Foreximba EA claims to be a user-friendly robot that requires a minimum deposit and trades in two currency pairs. It uses a strategy with a fixed lot size to minimize potential losses. The algorithm is operational with the MT4 platform. To find out more about this robot, read the review below where we have detailed all the pros and cons.

Vendor transparency

There is no information on the website about the developer’s identity, whereabouts, and credibility. The only means by which the customers can contact the seller is through a query form that asks for the customers’ emails. This is a bad practice by the developer that indicates a lack of transparency.

How Foreximba works

The robot comes with the following main features:

- It offers drawdown control

- It uses a fixed lot size

- The EA does not use martingale strategy

- It accepts multiple modes of payments

To install the EA, use the following steps:

- Make the payment and download the bot files on your PC

- Start the MT4 platform

- Extract the relevant EA files from the Foreximba package

- Drag the files onto the charts section in MT4

- Enable auto-trading

Timeframe, currency pairs, deposit

Foreximba operates with a minimum deposit of 60 USD in the trading account. It works on AUD/USD and EUR/USD. The average trade length is 2 days.

Trading approach

The developer states that the robot uses a fixed lot size with no martingale involved. It trades on EURUSD and AUDUSD from $60 in minimum deposit. From the history on Myfxbook, we can observe that the EA has a virtual stop loss for each trade and can use averaging in some instances. The average trade duration of 2 days refers to a swing trading approach.

Pricing and refund

The robot is sold at a one-time price of 194.99 USD and comes with a 30-day money-back guarantee on the condition that the drawdown rises above 40%. Payments are accepted in multiple formats like PayPal, MasterCard, Visa, UnionPay, American Express, & Discover. The package can be sent through mail or downloaded through the company website or by delivery (subject to delivery charges). The selling package includes one real lifetime account, 3-lifetime demo accounts, and a user manual accompanied by 24/7 customer support.

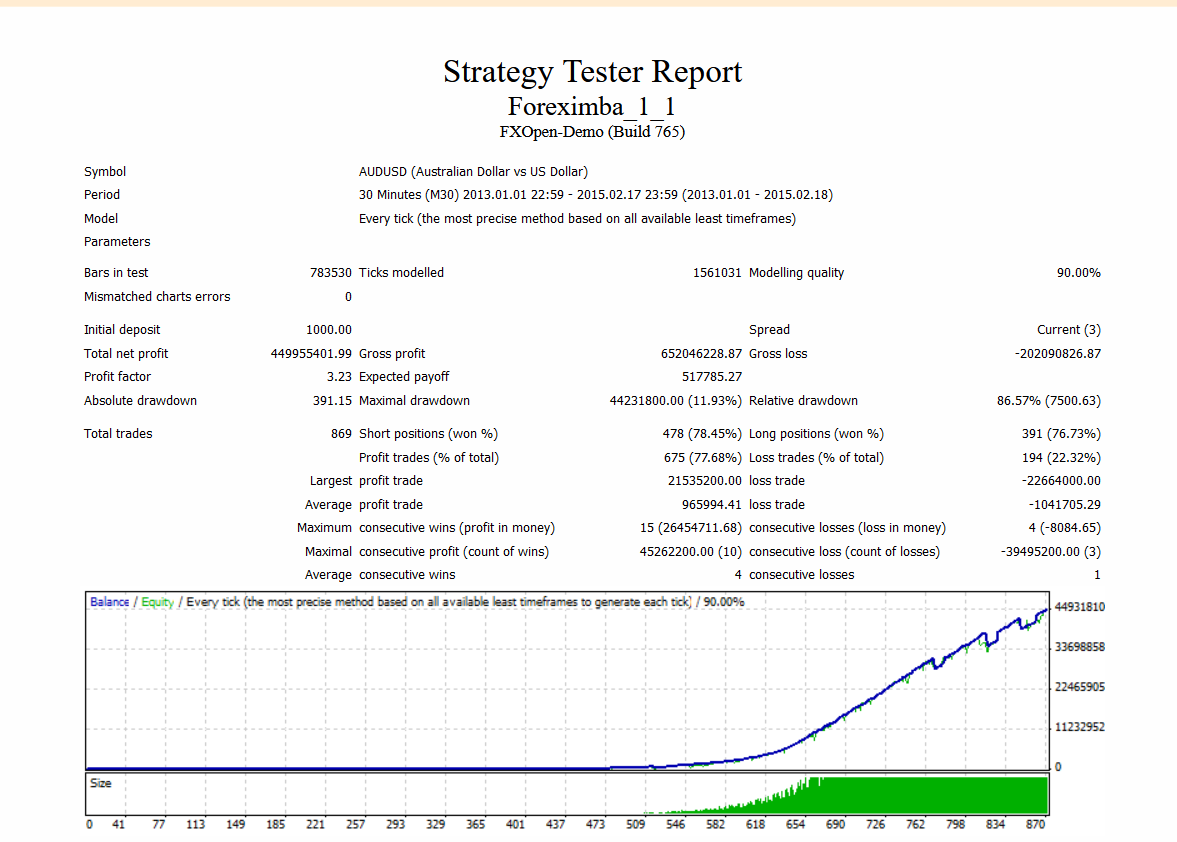

Trading results

Backtesting records for AUD against USD are present on the website from 2013.01.01 to 2015.01.17 that use 90.00% tick quality for modelling. The results show a relative drawdown of 86.57%, fatal to a trader’s account. For this time, the bot participated in 869 trades and lost 194 out of them. An initial deposit of 1000 USD, after accounting for a profit factor of 3.23, resulted in a total net profit of 449955401.99. The most significant profit trade was 21535200.00, while the loss trade was -22664000.00.

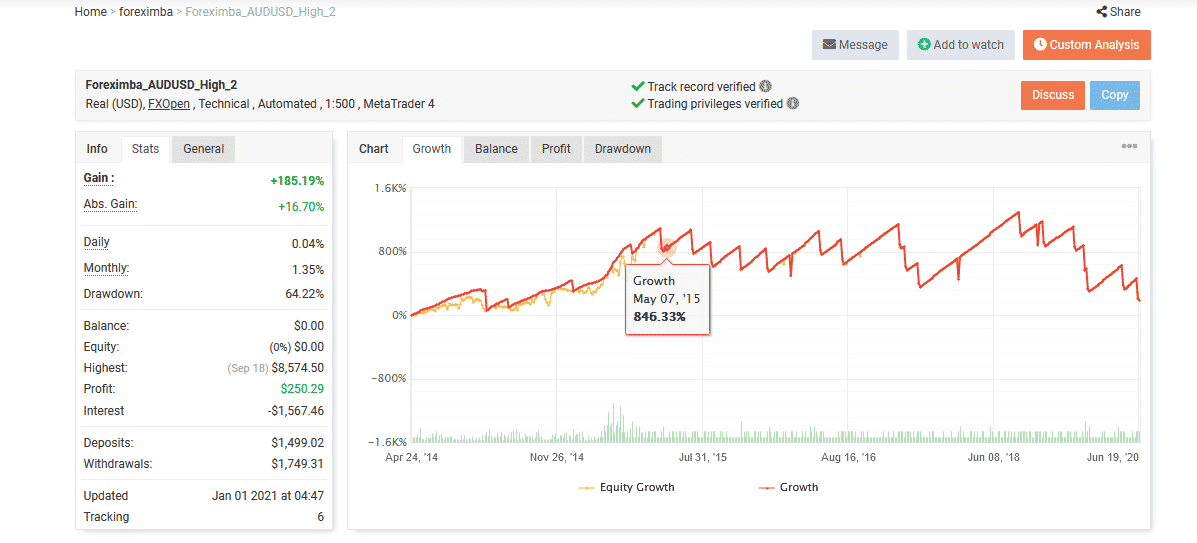

Myfxbook records, a verified source of third-party trading records from 2014 to 2020, show that the system made an absolute gain of +16.70 %, whereas the drawdown stood at 64.22%. This is a very negative and high value that can blow a trader’s account.

Apart from this, the robot participated in a total of 980 trades that had a profit factor of 1.01, with the best trade valued at 1,687.30 USD. The worst trade followed closely behind at -891.43 USD.

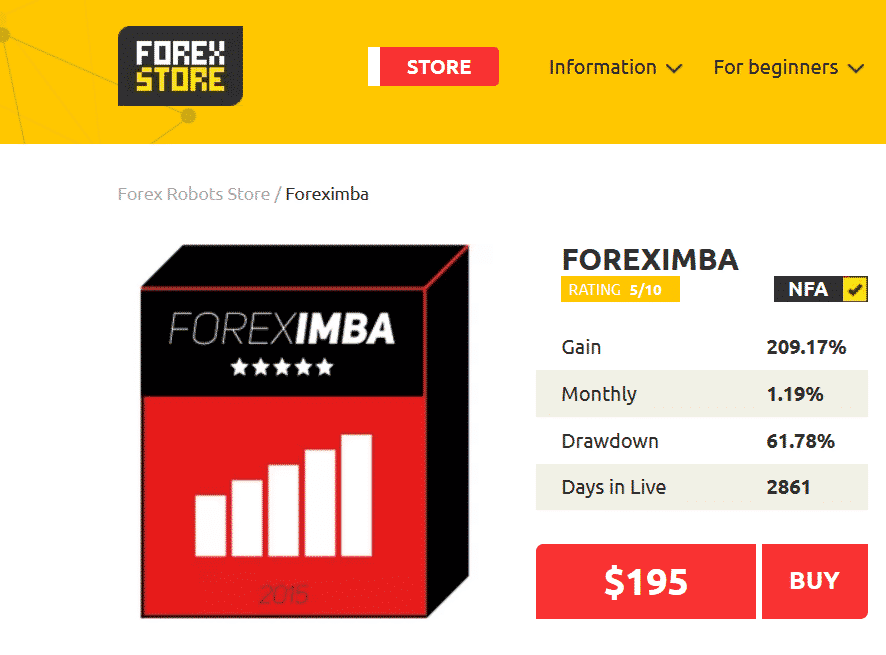

People say that Foreximba is…

Doubtful. Unfortunately, we could not find any customer reviews for this bot on third-party websites like TrustPilot, ForexPeaceArmy, & MQL5. However, ForexStore rates this robot with a 5/10 star rating with a highly devastating drawdown of 61.78% that can ruin a trader’s account.

Verdict

| Advantages | Disadvantages |

| 30-day money-back guarantee | No transparency of developer |

| Strategy not specified | |

| Rating is not good on ForexStore |

Foreximba EA Conclusion

Foreximba claims many trading benefits and does not use any martingale strategy for the users. However, the unnatural drawdown and the fact that the vendors are not transparent about their practices in strategy make this robot very risky.