Trading the green market has become a new trend among Forex traders. With an increase in eco-conscious investment ventures, Green Graph EA tries to capitalize on this trend. This MT4 tool promises a safe and profitable trading experience. It claims to reduce losses with its smart trade management measures. While the FX robot posts verified results, the trading stats reveal a high-risk strategy. With issues related to vendor transparency and customer support, our analysis reveals this is not a trustworthy EA.

Vendor Transparency

While the official site does not reveal info about the vendor or the developer, the myfxbook site provides some details on the developer. George Green is the developer of this EA with more than 5 years of experience in trading. He abides by the motto, ‘earn safe, earn green’.

With his location cited as the United Kingdom, the developer has posted two strategy tester reports for the GBPUSD and the EURAUD pairs on the myfxbook site. An online contact form and a contact email address are the only means of contacting the vendor or the developer for queries and complaints regarding the EA.

How Green Graph EA Works

Focused on making trading profitable and beneficial to new traders, this ATS features compatibility with all renowned brokers, 100% verified and tracked results, easy recovery of investment with high monthly profits, and smart Artificial Intelligence technology. This fully automated FX EA has a unique AI that revises the ticks constantly developing the algorithm for future trades. Other useful features include easy setup, user-friendly money management, continuous updates, and full customer support.

Timeframe, Currency Pairs, Deposit

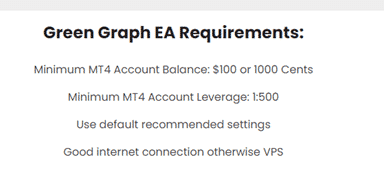

According to the information provided on the site, this EA requires a minimum account balance of $100 for trading. A cent account is also available with the minimum balance being 1000 cents. The leverage used starts from 1:500 and default settings are recommended for all traders.

A stable internet connection is required or you need a VPS for keeping track of the trading. Details like the currency pairs this EA can be used on, or the time frame applicable are not revealed by the vendor.

Trading Approach

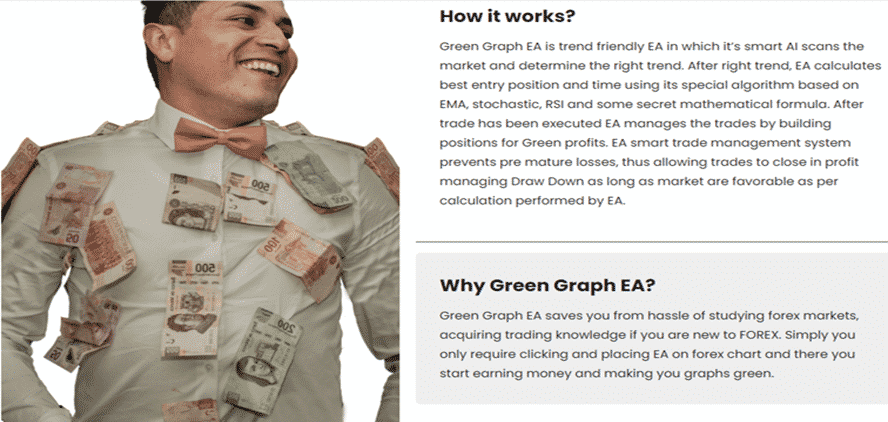

Regarding the working mechanism of this trading software, it uses a trend-following strategy. The smart AI assesses the market and identifies the appropriate trend. It then calculates the best trade entry time and position for which it uses a unique algorithm developed using various indicators like RSI and an undisclosed mathematical formula.

When the execution of the trade is complete, the FX advisor manages the trade by creating profitable positions. As per the vendor info, the smart money management measures by the EA help to avoid premature losses.

Pricing and Refund

Two packages namely the Profitable EA costing $45 per month and the Professional package costing $75 are provided. Features included in the packages include a real/demo account, 24/7 support, free updates, and no hidden charges. The Professional package includes free VPS for 30 days. A money-back guarantee of 30 days is offered by the vendor.

Subscription packages are mostly expensive and this EA is not an exception. Compared to EAs that have a lifetime license and unlimited accounts for a considerably less single payment, the cost of this MT4 tool is expensive.

Trading Results

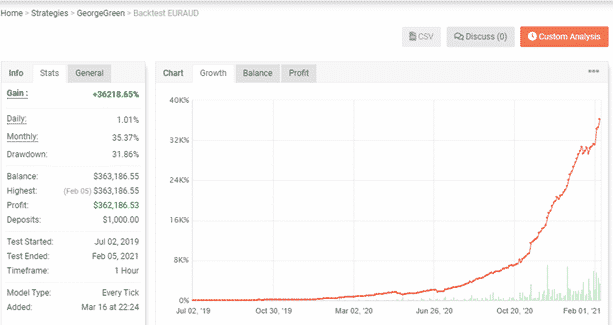

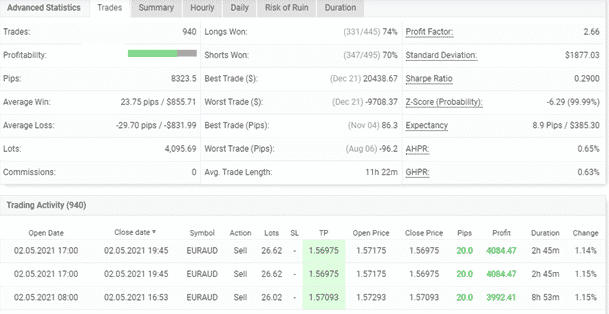

Two strategy tester reports are posted on the site by the vendor. Here is a screenshot of the test done on the EURAUD pair.

The modeling quality of 90% is not sufficient enough to know about details such as the spread, slippage, commission, etc. For the test started in July 2019 and completed in February 2021, using the ‘Every Tick’ model, a total profit of 36218.65% is shown. The drawdown value is 31.86% which is very high. A profit factor value of 2.66 is shown for the backtest.

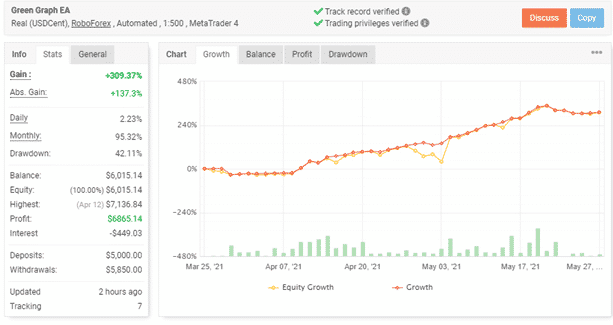

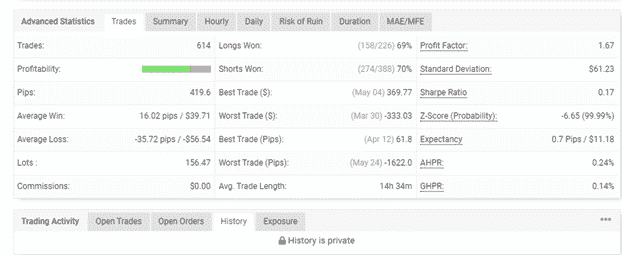

A real USDCent account using RoboForex broker and the leverage of 1:500 verified by the myfxbook site is posted by the vendor. From the results, we could see a total profit of 309.37% and an absolute gain value of 137.3%. The high difference between the two values indicates the strategy used is of a high-risk level. The 42.11% drawdown further confirms our suspicion about the risk level.

A daily profit of 2.23% and a monthly value of 95.32% are revealed for this cent account with deposits of $5000. The profit factor is 1.67. This account does not reveal the trading history which raises a red flag. From the backtests we could see the lot sizes are huge and this may also apply to the real account. Comparing the backtest and real account results there are several differences including the drawdown, profit factor, and total profits achieved.

People say that Green Graph EA is…

A scam. The lack of user reviews even on the official site indicates this is not a popular ATS. A reputed EA is bound to have feedback from users. With sites like Forexpeacearmy, Trustpilot, etc. not posting user feedback for this FX EA, we conclude it is a scam EA.

Verdict

| Pros | Cons |

| Fully automated software | Trading results indicate a high-risk strategy |

| 30 days money-back guarantee | Vendor transparency is not present |

| No user feedback |

Green Graph EA

Green Graph EA claims to be a profitable system but analysis of the MT4 tool reveals it is not trustworthy. The lack of vendor transparency and provision of meager options for customer support are factors that make this FX robot unreliable. Although the vendor provides verified results and backtests, the stats indicate the strategy used is not effective. The high drawdown value and discrepancy between the absolute and total profit values reveal the EA is not using an effective strategy.

-

Features5

-

Strategy4

-

Performance5

-

Price6

-

Customer support4