Gold Miner is an EA that works with full automation on an ECN broker with a low spread. As per the developer’s claims, the EA uses a grid strategy and still be profitable without having high drawdown and major losses. Grid and martingale strategies are notorious for having a high-risk strategical approach and are usually avoided by professional forex traders. To verify the statement we will go over the live and backtesting records of the product to see if the author is telling the truth.

Vendor transparency

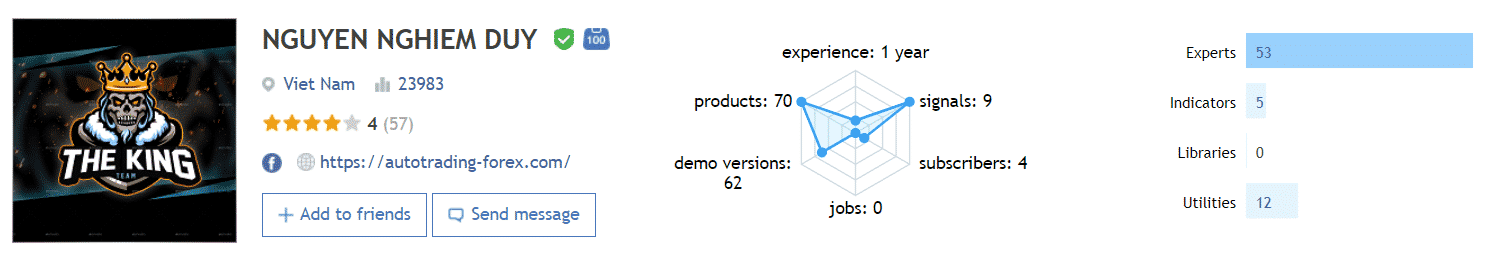

Gold Miner is developed by the Nguyen Nghiem Duy from Vietnam. The developer has an experience of one year, 9 signals, 70 products, 62 demo versions, and 4 subscribers on the MQL5 platform. The vendor provides no further evidence to prove his expertise in the Forex market, such as certifications, personal portfolio, contact information, etc.

How Gold Miner works

The ATS comes with the following features:

- The algorithm is 100% automated.

- The robot is compatible with multiple currency pairs.

- It can open executions using the MT4 trading terminal.

- The bot is easy to set up and install.

- The expert advisor supports ECN brokers.

To install the EA, use the following steps:

- Purchase the system from the MQL5 marketplace

- Open Metatrader 4/5 and log in to your account

- Download the product to your computer

- Drag the EA to charts to start trading

The algorithm will scan the respective instrument based on the coded information and the settings. Traders can adjust the timeframe, lot multiplier, step, stop loss and take profit.

Timeframe, currency pairs, and deposit

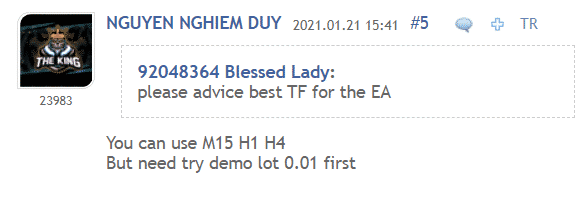

Gold Miner EA can trade on multiple symbols, i.e. XAUUSD, GBPUSD, USDCAD, EURUSD, USDJPY, USDCHF, AUDUSD, NZDUSD, etc. The expert advisor doesn’t come with recommended initial deposit and timeframe. Although one of the traders commented on the MQL5 platform asking for the preferred timeframe, the vendor advised using M15, H1, and H4 charts.

Trading approach

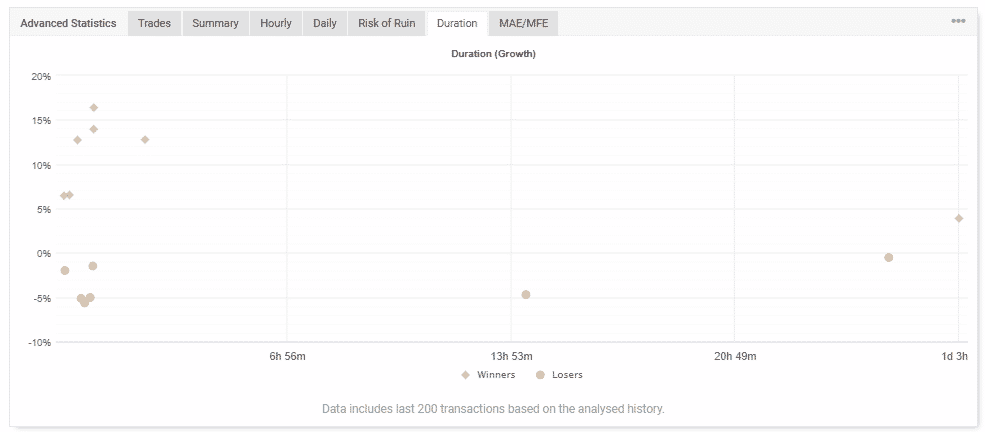

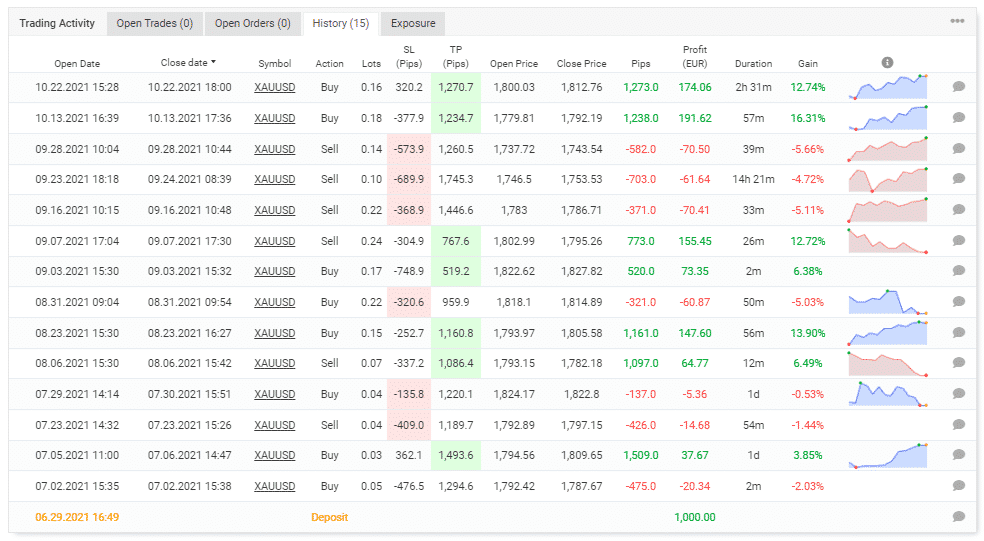

The author states that the robot searches the concentrated areas filled with buyers and sellers. It aims on capitalizing on the short-term trends on the charts. The history on Myfxbook shows us that the system generally holds trades for less than 6 hours.

It places trades with high stop loss and take profit than can range from 300 to over 1000 pips.

Pricing and refund

Gold Miner comes at the cost of $30 for a lifetime purchase. The developer also offers a demo version of the EA to check its performance on historical data before investing your real hard-earned money. The vendor doesn’t mention any money-back policy, but it can be excused considering the low price tag of the expert advisor.

Trading results

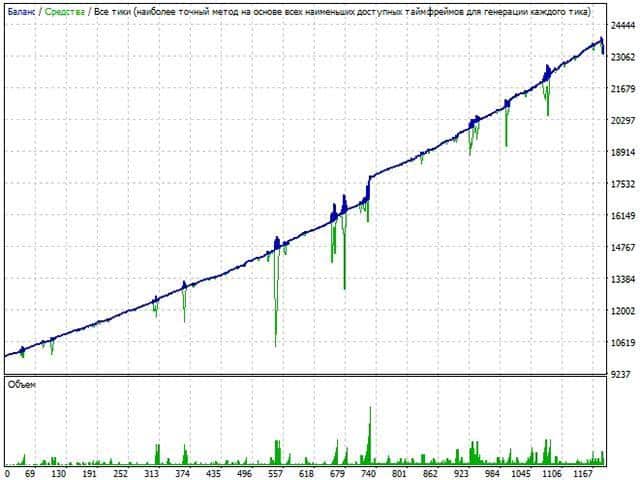

Gold Miner doesn’t come with a proper backtesting report. A backtesting picture is available on the MQL5 website, which is hard to analyze as it is not present in English. To test the martingale-based EA, a detailed analysis is required to properly check the behaviors of the EA in certain market events. The strategy test report cannot predict future performance, but still, it can show us the adaptability and viability of the expert advisor.

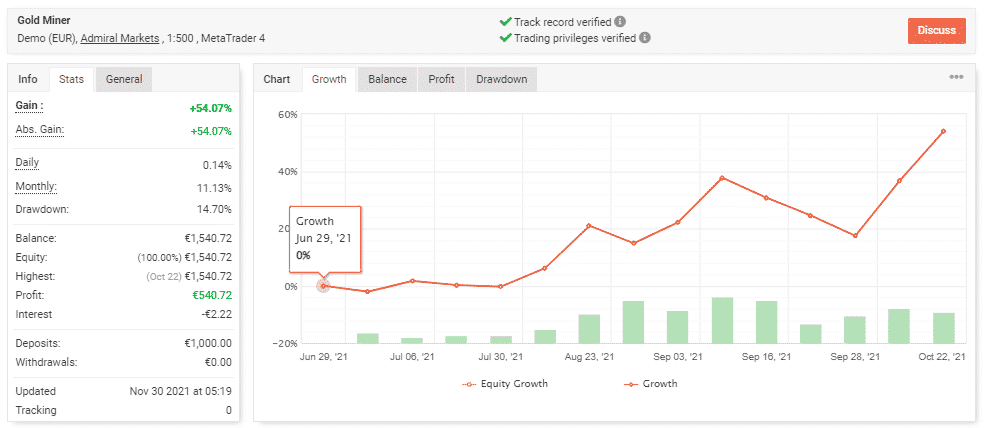

Verified trading records are available on Myfxbook that show performance from June 28, 2021, till October 22, 2021. The system made an average monthly gain of 11.13% during the period, with a drawdown of 14.7%.

The winning rate stood at 50%, with a profit factor of 2.78 in a total of 14 trades. The developer made 1000 Euros in deposits on a live account. Due to the short duration of live stats, we cannot hold them true for the current market conditions. The approach from the author is poor here as they do not share any real performance reports on their page.

People say that Gold Miner is…

There is no customer feedback on reputed third-party websites such as Quora, Trustpilot, Forexpeacearmy, etc. It tells that not many traders know about its existence. The developer needs to provide verified live testing records and extensive backtesting stats to prove the legitimacy of the EA, for traders to consider it a potential investment solution.

Verdict

Advantages

- Affordable pricing

Disadvantages

- No live trading and backtesting records

- Lack of customer transparency

- No customer feedback

Gold Miner Conclusion

Gold Miner comes with very low pricing, but the absence of a strategical game plan, vendor transparency, live testing stats, backtesting records, refund policy, and no user reviews are major drawbacks.