You’ve come to the right spot if you want to make a fortune by day trading cryptos. However, before you jump on this roller coaster, you may educate yourself on day trading cryptocurrency by reading this article.

Is it feasible to earn $100 each day trading crypto to get to the question? Yes, it is. On trading platforms, you are usually trading with the leverage, which multiplies the power of your money, for example, 10x or 100x.

Then there’s the risk of losing your cash if you don’t know how to manage positions effectively.

What is day trading?

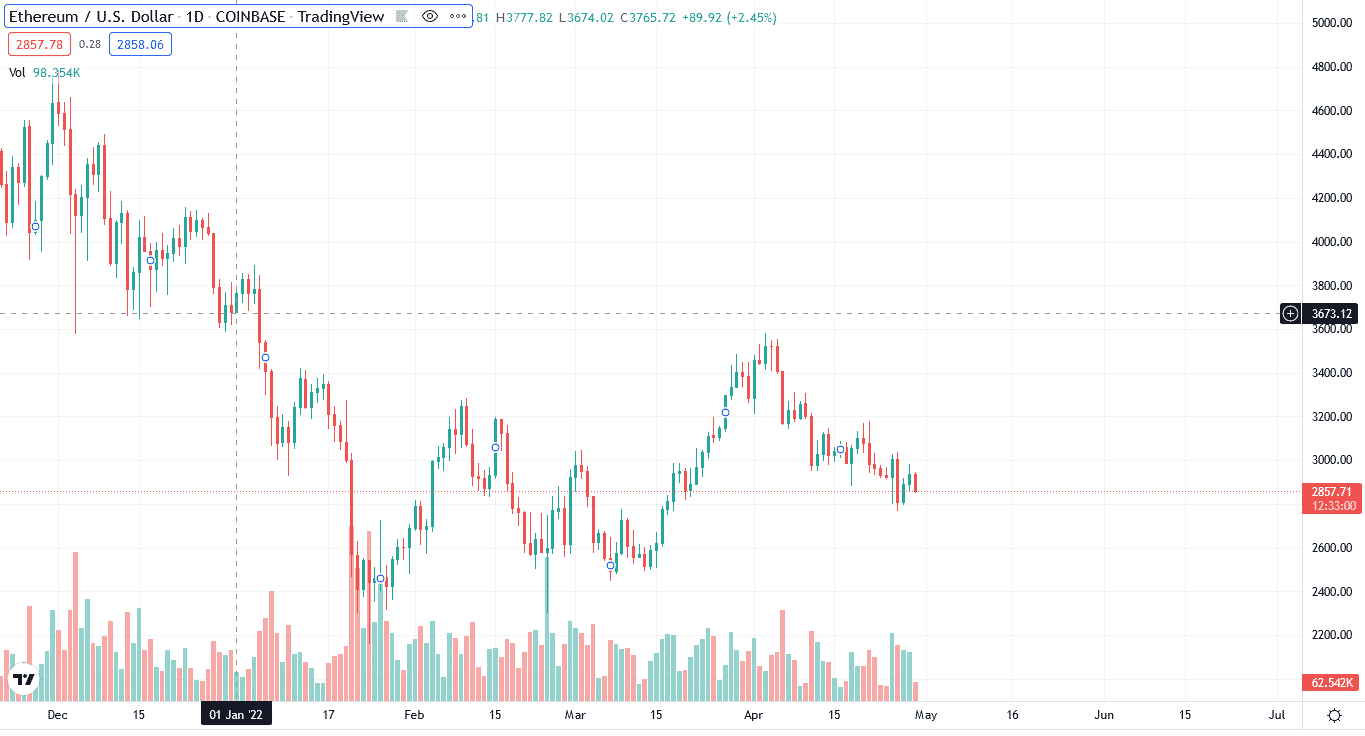

Traders use traditional marketplaces for day trading. Crypto day trading is a sort of trading that involves buying and selling crypto assets simultaneously. Because of the volatility and liquidity of crypto markets, day trading bitcoin is high-risk. As a result, it is vital to remain consistent and to have a greater understanding of crypto and blockchain technology.

While typical buy-and-hold investors are concerned with long-term success, day traders are more concerned with earning quick returns.

Top five tips for day trading

First and foremost, you must recognize that effective trading necessitates a high concentration level. Aside from the five top tips listed below, pay close attention to market dynamics to determine when this advice applies. It is critical to grasp each piece of advice in this guide and comprehend its reasons.

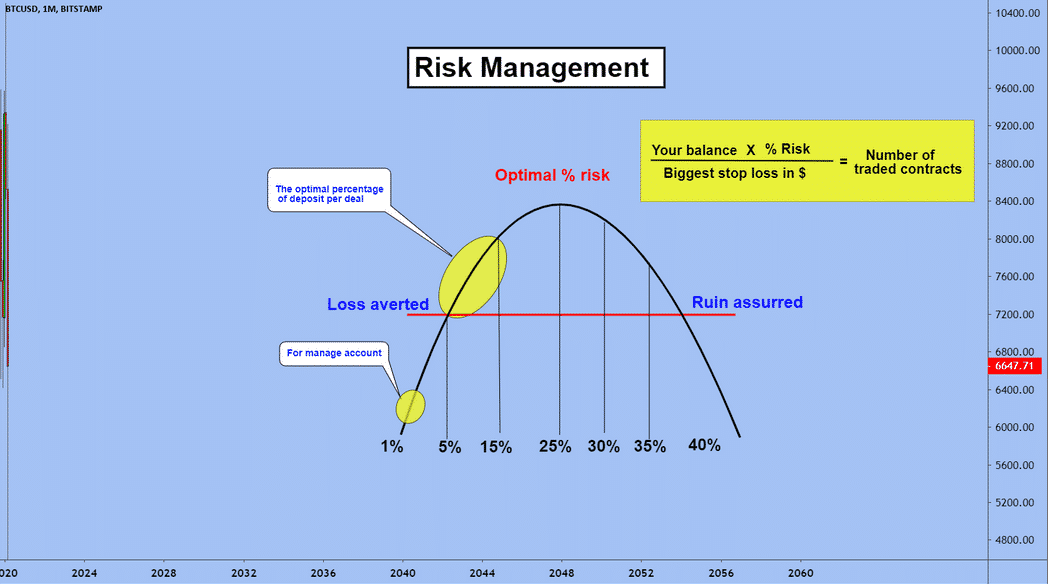

Tip 1. Risk management

When a trader examines the crypto market, the values of the majority of altcoins are dependent on the current market price of Bitcoin. Experienced traders do not like to go for large profits. As a result, they frequently stay put and make little but consistent gains from day trading. As a result, the most incredible risk management tip will assist you in reducing your losses.

Why does it happen?

It is vital to recognize that Bitcoin is linked to volatile fiat currencies. The essential idea here is that when the price of Bitcoin rises in the trading market, altcoins decrease, and vice versa.

How to avoid the mistake?

Most crypto traders will be confused by this. Thus it is best to set near targets or not trade at all at that period. Place limits on how much money you may invest in a single digital currency when day trading, and never trade with money you can’t afford to lose.

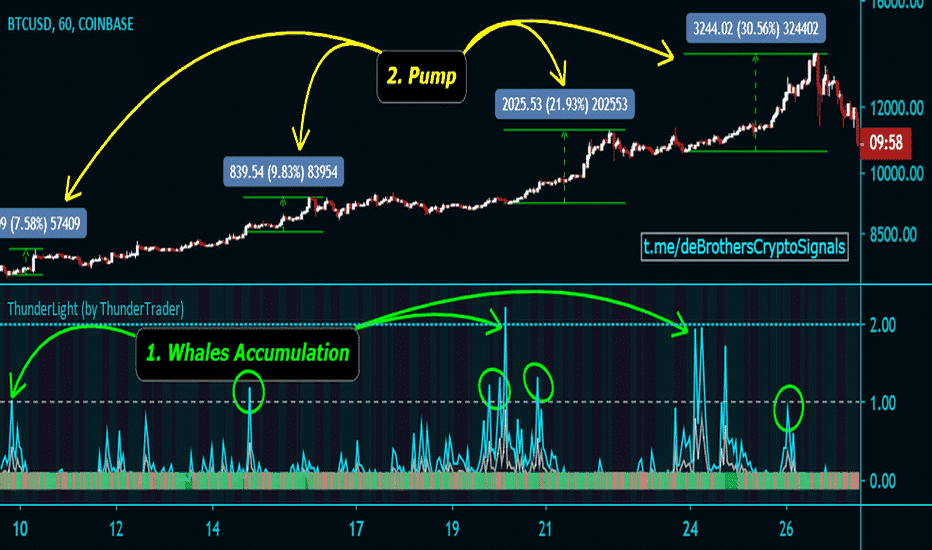

Tip 2. Have a purpose

While this may seem apparent, you must have a clear goal in mind while investing in Bitcoin. You must have a cause for starting to trade cryptos if you want to day trade. Trading currencies is a zero-sum game; you must recognize that an equal and opposite loss accompanies every victory. Someone wins, and someone loses.

Why does it happen?

Massive ‘whales,’ akin to individuals that deposit thousands of Bitcoins in market order books, dominate the crypto market. Can you figure out what these whales are good at? They have patience; they wait for inexperienced traders like you and me to make a single mistake, resulting in our money ending in their hands due to avoidable mistakes.

How to avoid the mistake?

If you are a day trader, it is preferable not to gain anything on a particular trade than hurry your way into losses. Based on our years of market monitoring, we can confidently inform you that you can only remain successful by avoiding specific trades on some days or times.

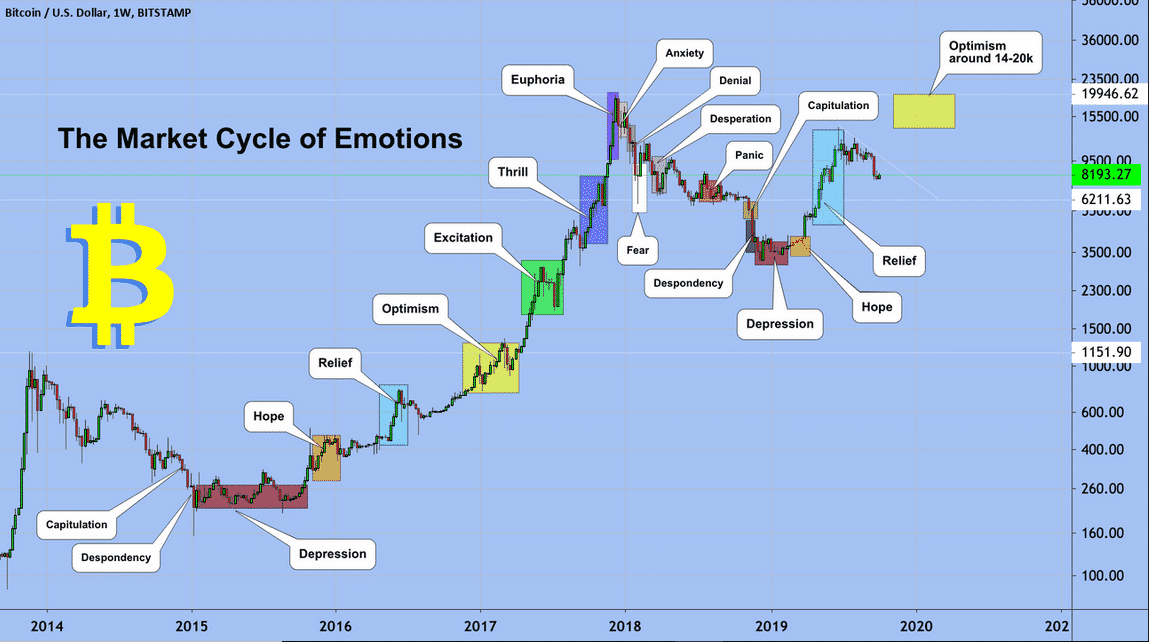

Tip 3. Control your emotions

Even with a clever trading technique, fundamental emotions such as fear and greed can turn the outcomes upside down. But, of course, everyone has risk tolerance and the ability to add positions following a setback. But, more importantly, remember to keep an eye out for yourself along the way.

Why does it happen?

Such emotions tend to grow when a trader has enormous fluctuations in his profit and loss account, which is usual with crypto assets due to their volatile movements.

How to avoid the mistake?

Working on trading psychology while controlling greed and anxiety appears beneficial for traders looking to profit in the market. Furthermore, traders must stick to their specific trading plans and comprehend when to register profits and losses. Do not blindly follow investing advice from influential people or skilled money managers.

Tip 4. Don’t buy just because the price is low

Most newcomers make the same mistake: they acquire a coin because the price appears to be cheap or what they deem reasonable. For example, consider someone who selects Ripple over Ethereum because it is less costly. Rather than its affordability, buying a coin should be driven by its market capitalization.

Why does it happen?

Like traditional equities, the market capitalization of cryptocurrencies is used to gauge their worth. We calculate it using the formula Current Market Price X Total Number of Outstanding Shares. There is no difference between a coin valued at $10 per coin with a total market share of 1 million and the same coin priced at $100 with a market share of 100,000.

How to avoid the mistake?

In conclusion, while deciding whether or not to invest in a coin, it is more reasonable to look at its market cap rather than its price. The bigger a coin’s market capitalization, the more suitable it is for investment.

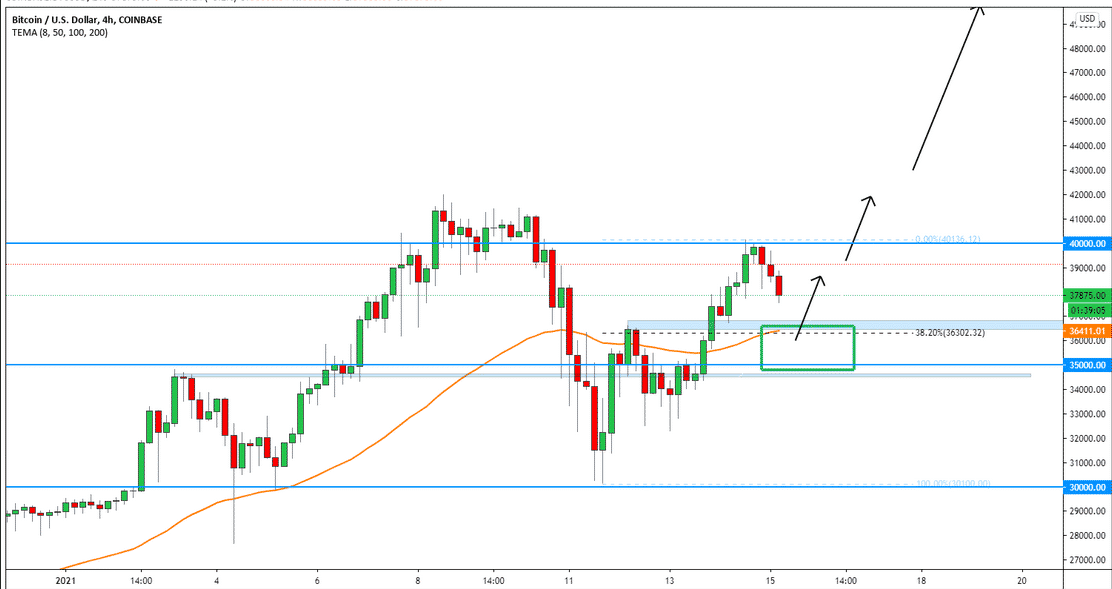

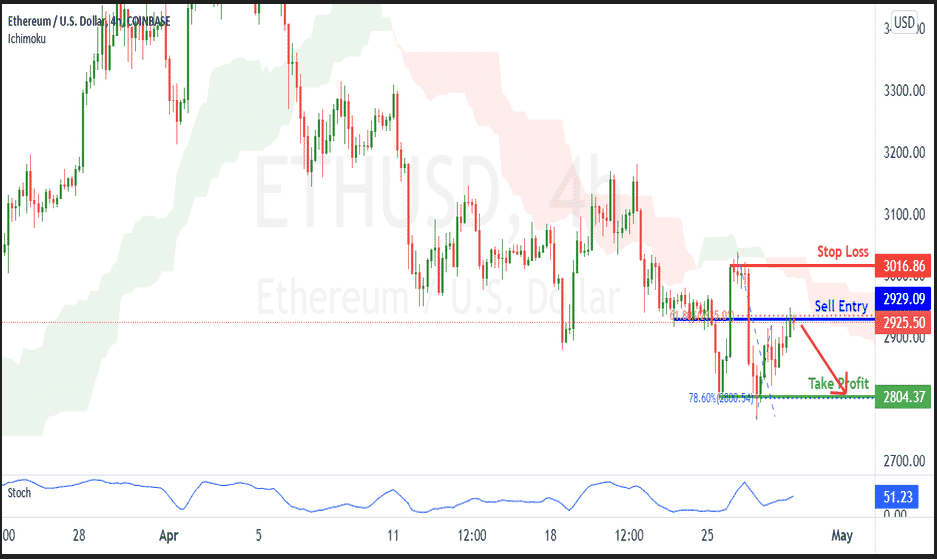

Tip 5. Make specific targets for profits and losses

To set particular profit and loss objectives, you must first define an obvious stop loss level that will assist you in minimizing your losses. Unfortunately, this is a skill that is uncommon among many traders.

A top crypto day trader continually devises a flawless winning strategy supported by extensive research and well-laid out unique methods for when to join and quit their holdings.

Why does it happen?

On the other hand, choosing a stop loss is not a random act; your currency’s current price is the optimal place to set your stop loss. Furthermore, it assures you to simply walk away with the money you initially spent if the worst should happen.

How to avoid the mistake?

Furthermore, once you’ve reached a sure minimum profit, you should adhere to it and never be greedy. The same holds for profits. But, again, don’t be greedy; establish a specific level for your earnings so that everything stays in order.

Final thought

Cryptos have surged as the next innovation, and many players have gained millions, yet some have also experienced losses. Trading cryptos may earn you $100 each day. However, it is not without difficulty. In reality, just 5% of cryptocurrency day traders are successful. Furthermore, approximately 95% of crypto day traders lose money.