Several factors make financial markets popular among investors. It’s highly liquid, and investors can borrow more against their capital through leverage as it is open 24/5, Monday through Friday.

Around 90% of FX traders lose money, while only 10% make consistent profits. So then, what does this 10% chunk do that makes them eligible for this league? Furthermore, it is essential to ask what they are doing that makes them consistently lose.

There’s quite a lot to learn about FX, so we left five tips for you in this article. Getting on the right path to trading profitability will help you join these successful investors, and you will be closer to getting into the 10% of the FX traders.

Five tips to become a profitable FX trader

A trader’s skills are honed by practice and discipline. As part of their self-analysis, they examine what motivates their investments so that they can avoid fear or greed when making decisions. Traders need to practice these tips to be successful.

Tip 1: Set goals and choose a trading style

Having some idea of your destination and the route to get there is imperative before setting out on any journey. So, you must define your investment goals beforehand and ensure your method enables you to achieve them. The risk profile of each trading style varies, which makes a specific approach and attitude necessary to be successful.

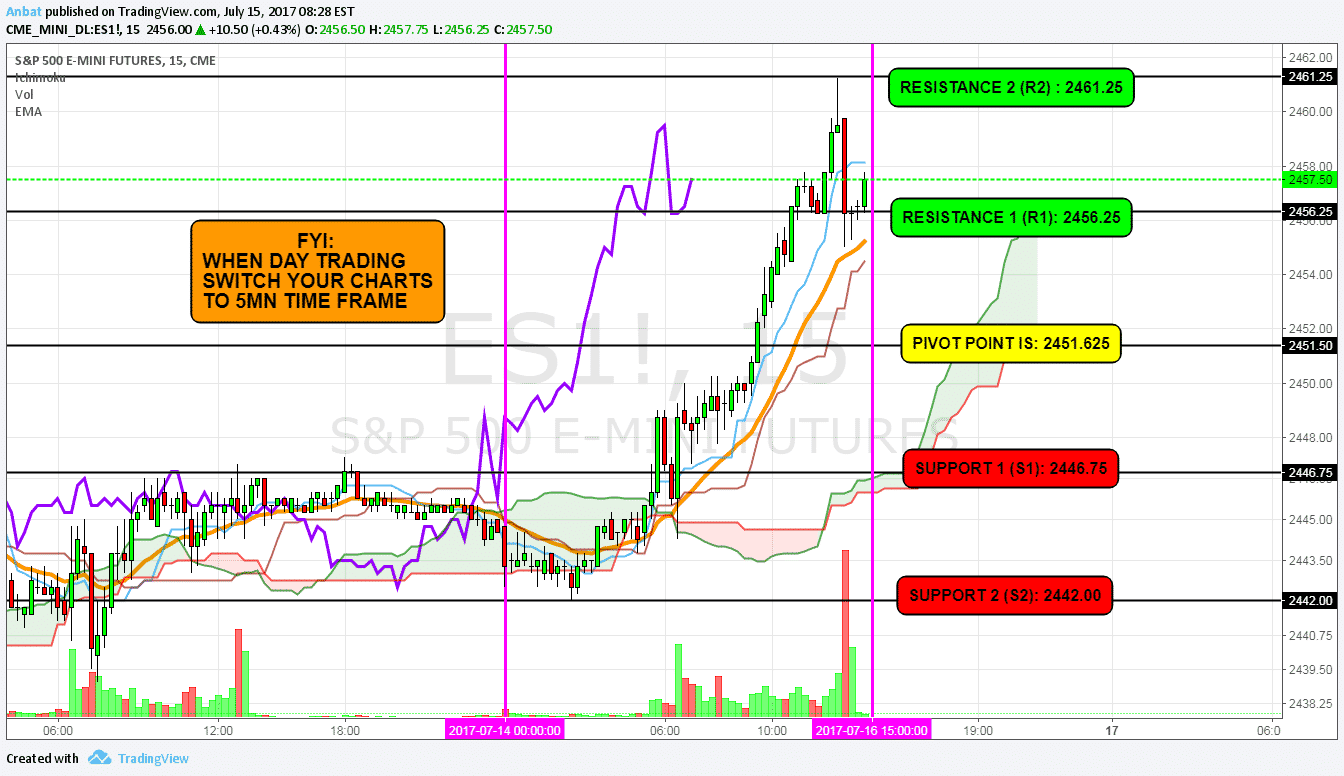

You might consider day trading if, for instance, you cannot handle leaving a position open at night. Check the chart with the example of day trading.

Alternatively, if you are looking to make money through the appreciation of an investment over some time, you might be a position trader. Before you decide what style of investment is best for you, consider your personality. Otherwise, you will be stressed and could lose money.

Tip 2: Do research to choose a broker and trading platform

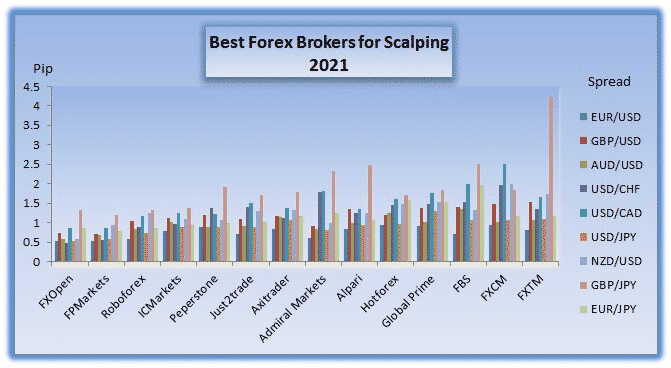

It is vital to choose a reputable broker, and it is also essential to research the differences between them. To make a successful deal, you must know the broker’s policies and how they do business. For example, investment in over-the-counter or spot markets is different from trading on exchanges.

You should make sure that the FX platform offered by your broker can accommodate the analysis you plan to perform. For example, consider whether your broker’s platform will allow you to draw Fibonacci lines if you trade off Fibonacci numbers.

Good brokers with weak platforms, or a robust platform with weak brokers, can pose problems. Choose a platform and broker that complements each other.

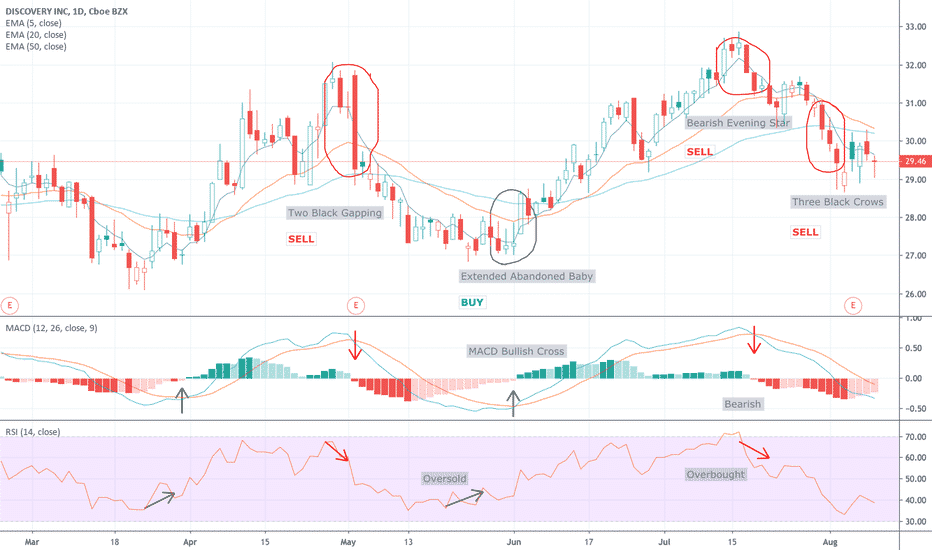

Tip 3: Choose a consistent methodology

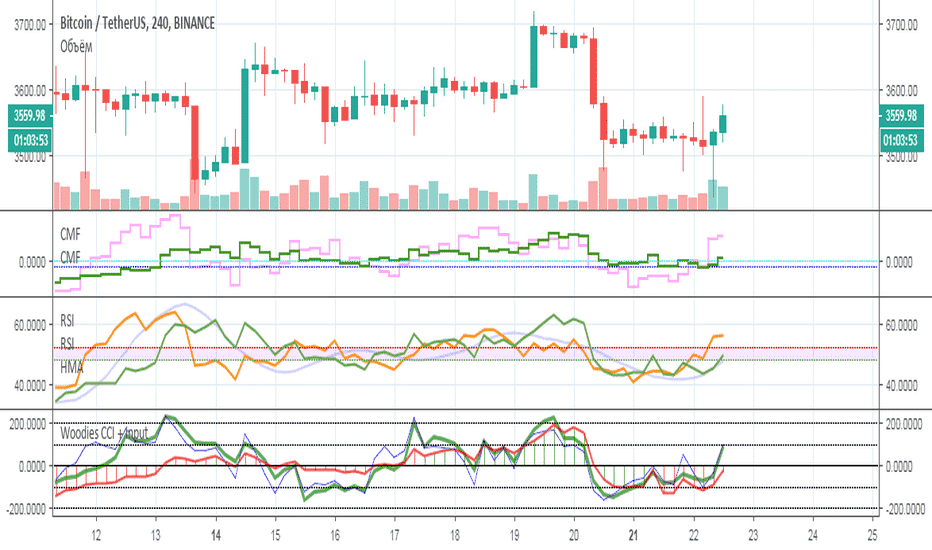

Traders need an idea about how they will execute their transactions before they enter any market. To make an appropriate decision on whether to enter or exit a deal, you must know the information you need. When deciding whether to execute a transaction, some people look at fundamental factors and charts. However, others only look at technical indicators.

Whichever method you choose, make sure it is consistent, adaptable, and continues to work with the dynamic changes in the market.

Tip 4: Determine the points of entry and exit

When looking at charts in different time frames, traders are often confused by conflicting information. For example, a weekly chart can suggest a buying opportunity which will show up as a buy signal on an intraday chart.

If you rely on a weekly chart to give your primary trading direction but use a daily chart to time your trades, be sure to synchronize the two. For example, you should wait until the daily chart confirms a buy signal if the weekly chart gives you a buy signal. Then, stay in sync with the chart.

Tip 5: Calculate your expectancy

Calculate the reliability of your system using the expectancy formula. Then, go back and analyze all your winning trades compared to how many losses you had with each losing trade. Then, you can determine how much profit your winning trades generated versus how much you lost on each losing one.

Analyze your last ten trades. Observe your chart to see which trades your system would have recommended you enter and exit. Calculate whether you would have been profitable or not. Make a note of your results. Add up all your winning deals and divide the answer by the number of FX deals you executed.

Use this formula:

E = [1+ (LW)] × P−1

E is expectancy

W is the Average winning deal

L is the average losing trade

P is the percentage of win ratio

Let’s consider this with an example.

A percentage win ratio of 60% would be calculated if six of your ten trades were winning and four were losing. In the example above, your six deals made $2,400, so your average win would be $2,400/6 = $400.

Your average loss would be $300 if your losses were $1,200. In the formula, these results equal E= [1 + (400/300) x 0.6 – 1 = 0.40, or 40%. When you set your risk equal to 1% of your account on every investment, you can expect to earn 40 cents on every dollar if you keep your expectancy at 40%.

Final thoughts

By following the tips above, you will gain a structured approach to trading and refine your trading abilities. To increase your proficiency in trading, you must practice consistently. These forex tips can serve as a starting place to build your assumptions about the market and create a trading plan that works for you. However, one person’s trading plan may not be suitable for another. You can improve your trading every day by creating your investing strategy.