Swing trading is a style that sits in between day trading and position trading. Its goal is to trade swings that form in the wake of price oscillations.

This trading profile might suit you if you are busy with commitments at work, business, or elsewhere. In swing trading, you do not need to check your charts within the day. With just an hour or two, you can do things like analyzing the markets, opening trades, and managing positions. You will typically do this at the close of the previous trading day and the current start.

If you want to make it big in trading, you should familiarize yourself with the common reasons why traders fail. Let’s go through five tips and understand why traders lose money and how to avoid this. Make sure you do not commit these mistakes in your trading.

Tip 1: Do not check your trades too often

While it sounds counterintuitive, it is the reality. Monitoring your open trades now and then will hurt your trading performance. When you do this, you will end up doing something when you should be doing nothing.

For example, you might decide to close an open trade because the market is not moving. After a while, you might be surprised to see the price moving in your direction without you on board.

Why does it happen?

Every trader faces the temptation to mess a trade on a whim or boredom. We want to see action in the market, so we feel bored when the market is not moving at all. This could happen if we enter the market during inactive sessions.

How to avoid the mistake?

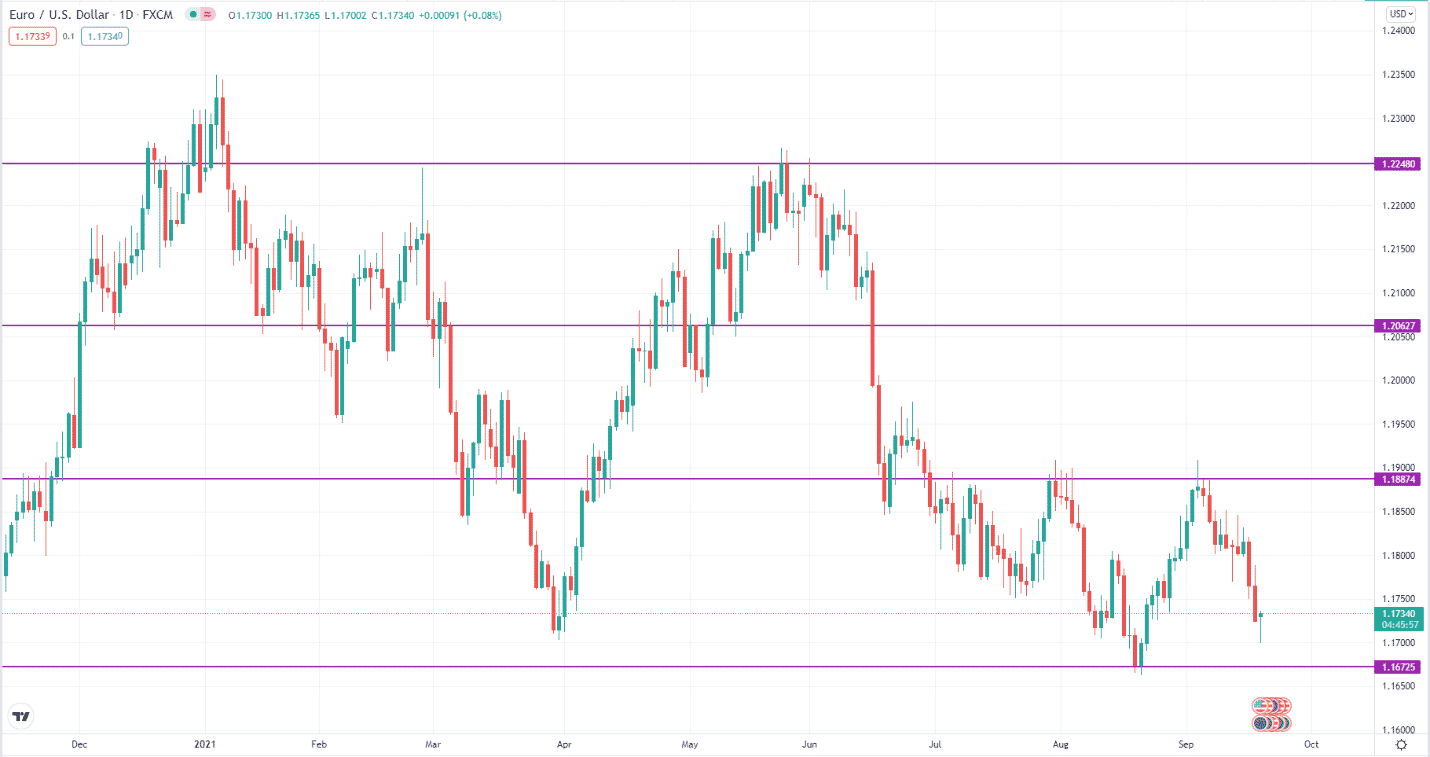

Keeping tabs on the market condition is good if done sparingly. However, continuously looking at your charts now and then could make you sabotage your trades. Since you are a swing trader, checking your charts often goes against the principle of this style. You should be checking your charts only when significant events happen, such as price reaching critical levels. Look at the image below.

Tip 2: Focus on risk rather than reward

Everyone coming into the FXt wants to make money. Not only that, but we also want to make money fast. Although this is possible, it is not the right mindset. If you have this thinking when you approach trading, you will lose money instead. Just because you want something in trading, that does not mean the market will give it to you.

Why does it happen?

To make money fast, we focus our attention on strategies that could bring us profits. That is the case for novice traders. They have not known that there are other aspects to trading: risk management and psychology. Little did they know that these different facets hold more importance than strategies themselves.

How to avoid the mistake?

It would help if you focused on risk to succeed in trading. You have to protect your capital and trade over the long haul. Learning how to trade takes time. The best way to learn is to trade with real money. If you lose your capital right away, your learning stops. Focus on controlling risk and keeping your capital safe. Profits will come when you learn this lesson.

Tip 3: Know the current condition of the market

You must know the condition of the market you are considering trading. Typically, this should be part of your trading plan. A market assumes one of two phases at any one time. You have to understand this basic concept. If the market is trending, you must use a different set of strategies. On the other hand, a ranging market calls for a different approach.

Why does it happen?

Traders without a trading plan often make this mistake. Perhaps they do not take trading seriously for some reason. These traders may have a gambling attitude or are just downright lazy. They make the wrong assumption that their trading will improve naturally over time without making a conscious effort.

How to avoid the mistake?

If you want to make a shortlist of successful traders, you have to create your plan. No one is exempted from this. Even experienced traders maintain a trading plan. One of the things to include in your trade plan is the type of market environment you would like to trade. If you would like to trade both trending and ranging markets, that is possible. Just make sure that your trading approach in each scenario is carefully outlined.

Tip 4: Limit your losses

Losses are part of trading. There is just no way around it. New and old traders alike experience losses from time to time. You can think of them as overhead costs in running your trading business. If you do not think about risks seriously, you could end up losing more than you expect in a single trade. Controlling risk is your job as a trader.

Why does it happen?

Holding trades longer than one day subjects them to unexpected news events. During these times, markets can become turbulent and crazy. Any winning position you might be holding for a while could turn into a losing position in a matter of minutes. Keep in mind that a lot of news items are being released weekly. Sometimes news items are high impact and carry a lot of weight, such as the Brexit referendum in 2016.

How to avoid the mistake?

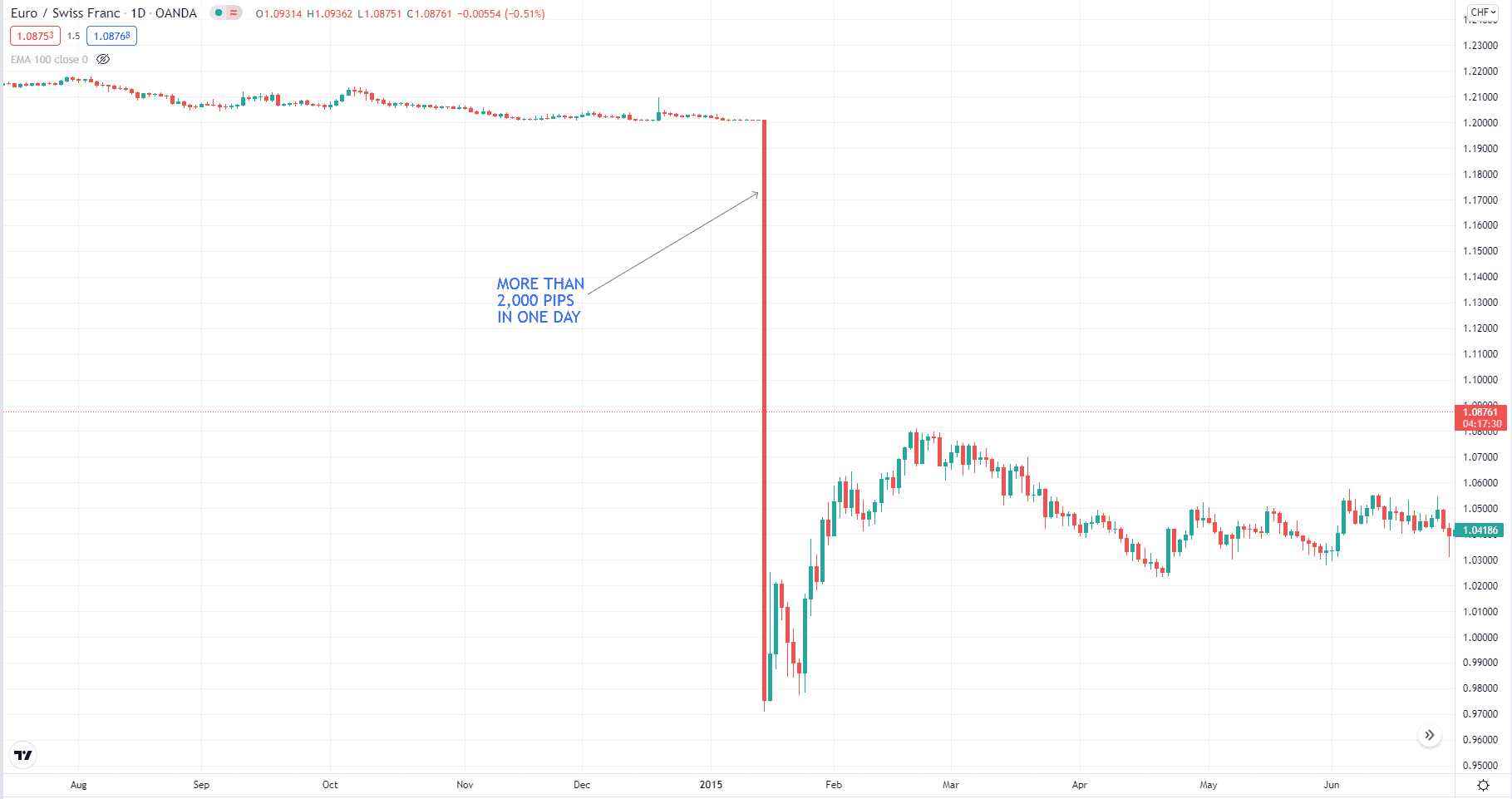

To avoid losing more than necessary, put protective stops in your trades, every single one of them. This should be the case even if you trade higher time frames such as 4-hour or daily charts. You would not know when a market crash comes about. It could be around the corner. Remember the flash crash that happened in EUR/CHF on 15 January 2015.

Tip 5: Keep tabs on fundamental influences

Trading the FX market involves buying one currency and selling another. Whether the exchange rate of a currency pair appreciates or depreciates depends on the relative strength of the two currencies. Over the long term, fundamental influences drive the markets. While you can trade in both directions in forex, it is best to trade in the general direction of the trend. The underlying factor behind this trend is none other than fundamental influences.

Why does it happen?

Technical traders embrace the notion that price contains everything. They contend that since price factors in fundamental elements, they do not need other information to trade profitably. For them, looking at the economic calendar is a waste of time.

How to avoid the mistake?

Be aware of the upcoming news announcements in the FX market. Because of the number of scheduled news events it would be a daunting task to follow each event. Therefore, you should focus on high-impact news events. Various websites provide an economic calendar for free.