The Covid-19 pandemic hit the world in early 2020. Millions of people were infected, and many died. Not only has the virus attacked humans, but its ramifications spread to the financial markets as well. Nations had to impose strict lockdowns and ban domestic and international travel.

Everyone had to adjust to a new way of doing things. The majority of businesses closed, and the staff was working remotely. For those lucky enough to retain their jobs, they could work from home. However, many lost their jobs and had other means of income.

The financial markets were significantly strained, especially the forex market. Even the countries with the most robust economies like the USA, UK, and China could not escape the impact of the pandemic.

During this time, the forex trading industry was booming, and brokers reported a 30% spike in trading volume. People realized that the currency market was an excellent opportunity to earn an extra income. As a forex trader, it is essential to understand the impact of the pandemic on currencies and how you can still invest during this time.

How has Covid-19 impacted the global economy

The world’s largest economies have been significantly affected, and even the world’s leading US dollar was under pressure.

Due to the lockdown and restricted movements, many businesses had to close down. Furthermore, goods and services which were not deemed essential also stopped. Some of these are brick-and-mortar businesses and do not operate online. Their services or products are reliant on customers walking into a store.

The first thing that is affected during such a crisis is unemployment rates. Within a matter of five weeks, 26 million Americans applied for unemployment benefits. And during the lockdown of 2020., the US unemployment rate skyrocketed to over 13%.

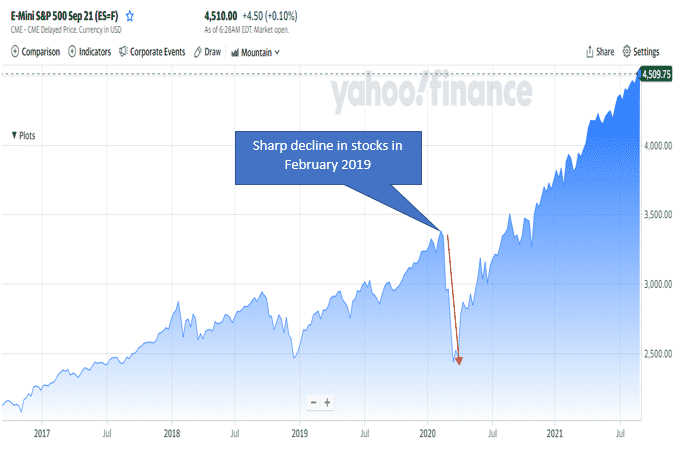

The rising fear among investors resulted in them selling off stocks, and we saw this in the sharp downward trend of the US stock indices.

S&P 500 futures index, which tracks the performance of the top 500 US companies. The chart is showing the decline in the stock market at the start of the pandemic in 2020.

When the stock market declines, it is a sign that investors’ confidence in the economy is dwindling.

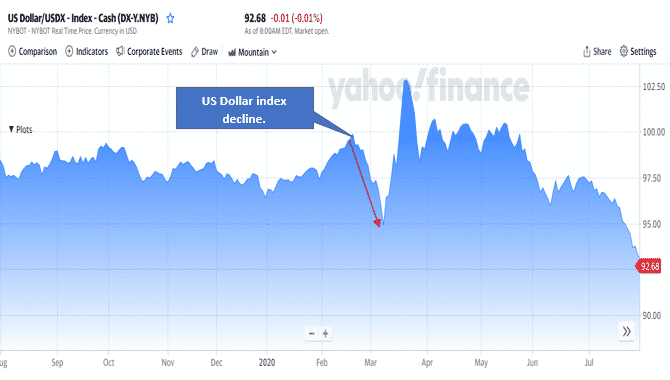

The US dollar index measures the strength of the US dollar versus six global currencies. These are the British pound, euro, Swiss franc, Swedish krona, Japanese yen, and the Canadian dollar.

Similar to the stock market, the US dollar index declined sharply during February and March of 2020. When the index declines, the US dollar has lost value, and when the index increases, the US dollar has gained value.

Let’s look at a few currencies which trade against the dollar to understand the pandemic’s impact.

How did currencies react to the pandemic?

We will review the impact of the pandemic on the euro and British pound. These are two of seven major currencies on the FX market. Their strength against the US dollar is a crucial indicator of the nations’ economic health.

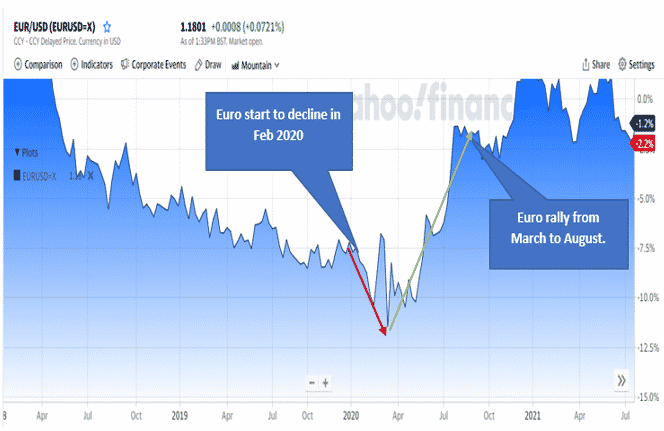

Euro

European countries were particularly hit hard by the pandemic. Italy is the worst out of the Eurozone. The virus had not yet fully reached the USA at this stage, and the infection rate was low.

At the start of the pandemic around February 2020, the euro was weaker versus the US dollar. Then, from March 2020, the euro started gaining against the dollar by more than 10%. This rally lasted until August 2020.

However, the sudden decline in the euro was not due to significant fundamentals but a growing fear of the second wave of Covid-19. This second wave harmed the economy and the value of the euro. Spain and France were more affected as infection rates jumped rapidly.

We can see that from February 2020, the euro started to decline against the US dollar. Then, from mid-March, the euro began gaining until August 2020, when the second wave hit.

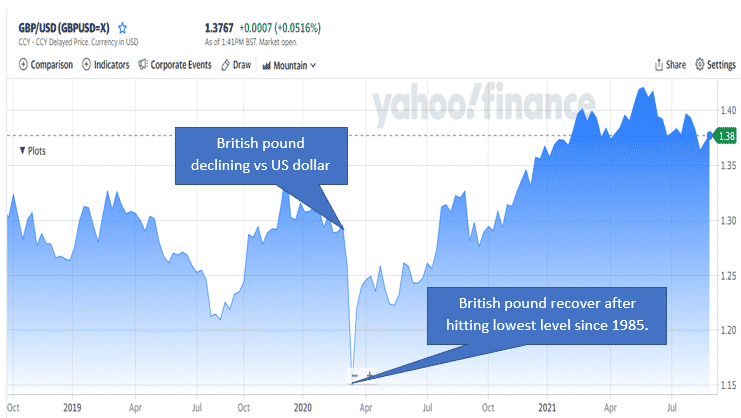

British pound

The British pound hit record lows last seen in 1985. The pound lost 5% value against the dollar on a single day. The Bank of England had issued stimulus packages as financial aid for businesses and individuals against the pandemic. However, the fear of the pandemic was so great that these plans failed to recover the economy.

The British pound declined on 1 March 2020. It only started regaining strength against the dollar from 15 March 2020.

We can see from the charts of the euro and the pound that the prices started to recover when the countries began to have better control over the spread of the virus. As the infection rates declined, lockdown and mobility restrictions were less.

Businesses like restaurants, pubs, and bars were allowed to open, and curfews were in place. This allowed spending to increase, and it also lifted consumer’s fears for the pandemic. In addition, investors were more confident in the economy’s stability, and stock markets recovered moderately.

How to invest during a pandemic

The Covid-19 induced recession is different from historical recessions since those were mainly due to socioeconomic factors. However, the lessons are still applicable now. Investing in stocks during a pandemic is risky, but the forex market can be favorable since the impact is short-term.

Trade currencies

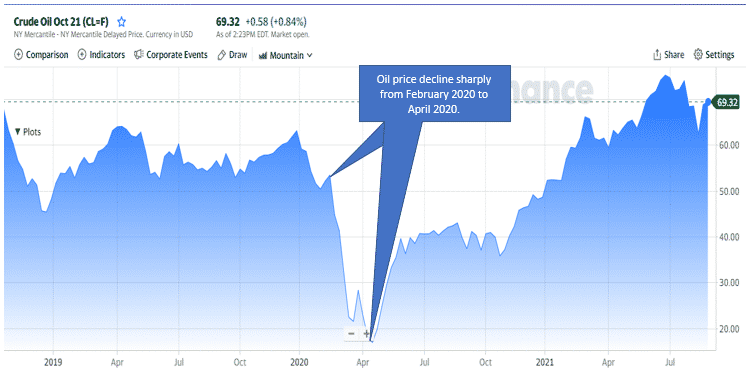

Forex trading was a thriving opportunity during the pandemic. Trading forex is not like stock trading; you can trade short-term or hold longer. Currency traders can enter and exit the market much quicker than stock traders since the forex market has high liquidity. Many traders took advantage of the oil price crash in 2020. To the extent that brokers couldn’t keep up with the volumes and disabled oil trading for a short period.

We can see how sharply oil declined to below $20 per barrel. Many retail traders made a fortune during this time.

Benefit from volatility

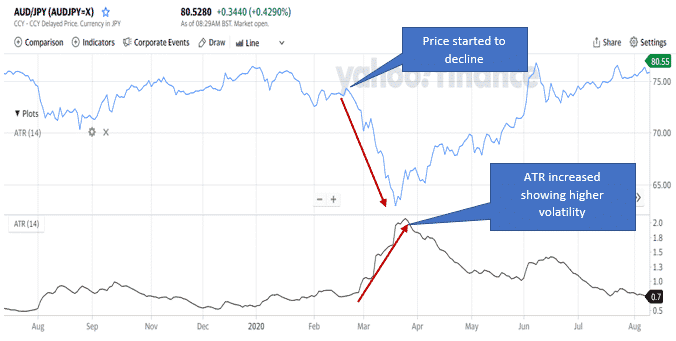

The forex market is highly liquid, also has a high degree of volatility, and this was especially the case during the pandemic. Although volatility comes with high risk, it also presents many opportunities for traders to enter the market. And you can take advantage of the large price swings. An indicator that we can use to measure volatility in forex is the average true range.

We can see during April 2020, there was high volatility in the currency pair, as seen from the increase in ATR value.

Buy low and hold

This is probably one of the fundamental aspects of the forex market. If you buy low, you stand a better chance of profiting. We have seen that major currencies made significant dips in the market, and it was a reasonable time for currency traders to buy and hold.

Both the pound and the euro recovered quickly, and the trend continued upwards for months. The same applied to oil; after the significant crash, oil was an excellent opportunity to buy and hold for months since the price steadily increased. This is the perfect opportunity for swing and position traders to enter the market.

Final thoughts

The pandemic has left a lasting impact on the world, and we are still not rid of its effects as new virus strains are still a threat. However, the world seems much better prepared, and markets are recovering steadily. It also proves there’s an opportunity to make money even during the pandemic, provided you follow risk and money management rules.