The creators of FX Classic Trader emphasize that this EA is not just another automated trading tool. This is because they developed it after years of research. So, the robot has a perfect trading strategy that is not only robust but safe and lucrative. We conduct an in-depth analysis of the robot to gauge if there is any truth to these claims and if you should trust the EA or not.

Vendor transparency

The vendor behind this robot is anonymous. There is zero information about the company involved, its developers, year of foundation, trading experience, contact details, location, etc.

How FX Classic Trader works

The EA comes with a variety of features:

- It is 100% automated

- It works on the MT4 platform only

- The minimum leverage is 1:50, while the recommended one is 1:100-1:500

- The system generates higher gains on brokers with lower spreads

- It can run on any broker and any account type

- The vendor advises you test it on a demo account at your broker before trading on a live account

- You are to use a VPS, especially if you lack a good computer or internet connection

- It must be left on 24/7 so as to run properly

- It includes a smart money management

- The EA adheres to FIFO rules

Timeframe, currency pairs, deposit

The EA mainly trades on the EURGBP currency pair and requires a minimum deposit of $200 for a 0.01 lot size. The timeframe used is H1.

Trading approach

As per the vendor claims, FX Classic Trader focuses on support/resistances and indicator analysis. It is non-martingale and is designed to reduce losses early and allow good trades to optimize gains. These explanations come across as superficial and non-detailed.

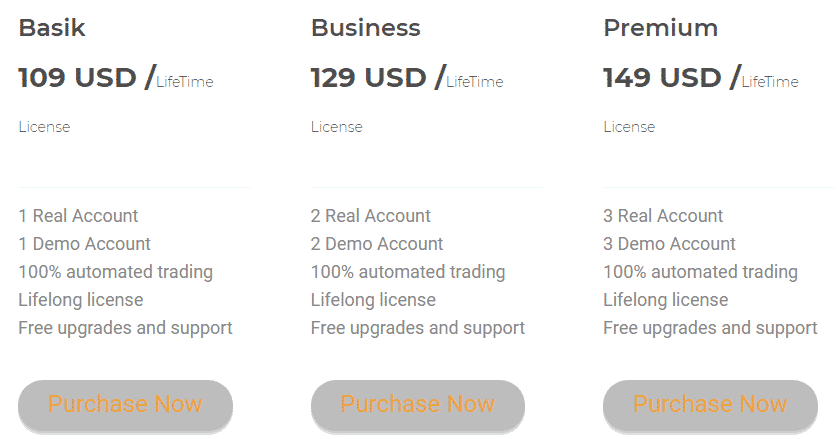

Pricing and refund

FX Classic Trader offers 3 distinctive plans. The basic pack is $109, while the business one is $129. The premium plan is costlier than the first two options as the vendor asks you to pay $149 for it. All the packages offer real and demo accounts, but the number of accounts you can trade on depends on the plan bought.

Trading results

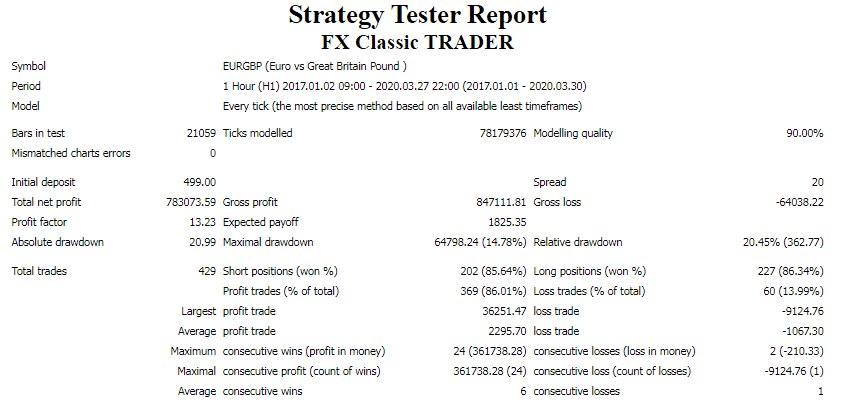

This is a strategy tester report for the EURGBP currency pair. The test was carried out on the H1 chart from January 2017 to March 2020. A total net profit of $783073.59 was generated from a deposit of $499 after the EA completed 429 trades. The maximal drawdown was low as it stood at 14.78%. This indicates that low-risk trading was applied.

The win rates for short and long positions were 85.64% and 86.34%, respectively. A profit factor of 13.23 depicted this EA as a very lucrative tool.

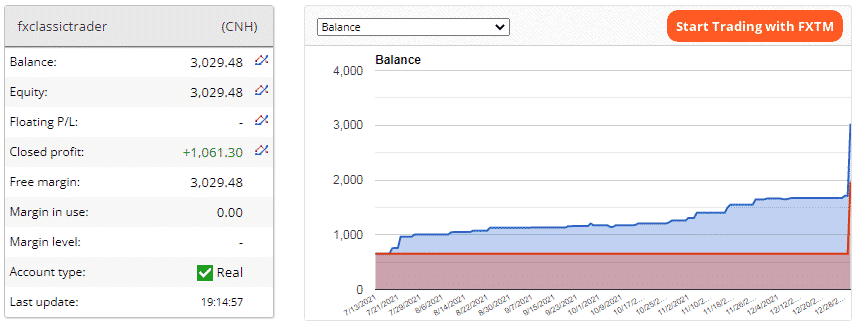

This account was opened on July 13, 2021, and deposited at $1968.18. So far, the robot has made a profit of $1061.30 for the owner. As a consequence, the balance has increased to $3029.48.

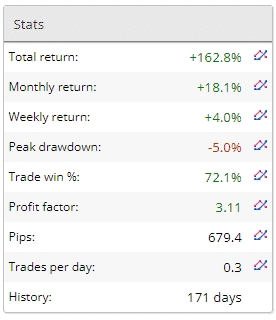

The EA has traded on this account for 171 days now and increased its worth by 162.8%. The profit factor is 3.11, while the monthly and weekly returns are 18.1% and 4%, respectively. There’s a drawdown of -5%, which confirms that the system is a low-risk strategy. A total of 679.4 pips have been made.

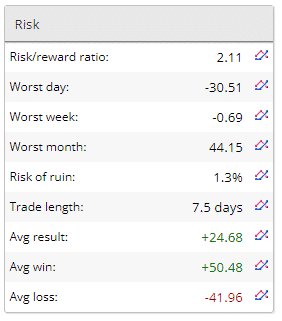

The robot wins more than it loses, as illustrated by an average win of $50.48 and an average loss of -$41.96. The risk/reward ratio is 2.11, and the risk of ruin (1.3%) shows that the account is not under any threat of being obliterated. So, we expect it to be around for some time. On average, trades are held for long periods — 7.5 days.

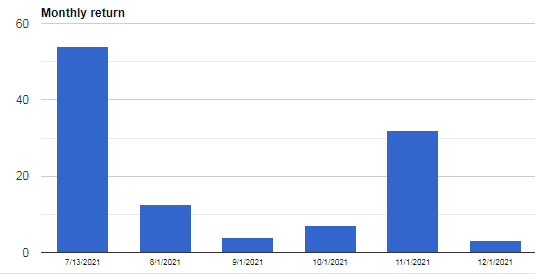

The robot generated significant profits in July and November. December was the least lucrative month.

A majority of trades were conducted in October (11 orders). However, orders placed in November brought in the most profits as they recorded a net profit of $401.48.

FX Classic Trader traded on the EURGBP using fixed lot sizes (0.02) and some grids of orders.

People say that FX Classic Trader is…

A mystery. FX Classic Trader has a page on FPA, but there are no reviews yet. Therefore, we are not sure if traders are using it to run their trading accounts or not.

Verdict

| Pros | Cons |

| Low drawdown | The element of grid is present |

| Live trading results are present | No vendor transparency |

| Zero customer feedback | |

| Strategy explanation isn’t detailed enough |

FX Classic Trader Conclusion

FX Classic Trader was able to record a low drawdown during the backtesting period and in live trading. But we have noted the grid approach is applied. This strategy may produce unfavorable outcomes for the account in the future. Also, the devs do not reveal their identity, which makes it virtually impossible to determine their reputation and trustworthiness.