Forex hedging involves executing one or more trades to balance an existing position. This is done to prevent significant losses that may arise due to an unexpected market event. Since it is impossible to eliminate risk in trading, hedging defines and limits the risk.

Various market events bring elevated volatility to the currency market. These include inflation, interest rate fluctuations, unexpected news releases, and others. To dampen the effect of volatility on your open positions, you can use various types of hedging strategies.

In this article, we are going to explore some common hedging strategies. Let us start by discussing hedging in more depth in the next section.

What is the forex hedging strategy?

Hedging takes place when you open trades of equal volume as an existing position. You often place the additional trade in the same instrument or another instrument. It depends on what hedging strategy you prefer to use.

By opening the hedge trade, you limit your drawdown to an amount that your account can handle. If you will use another instrument as a hedge, see that it correlates with the original instrument. When using the same instrument, the hedge trade should ultimately equal the total volume of the open trades.

How does the forex hedging strategy work?

Hedging is an advanced FX trading strategy. It requires knowledge of correlation among currency pairs and even with other financial instruments. As already pointed out, you can hedge an active position using the same asset or another asset.

However, the second instrument does not have to be another currency pair. It can be a different financial asset such as oil, gold, etc. Hedging is possible provided there is some correlation between the two financial instruments.

How to trade with the forex hedging strategy?

As pointed out earlier, there are various hedging strategies in existence. This article will cover the two most popular hedging methods, namely:

- Same-instrument hedging

- Correlation hedging

Same-instrument hedge

You are probably familiar with this type of hedge. As the name implies, you will hedge an open position with another trade in the same instrument. Some traders call martingale a hedge. This is not correct, though. Martingale involves an imbalance of position in a particular direction. Meanwhile, hedging always involves a complete balance of positions in both the long and short sides.

Let us take an example. If you initially bought EUR/USD, you would initiate a sell trade of the same volume as the buy trade. The sell trade becomes your hedge trade. If you traded 0.10 lot EUR/USD to the long side, your hedge trade would be 0.10 lot EUR/USD to the short side.

The main factor is the distance between the initial position and the hedge position. This is what we call the hedge distance. The moment you place the hedge trade on the same instrument, the floating profit is likely negative. The smaller the hedge distance, the faster you can get out of the trade cycle. The size of the hedge distance often separates the professional from an amateur.

Correlation hedge

Let us use another pair as a hedge trade. In this type of hedge, you will trade two currency pairs that tend to move in unison. Then you will take opposite trades on the two pairs.

For instance, EUR/USD and GBP/USD are positively correlated currency pairs. Hedging works like this. If you are holding a buy trade in EUR/USD, you can hedge it by taking a short trade on GBP/USD.

With this hedging, keep in mind that your risk covers multiple currency pairs. A positive correlation can work for you as long as the market dynamics involving the two pairs remain. If market influences affect the two pairs differently, each pair could move independently. This will also have a bearing on your hedge trade.

Same-instrument hedging examples

Let us understand what a bullish and bearish setup looks like for same-instrument hedging.

Bullish trade setup

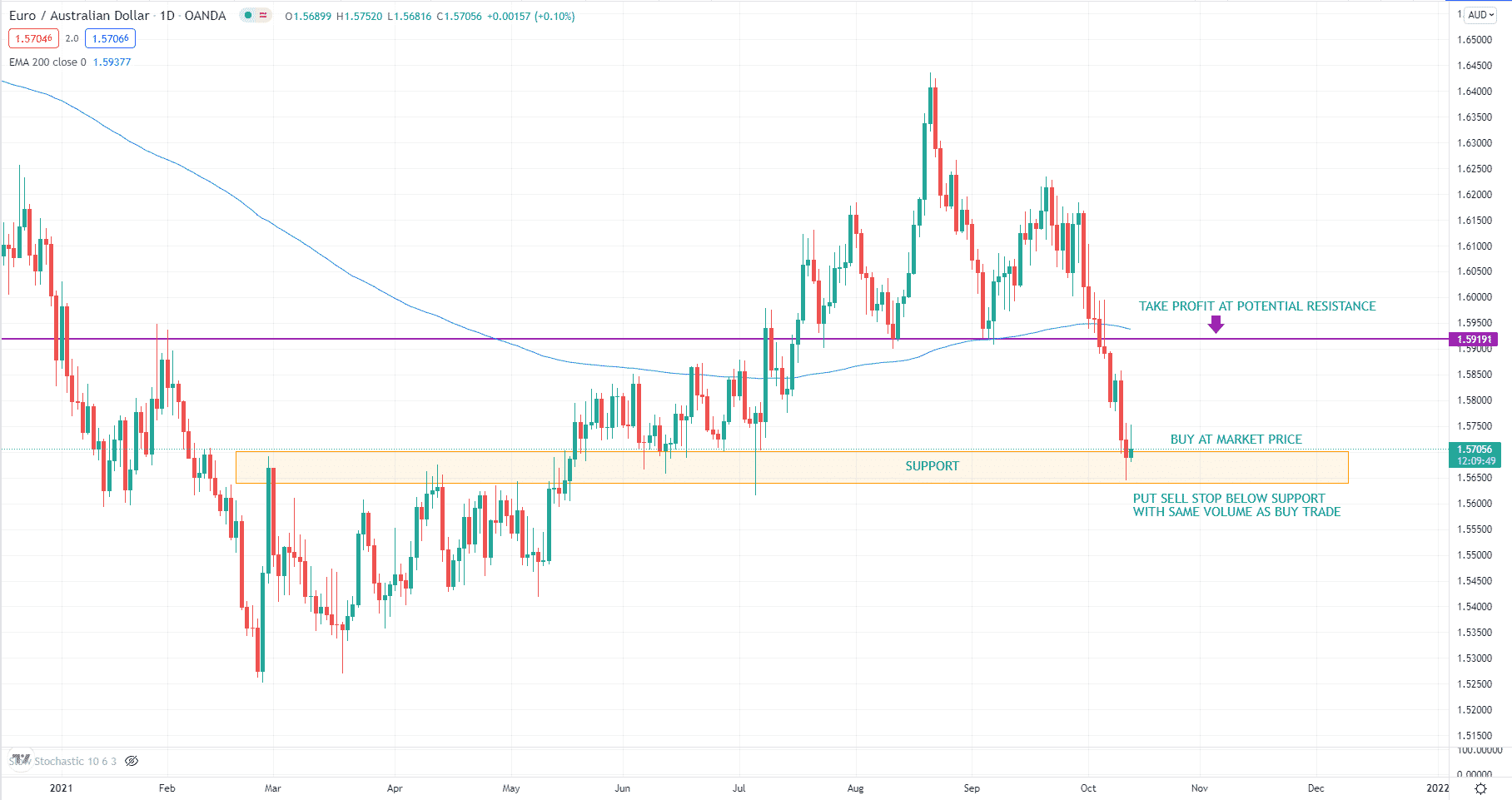

The above graphic shows the daily EUR/AUD chart. This is the scenario of this pair at the time of writing this article. You can tell that price is currently resting on a support. If you expect a bounce, you can open a buy trade at the market price and set the take profit price at the nearest resistance at around 1.59.

If you are not confident in this trade but want to try it, you can use hedging. Just place a sell stop of the same volume as the buy trade. Put the pending order a little below the rectangle. If the price bounces and makes it to your “take profit,” you will make money. If the current sell-off continues and disrespects the support, you can keep the two open trades with a minimal drawdown.

Bearish trade setup

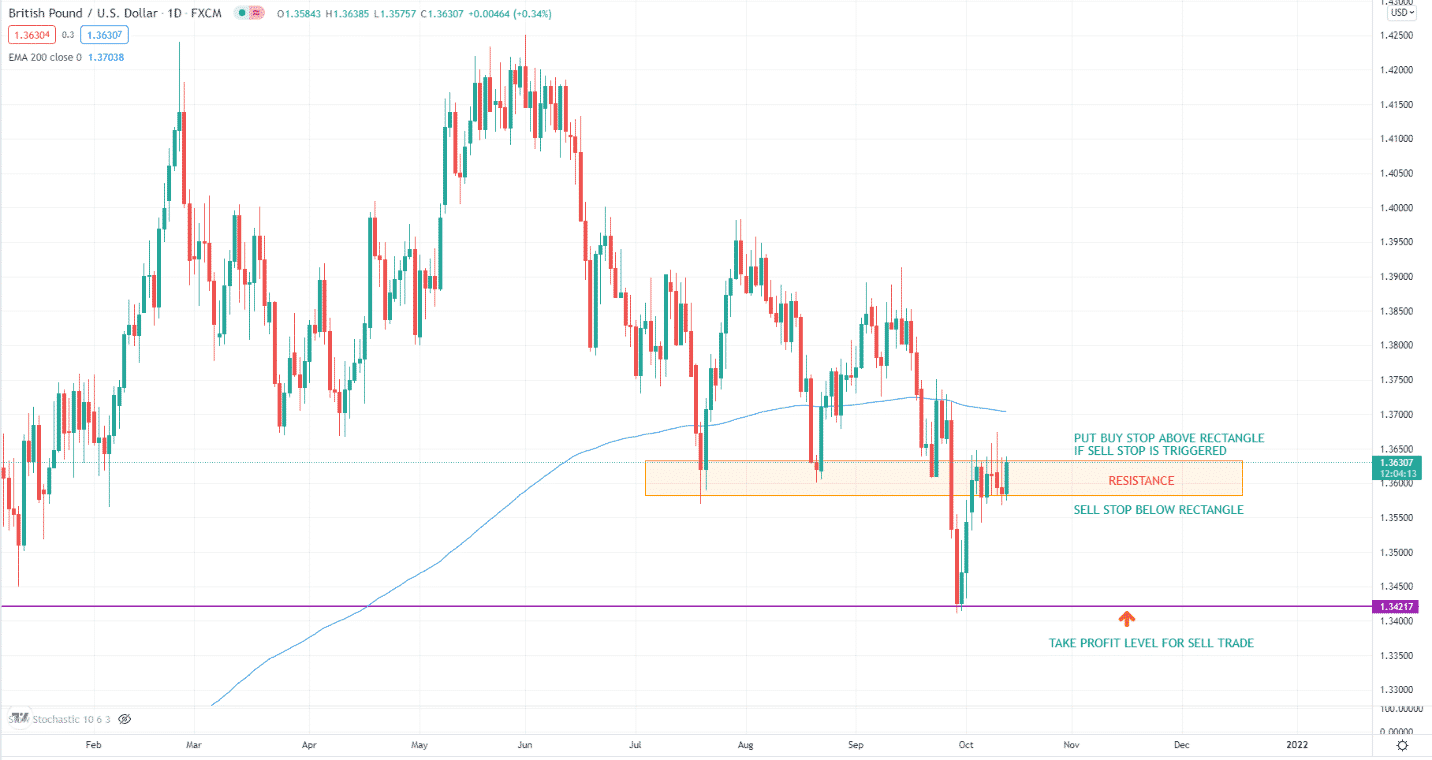

The above chart shows the daily time frame of GBP/USD. It is easy to tell that price has been trading in a tight range over the last few candles. You have probably understood that previous support could turn into resistance. Therefore, you expect the area to hold and the bears to push the price downward.

What you will do is place a sell stop below the rectangle. If the price executes your sell stop entry, you can put a buy stop above the rectangle. The buy stop is your hedge trade in case the price turns around after touching your sell entry. Your “take profit” is the recent swing low, as shown.

How to manage risks?

Traders use hedging to control risk. You can use this method to fix the current drawdown of a trade. This is a temporary solution, though. You want to maintain the status quo until you find a good time to close the hedge in profit. Also, you expect the price to go in the direction of your original trade. When this happens, you can complete the initial trade at breakeven, in profit, or with minimal loss. Your goal is to close the hedge and original trades with some profit.

One challenge in hedging is the timing of adding the hedge trade. Another challenge is the timing of letting go of the hedge trade. These challenges are often complex for a new trader to handle. As such, hedging is suitable for advanced traders.

Final thoughts

As with any trading strategy, hedging aims to generate profit for the trader. You can think of it as a no-loss trading strategy. With it, you do not have to be precise with your entries all the time. You can even trade the wrong direction and still get out positively.

However, technical analysis is nonetheless essential. Holding trades with a negative floating profit can be psychologically and emotionally challenging. Therefore, you would want to trade in the correct market direction and avoid using a hedge trade as much as possible.