Traders either choose a long position or a short position, depending on their investment goals. Traders who take a long position believe the price will go up, while those who take the short position believe the price will go down from a particular entry point. Therefore, those who take the short position make money when the prices go down, and vice versa.

What is shorting?

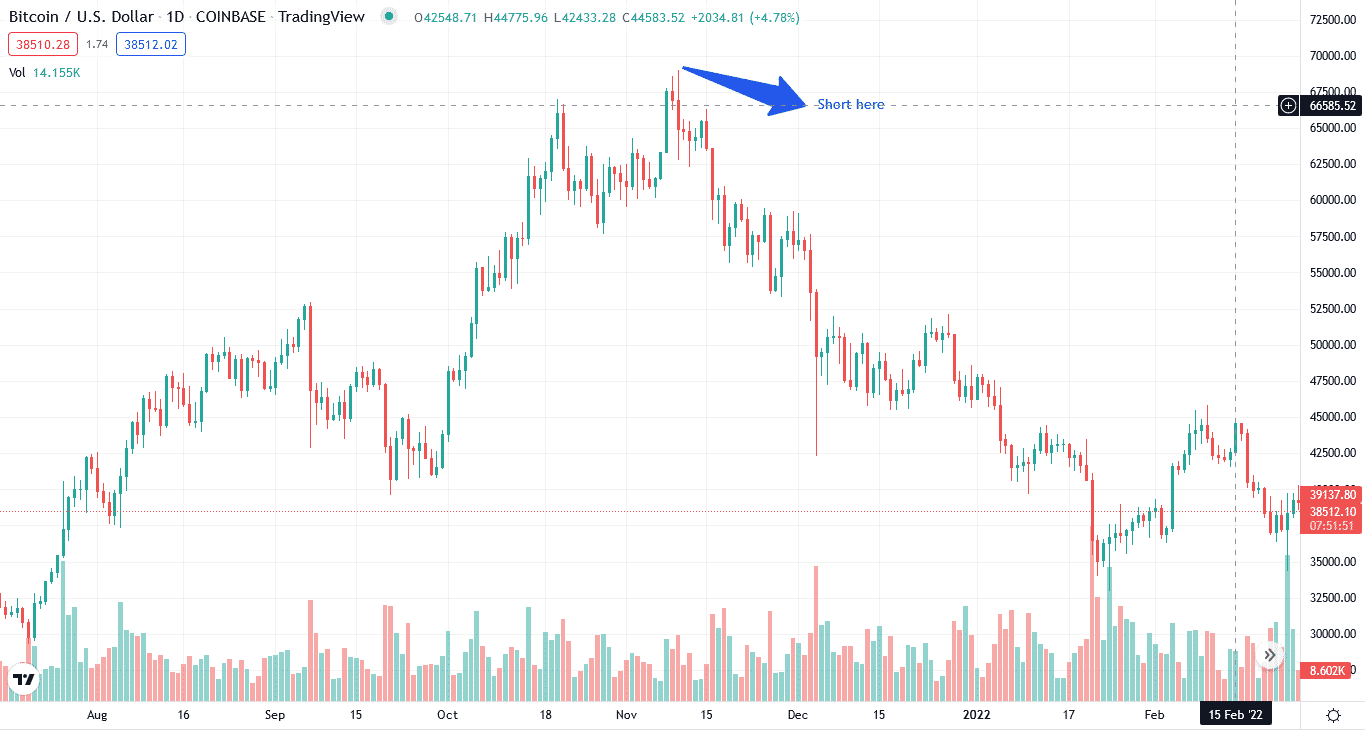

Shorting crypto means you sell it at a high price and repurchase it at a lower one. This idea is that if their prediction is correct, they will receive sufficient profit. Usually, traders like doing the opposite, i.e., buying low and selling high, but the short traders prefer the converse.

Specifically, short traders believe that the price of an asset will go down by the time they have to buy it back. The price difference between how much they sold the asset for earlier and how much they purchased it later generates the profit.

Top 5 tips for trading with short crypto

This article will go over some of the tips you can use if you are interested in trading shorts. We will describe ways to short crypto and Bitcoin and mention the details to help you get the maximum benefit from the shorts.

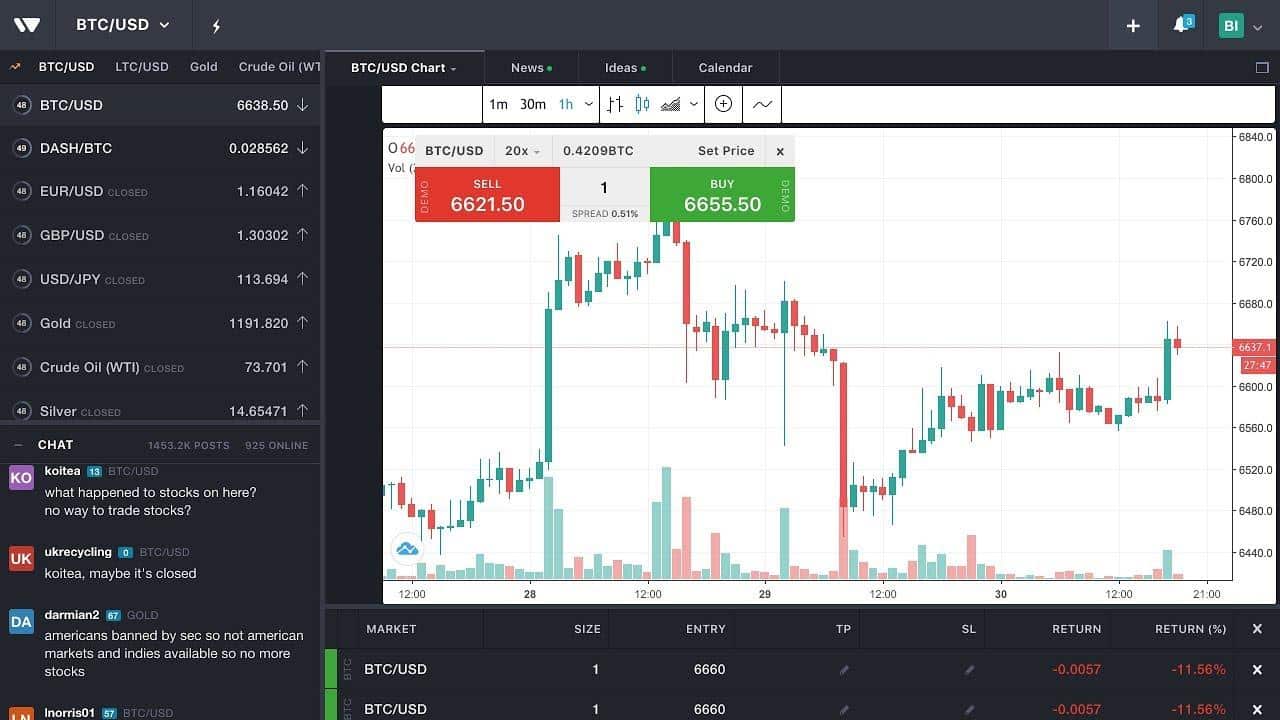

Tip 1. Margin trading

Margin trading is the most straightforward course of action for short crypto. Kraken is an example of a crypto exchange that allows traders to short sell BTC by leveraging or borrowing.

Why does it happen?

Margining means leveraging or borrowing money. A broker offers the traders some percentage of the exchange money they can borrow and then use for trading. Unfortunately, this increases the risk of loss as well.

How to avoid the mistake?

Many crypto exchanges support margin trading, such as FTX and Binance Futures. You borrow crypto from a trader and then execute the trade. You have to return the borrowed money after some specified days and settle the transactions. Certain advanced settings allow you to margin effectively, but, of course, with borrowing limits.

Tip 2. Futures contracts

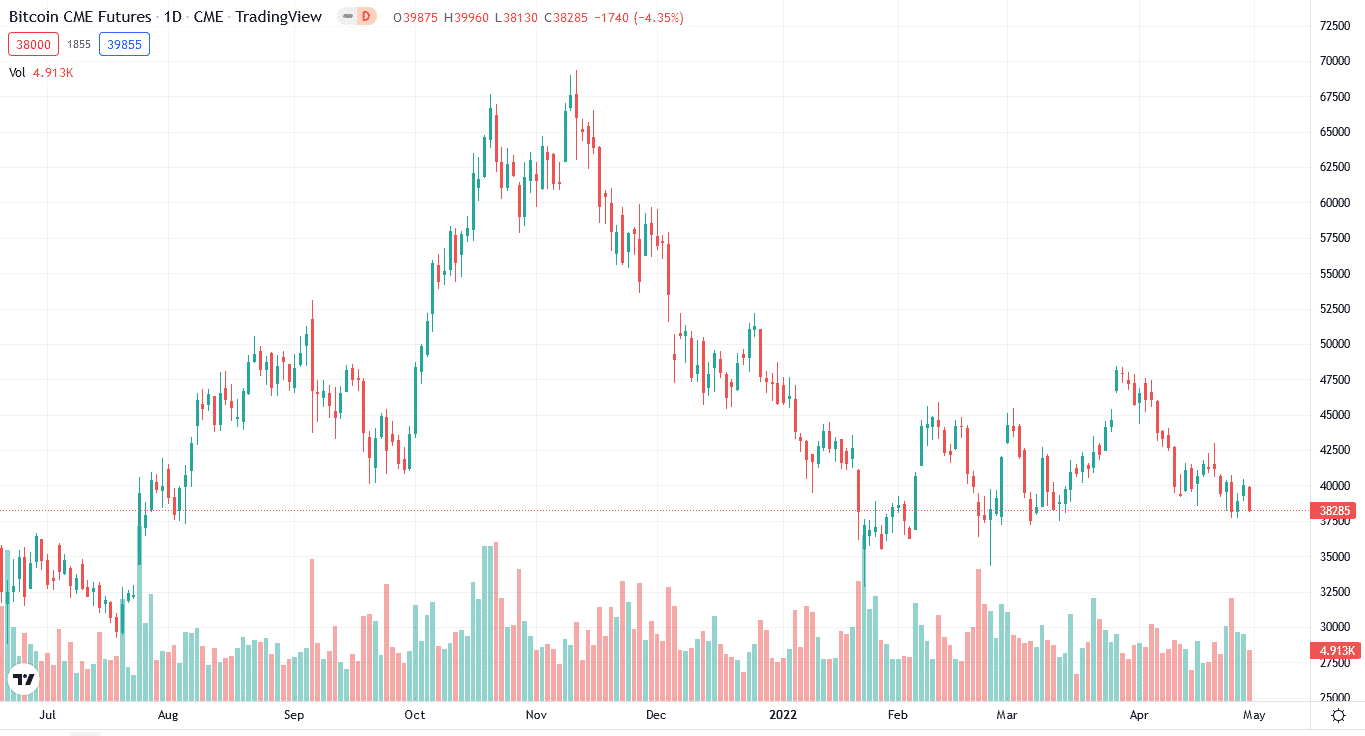

For regular exchanges, both parties on either side of the contract agree to buy or sell a security at a predetermined price later in the future.

Why does it happen?

In a trade involving future contracts, you buy security with a contract that specifies how much you will sell the security. The contract also mentions when the security will be sold. An example of an exchange where you can buy and sell futures contracts is Bitmex. However, US citizens can only use Bitmex through a VPN.

How to avoid the mistake?

Buying a futures contract means that you believe the security price will increase. If you think the security value will decrease, purchasing future contracts would be wiser. Over time, this strategy can prove beneficial and help you receive decent profits.

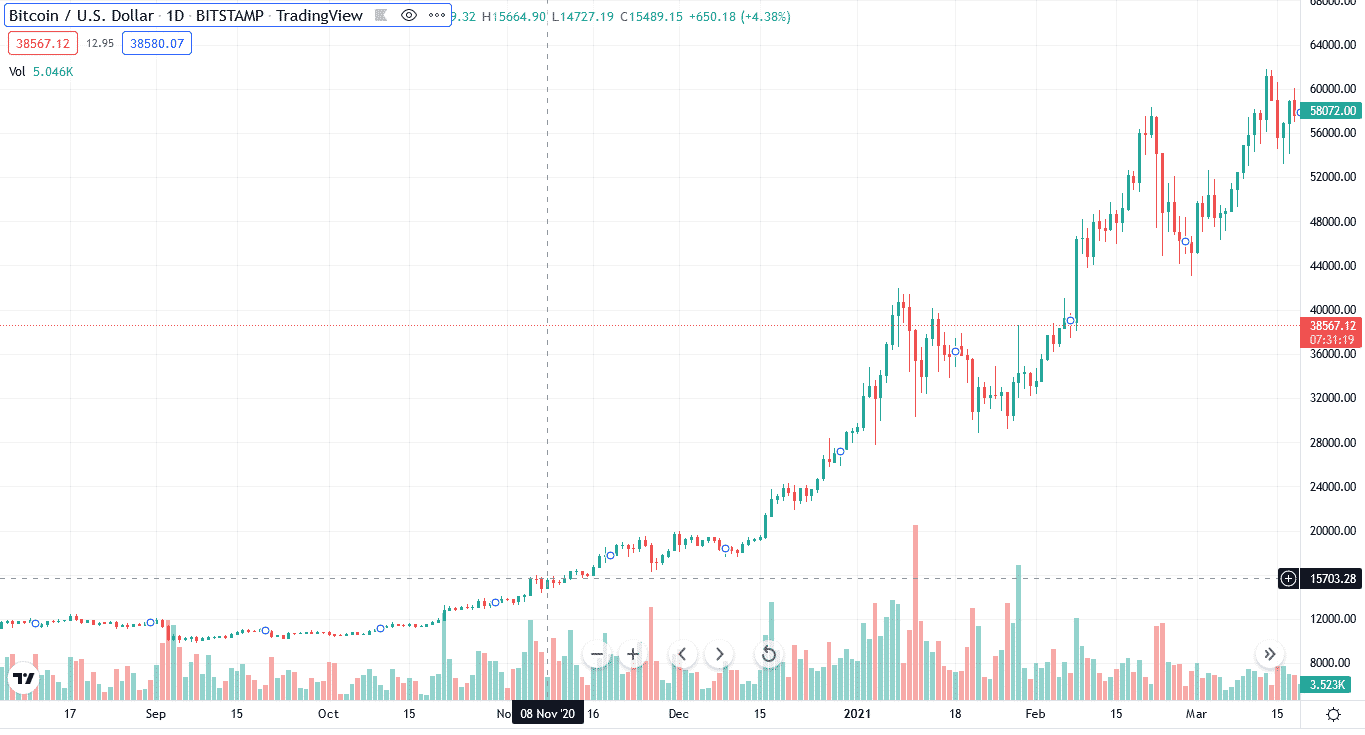

Tip 3. Technical analysis

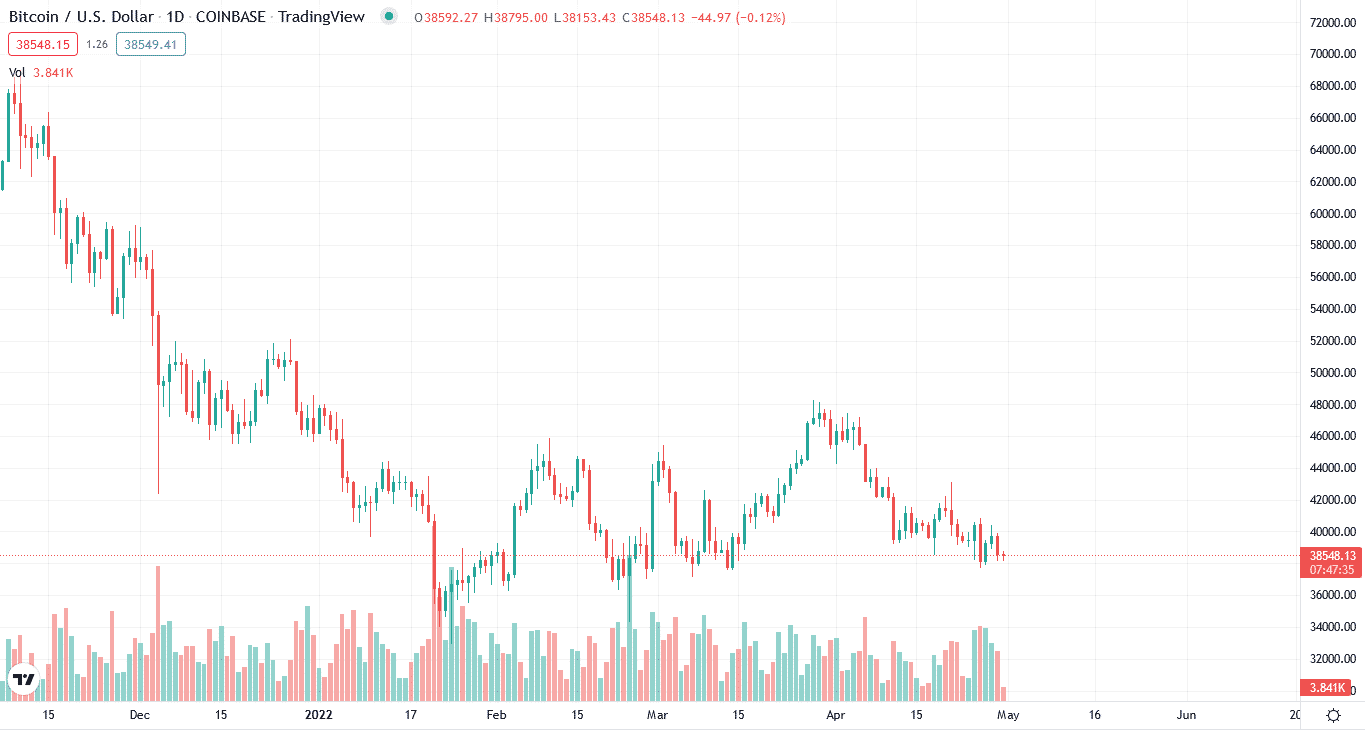

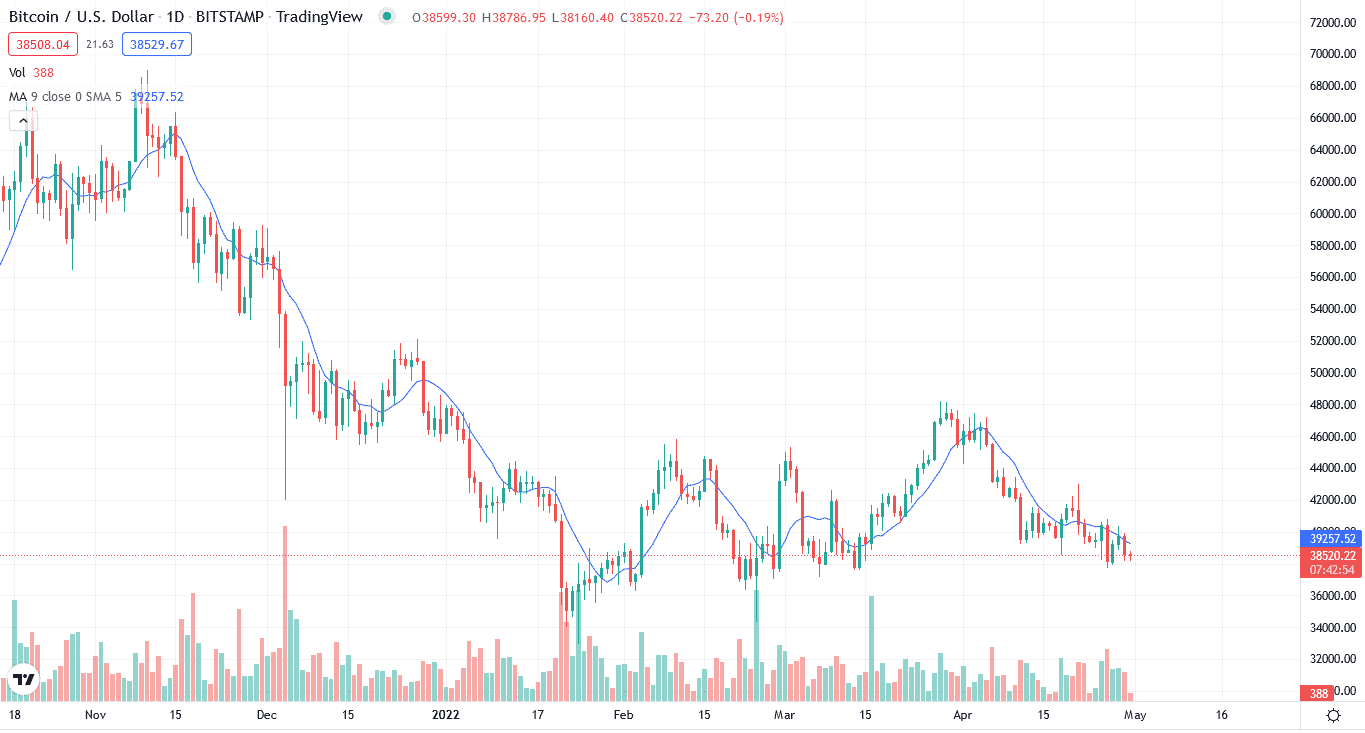

People who use technical analysis traditionally go over past performances of Bitcoin or crypto to predict future movements.

Why does it happen?

There are numerous technical indicators, each giving slightly different information to the trader. For example, moving average indicators help reduce BTC’s complicated price history into a simple trend line. Average Directional Index will inform you about the trend’s strength, while Bollinger Bands will show the relative high or low price of an asset. Support and resistance levels are also frequently used as a method of technical analysis, but these are of less importance when a market rapidly increases or declines.

How to avoid the mistake?

The basic idea behind technical analysis is that past trends will reoccur in the future. In other words, trends are not random; and are based on previous short-term and long-term trends. If an asset follows a particular trend right now, it will likely follow the opposite one in the future. For short crypto, you need to know about the moving average indicator. For accuracy, connect all your moving averages.

Tip 4. Fundamental analysis

Some traders argue against fundamental analysis and believe technical analysis is enough, as crypto does not have any “fundamentals”.

Why does it happen?

Fundamental analysis is another strategy used for short crypto. Supply variables are likely to be similar to one another and can be used to predict future movements. However, dead Bitcoins can affect the supply. Look at the network activity of an asset as well. Are there a lot of new users entering and buying? Are they holding on to coins or instantly selling them? Such questions will help the trader get a clearer view of the market.

How to avoid the mistake?

Firstly, try and figure out the causes or forces behind supply and demand. You have to look at internal and external factors to check how much an asset is valued or not valued.

Tip 5. Binary options

Binary options are our last but not the least choice for trading with short crypto.

Why does it happen?

Binary options include call options and put options. Call options give holders the right to buy, while put options give them the right to sell. The aim is to sell the asset at the current price despite the possibility of the market dropping later.

How to avoid the mistake?

Limit any loss by choosing not to sell your put options. Binary options are a short-term but effective strategy for short crypto. You either get the profit you predicted earlier or lose the amount you used to begin a trade.

Final thoughts

The concept of short crypto may be intimidating to some. Shorting crypto is an effective way to make money. However, once you know how to go about it properly, it is only uphill from there. Hopefully, reading this would have given you some idea of what to do and how to avoid some mistakes when trading shorts. There are several other strategies and tips too, but for now, these should suffice.