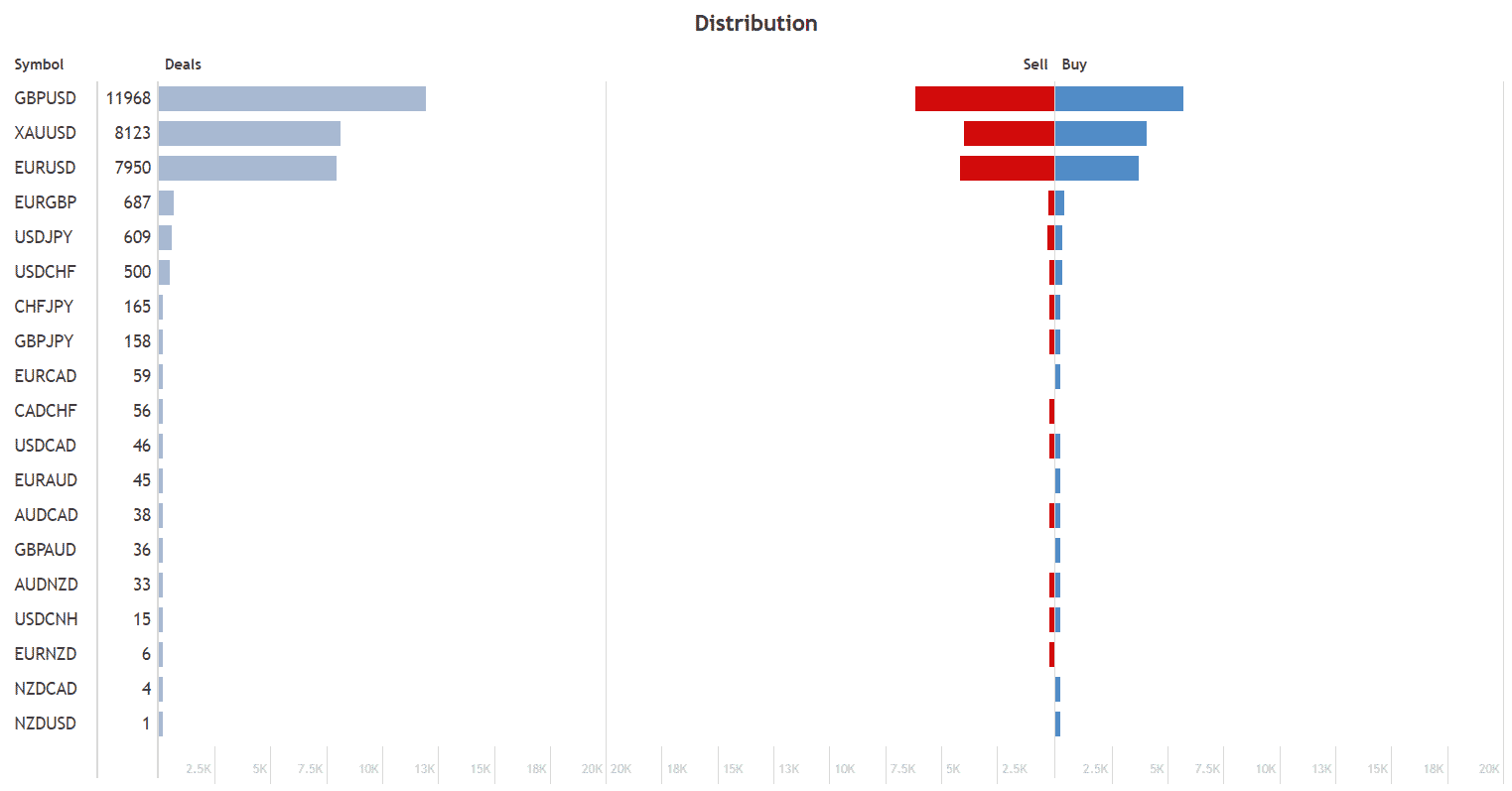

- We know that the core pairs to trade are EURUSD, GBPUSD, and XAUUSD.

- The deposit requirements aren’t revealed as well.

Trading approach

The robot works with cost averaging and martingale to overtake any market move.

Pricing and refund

The price was decreased from $499 to $250, and then increased to $299. It’s possible to rent the robot out for $50 monthly. We can download a demo copy of the system to check its settings and other parameters on the terminal.

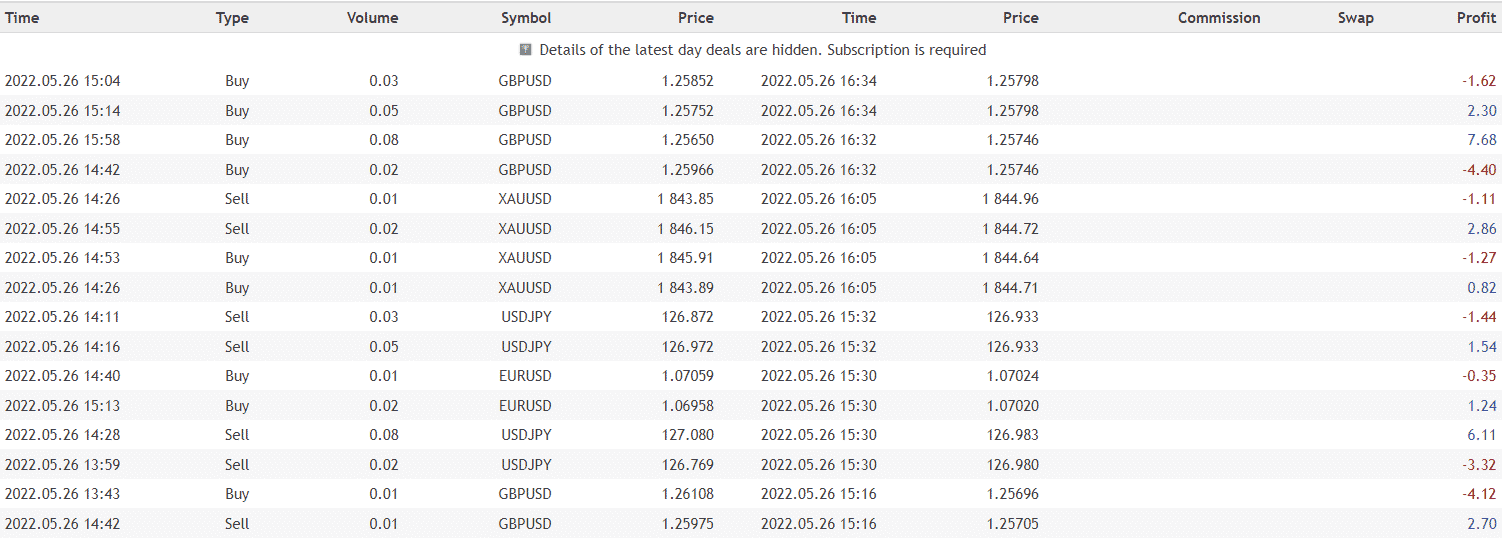

Trading results

The presentation doesn’t include bactest reports. So, we don’t know how well the system was tested before being released.

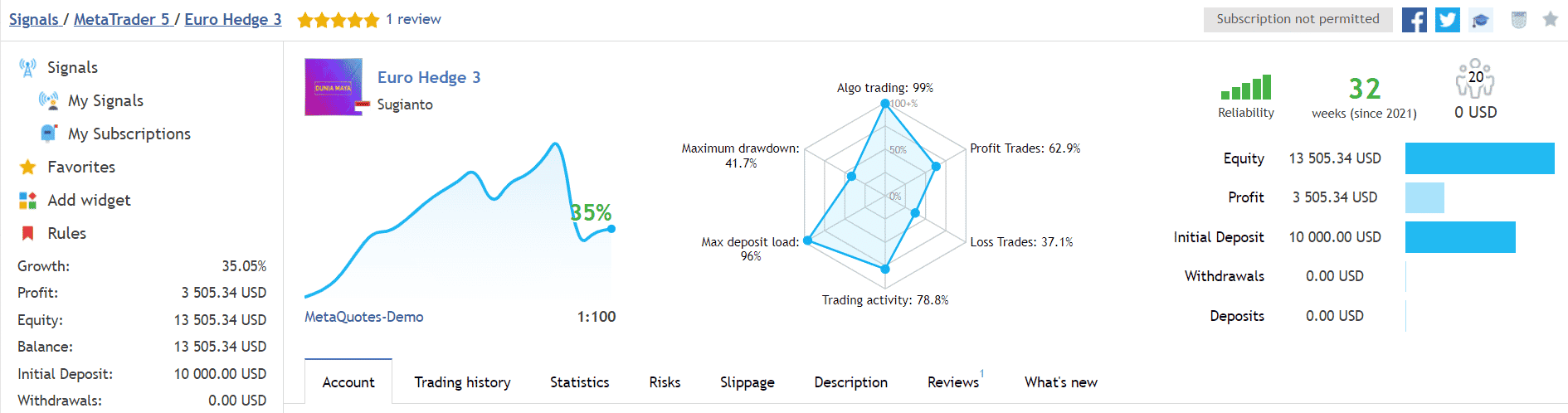

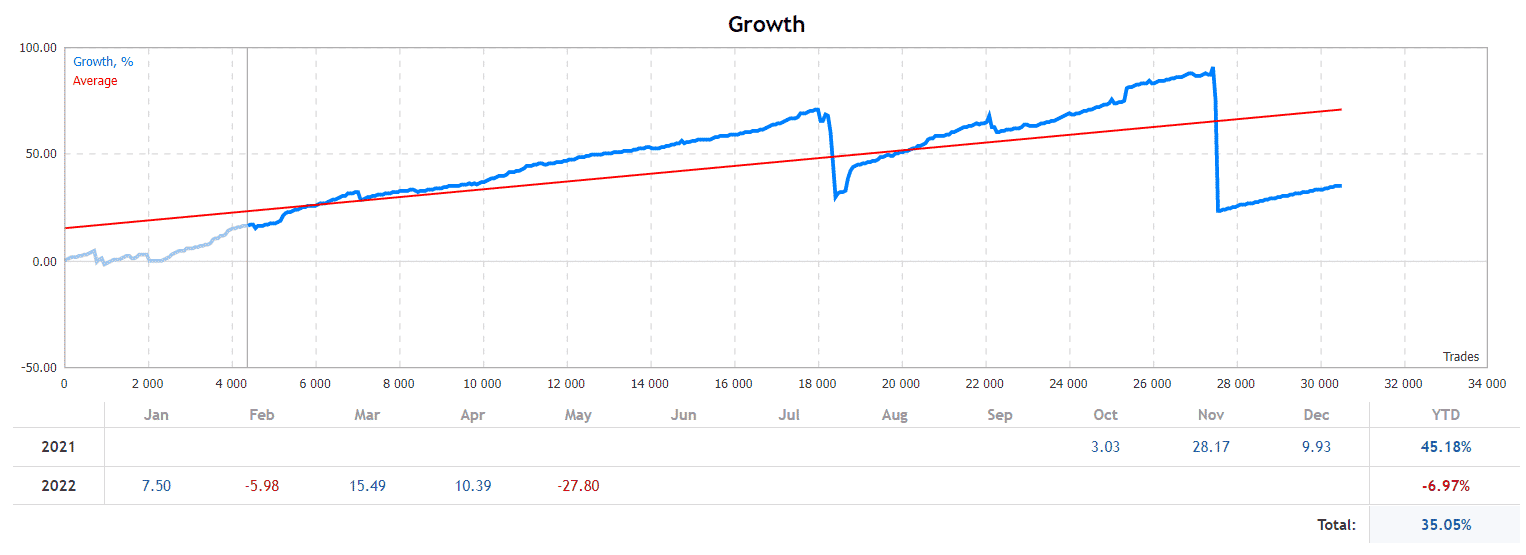

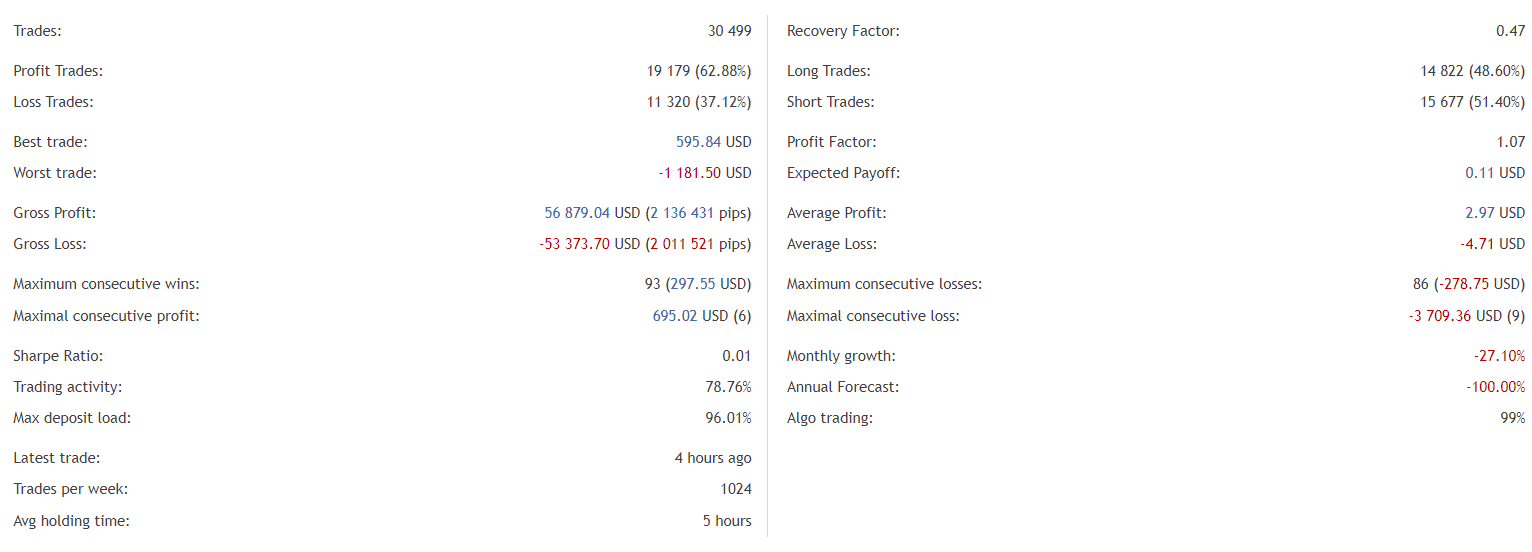

The robot was set to trade on a demo account only on MetaQuotes with leverage of 1:100. The maximum drawdown is 41.7% when the maximum deposit load is 96%. It’s unfriendly number at all. The win rate is 62.9%. Its absolute growth has amounted to 35.05%.

The system is going to lose May 2022.

The system works with Hedge, Grid, and Martingale at the same time. It’s a pretty risky move.

The robot has performed performed 30,499 orders. The best trade is $595.84 when the worst trade is -$1181.50. The recovery factor is 0.47 when the profit factor is 1.07. An average monthly loss can be -27.10%.

GBPUSD is the most actively traded day with 11,968 orders performed.

People say that Euro Hedge is…

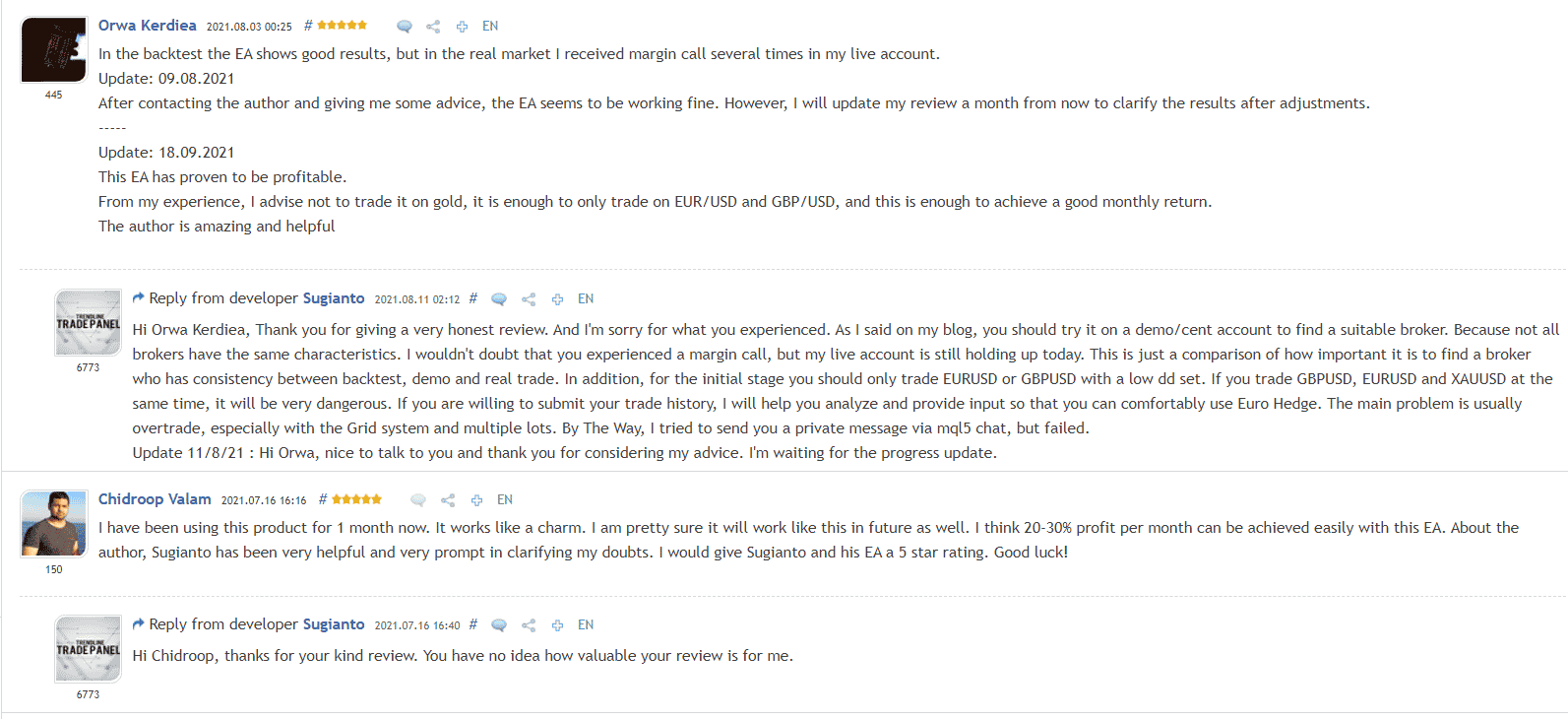

Good. There are mostly positive testimonials written about the system’s performance. The developer provided advice to a client that helped him to manage the system performance correctly. The second testimonial mentioned positive results after a month of using it.

Verdict

| Pros | Cons |

| Trading results provided | No risk advice given |

| No settings explanations provided | |

| No backtest reports shown | |

| The system works with risky strategies | |

| The current profitability is horrible | |

| The pricing is high |

Euro Hedge Conclusion

Euro Hedge is a trading solution that works on a demo account performing a combo of risky strategies like Hedge, Martingale, and a Grid of orders. We’d like to note that using this advisor will require much margin to keep orders on the market. So, you have to take this into account before making the final decision.